UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 |

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Quantum Corporation

Annual Shareholder Meeting Preliminary Proxy Statement 2025

Subject to Completion

A Message from Our Leadership

The question I’ve heard most in the last few months is, “Why would you want to come out of retirement to go back to work at Quantum?” The honest answer is that it feels like fate.

Much of my professional work has been in the storage industry. More specifically, I have been associated with Quantum since the 1990s, as a supplier, employee, competitor, or Board member. Each of these roles has given me the ability to learn, experience, and understand Quantum’s products and opportunities in a unique way. This tenure makes it feel like Quantum is in my blood.

I am extremely happy to step into the President and Chief Executive Officer role, and am passionately focused on driving the company toward successfully achieving the opportunities ahead of us. We have fantastic products, amazing people, and fascinating customers. I’m looking forward to combining all of those resources into providing unmatched solutions for unstructured data and AI-enabled workflows.

I sincerely believe Quantum is uniquely positioned to grow our business and deliver more consistent results for our shareholders. We believe that your support on the proposals included in this proxy statement will help us do that.

Hugues Meyrath

President and Chief Executive Officer

Fiscal year 2025 created the foundation for significant change for Quantum. We revised our product portfolio, go to market strategies and resources, customer purchase methodologies, access to capital, and global employee footprint.

On the heels of those actions, we ushered in fiscal year 2026 by revising our debt structure and reconstituting our executive management team. Having known Hugues for more than 20 years, I could not have been more pleased to welcome him as Quantum’s new President and Chief Executive Officer. His depth and breadth of interaction with Quantum over the last thirty years is rare and sincere, and he was truly excited to have the opportunity to lead the company forward.

I have no doubt that excitement has translated into renewed focus and engagement with Quantum’s leadership team, employees, customers, suppliers, and other partners. Quantum’s recent history has been defined by charting a new direction; fiscal year 2026 presents an opportunity to leverage that work and define a future that can deliver positive outcomes for all stakeholders. We recommend you support our proxy proposals as a critical step in continuing Quantum’s transformation.

I’ve very excited to play a part in that process and support Hugues and the Quantum team through this journey.

Don Jaworski

Chairman of the Board

3

Notice of Annual Meeting of Shareholders

https://web.viewproxy.com/qmco/2025

Virtual Meeting

(you must preregister in order to attend)

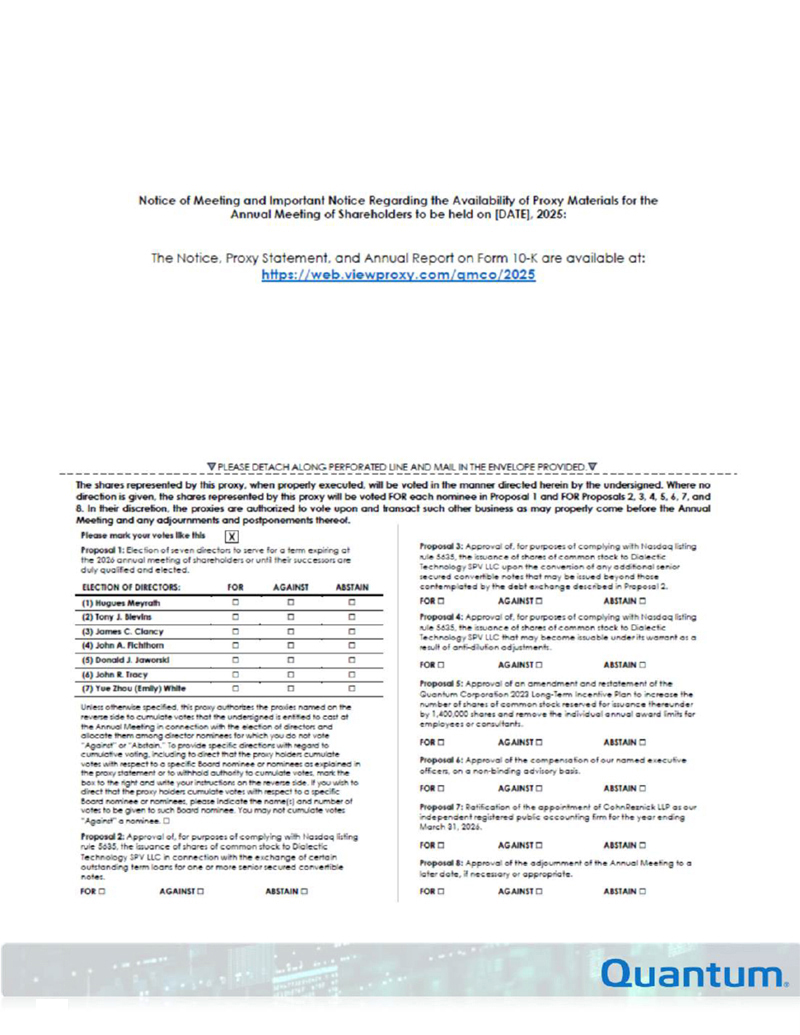

Quantum Corporation (Quantum or the Company) invites you to attend our 2025 annual meeting of shareholders (Annual Meeting) on [ ], [ ], 2025, beginning promptly at [ ], [a/p].m. Pacific Time. At the meeting, we will consider and vote on the following proposals:

Proposal

One

Elect Directors

Proposals Two and Three

Issuance of Common Stock Related to the Debt Exchange and Convertible Notes

Proposal

Four

Issuance of Common Stock Under Warrant Anti-Dilution Provisions

Proposal Five

Amend and Restate the 2023 Long-Term Incentive Plan

Proposal Six

Non-Binding Advisory Vote on Executive Compensation

Proposal Seven

Ratify Independent Auditors

Proposal Eight

Adjournment of the Annual Meeting

Other

Matters Properly Raised

None as of the time this proxy statement

was filed

Only shareholders of record at the close of business on [ ], 2025 (the Record Date), or their valid proxy holders, may vote at the meeting. Our Board of Directors (Board) recommends you vote “FOR” each of the nominees in Proposal One, and “FOR” Proposals Two, Three, Four, Five, Six, Seven, and Eight.

4

Important Notice Regarding the Availability of Proxy Materials

The following pages set forth our 2025 proxy statement, including more complete descriptions of proposals and Board candidates. This information is also available at https://web.viewproxy.com/qmco/2025.

Efficiency and conservation matter to us. To reduce environmental impacts of the proxy process, shareholders will not automatically receive paper copies of our proxy statement and annual report. We will instead send a Notice of Internet Availability (Notice) with instructions for accessing the proxy materials and voting online. The notice will also provide information about how shareholders may obtain paper copies of proxy materials if they prefer. Our Notice is first being sent on or about [ ], 2025 to all shareholders entitled to vote at the Annual Meeting.

Quantum knows of no other matters to be submitted at the Annual Meeting. As Corporate Secretary, I must receive any shareholder proposals intended for consideration at the Annual Meeting (including their required information) within the timeframes, specified in our Bylaws and required by the rules of the Securities and Exchange Commission (SEC). If any other matters properly come before the Annual Meeting, the individuals named in the form of proxy will vote the shares they represent as the Board may recommend.

By Order of the Board of Directors,

Tara Ilges

Vice President, Corporate Affairs and Corporate Secretary

[ ], 2025

5

Table of Contents

6

Director Biographies

|

Donald

J. Jaworski Chairman of the Board Chair, Leadership and Compensation Committee |

|

Hugues

Meyrath Chief Executive Officer Board Member |

|

Yue

Zhou (Emily) White Board Member |

|

John

R. Tracy Chair, Audit Committee Chair, Special Committee |

|

John

A. Fichthorn Chair, Corporate Governance and Nominating Committee |

|

James

C. Clancy Board Member |

|

Tony

J. Blevins Board Member |

The key roles for our Board include, but are not limited to:

| • | Selecting and evaluating the Company’s Chief Executive Officer (CEO). |

| • | Reviewing and approving the CEO’s objectives and compensation. |

| • | Overseeing CEO succession planning. |

| • | Advising the CEO and management on the Company’s fundamental strategies and approving the annual operating plan. |

| • | Approving acquisitions, divestitures, important organizational changes, and other significant corporate actions. |

For the April 1 – August 14, 2024 portion of the fiscal year ended March 31, 2025 (Fiscal 2025), Mr. Marc E. Rothman served on the Board as the Lead Independent Director and Chair of our Audit Committee. Mr. Rothman did not stand for re-election at our 2024 shareholder meeting.

