Profitability. Leadership. Growth.

May 2006

Filed by Quantum Corporation Pursuant to Rule 425

Under the Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Subject Company: Advanced Digital Information Corporation

Commission File No.: 0-21103

Profitability. Leadership. Growth. May 2006 |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 2 Tiered Storage Environment Primary Storage Near Line Storage 2nd to N Storage Deep Archival • Mission Critical • Mirroring • Most expensive • Most reliable • Most scalable • High data value • High availability • Medium performance • Less expensive • Readily accessible • Medium to high data value • Disk-based backup • Limited scalability • High capacity • Low performance • Low cost • Tape archival • Infrequently accessed • Archival data offsite • Regulatory requirements: WORM, security • Low data value • Infrequently accessed th |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 3 Historical Perspective • 25 years of storage experience and expertise: in 2001, began the transition from hard drives to a new mission • Spent past several years re-engineering every aspect of the company – Legacy issues – Organization/infrastructure – Cost structure – Certance acquisition & integration – Research & development in new products & platforms – Quality improvement The largest independent provider of backup, recovery and archive solutions |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 4 Financial Results Illustrate Progress *Financial results reflect Income/loss from continuing operations 2 cents loss 7 cent profit $13.0M $230M (29%) 32% $794M FY’05 36 cents loss 4 cents loss ($6.2M) $250M (31%) 33% $808M FY’04 23 cent loss 10 cent profit $19.3M $229M (27.5%) 30% $834M FY’06 81 cents loss GAAP EPS* 7 cents loss Non-GAAP EPS** ($10.8M) Net Income (loss)* $278M (32%) Opex (% of Revenue) 32% GM Rate $871M Revenue FY’03 Non-GAAP** **Non-GAAP financial measures presented here are not prepared in accordance with GAAP. For a presentation of the GAAP measures, and a reconciliation of the differences between the GAAP and non-GAAP measures, please visit the Investor