Additionally,

Christopher D. Neumeyer served on the Board as Chair of the Corporate Governance and Nominating Committee from April 1, 2024 through

March 19, 2025.

Mr. Neumeyer was named a Board observer in April 2025.

Finally, Mr. Todd W. Arden served on the Board from June 6, 2024 through April 2, 2025.

Neither Mr. Neumeyer nor Mr. Arden had any disagreements with the Board or Quantum Management team on any matter relating to the Company’s operations, policies, or practices.

Each of our directors has been nominated for election at the Annual Meeting. There are no familial relationships between any directors or executive officers of the Company.

8

|

Donald J. Jaworski INDEPENDENT DIRECTOR NOMINEE 66 years old |

|||

| CHAIR • Board of Directors • Leadership and Compensation Committee |

|||

| MEMBER • Audit Committee • Special Committee |

|||

Mr. Jaworski was appointed to our Board in November 2022 and named Chairman on June 2, 2025. He served as Lead Independent Director from August 15, 2024 to June 1, 2025.

Mr. Jaworski is President and Chief Operating Officer of Lacuna Technologies, Inc., a leader in software that helps municipalities to operationalize digital infrastructure and manage transportation, since March 2021. Mr. Jaworski leads execution and is focused on delivering value to Lacuna’s customers. Prior to joining Lacuna, from January 2015 to March 2020, he was CEO of SwiftStack, Inc., an open-source cloud data management company focused on large scale data applications, which was acquired by NVIDIA Corporation, a publicly-traded technology company, in March 2020.

Mr. Jaworski previously served as: • Senior Vice President and General Manager of the core platform business at NetApp, Inc. from August 2010 through January 2012, where the team focused on the transition to scale-out systems. • Senior Vice President Product at Brocade Communications Systems, Inc. • General Manager of the Enterprise Security business unit at Nokia Corporation.

In

addition, Mr. Jaworski’s early career included management positions at Sun Microsystems,

Inc. and Amdahl Corporation. He has been an advisor and board member for a number of

early-stage companies.

We believe Mr. Jaworski brings strength to our Board through his broad and deep technology and product development and marketing experience. |

||||

|

Hugues Meyrath DIRECTOR NOMINEE 55 years old |

|||

Mr. Meyrath was appointed to our Board in November 2022 and named President and Chief Executive Officer on June 2, 2025.

Mr. Meyrath has developed an extensive background in various leadership roles at global technology companies, most notably in the networking and data storage segments. Before joining Quantum, from January 2017 to December 2021, he served as Chief Product Officer of ServiceChannel Holdings Inc., a provider of SaaS-based multi-site solutions, which was acquired by Fortive Corporation, a publicly-traded provider of connected workflow solutions, in 2021.

From January 2014 to January 2017, Mr. Meyrath was Vice President at Dell Technologies Capital, a venture capital arm of Dell Technologies that invests in enterprise and cloud infrastructure, where he was responsible for driving venture funding, mergers and acquisitions, and other advisory roles for a diverse set of portfolio companies. He also held the role of Vice President of Product Management and Business Development for Dell EMC’s Backup and Recovery Services, which offers data protection and business continuity products.

Mr. Meyrath’s experience also includes executive roles at: • Juniper Networks, Inc. • Brocade Communications Systems, Inc. • Strategic Business Systems, Inc.

He was also previously a Quantum employee from January 2002 to September 2003.

We believe Mr. Meyrath’s extensive work in product portfolio and technology development, and in particular his experience with data storage technologies, as well as his deep understanding of our business given his role as our Chief Executive Officer, provides valuable experience and perspective to our Board. |

||||

9

|

Yue Zhou (Emily) White INDEPENDENT DIRECTOR NOMINEE 53 years old |

|||

| MEMBER • Audit Committee • Leadership and Compensation Committee • Corporate Governance and Nominating Committee • Special Committee |

|||

Ms. White was elected to our Board in September 2021.

Ms. White held the position of Vice President, Enterprise Data and Analytics at Cisco Systems, a publicly-traded networking hardware and software manufacturing company from July 2024 to July 2025.

Prior to Cisco, she served as Vice President of Enterprise Data and Analytics at NIKE, Inc., a public company that manufactures and sells athletic apparel, beginning in April 2020. Prior to NIKE, from February 2017 to April 2020, Ms. White served as Vice President of Enterprise Data Engineering at Synchrony Financial, a publicly-traded consumer financial services company.

Ms. White previously held multiple positions at General Electric entities. From November 2013 to June 2015, she served as Data Science Director and Global Commercial IT Director at General Electric Healthcare, a company that manufactures and distributes medical imaging modalities. From May 2007 to October 2013, she was Global Enterprise Resource Director and Senior Global Business Intelligence Program Manager for General Electric Transportation, a company that manufactures equipment for energy generation industries.

Ms. White’s education includes a: • Bachelor of Science degree in Accounting and Finance from Shengyang Polytechnic University; • Master of Business Administration degree from Huron University; • Master of Applied Mathematics degree in Computer Science at the University of Central Oklahoma; and • Certificate in Health Economics & Outcomes Research from the University of Washington.

We believe Ms. White’s extensive senior management experience, particularly in data science and analytics, brings valuable perspective to our Board and to the oversight of these functions within Quantum. |

||||

|

John R. Tracy INDEPENDENT DIRECTOR NOMINEE 60 years old |

|||

| CHAIR • Audit Committee • Special Committee |

|||

| MEMBER • Leadership and Compensation Committee • Corporate Governance and Nominating Committee |

|||

We appointed John R. Tracy to our Board in June 2024.

Mr. Tracy has an extensive background in public company financial planning and operations. Most recently, he served as Executive Vice President and Chief Financial Officer at Verifone Systems, Inc., a payment system company, from February 2019 until April 2024. Prior to that, from November 2017 to November 2019, Mr. Tracy served as Senior Director at Pine Hill Group (now CFGI), an accounting and transaction advisory firm.

From July 2015 to October 2016, Mr. Tracy held the position of Senior Vice President Finance for TiVo Inc. (formerly Rovi), a streaming entertainment content delivery service. Prior to that, he was Vice President Finance and Chief Financial Officer for TE Connectivity Inc., a publicly-traded electronics connector and sensor manufacturer, from June 2013 to June 2015. He also served as Vice President and Corporate Controller at ConvaTec, a publicly-traded medical products and technology company, from October 2012 to June 2013.

Mr. Tracy also held various senior finance roles at Motorola Inc. and its subsidiaries. He received a Bachelor of Science degree in Accounting from Rider University and a Masters of Science in Taxation from Fairleigh Dickinson University.

We believe Mr. Tracy’s financial expertise, including his experience as a chief financial officer, makes him a valuable member of our Board. |

||||

10

|

John A. Fichthorn INDEPENDENT DIRECTOR NOMINEE 52 years old |

|||

| CHAIR • Corporate Governance and Nominating Committee |

|||

Mr. Fichthorn was appointed to the Board in April 2025. He was previously a member of the Board from April 2019 to July 2021.

Mr. Fichthorn has served as the Founder and Managing Partner of Dialectic Capital Management, since the re-launching of Dialectic in May 2020. He is also the Founder and Managing Partner of Medtex Ventures, a medical device venture capital firm he founded in 2020.

Prior to that, Mr. Fichthorn was the Head of Alternative Investments at B. Riley Capital Management, LLC, an investment advisor and wholly-owned subsidiary of B. Riley Financial, Inc, from April 2017 until May 2020. Before that, Mr. Fichthorn co-founded Dialectic Capital Management, where he was an equities portfolio manager and analyst from 2003 to 2017.

Mr. Fichthorn has served on the boards of directors at: • Benefytt, formerly called Health Insurance Innovations, Inc., a publicly traded health insurance and technology platform company, from December 2017 to August 2020. • TheMaven (now The Arena Group), a publicly traded online media company, from September 2018 to October 2021. • Multiple private companies that are portfolio companies of Dialectic Capital and Medtex Ventures.

Mr. Fichthorn earned a Bachelor of Arts degree in Astronomy from the University of North Carolina at Chapel Hill.

Mr. Fichthorn has significant experience in accounting and financial matters, experience serving on other public and private company boards, and brings shareholder perspective to our Board. We believe he brings strength to our Board as a result of his experience managing investment firms and being a shareholder activist. |

||||

|

James C. Clancy INDEPENDENT DIRECTOR NOMINEE 58 years old |

|||

Mr. Clancy was appointed to the Board in August 2025.