Relations section of our website located at www.Quantum.com. •

FY05 first full year of non-GAAP profit in 3 years • Focus on resolving legacy issues • Reassessed roadmap for new products and platforms |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 5 FY06 was a Pivotal Year • Develop an execution platform that facilitates success – Simplified business systems to one Oracle platform; consolidated operations and manufacturing sites; consolidated engineering and marketing functions; launched new Quantum.com site • Create the industry’s leading tape business – Launched 11 new products: SuperLoader3, PX500 Series, DLT-V4, SDLT 600A, DLT-S4, the Quantum security framework and more! • Build a promising growth platform – Launched StorageCare Guardian, DX3000, DX5000, DPM5500 and GoVault • Settle legacy issues – Sun/STK lawsuit – All issues are resolved |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 6 Develop stronger execution platform that facilitates success by leveraging Quantum’s breadth to create sustainable cost and quality advantages Build on industry’s leading independent tape business by capitalizing on unique position as developer of tape drives, media and automation Create growth platform by moving beyond tape with disk, software and services optimized for tiered storage environments Quantum’s Strategic Priorities More diverse, differentiated and valuable storage market position Increased customer value and better overall experience |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 7 A Transforming Transaction The two leading, independent backup, recovery The two leading, independent backup, recovery and archive providers… and archive providers… are joining together to create one of the are joining together to create one of the industry’s largest, independent storage industry’s largest, independent storage company and one that will provide customers company and one that will provide customers the most comprehensive and integrated range the most comprehensive and integrated range of solutions for securely storing, managing, of solutions for securely storing, managing, protecting and recovering their data in open protecting and recovering their data in open systems IT environments systems IT environments + |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 8 Transaction Summary • Expected 3 to 4 months after announcement Closing • ADIC shareholder approval • HSR clearance • No financing condition • Other customary conditions Conditions • Combined cash on hand of $320M • Debt of up to $500M • Obtained formal commitment from KeyBanc Financing • $770 million, net of transaction expenses Total Offer Value • $12.25 per share in cash or 3.461 shares of Quantum stock for each ADIC share in lieu of cash. • Stock election is subject to pro-ration such that Quantum will issue no more than 19.95% of its stock outstanding Offer Price |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 9 Powerful Strategic Rationale Enhances financial position Expands market access Stronger growth platform |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 10 Growth Opportunities • Data growth rates show no signs of slowing • Storage remains a top IT decision-maker priority • Regulatory compliance issues increase storage complexity, risk and cost • Existing storage architectures no longer meeting requirements • Users seeking trusted suppliers that can deliver best-of-breed solutions • Constrained IT budgets dictate strong focus on total cost of ownership 001011010010101010101010101000101010010101001001000100 001011010010101010101010101000101010010101001001000100 100010001101110001011000001111001111010010111001001010 011011100010110000011110011110100101110010010101010101 000001001011010010101010101010101000101010010101001001 000100100010001101110001011000001111001111010010111001 001010101010100000100101101001010101010101010100010101 001010100100100010010001000110111000101100000111100111 101001011100100101010101010000010010110100101010101010 101010001010100101010010010001001000100011011100010110 000011110011110100101110010010101010101000001001011010 010101010101010101000101010010101001001000100100010001 101110001011000001111001111010010111001001010101010100 000101101110001011000001111001111010010111001001010101 010100000100101101001010101010101010100010101001010101 001011010010101010101010101000101010010101001001000100 100010001101110001011000001111001111010010111001001010 011011100010110000011110011110100101110010010101010101 000001001011010010101010101010101000101010010101001001 000100100010001101110001011000001111001111010010111001 001010101010100000100101101001010101010101010100010101 001010100100100010010001000110111000101100000111100111 101001011100100101010101010000010010110100101010101010 101010001010100101010010010001001000100011011100010110 000011110011110100101110010010101010101000001001011010 010101010101010101000101010010101001001000100100010001 101110001011000001111001111010010111001001010101010100 000101101110001011000001111001111010010111001001010101 010100000100101101001010101010101010100010101001010101 001011010010101010101010101000101010010101001001000100 100010001101110001011000001111001111010010111001001010 011011100010110000011110011110100101110010010101010101 000001001011010010101010101010101000101010010101001001 000100100010001101110001011000001111001111010010111001 001010101010100000100101101001010101010101010100010101 001010100100100010010001000110111000101100000111100111 101001011100100101010101010000010010110100101010101010 101010001010100101010010010001001000100011011100010110 000011110011110100101110010010101010101000001001011010 010101010101010101000101010010101001001000100100010001 101110001011000001111001111010010111001001010101010100 000101101110001011000001111001111010010111001001010101 010100000100101101001010101010101010100010101001010101 Unprecedented Opportunity for a Storage Industry Innovator to Unprecedented Opportunity for a Storage Industry Innovator to Deliver Integrated Backup, Recovery and Archive Solutions Deliver Integrated Backup, Recovery and Archive Solutions |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 11 Total Storage Market 2006 CAGR% Network Infrastructure 3.2 $ 17.5% Management Software 8.9 $ 11.6% Tape Devices / Systems 7.9 $ 5.1% Host-Attached Disk 7.3 $ -5.5% Disk Arrays 18.4 $ 5.8% Total 45.7 $ 5.3% Recovery Storage Market 2006 CAGR% Recovery Services 0.08 $ 14.9% Recovery Net. Infra. 1.3 $ 23.8% Recovery Mgmt. Software 5.3 $ 12.0% Tape Devices / Systems 7.9 $ 5.1% Recovery Disk Systems 4.9 $ 15.7% Total 19.4 $ 10.6% $20 Billion Growth Market Total Storage Market End-user Revenue $ Billions “Recovery” Storage Market End-user Revenue $ Billions CAGR% for 2003-2008 Source: Gartner and Quantum Target Market Represents Growth Opportunity that is 2x Target Market Represents Growth Opportunity that is 2x the Rate of Storage Industry Overall the Rate of Storage Industry Overall |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 12 Stronger Platform for Growth Our Vision: Comprehensive and integrated solutions for Our Vision: Comprehensive and integrated solutions for securely storing, managing, protecting and recovering data in securely storing, managing, protecting and recovering data in open systems IT environments open systems IT environments Core Backup & Recovery Remote Site Disaster Recovery Workflow & Archiving Storage Security Tiered Data Center Storage Data Mgmt. FastStor FastStor Scalar i500 Scalar i500 PX500 Series PX500 Series Scalar 10k Scalar 10k SuperLoader 3 SuperLoader 3 iSurety iSurety Guardian Guardian Global Services Global Services Pathlight VX Pathlight VX DX-Series PX720 PX720 Scalar i2000 Scalar i2000 DPM5500 DPM5500 |

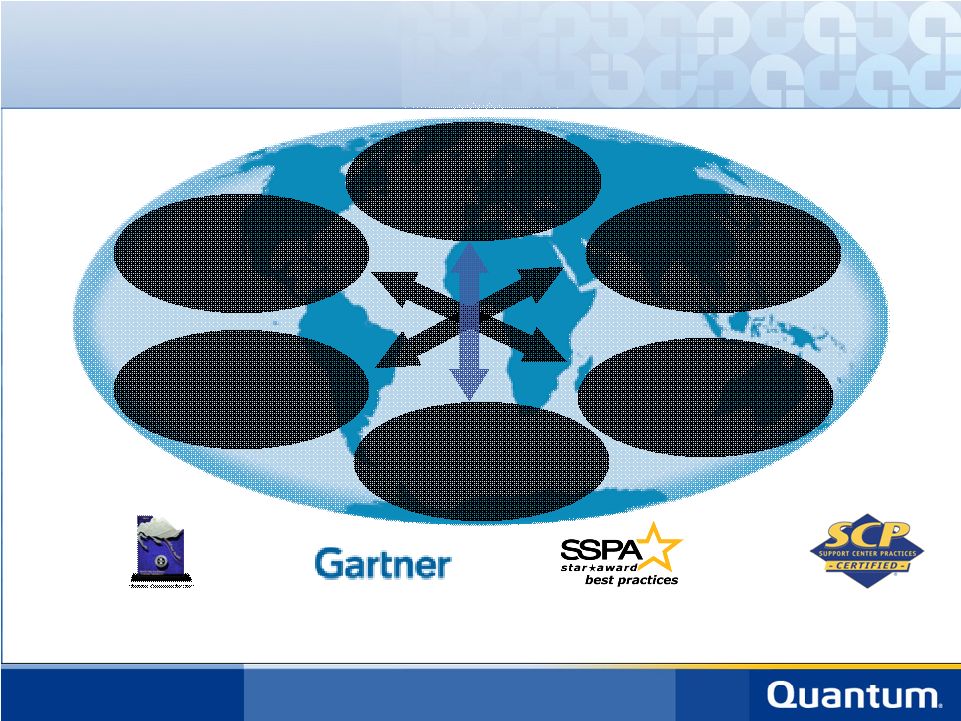

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 13 Market Access = Revenue Opportunity • Over 3000 employees • Significant global presence • Substantial customer access capabilities – 3x the sales force and 2x the service sales force – Broad base of OEM relationships – Over 250 enterprise VARs – Over 5,000 VARs actively selling product each quarter – Over 200,000 automation systems installed in last four years – Almost 20,000 systems covered by service uplift contracts |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 14 Dual Go-to-Market Approach Workgroup

Midrange Enterprise Workgroup

Midrange Enterprise Quantum Strengths: • Tape drives and media • Low-end tape automation • Removable disk drives • Security • High volume channel ADIC Strengths: • Enterprise tape automation • Data management software • Enterprise sales expertise • Direct and vertical accounts • EMEA and APAC field coverage Common strengths; More critical mass • Midrange tape automation • Disk-based backup • Services • OEM partnerships: IBM, Dell, HP, Fujitsu Siemens, Sun |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