Mr. Clancy has served as an Advisor to the CEO at DataPivot Technologies, Inc., a data center and cloud technologies solutions provider, since December 2024.

Mr. Clancy previously served as the Senior Vice President, Global Sales, Data Protection Solutions at Dell Technologies Inc.,

a publicly-traded technology company, from 2019 until December 2024. Prior to that, Mr. Clancy held various positions at Dell

including President of Global Specialties Sales from 2018 to 2019 and Senior Vice President, Global Sales, Data Protection

Solutions from 2013 to 2018. Additionally,

Mr. Clancy earned a Bachelor of Business Administration and General Management Degree from the University of Massachusetts Dartmouth.

We believe Mr. Clancy brings strength to our Board through his extensive experience with sales strategies for global data protection and cyber resiliency solutions. |

||||

11

|

Tony J. Blevins INDEPENDENT DIRECTOR NOMINEE 58 years old |

|||

Mr. Blevins was appointed to the Board in August 2025.

Mr. Blevins most recently served as Vice President of Procurement at Apple, Inc., a publicly-traded technology company, from 2000 until September 2022.

Prior to that, he served in various senior roles at IBM, a publicly-traded technology company, in both supply chain and engineering.

Mr. Blevins earned a Bachelor’s degree in Industrial Engineering from North Carolina State University.

We believe Mr. Blevins brings strength to our Board as a result of his significant supply chain leadership and strategy experience. |

||||

| BOARD CHAIR RESPONSIBILITIES | |||

| • | Planning and organizing Board activities, including meeting agendas, frequency, content, and conduct. | ||

| • | Ensuring, along with the Corporate Governance and Nominating Committee, that the Board’s work processes effectively enable the Board to exercise oversight and due diligence in fulfilling its mandate, including for the oversight of Company strategy and risk. | ||

| • | Promoting effective communication among directors between Board meetings. | ||

| • | Working with committee chairs to ensure committees perform effectively and apprise the Board of actions taken. | ||

| • | Ensuring that the Board’s action items are tracked and appropriately resolved. | ||

| • | Encouraging an environment that facilitates all directors expressing their views on key Board matters. | ||

| LEAD INDEPENDENT DIRECTOR RESPONSIBILITIES (where appointed) | |||

| • | Presiding at any Board meeting the Chair does not attend, including executive sessions of only independent directors. | ||

| • | Calling meetings of non-management directors and providing appropriate executive session feedback to the CEO and management. | ||

| • | Serving as a liaison and facilitator between the independent directors and CEO. | ||

| • | Advising the Chair regarding Board meeting agendas, frequency, content, and conduct. | ||

| • | Collaborating with Board committees, including the Corporate Governance and Nominating Committee, on appointing members and chairs. | ||

12

Board Meetings and Independence

Board Meeting Attendance

The Board met a total of 34 times in Fiscal 2025. All Board members during Fiscal 2025, other than Ms. White, attended at

least 75% of the Board and Committee meetings for which they were eligible to attend, which is the expectation outlined in

our Corporate Governance Principles. Ms. White’s ability to join at least 75% of the meetings she was eligible to attend

was atypically impacted by the unusually high number of meetings, her job change, and significant work-related international

travel. The Board anticipates that Ms. White will have increased ability to attend meetings in the fiscal year ending March

31, 2026 (Fiscal 2026), as she had in prior years. Each of the directors nominated for election at our 2024 annual meeting

of shareholders, other than

Mr. Neumeyer and Ms. White, who had unavoidable business conflicts, attended that meeting.

Director Independence

The Board has determined that all current members other than Mr. Meyrath are independent directors as defined under the rules of the Nasdaq Stock Market LLC (Nasdaq).

We also exceed Nasdaq listing standards by requiring approximately 75% of our Board to be comprised of independent directors.

Our independent directors meet in executive session, without employee directors, at least as often as each regularly scheduled quarterly Board meeting. The independent directors are also empowered to request reporting from any employee during the executive session, including audit and compliance personnel.

Leadership Structure

Quantum’s

Board is committed to strong, independent Board leadership and oversight of management’s performance. The Board determines

the Chair assignment, from time to time and in its business judgement after considering relevant factors, including Quantum’s

needs and our shareholders’ best interests. With

Mr. Meyrath’s appointment as President and Chief Executive Officer

on June 2, 2025, the Board determined it would be appropriate and strengthen the Company’s corporate governance to separate

the roles of Board Chair and CEO. Following a thorough evaluation, the Board determined that Mr. Jaworski, who previously served

as Lead Independent Director, should assume the role of Chairman of the Board. The Board believes this structure promotes implementing

accountability for the Company’s performance.

The Chair focuses on effectively leading and managing the Board, with responsibilities described in more detail in our Corporate Governance Principles available on the investor relations section of our website at www.investors.quantum.com.

13

Board Committees and Leadership Structure

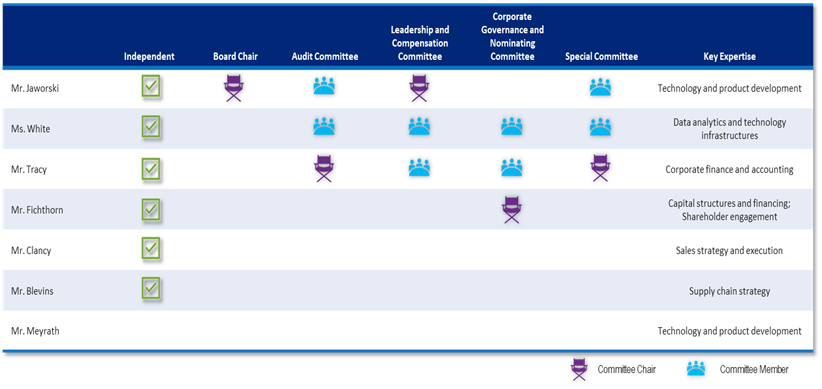

Board Demographics and Committees

Key demographics for our current Board members are:

|

Independent Committee Chairs (100%)

|

Independent Directors (86%)

|

1.7

Average Tenure (Years)

|

57.4

Average Age (Years)

|

Board Committee Composition

Board Committee Responsibilities

Each of our standing committees is governed by a written charter, available on the investor relations section of our website at www.investors.quantum.com. Copies of the charters may be requested from Quantum’s Corporate Secretary at 10770 E. Briarwood Avenue, Centennial, Colorado, 80112.

14

Audit Committee

The Audit Committee of the Board of Directors (Audit Committee) met ten times in Fiscal 2025. All members are independent and financially literate. Mr. Tracy qualifies as an “audit committee financial expert” per Nasdaq and SEC requirements. The Audit Committee’s primary responsibilities are to:

| • | Prepare the Audit Committee report. |

| • | Appoint and approve the Company’s independent registered accounting firm, and meet with that firm without management present. |

| • | Assist the Board with overseeing: |

| ○ | Financial statement integrity and compliance with legal and regulatory requirements. |

| ○ | Internal accounting, financial reporting, and internal audit processes and controls adequacy. |

| ○ | Policies and processes for risk assessment and management, including cybersecurity risks. |

Leadership and Compensation Committee

The Leadership and Compensation Committee of the Board of Directors (LCC) met five times in Fiscal 2025. All members are independent. The LCC is primarily responsible for:

| • | Reviewing and approving the Company’s compensation philosophy, strategy, and practices. |

| • | Reviewing and approving executive compensation for all executive officers other than the CEO, and recommending CEO and non-employee director compensation decisions to the Board. |

| • | Reviewing strategy and practices relating to the attraction, retention, development, performance, and succession planning of Quantum’s leadership team. |

| • | Developing guidelines for establishing and adjusting compensation of all non-executive vice presidents. |

| • | Assisting the Board with overseeing human capital management strategy. |

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee of the Board of Directors also met five times in Fiscal 2025 and is also comprised of only independent members. The committee’s primary responsibilities are to:

| • | Identify and recommend director nominees and consider shareholder nominees to the Board. |

| • | Develop corporate governance principles and assess Board effectiveness. |

| • | Advise the Board on corporate governance matters, including Board and committee composition, roles, and procedures. |

| • | Recommend a Board chair and Lead Independent Director, as well as CEO succession planning. |

| • | Review potential conflicts of interest. |

| • | Oversee Quantum’s ethics and compliance programs. |

15

Special Committee

The Special Committee of the Board of Directors (Special Committee) was initially formed to provide a forum for discussion of strategic initiatives amongst independent Board members, and reconstituted in May 2025 to review and independently approve the Company’s debt and capital structure negotiations with Dialectic Capital LLC. The committee met five times in Fiscal 2025.