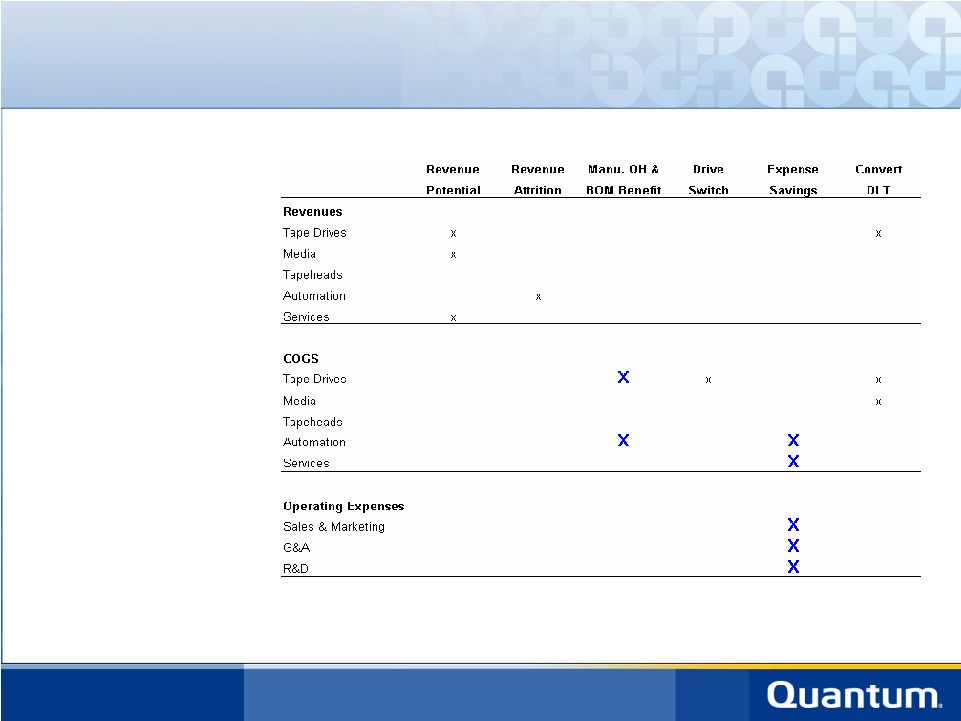

outlook and is for planning purposes only. 15 Enhances Quantum’s Financial Position • Highly accretive to EPS – Up to 15 cents accretive to cash EPS in the first full year of combined operations • Annual cost synergies of approximately $45 million, primarily from: – COGS economies of scale and manufacturing efficiencies – Reduction of duplicative operating expenses – Sharing of R&D and marketing costs • Higher margin revenue base – Quantum branded revenue ~ 30% vs. ADIC branded revenue ~ 60% – Increased service revenue |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 16 Integration is Critical • Dedicated experienced integration leader • Cost synergies are well concentrated – R&D – G&A – Services – Operations • Sales and marketing is largely complementary – minimal disruption • Additional sales opportunities – Tape drive and media • Customer and partner feedback has been positive • Integration plan is underway |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 17 Integration Philosophy • Pick the best – Management – Products – Operations • Make decisions soon after close on all critical areas, including synergy actions • Blend sales force and capabilities: High volume (Quantum) and High touch (ADIC) • Aggressive communications to relevant constituents to ensure smooth integration: customers, employees, partners • De-leverage quickly and prudently |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 18 11 80% of Synergies are Concentrated in Four Areas Manufacturing OH & BOM • Service infrastructure utilization improvement • Higher manufacturing utilization • Supply chain management • CM consolidation • BOM reduction Sales & Marketing • HC reductions for duplicative functions • Marketing/tradeshow programs consolidation • Administrative redundancies G&A • HC reductions for duplicative functions (HR/Facilities/Admin/Exec) • Audit/legal/IR fees reduced • BOD & R/E elimination • IT redundancies R&D • HC reductions • Shared R&D costs |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 19 Product Portfolio DX100 DX30 CDL Autoloader SuperLoader™ 3 PX502 PX506 PX510 PX720 LTO FH SDLT / DLT-S4 LTO HH DLT VS / DLT-V4 DDS / DAT Travan DISK-BASED BACKUP APPLIANCES AND SYSTEMS STORAGE DEVICES AND MEDIA DX5000 DPM5500 DX3000 TAPE AUTOMATION SYSTEMS DPM5500 New New New New New New New New New SDLT 600A GoVault New New |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 20 Award-Winning Global Services Eight Technical Eight Technical Assistance Assistance Centers Centers Over 400 Strategic Over 400 Strategic Stocking Stocking Locations Locations 90 Countries 90 Countries Covered Covered >50 Product Lines >50 Product Lines Supported Supported >18k Contracts >18k Contracts 2005, 2006 NorthFace Award Customer Sat. Excellence 2006 SSPA STAR Award Best Practices in Support 2004, 2005, 2006 SCP Certified Support Effectiveness 2005 Positive Rating Support / Acct. Management Over 700 Service Over 700 Service Team Members Team Members (+ Partners) (+ Partners) Leadership in Leadership in Enabling Enabling Technology Technology (iSurety, Guardian) (iSurety, Guardian) |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 21 Quantum Summary Historical Financials Free Cash Flow defined as Cash From Operations minus Capital Expenditures. EBITDA includes

interest income. Fixed Charge Coverage equals EBITDA divided by Interest Expense + CapEx ($ in Millions) Fiscal Year Ended March 31, 2000 2001 2002 2003 2004 2005 2006 Revenues $1,418.9 $1,346.1 $1,029.7 $870.8 $808.4 $794.2 $834.3 Growth 8.9% (5.1%) (23.5%) (15.4%) (7.2%) (1.8%) 5.1% Gross Profit $648.9 $612.5 $377.6 $267.2 $251.7 $235.5 $231.9 Margin 45.7% 45.5% 36.7% 30.7% 31.1% 29.7% 27.8% EBITDA $425.4 $350.8 $103.7 $44.5 $55.1 $64.5 $52.1 Margin 30.0% 26.1% 10.1% 5.1% 6.8% 8.1% 6.2% Operating Income $344.6 $309.4 $41.9 ($16.5) ($4.5) $2.0 ($4.2) Margin 24.3% 23.0% 4.1% (1.9%) (0.6%) 0.3% (0.5%) Net Income $40.8 $160.7 $42.5 ($264.3) ($62.0) ($3.5) ($41.5) Margin 2.9% 11.9% 4.1% (30.4%) (7.7%) (0.4%) (5.0%) Interest Expense $19.0 $17.7 $23.0 $24.4 $17.6 $11.2 $10.0 CapEx $35.2 $58.6 $41.3 $18.5 $22.3 $19.8 $24.4 Senior Secured Debt - - - - - - - Total Debt $287.5 $287.5 $287.5 $287.5 $160.5 $160.0 $160.0 Free Cash Flow $461.5 $119.9 ($2.5) ($0.9) ($24.3) $6.5 ($11.5) EBITDA / Interest 22.4x 19.9x 4.5x 1.8x 3.1x 5.8x 5.2x Fixed Charge Coverage 7.9x 4.6x 1.6x 1.0x 1.4x 2.1x 1.5x Senior Debt / EBITDA NM NM NM NM NM NM NM Total Debt / EBITDA 0.7x 0.8x 2.8x 6.5x 2.9x 2.5x 3.1x Total Debt / Capital 32.7% 18.2% 33.9% 44.7% 34.4% 34.0% 36.3% |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 22 ADIC Summary Historical Financials ($ in Millions) Fiscal Year Ended October 31, LTM, as of 2000 2001 2002 2003 2004 2005 1/31/2006 Revenues $290.3 $364.7 $337.6 $424.0 $454.8 $454.2 $462.6 Growth 27.7% 25.6% (7.4%) 25.6% 7.3% (0.1%) 1.9% Gross Profit $106.6 $105.8 $91.8 $131.9 $129.2 $139.1 $141.3 Margin 36.7% 29.0% 27.2% 31.1% 28.4% 30.6% 30.5% EBITDA $20.0 $27.8 $32.2 $40.6 $37.9 $40.7 $39.3 Margin 6.9% 7.6% 9.5% 9.6% 8.3% 9.0% 8.5% Operating Income $32.0 $14.4 ($11.9) $9.5 $2.2 $6.3 $8.6 Margin 11.0% 3.9% (3.5%) 2.2% 0.5% 1.4% 1.9% Net Income $95.4 ($10.8) $1.6 $12.5 $7.7 $14.3 $18.0 Margin 32.9% (3.0%) 0.5% 2.9% 1.7% 3.1% 3.9% Interest Expense $0.4 $0.3 $0.2 $0.0 $0.0 $0.0 $0.0 CapEx $15.2 $20.1 $26.9 $14.3 $14.6 $13.9 $16.1 Senior Secured Debt - - - - - - - Total Debt $1.3 $1.2 $1.0 $1.0 $0.0 $0.0 $0.0 Free Cash Flow ($33.8) ($55.6) $13.1 $1.7 $17.0 $34.8 $32.2 EBITDA / Interest 50.9x 93.8x 177.1x NM NM NM NM Fixed Charge Coverage 1.3x 1.4x 1.2x 2.8x 2.6x 2.9x 2.4x Senior Debt / EBITDA NM NM NM NM NM NM NM Total Debt / EBITDA 0.1x 0.0x 0.0x 0.0x 0.0x 0.0x 0.0x Total Debt / Capital 0.4% 0.4% 0.3% 0.3% 0.0% 0.0% 0.0% Free Cash Flow defined as Cash From Operations minus Capital Expenditures. EBITDA includes

interest income. Fixed Charge Coverage equals EBITDA divided by Interest Expense + CapEx |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 23 Summary • Coming together to become the largest independent provider of backup, recovery and archive solutions – Address customers evolving data protection, retention and recovery needs • Most comprehensive and integrated range of solutions – Unparalleled portfolio of systems, software, devices, media and service

capabilities • Benefits of scale and integration, and a single source of intelligent and innovative products and services – Deliver unsurpassed value to customers and partners – Financially positioned to invest in new solutions to address emerging storage

challenges • Much stronger go-to-market infrastructure – Larger and better leveraged sales and service capabilities – Enhanced support for channel partners, OEMs and end-users • Broader base of R&D expertise provides opportunities for greater innovation |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 24 Additional Information and Where to Find It Quantum plans to file with the SEC a Registration Statement on Form S 4 in connection with the transaction, and ADIC plans to file with the SEC and mail to its stockholders a Proxy Statement/Prospectus in connection with the transaction. The Registration Statement and the Proxy Statement/Prospectus will contain important information about Quantum, ADIC, the transaction and related matters. Investors and stockholders are urged to read the Registration

Statement and the Proxy Statement/Prospectus carefully when they are available. Investors and stockholders will be able to obtain free copies of the

Registration Statement and the Proxy Statement/Prospectus and other documents filed with the SEC by Quantum and ADIC through the web site maintained by the SEC at www.sec.gov. In addition, investors and stockholders

will be able to obtain free copies of the Registration Statement and the Proxy Statement/Prospectus from Quantum by contacting Investor Relations at (408) 944-4450 or IR@quantum.com, or from ADIC by contacting Stacie Timmermans

at (425) 881-8004 or stacie.timmermans@adic.com. Quantum and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of ADIC in connection with the transaction described herein. Information regarding the special interests of these directors and executive officers in the transaction

described herein will be included in the Proxy Statement/Prospectus described

above. |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 25 Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the

federal securities laws including, without limitation, statements regarding

the following: the merger transaction and the benefits and synergies of the

merger; expectation that target market represents growth opportunity

compared to growth of storage industry; expected benefits of increased

financial strength; and the revenues, partners, markets, customers, products and technologies of the combined company. These forward-looking statements are

subject to risks and uncertainties as well as assumptions that could cause

the actual results of Quantum to differ materially from those expressed or

implied by such forward- looking statements. Such risks and uncertainties include, among others, the following: the approval of the

transaction by the stockholders of ADIC; the satisfaction of closing

conditions to the transaction, including the receipt of regulatory

approvals; the successful and timely integration of ADIC operations,

technologies and employees with those of Quantum; the ability to realize the

anticipated benefits or synergies of the transaction in a timely manner or

at all; fluctuations in the demand for the products of the combined company; possible development or marketing delays relating to product offerings of the combined company; the introduction of new products or technologies by competitors; and the ability of the combined company to achieve expected operating and financial results. A detailed

discussion of other risks and uncertainties that could cause actual results or

events to differ materially from such forward-looking statements is

included in Quantum’s and ADIC’s most recent filings with the Securities and Exchange Commission. Quantum and

ADIC undertake no obligation and do not intend to update these forward-looking

statements to reflect events or circumstances occurring after this

presentation. |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 26 Appendix |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 27 ADIC Information • ADIC is a publicly traded, NASDAQ listed (ADIC) company headquartered in Redmond,

WA – LTM Revenue, EBITDA and market Cap of $462m, $39.5m and $511m (5/2/06) respectively • ADIC is the world’s leading supplier of automated tape systems, customers

include: – Technology: Cray, Dell, Fujitsu Siemens, HP, IBM, Microsoft, SAP, Siemens, Sony, Sun