Technology Advisory Committee

The Technology Advisory Committee of the Board of Directors was disbanded in May 2025. It was formerly comprised of Mr. Meyrath as Chair and Mr. Jaworski as its other member. The committee advised the Company on its technology development plans. The committee formally met four times in Fiscal 2025, plus informal working meetings generally held biweekly.

Audit Committee Oversight of Financial Statement Restatements

As previously disclosed, the Company restated certain financial statements in Fiscal 2025 and Fiscal 2024. The Fiscal 2025 restatement resulted from inconsistencies in applying revenue-recognition standards to its service and subscription revenue contracts, and did not affect any contracts entered into prior to Fiscal 2025. The Fiscal 2024 restatement involved the Company’s application of standalone selling price and warrant classification. The Audit Committee, including the current director nominees standing for re-election supervised the Fiscal 2025 restatement, and in part, the Fiscal 2024 restatement.

The Audit Committee worked closely with management, the Company’s independent auditors, and external advisors to review the affected financial statements, oversee the restatement process, and monitor the remediation of related control deficiencies. The Audit Committee met regularly during these reviews and was actively engaged in overseeing the process.

The Board believes that the diligence, judgment, and commitment demonstrated by the members of the Audit Committee in overseeing the restatements, together with their continued focus on accurate financial reporting, strong governance, and improvement in internal control over financial reporting, support their re-election at the Annual Meeting.

16

Director Candidate Evaluation

The Corporate Governance and Nominating Committee is responsible for identifying, evaluating, recruiting, and recommending qualified director candidates to our Board. The Board nominates directors for election at each annual shareholder meeting and appoints new Board members at other times determined to be appropriate. Directors are not permitted to serve on the Board for more than ten years.

General and Specific Considerations

The Board’s evaluation process will generally consider a candidate’s:

| • | Independence. |

| • | High integrity and character. |

| • | Qualifications that will increase Board effectiveness. |

| • | Diverse personal characteristics, thinking, and backgrounds. |

| • | Other requirements as may be set forth by applicable rules, such as financial expertise for audit committee members. |

The Board will also more specifically weigh:

| • | Its current size, composition, and performance and oversight requirements. |

| • | Previous experience serving on public company boards or senior management teams. |

| • | Independence determinations under all applicable rules, including Nasdaq and SEC. |

| • | Whether the candidate possesses knowledge, experience, skills, and diversity to enhance the Board’s ability to manage and direct the Company’s affairs and business. |

| • | Key personal characteristics including strategic thinking, objectivity, independent judgment, integrity, intellect, and the courage to speak out and actively participate in meetings. |

| • | Knowledge of and familiarity with information technology. |

| • | The absence of conflicts of interest with Quantum’s business. |

| • | A willingness to devote significant time in effectively carrying out duties and responsibilities, including committing to attend at least six Board meetings per year, sit on at least one committee, and serve on the Board for an extended period of time. |

| • | Other factors the Corporate Governance and Nominating Committee may consider appropriate. |

Identifying and Evaluating Director Nominees

The Corporate Governance and Nominating Committee uses the following procedures to identify and evaluate potential director nominees:

| • | Regularly reviewing the Board’s size, composition, and collective performance, in addition to individual member performance and qualifications. |

| • | Determining whether to retain or terminate any third-party search firm used to identify director candidates, including approving the fees paid. |

| • | Reviewing qualifications of any properly identified, recommended, or nominated candidate. The committee’s review, in its discretion, may consider only the information provided to it or include discussions with third parties familiar with the candidate, candidate interviews, or other actions the committee deems proper. |

| • | Evaluating each candidate according to the General and Specific Considerations previously outlined. |

| • | Recommending a slate of director nominees to be approved by the Board. |

| • | Endeavoring to promptly notify director candidates of its decision regarding whether to nominate a candidate for Board election. |

17

The Board has not historically maintained a formal diversity policy for its members. However, in evaluating the Board’s composition, the Board and Corporate Governance and Nominating Committee consider diversity of:

|

|

|

|

|

| Knowledge | Culture | Race | Gender | Age |

The Board believes that directors with a diverse range of perspectives, skills, and experiences enable it to more effectively oversee all aspects of Quantum’s business. The Board considers underrepresented populations when seeking candidates for future nomination to the Board, and seeks to include women and members of underrepresented groups in each nominee candidate pool.

Shareholder Recommendations

The Corporate Governance and Nominating Committee’s policy is to consider shareholder recommendations for Board candidates. A shareholder must submit a written recommendation for a Board candidate to the attention of Quantum Corporation, Attn: Corporate Secretary, 10770 E. Briarwood Avenue, Centennial, Colorado, 80112.

Submissions must include:

| • | Candidate name and contact information. |

| • | Detailed biographical data and relevant qualifications, including references. |

| • | Descriptions of any relationships between the candidate and Quantum. |

| • | The shareholder’s statement in support of the candidate. |

| • | The candidate’s written indication of his or her willingness to serve if elected. |

| • | Other nominee information that our Bylaws and applicable SEC regulations require to be disclosed. |

Shareholder Nominees

Shareholders may also nominate director candidates for election to the Board. A shareholder that desires to nominate a candidate directly for election must meet the deadlines and other requirements set forth in our Bylaws and SEC rules and regulations (see Shareholder Proposals for Our 2026 Annual Meeting for more information). Our Bylaws are available on the investor relations section of our website at www.investors.quantum.com and as an exhibit to our Annual Report on Form 10-K.

The Corporate Governance and Nominating Committee may require any prospective nominee to furnish other information it reasonably desires to determine the nominee’s independence or eligibility to serve as a director.

18

Ethics and Compliance

We conduct business ethically, honestly, and in compliance with all applicable laws and regulations. Our path through complex AI and unstructured data environments presents new opportunities as well as new challenges. Our code of conduct is meant to help us successfully navigate this changing landscape by enabling effective business processes, relationships, and solutions.

The code applies to anyone conducting business on behalf of Quantum or its subsidiaries, including all directors, officers, and employees, and defines expectations in each of the following key areas:

|

|

| ||

| Mutual Respect | Professionalism | Accountability | ||

We: • Treat each other with respect. • Choose our words carefully. • Uphold human rights. • Value diversity. • Prioritize privacy. • Set a good example. |

We: • Grow our business ethically. • Maintain accurate records. • Document open-source use. • Get approvals if needed. • Negotiate with integrity. • Keep relationships professional. |

We: • Know Quantum’s policies. • Follow policies and processes. • Engage in ongoing training. • Report code of conduct violations. • Preserve confidentiality. • Protect Company assets. | ||

The Board most recently revised the code in February 2024, and it was distributed to all employees in both English and local languages the following month and again in February 2025. We also provided code of conduct training to all employees in the first few months of 2025.

We maintain an internal ethics committee comprised of leaders from our finance, internal audit, human resources, and legal teams. The committee supports the Company’s oversight of our compliance program and provides appropriate assistance in reviewing, investigating, and responding to reported concerns. We have also implemented a whistleblower policy and encourage reporting of ethics and compliance concerns, including by providing a confidential and anonymous third-party reporting hotline. Concerns that may relate to material accounting or auditing matters are communicated promptly to our Audit Committee.

Waivers of the code’s applicability to a Quantum director or executive officer may only be granted by our Board or its committees and must be timely disclosed as required by applicable law.

The code of conduct is available on the investor relations section of our website at www.investors.quantum.com. Copies of the code may be requested from Quantum’s Corporate Secretary at 10770 E. Briarwood Avenue, Centennial, Colorado, 80112.

Insider Trading Policy

We have adopted an

20

Anti-Hedging Policy

Under our insider trading policy, our directors, officers, employees, consultants and agents are prohibited from engaging in short sales of our securities, purchases of our securities on margin, hedging or monetization transactions through the use of financial instruments, and options and derivatives trading on any of the stock exchanges or futures exchanges.

21

Environmental, Social, and Governance Oversight

We recognize environmental, social, and governance (ESG) stewardship as an important component of our long-term business strategy, but one that follows an evolving path. We are committed to adapting in this significant endeavor, aware that today’s actions will shape the future. In Fiscal 2025 we continued working to improve our carbon footprint data. Our Carbon Disclosure Project score continued to keep pace with worldwide and industry-specific benchmarks.