Microsystems, Yahoo! – Financial/ Services: Abbey, Bank of China, CIT Group, Clifford Chance, Deutsche Bank,

Ernst & Young, Fidelity Investments, JP Morgan Chase – Commercial/Industrial: BP, ChevronTexaco, Corporate Express, Ford, Harley Davidson,

Johnson & Johnson, Shell – Telecommunications/Entertainment: BT, Deutsche Telecom, Disney, MCI, Nokia, Sprint

PCS, T-Mobile, Time Warner, Turner Broadcasting, Verizon • Uses a worldwide sales force, a global reseller network and OEMs. Products are sold

under the ADIC brand name and under the names of various OEM customers

including Apple, Cray, Dell, EMC, Fujitsu-Siemens, HP, IBM, and

Sun/StorageTek. OEM customers accounted for 39% of FY05 sales • As of October 31, 2005, ADIC had 1,109 full-time employees, including 275 in sales

and marketing, 211 in engineering and research and development, 308 in

global services, 200 in manufacturing and operations and 115 in finance,

general administration and management |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 28 ADIC Market Approach • ADIC is moving beyond simple hardware to focus on Intelligent Storage™ – Hardware devices with a significant software component – This makes ADIC’s devices easier to manage, easier to integrate into a complex, multi-protocol networking environment, and more reliable for large-scale data

storage in an enterprise environment – Archiving and data management software, Storage Area Network (SAN) management solutions, tape libraries with built-in controllers, remote monitoring,

diagnostics, and repair, and comprehensive, full-solution backup

systems • The “Intelligent” approach allows for faster backup in shorter backup windows, more reliable data transfer, better compression performance, easier service and diagnostics, superior scalability, and more options for customized management by IT

departments and storage administrators • This high-end model is expected to drive growth in the segment going forward

|

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 29 ADIC Entry-Level Products • ADIC offers an entry-level autoloader and an entry-level tape library, slotting

above Quantum’s single tape drives – FastStor 1 and 2 (based on height) offer 8-tape capacity with a single drive – Offers a weeks worth of reliable, unattended backup – FastStor 1 is the industry’s smallest LTO autoloader at only 1.75 vertical inches

(1U) – The Scalar24 offers native capacity up to 9.6TB with 2 drives and 24 storage

slots – Offers LTO or SDLT media, iSCSI and Fibre Channel (FC) connectivity – A robust library at an affordable price |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 30 ADIC Tape Libraries • ADIC’s strongest product suite is its extensive selection of mid-range and high-end

tape libraries – The Scalar i500, introduced at the end of 2005 and boasting up to 323TB of storage, has

become the fastest ADIC Library to reach 2,000 units sold, in only five

months – Innovative solutions, including iPlatform architecture and iLayer server management, help to reduce service calls by 50% and issue resolution time by 30% – Libraries have “Capacity-On-Demand”, with the Scalar i2000

enterprise-class device expandable from 100 slots to nearly 3,500, with

2,800TB of maximum storage – The Scalar 10K is the first Storage Area Network (SAN) enabled library for consolidated

enterprise backup and archiving – Boasts up to 324 drives and 13,884 cartridges with 11,107 TB of maximum capacity

|

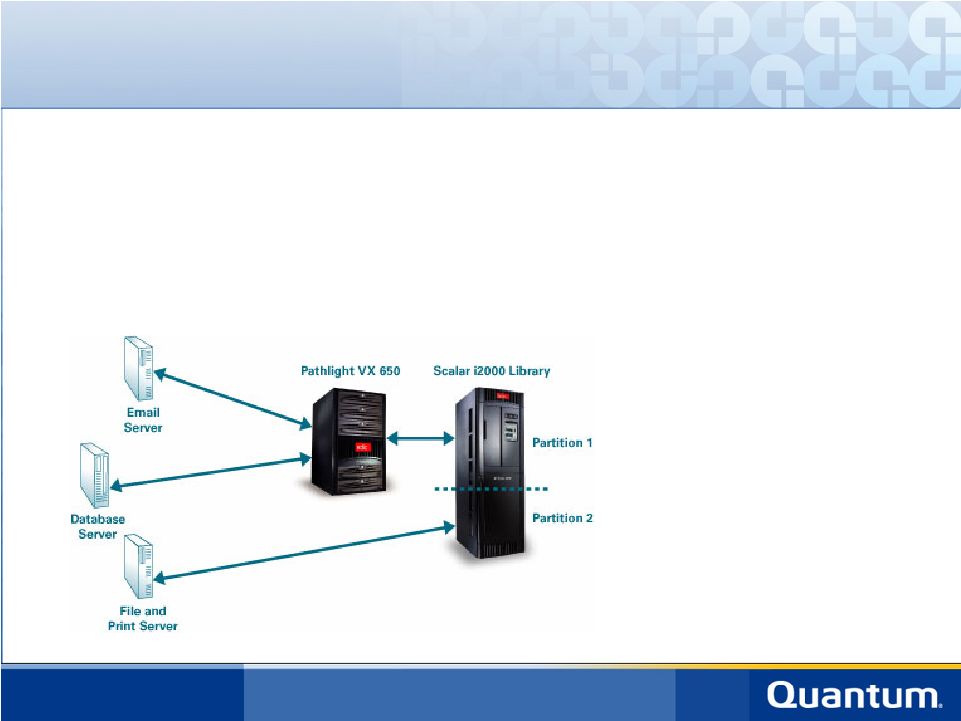

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 31 ADIC Disk-Based Backup • From its acquisition of PathLight Technology, ADIC offers a mid-range and enterprise-class disk backup system – Disk-based replication offers a secure, rapid, and reliable form of backup, adding

additional redundancy to storage – Difficult-to-backup data, and more critical data is backed up to disk, then

automatically transferred to tape • The disk writes quicker and the data is maintained with more certainty ADIC’s Pathlight VX 650 delivers premium protection for your organization’s most difficult-to- backup data. In this example, email and database information is backed up to disk, while tapes are created automatically in one library partition for disaster recovery and retention. File and print server data is backed up directly to tape using a separate partition in the same library. |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 32 ADIC SAN Appliances • SAN Devices work as a hardware front for a storage network, linking dissimilar

operating systems and protocols work together in a unified network

– Dynamically maps diskless servers to disk volumes and providing access security

– IT architects use the SNC 5000 to combine heterogeneous devices into a single,

centrally managed environment in order to obtain the highest possible value

and utility from their data center resources Test results demonstrate significant write performance increases for library configurations that connect tape drives to a switched fabric through an ADIC® Storage Networking Library controller in comparison to similar drives connected directly to the fabric. Typical enterprise-scale configurations show a 19% throughput improvement for controller-connected units. |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

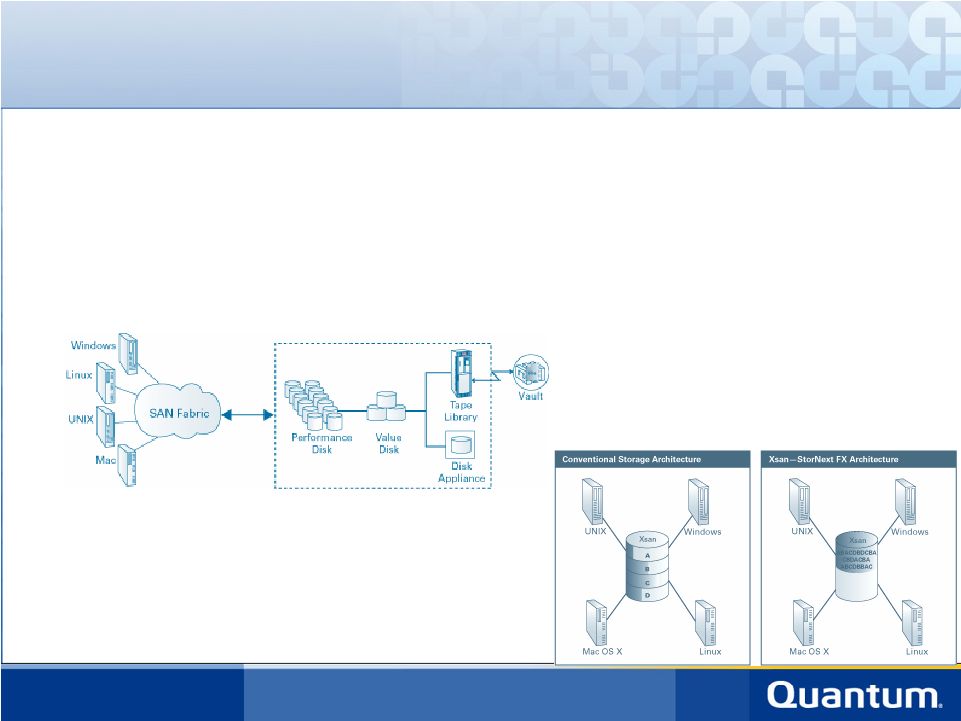

outlook and is for planning purposes only. 33 ADIC Software Solutions • Data Management Software – StorNext helps customers store data at a lower overall cost and access that data faster through

workflow management and intelligent archiving – Creates shared pools of digital assets, including media content and analytical data, so

that critical files can be processed faster – It also consolidates data on Xserve RAID systems, and provides a common interface to Windows, Linux, UNIX, and Apple Xsan systems to move data more easily Xsan and StorNext FX clients deliver shared storage access down to the file level for multiple hosts, eliminating the need for storage provisioning. StorNext provides high speed, shared workflow and high capacity, multi-tier archives for images, rich media, broadcast content, analytic data sets, and other digital assets. |