The Corporate Governance and Nominating Committee oversees our ESG initiatives and policies, including communicating with stakeholders. Integral in that is our human capital management strategy, which includes:

|

|

|

|

|

|

Recruiting |

Retention |

Learning and |

Performance |

Rewards and |

Succession |

Internal survey results consistently indicate that employees generally have strong relationships with their managers, describing them as one of the best aspects of working at Quantum.

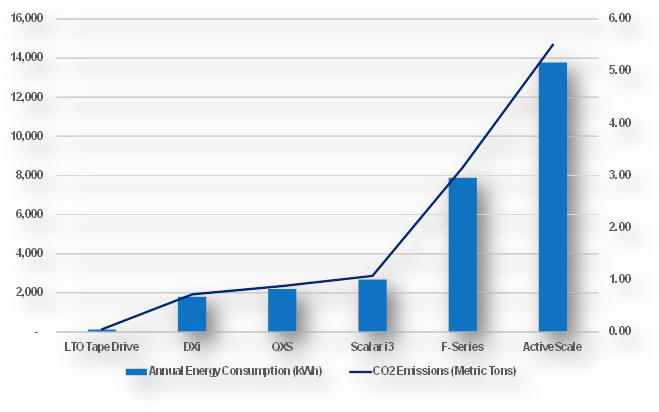

The following graph shows average energy usage and carbon emissions for selected Quantum products, based on one unit in service for twelve hours per day over one year. The average applies across all product models for which calculations have been completed.

22

Board Role in Risk Oversight and Board Evaluation

Quantum faces a wide spectrum of financial, strategic, operational, and regulatory risks. The Audit Committee is primarily responsible for overseeing the Company’s management of those risks and providing appropriate updates to the Board. The Audit Committee guides our risk identification, assessment, and management policies and procedures, including discussions of our major risk exposures, associated risk mitigation activities, and risk management practices implemented throughout the Company. It also actively monitors the Company's product and information technology cybersecurity risks and mitigation procedures.

The Board’s other committees also oversee risks associated with their respective areas of responsibility, including:

| • | The LCC’s review of compensation policies and practices risks. |

| • | The Corporate Governance and Nominating Committee’s guidance regarding compliance risks. |

The committees update the Board regarding their risk oversight practices through regular reporting and discussion. While the Board is responsible for risk oversight, risk management accountability lies with our management team. Quantum’s enterprise risk management practices and formal risk assessments are led by our internal audit team, which periodically reports status to the Audit Committee or Board, where appropriate. Our functional teams apply other appropriate risk assessment and mitigation techniques, with the relevant management representatives updating the Board as needed.

Our Board, committees, and individual directors perform annual self-evaluations in accordance with our corporate governance principles. The evaluations ensure our Board is strategic, productive, and effective, and contributes to long-term shareholder value. As part of the evaluation process, the Board and legal counsel hold ongoing discussions regarding Board and committee composition, effectiveness, and decision-making, as well as individual director performance.

23

Stock Ownership Guidelines

We annually review our stock ownership guidelines for our CEO, directors, and other officers. We compare our guidelines with those of peer group companies and consider ISS ownership governance best practices. Our Board believes that best aligning with shareholder interests requires our directors to hold common stock amounts on the larger end of our peer group and the ISS guidelines.

In Fiscal 2025, our Board determined it would continue the following stock ownership guidelines, which were last increased in 2020:

|

|

|

Directors 5x Annual Retainer |

CEO 3x Annual Base Salary |

CFO 2x Annual Base Salary |

Our policy does not include vested and unvested outstanding stock options, unvested restricted stock and restricted stock units, and unearned performance stock and performance stock units in share ownership. Eligible stock ownership includes the following elements:

| • | Shares purchased on the open market or through the 2022 rights offering. |

| • | Shares acquired by exercising stock options or under our Employee Stock Purchase Plan. |

| • | Vested restricted stock and restricted stock units. |

| • | Stock beneficially owned in a trust. |

| • | Stock held by a spouse or minor children. |

Compliance with our stock ownership guidelines is due on the later of five years from:

| • | The date an individual first became eligible for our stock ownership guidelines. |

| • | The date the stock ownership guidelines were last revised. |

If the dollar value of required holdings increases due to base salary or director cash compensation increases, stock ownership must also be increased within five years. We measure compliance with these guidelines at the end of each fiscal year. At the end of Fiscal 2025, all included positions were on track to meet their stock ownership guidelines.

24

Non-Employee Director Compensation

The Board, following recommendations from the LCC, determines the amount and form of non-employee director compensation. Management also provides information and recommendations regarding competitive market practices, target compensation levels, and compensation program design. The LCC also retains an independent compensation consultant to provide analysis and advice.

The LCC generally conducts a comprehensive periodic review of the Company’s compensation program, most recently in Fiscal 2025 when Quantum engaged Compensia as its independent compensation consultant. Following that review, our non-employee director compensation program elements were updated to include separate committee service and chair fees for service on the Company’s newly-created Special Committee, and to revise the automatic annual equity grant to be a fixed number of shares rather than a target grant date value. Our updated non-employee director compensation program is summarized in the table below.

Compensation Element |

Annual Value |

Frequency |

| Director Retainer | $50,000 | Equal quarterly installments |

| Lead Independent Director Retainer | $25,000 | Equal quarterly installments |

Committee Chair Fees • Audit Committee |

$25,000 | Equal quarterly installments |

| • Leadership & Compensation Committee | $17,500 | |

| • Corporate Governance & Nominating Committee | $15,000 | |

| • Special Committee | $30,000 | |

| • Technology Advisory Committee (disbanded) | $15,000 | |

Committee Member Fees • Audit Committee |

$12,500 | Equal quarterly installments |

| • Leadership & Compensation Committee | $10,000 | |

| • Corporate Governance & Nominating Committee | $7,500 | |

| • Special Committee | $12,500 | |

| • Technology Advisory Committee (disbanded) | $7,500 | |

| New Director Equity Grant | 12,000 shares | Pro-rated with 100% vesting at next annual meeting |

| Director Refresh Equity Grant | 12,000 shares | 100% vesting at earlier of next annual meeting or one year |

We have executed change of control agreements with each of our current non-employee directors. The agreements provide for automatic accelerated vesting of equity-based awards if the director’s service with the Company ends within twelve months following a change of control (other than for termination due to death or disability).

We allow our non-employee directors to defer some or all of their cash fees, which defers federal and state income taxes. Plan participants direct the deemed investment of their deferred accounts among a preselected group of investment funds which excludes Quantum’s common stock. The deemed investment accounts mirror the investment options available under Quantum’s 401(k) Savings Plan. Plan participants’ deferred accounts are credited with interest based on their selected deemed investments. During Fiscal 2025, no non-employee directors elected to participate in the deferred compensation plan.

25

In the fiscal year ended March 31, 2024 (Fiscal 2024), given the Company’s stock price and potential dilution impacts, the Board voted to delay its refresh equity grant. As a result, no non-employee Board members received equity grants in Fiscal 2024. Board members also did not receive any incremental cash compensation to offset the delayed equity grant. In Fiscal 2025, Board members received fully-vested restricted stock unit grants applicable to Fiscal 2024 as well as unvested grants of time-based restricted stock units applicable to Fiscal 2025, as reflected in the Director Compensation table below.

Fiscal 2025 Director Compensation

The following tables detail the Fiscal 2025 annual cash retainers, applicable committee service fees, and applicable Chair retainers paid to our directors. We do not pay meeting fees to our Board members. Following his appointment as President and Chief Executive Officer, Mr. Meyrath stopped receiving non-employee compensation for Board service.

| Name | Fees Earned or Paid in Cash1 | Stock Awards2 | All Other Compensation | Total |

| Arden, Todd W.3 | $169,998 | - | - | $169,998 |

| Jaworski, Donald J. | $103,125 | $82,080 | - | $185,205 |

| Meyrath, Hugues | $90,000 | $82,080 | - | $172,080 |

| Neumeyer, Christopher D.4 | - | - | - | - |

| Rothman, Marc E.5 | $44,063 | $41,040 | - | $85,103 |

| Tracy, John R. | $67,535 | $51,300 | $118,835 | |

| White, Yue Zhou (Emily) | $59,063 | $82,080 | - | $141,143 |

| 1Amounts reflect compensation earned by each director during Fiscal 2025 and include the amounts in the next table. | ||||

| 2Value reflects the closing price on the grant date of $3.42 per share. In accordance with the Company’s standard equity compensation program for non-employee directors, the Board approved an annual Fiscal 2025 award for Directors Jaworski, Meyrath, and White of 12,000 fully vested restricted stock units and 12,000 restricted stock units each, the latter of which will vest upon the earlier of the Annual Meeting or October 1, 2026, subject to each director’s continued Board service. The Board approved an award for Mr. Rothman of 12,000 fully vested restricted stock units. The Board approved a prorated award for Mr. Tracy of 3,000 fully vested restricted stock units and 12,000 restricted stock units which will vest upon the earlier of the Annual Meeting or October 1, 2026, subject to his continued Board service. | ||||

| 3Mr. Arden resigned from the Board effective April 2, 2025. He was paid $15,000 in cash retainers per month from June 2024 through September 2024. His cash retainer was increased to $18,333 per month beginning in October 2024, continuing through March 2025. Mr. Arden did not receive any equity compensation from the Company for his Board service. | ||||

| 4Mr. Neumeyer resigned from the Board effective March 19, 2025. He did not receive cash or equity compensation from Quantum for his Board service. | ||||

| 3Mr. Rothman did not stand for re-election at Quantum’s 2024 annual meeting of shareholders and his term ended immediately prior to the start of the 2024 annual meeting on August 15, 2024. | ||||

26

| Name | Board Retainer | Lead

Independent Director Retainer |

Committee

Membership Retainer |

Committee Chair Retainer | Total Fees Paid in Cash |

| Arden, Todd W. | $150,000 | - | $19,998 | $169,998 | |

| Jaworski, Donald J. | $50,000 | $15,625 | $20,000 | $17,500 | $103,125 |

| Meyrath, Hugues | $50,000 | - | $25,000 | $15,000 | $90,000 |

| Neumeyer, Christopher D. | - | - | - | - | - |

| Rothman, Marc E. | $18,750 | $9,375 | $6,563 | $9,375 | $44,063 |

| Tracy, John R. | $37,778 | - | $14,132 | $15,625 | $67,535 |

| White, Yue Zhou (Emily) | $50,000 | - | $9,063 | - | $59,063 |

27

Proposal One | Election of Directors

Quantum has nominated seven directors to be elected to the Board at the Annual Meeting, to serve until the 2026 annual meeting or until their successors are duly qualified and elected. The Corporate Governance and Nominating Committee recommended all nominees and the Board nominated all for election.

The nominees are:

|

Donald

J. Jaworski INDEPENDENT |

|

John A. Fichthorn INDEPENDENT |

|

Hugues

Meyrath Chief Executive Officer |

|

James C. Clancy INDEPENDENT |

|

Yue Zhou (Emily) White INDEPENDENT |

|

Tony J. Blevins INDEPENDENT |

|

John

R. Tracy INDEPENDENT |

Required Vote

This is an uncontested election requiring a majority of votes cast. A majority of votes cast means that the number of shares voted for a director exceeds the number of votes cast against the director. Abstentions will not be counted for or against a nominee and broker non-votes will have no effect on the outcome of this proposal. If a director nominee does not receive a majority of votes cast, he or she will not be elected. You may vote “FOR,” “AGAINST” or “ABSTAIN” on this proposal. See Information Concerning Solicitation, Voting, and Communication for more information about our majority voting policy.

Each shareholder voting on Proposal One may cumulate their votes as described in Information Concerning Solicitation, Voting, and Communication.

|

THE BOARD RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES LISTED ABOVE. |

29

| Proposals Two and Three | | Issuance of Common Stock Related to the Debt Exchange and Convertible Notes |

Overview

In connection with our ongoing efforts to restructure our debt and improve our balance sheet, on September 23, 2025, we entered into a Transaction Agreement (Transaction Agreement) with our existing lenders. The lender parties include Dialectic Technology SPV LLC, a Delaware limited liability company (Dialectic), OC III LVS XXXIII LP, a Delaware limited partnership (LVS XXXIII), and OC III LVS XL LP, a Delaware limited partnership (LVS XL and together with LVS XXXIII, the OC III Lenders). The OC III Lenders, together with Dialectic, are collectively referred to as the Lenders. Pursuant to the Transaction Agreement, we are proposing to issue to Dialectic, on a dollar-for-dollar basis, one or more senior secured convertible notes (Convertible Notes) in exchange for the amounts we have then outstanding and owing to Dialectic under certain term loans held by Dialectic, as further discussed below (such issuance, the Debt Exchange). The Convertible Notes will be governed by an indenture (Indenture).

Background

On August 5, 2021, we entered into a Term Loan Credit and Security Agreement (as amended, modified, supplemented, renewed, restated or replaced from time to time, the Term Loan Credit Agreement) with Quantum LTO Holdings, LLC, our wholly-owned subsidiary (Quantum LTO), the other borrowers and guarantors and lenders from time to time party thereto, and Blue Torch Finance LLC (Blue Torch), as disbursing agent and collateral agent for such lenders. On April 2, 2025, certain entities affiliated with Blue Torch assigned their rights and obligations as lenders under the Term Loan Credit Agreement to Dialectic, in an aggregate amount of approximately $51.3 million in term loans issued pursuant to the Term Loan Credit Agreement (Term Loans).

We have executed a series of amendments to the Term Loan Credit Agreement intended to improve our liquidity and operational flexibility, including to provide covenant relief, modify prepayment requirements, permit certain asset sales, allow a portion of interest to accrue in kind, and issue additional term loans and warrants. In addition, we entered into a Standby Equity Purchase Agreement dated January 25, 2025 (as amended, modified, supplemented, renewed, restated or replaced from time to time, the SEPA) with YA II PN, LTD (Yorkville). Pursuant to the SEPA, Yorkville has committed to purchase from us, at our direction, up to $200.0 million of our common stock, subject to terms and conditions specified in the SEPA. Under the terms of the Term Loan Credit Agreement, certain proceeds under the SEPA must be applied to repay the outstanding Term Loans. In connection with those efforts, we also terminated our revolving credit facility in August 2025.

Our recent financial performance and failure to timely file our periodic reports in the past two fiscal years have resulted in the need to obtain waivers from our lenders for breaches of various covenants, including financial covenants. In the past, we have had to pay cash fees, issue warrants to purchase shares of common stock and provide other economic concessions in response to lenders’ demands in order to obtain waivers for those covenant breaches. If we breach any remaining covenants in the Term Loan Credit Agreement, there is no guarantee that we will be able to obtain waivers from our current Lenders, which may result in an event of default, thereby accelerating our repayment obligations under the Term Loan Credit Agreement. As we do not currently have the ability to repay our obligations under the Term Loan Credit Agreement, our ability to continue as a going

30

concern would be in doubt if the proposal to approve the Debt Exchange (Debt Exchange Proposal) is not approved by shareholders and we subsequently breach a covenant

under the Term Loan Credit Agreement.

Even if we do not breach a covenant in the future, the Term Loans will become due in August 2026. We do not currently anticipate having the ability to meet our repayment obligations at that time if the Debt Exchange Proposal is not approved by shareholders or otherwise not completed. As discussed further below, the maturity date of the Convertible Notes to be issued in the Debt Exchange would be three years from the date of the Debt Exchange. In light of these circumstances, our Board explored a number of alternatives, including conducting a strategic process to explore divestitures of business lines or assets, a potential sale of the Company, or alternative equity and debt financings, as well as engaging in financial restructuring discussions with our current lenders. After exploring these strategic alternatives, our Board approved the Transaction Agreement and the transactions it contemplates.

We

have also undertaken measures to restructure our business to better align our cost structure with current performance. These

activities have required us to incur certain restructuring costs, placing even further strain on our current cash position

and increasing the need for a long-term solution to our outstanding debt as well as additional capital to execute on our

growth initiatives. We believe that consummating the Debt Exchange and strengthening our balance sheet will improve our

long-term outlook, which will help address long-term viability concerns raised by current and potential customers, suppliers,

and employees. Our strategy is rooted in ultimately addressing our outstanding debt, for which the Debt Exchange is critical,

raising additional capital as permitted in the Transaction Agreement, and continuing to execute on our cost-saving measures and strategic growth plan. Concurrently with entering into the Transaction Agreement, we entered into the

Fifteenth Amendment to the Term Loan Credit Agreement (Fifteenth Term Loan Amendment) with Quantum LTO, the Lenders and Alter

Domus (US) LLC, as disbursing and collateral agent. The Fifteenth Term Loan Amendment, among other things, (i) permits us to

retain up to $15.0 million of proceeds received under the SEPA after the date of the Fifteenth Term Loan Amendment for

working capital and other general corporate purposes,

(ii) converted certain tranches of Term Loans then held by the OC III

Lenders into new and separate tranches under the Term Loan Credit Agreement, (iii) deferred certain cash interest payments on

the Dialectic Term Loans, and (iv) eliminated the maximum total net leverage ratio covenant and minimum daily liquidity

covenant (but as noted below, the Convertible Notes will be subject to a minimum liquidity covenant following the Debt

Exchange). Together, the Fifteenth Term Loan Amendment and Transaction Agreement contemplate the exchange of existing Term

Loans held by Dialectic for Convertible Notes (as described below), providing us with additional liquidity, improved balance

sheet strength, and operational flexibility. Improving our capital structure through the Debt Exchange will also

reduce long-term viability concerns expressed by our customers, suppliers, and employees.

As previously disclosed, on September 23, 2025, concurrently with the execution and delivery of the Transaction Agreement, and as consideration for the forbearance, waivers and amendments granted by Dialectic under the Fifteenth Term Loan Amendment, we issued to Dialectic a warrant (Forbearance Warrant) to purchase 2,653,308 shares of our common stock, representing 19.9% of the outstanding shares of common stock as of the date of the Transaction Agreement.

At the closing (Closing) of the transactions contemplated by the Transaction Agreement and subject to its terms and conditions, including approval of the Debt Exchange Proposal by the Company’s shareholders, we will consummate the Debt Exchange by issuing to Dialectic, on a dollar-for-dollar basis, Convertible Notes in exchange for the amounts then outstanding under the Term Loans held by Dialectic (including principal, any prepayment penalties, and exit fees, but excluding any accrued and unpaid interest thereon).

We expect to be able to raise net cash proceeds pursuant to the SEPA that are sufficient (i) to pay the costs and expenses of the transactions contemplated by the Transaction Agreement, (ii) to repay amounts outstanding and owing under the Term Loan Credit Agreement to the OC III Lenders, and (iii) for our working capital needs and other general corporate purposes (collectively, the Specified Purposes). In the event that we use commercially

31

reasonable efforts but are unable to raise funds under the SEPA sufficient for the Specified Purposes, and upon our written request,

Dialectic shall use commercially reasonable efforts to make additional funds available to us for the Specified Purposes. These

additional funds will be provided by either (i) prior to the Closing, increasing the aggregate principal amount of the Term Loans

made by Dialectic to us, or (ii) subject to shareholder approval, at or following the Closing, purchasing additional Convertible

Notes beyond those we may issue to Dialectic in the Debt Exchange (Additional Convertible Notes and, if we issue Additional Convertible

Notes, an Additional Notes Issuance).

The Closing is subject to various conditions, including the approval of the Debt Exchange by our shareholders.

Relationship Between the Company and Dialectic

As previously disclosed, effective April 3, 2025, John Fichthorn was appointed as a director of the Company. Mr. Fichthorn is the Managing Partner of Dialectic Capital Management, an investment advisor to Dialectic.

Because of the relationships among the Company, Dialectic and Mr. Fichthorn, in considering the Transaction Agreement, the Fifteenth Term Loan Amendment, the Forbearance Warrant, the Forbearance Warrant Registration Rights Agreement (as defined below), the Convertible Notes, and the Convertible Notes Registration Rights Agreement (as defined below) (collectively, the Transaction Documents) and the transactions contemplated thereby (collectively, with the Transaction Documents, the Proposed Transaction), the Board delegated to the Special Committee the power and authority to evaluate, negotiate and approve, or decline to approve, the Proposed Transaction and future transactions with Dialectic and its affiliates. On September 22, 2025, the Special Committee approved and declared advisable the Proposed Transaction, determined that the terms of the Proposed Transaction are fair to, and in the best interests of, the Company and its shareholders, and recommended that the Board approve the Proposed Transaction.

On

the same day, the Audit Committee, consisting solely of independent directors and not including

Mr. Fichthorn, in its capacity

of reviewing related party transactions to which we propose to become a party, reviewed and approved the Proposed Transaction

and recommended that the Board approve the Proposed Transaction. The Audit Committee approved and recommended that the Board approve

the Proposed Transaction after considering the following factors, among others: (i) whether the terms of the transaction are fair

to the Company and on arms-length terms that would apply if the transaction did not involve a related party; and (ii) whether

there are business reasons for the Company to enter into the related party transaction.

Also on September 22, 2025, the Board, with Mr. Fichthorn abstaining from both discussion and voting on the matter, (a) approved and declared advisable the Proposed Transaction, (b) determined that the terms of the Proposed Transaction are fair to, and in the best interests of, the Company and its shareholders, (c) directed that, for purposes of compliance with applicable Nasdaq rules, (i) the Debt Exchange, (ii) any Forbearance Warrant Excess Shares Issuance (as defined below) and (iii) if applicable, any Additional Convertible Notes, be submitted to a vote of the Company’s shareholders at a shareholder meeting, and (d) recommended that the Company’s shareholders approve the Debt Exchange, any Forbearance Warrant Excess Shares Issuance, and, if applicable, any Additional Convertible Notes, on the terms and subject to the conditions set forth in the Transaction Agreement.

Terms of the Convertible Notes and any Additional Convertible Notes

The Convertible

Notes will mature on the third anniversary of the Closing (Maturity Date) and will have an interest rate of 10% per annum, payable

in kind, compounded annually. The initial conversion price of the Convertible Notes is contemplated to equal $10.00 per share

of common stock (Conversion Price), subject to adjustment for stock splits and similar events, and includes antidilution protections.

At the time of the approval of the Transaction Agreement, the 30-day Daily VWAP (as defined in the Indenture) for the preceding

30 days was $10.11

32

per share and the

90-day Daily VWAP for the preceding 90 days was $10.78 per share. The Conversion Price is subject to adjustment on the last

day of each calendar quarter following execution of the Transaction Agreement (each, a Reset Price Date) to the greater of

(a) $4.00 per share and (b) the lesser of (i) the then Conversion Price and (ii) the 30-day Daily VWAP of the common

stock immediately preceding the Reset Price Date. Assuming a Conversion Price of $10.00 and no Additional Notes Issuance, at

the time of the Closing, the shares issuable upon full conversion of the Convertible Notes (without taking into account any

interest payable on the Convertible Notes following the Closing) would represent approximately 29.4% of our issued and

outstanding common stock immediately after giving effect to the conversion.

At our option, all outstanding principal amount, accrued and unpaid interest and premium, if any, of any Convertible Notes outstanding on the Maturity Date shall be exchanged into shares of our common stock at an exchange price equal to 80% of the Market Price, defined as the average of the Daily VWAP for each of the five lowest consecutive trading days during the 20 consecutive trading days ending on (and including) the trading day immediately prior to the Maturity Date. Following the six-month anniversary of Closing, if certain conditions are met, we may elect to require the exchange of a portion of the total outstanding amount of any Convertible Notes into shares of common stock at the then outstanding Conversion Price.

The Indenture will contain certain affirmative and negative covenants substantially consistent with the Fifteenth Term Loan Amendment, as well as a covenant requiring that we maintain minimum liquidity of $3.75 million as of the last day of the first quarter of 2026, $5.0 million as of the last day of the second quarter of 2026, $6.25 million as of the last day of the third quarter of 2026, and $7.5 million as of the last day of the fourth quarter of 2026 as well as each quarter thereafter. The Convertible Notes will be secured by all of our assets currently securing the Term Loans.

In addition, at the Closing, we and Dialectic will enter into a registration rights agreement pursuant to which, among other things, we will provide Dialectic (or any assignee of the Convertible Notes) with certain demand and piggyback registration rights with respect to the shares of common stock issuable upon any conversion of the Convertible Notes (Convertible Notes Registration Rights Agreement).

The number of shares of common stock issuable upon conversion of the Convertible Notes, including, if applicable, any Additional Convertible Notes, either individually or collectively with the shares issuable upon exercise of the Forbearance Warrant, may be equal to or exceed 20% of our outstanding common stock or voting power prior to such issuance.

The foregoing is a summary of the principal terms of the Convertible Notes, including any Additional Convertible Notes. While we believe that the summary above describes the material terms of the Convertible Notes and any Additional Convertible Notes necessary for you to make a voting decision for the purposes of the Debt Exchange Proposal and the proposal to approve any Additional Notes Issuance (Additional Notes Issuance Proposal), it may not contain all of the information that is important to you. The summary above is qualified in its entirety by reference to our Current Report on Form 8-K filed with the SEC on September 23, 2025 (September 8-K), which is incorporated herein by reference, and to the Transaction Agreement, which includes forms of the Indenture and Convertible Notes, the Fifteenth Term Loan Amendment, and the Forbearance Warrant, which are included as exhibits to the September 8-K. We encourage you to read the Transaction Agreement and the forms of the Indenture and Convertible Notes included therein, the Fifteenth Term Loan Amendment, and the Forbearance Warrant in their entirety.

Reasons for the Debt Exchange Proposal and the Additional Notes Issuance Proposal

Our common stock is listed on the Nasdaq Global Market, and we are subject to Nasdaq listing rules and regulations. Nasdaq listing rule 5635 requires shareholder approval: (a) prior to the issuance of securities in connection with a transaction (other than a public offering) involving the sale, issuance, or potential issuance of common stock (or securities convertible into or exercisable for common stock) equal to 20% or more of the

33

common stock or 20% or more of the voting power outstanding before the issuance for a price that is less than the lower of: (i)

the closing price of the common stock immediately preceding the signing of the binding agreement for the issuance of such securities;

or (ii) the average closing price of the common stock for the five trading days immediately preceding the signing of the binding

agreement for the issuance of such securities (such threshold, the 20% Cap); and (b) when such issuance or potential issuance

could result in a change of control, as interpreted by Nasdaq.

Accordingly, we are seeking shareholder approval to authorize the issuance of shares of our common stock in connection with the conversion of the Convertible Notes, including, if applicable, any Additional Convertible Notes to the extent that such issuance (a) could equal or exceed the 20% Cap or (b) could result in a change of control of the Company, as interpreted by Nasdaq.

We are seeking shareholder approval to make such issuances in accordance with Nasdaq listing rule 5635 because we would like to settle conversions of the Convertible Notes, including, if applicable, any Additional Convertible Notes, in shares of our common stock and to avoid additional financial obligations we will face if we do not receive shareholder approval. We believe this is in the Company’s best interests and the best interests of its shareholders. Without shareholder approval, the issuance of shares in excess of the 20% Cap, or the issuance of shares that could result in a change of control, may constitute a violation of Nasdaq listing rule 5635. Accordingly, we are seeking shareholder approval to ensure compliance with Nasdaq requirements and to provide us with the flexibility to settle the Convertible Notes, including, if applicable, any Additional Convertible Notes, in shares of our common stock.

Effect of Approval of the Debt Exchange Proposal

Approval of the Debt Exchange Proposal is not contingent on the approval of any other proposal in this Proxy Statement. If this proposal is approved, we will be authorized to issue to Dialectic, on a dollar-for-dollar basis, one or more Convertible Notes in exchange for approximately $52 million then outstanding under the Term Loans held by Dialectic (including principal, any prepayment penalties and exit fees, but excluding any accrued and unpaid interest thereon). As a result, Dialectic would be entitled to acquire shares of our common stock upon the conversion of such Convertible Notes, together with the shares issuable upon the conversion of any Additional Convertible Notes (subject to shareholder approval of the Additional Notes Issuance Proposal).

The conversion of these Convertible Notes and any Additional Convertible Notes, as well as the exercise of the Forbearance Warrant, could result in Dialectic holding a substantial percentage of our outstanding common stock that may be voted without restriction. Assuming a Conversion Price of $10.00 and no Additional Notes Issuance, at the time of the Closing, the shares issuable upon full conversion of the Convertible Notes would represent approximately 29.4% of our issued and outstanding common stock immediately after giving effect to the conversion. The Forbearance Warrant issued to Dialectic is exercisable for up to approximately 19.9% of the number of issued and outstanding shares of common stock as of the date of its issuance. Accordingly, immediately after the Closing, Dialectic is expected to be entitled to hold up to approximately 38.1% of the issued and outstanding shares of common stock at such time, assuming (i) conversion of all of the Convertible Notes to be issued to Dialectic at a Conversion Price of $10.00 (without taking into account any interest payable on the Convertible Notes following the Closing) and (ii) the exercise, in full and by the payment of cash, of the Forbearance Warrant held by Dialectic, with no adjustment to the Forbearance Warrant Exercise Price.

In the event of a significant adjustment to the Forbearance Warrant Exercise Price resulting in a Forbearance Warrant Excess Shares Issuance (as defined below), and/or if any Additional Convertible Notes are issued and subsequently converted, Dialectic could potentially beneficially own more than 50% of our then issued and outstanding shares of common stock upon full exercise and conversion of such securities.

The issuance of common stock to Dialectic upon conversion of the Convertible Notes (including, if applicable, any Additional Convertible Notes) will have a dilutive effect on our existing shareholders. Such issuances, including

34

any such issuances in excess of the 20% Cap, will not affect the rights or privileges of our existing shareholders, except that

the economic and voting interests of each of our existing shareholders will be diluted as a result of any such issuance. Although

the number of shares of common stock that our existing shareholders own will not decrease as a result of issuances of common stock

upon the conversion of the Convertible Notes (including, if applicable, any Additional Convertible Notes), the shares owned by

our existing shareholders will represent a smaller percentage of our total outstanding shares following any such issuance. We

recommend that shareholders approve the Debt Exchange Proposal despite this dilution because of the additional balance sheet strength

and operating flexibility that we believe will result from executing the Proposed Transaction.

Potential Consequences if the Debt Exchange Proposal is Not Approved

The Board is not seeking shareholder approval to authorize our entry into the Transaction Agreement. The Transaction Agreement has already been executed and delivered. However, if shareholders do not approve this proposal, approximately $52 million of the Term Loans held by Dialectic will not be exchanged for Convertible Notes and will remain outstanding, maturing in August 2026. If our shareholders do not approve the Debt Exchange Proposal, or if the Closing has not occurred by March 23, 2026, either we or Dialectic would have the right to terminate the Transaction Agreement, which may require us to reimburse Dialectic and its affiliates for certain transaction-related expenses. If the transactions contemplated by the Transaction Agreement are not consummated, any reimbursement of such expenses could have an adverse effect on our liquidity and financial position. As noted above, our strategy is rooted in ultimately addressing our outstanding debt, for which the Debt Exchange is critical, raising additional capital as permitted in the Transaction Agreement, and continuing to execute on our cost-saving measures and our strategic growth plan. If the Debt Exchange Proposal is not approved, we will need to continue to explore alternative transactions to address our outstanding debt and raise additional capital to fund our continuing operations, which may not be available to the Company on commercially reasonable terms. These transactions may not be available and, if available, may only be available on terms that are materially adverse to the Company and its shareholders. The failure to consummate the Debt Exchange, as contemplated, could have a material and adverse effect on the Company and its ability to execute our business objectives. In addition, these outcomes could materially and adversely affect our liquidity, as we may be required to use cash to repay all of the outstanding Term Loans and reimburse such expenses, and we do not currently have sufficient funds available to satisfy these obligations.

We may adjourn or postpone the Annual Meeting to a later date if, after consultation with Dialectic, we believe in good faith that such adjournment or postponement is reasonably necessary to allow reasonable additional time to solicit additional proxies necessary to obtain shareholder approval of the Debt Exchange Proposal. Any such adjournment or postponement of the Annual Meeting, however, may not by itself result in the approval of this proposal.

Required Vote

The approval of the Debt Exchange Proposal requires the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote thereon. Abstentions will have the effect of a vote against this proposal. Broker non-votes will have no effect on the outcome of this proposal. You may vote “FOR,” “AGAINST” or “ABSTAIN” on this proposal.

| THE BOARD RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE ISSUANCE OF CONVERTIBLE NOTES PURSUANT TO THE DEBT EXCHANGE FOR PURPOSES OF COMPLYING WITH NASDAQ LISTING RULE 5635. |

35

Effect of Approval of the Additional Notes Issuance Proposal

Approval of the Additional Notes Issuance Proposal is not contingent on the approval of any other proposal in this Proxy Statement. If this proposal is approved, we will be authorized to issue to Dialectic one or more Additional Convertible Notes agreed to by us and Dialectic pursuant to the terms of the Transaction Agreement. As a result, Dialectic would be entitled to acquire additional shares of our common stock upon the conversion of such Additional Convertible Notes, together with the shares issuable upon conversion of the Convertible Notes to be issued in the Debt Exchange (subject to shareholder approval of the Debt Exchange Proposal).