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

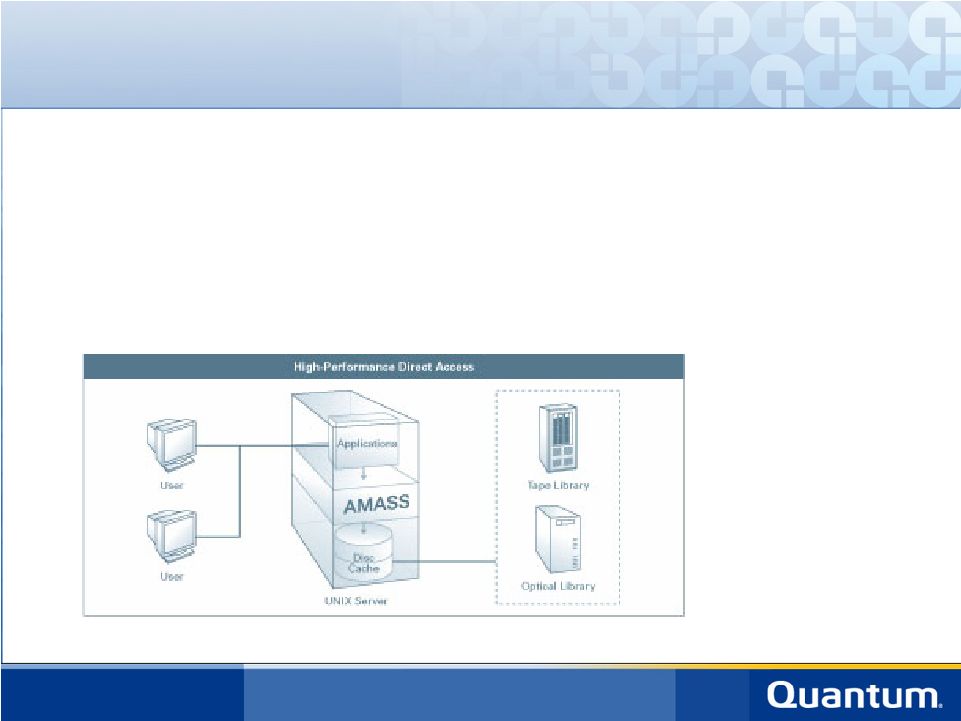

outlook and is for planning purposes only. 34 ADIC Software Solutions • Archiving Software – AMASS, stored on a UNIX server, acts as a virtual front for tape libraries and optical storage libraries – Transforms “off-line” storage (automated backup) into direct-access, mass-storage devices – Effectively presents a group of storage devices as one device, and allows the user to

access it to retrieve or store files as they would a standard magnetic

disk AMASS provides transparent access to data on disk and library storage. With its buffer cache, AMASS allows gigabytes of disk to support files which are terabytes in size. |

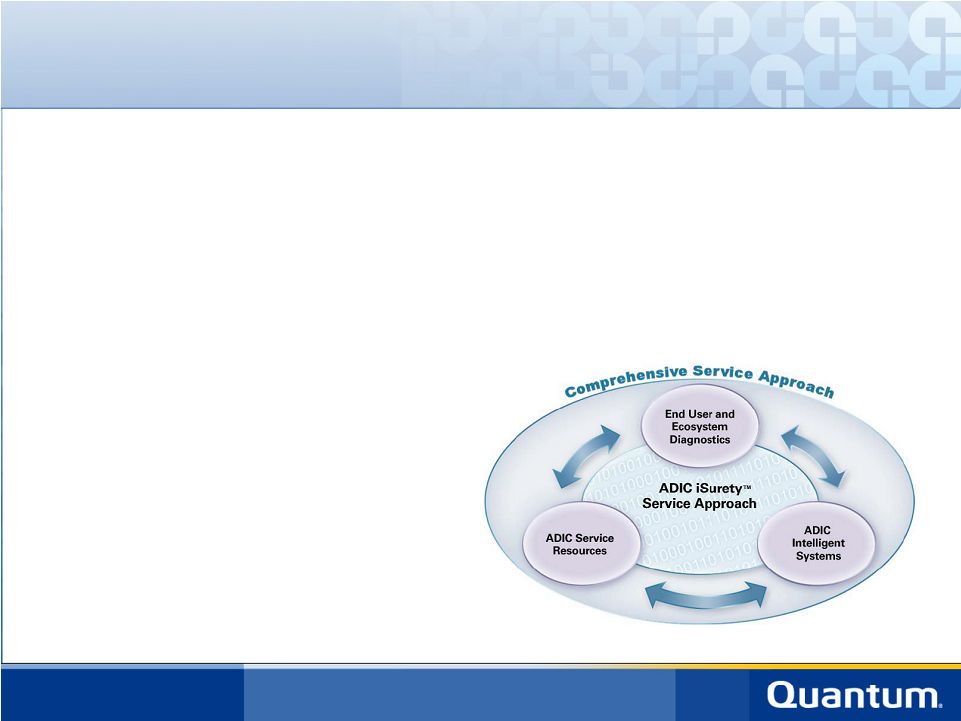

©2006 Quantum Corporation. Forward-looking information is based upon multiple

assumptions and uncertainties, does not necessarily represent the company's

outlook and is for planning purposes only. 35 ADIC Services • Your best line of defense in protecting your organization’s mission-critical data is our iSurety™ service approach featuring our bi-directional iLink™ remote diagnostics technology—an industry first that extends diagnostics into the broader storage environment. With iLink, ADIC’s remote diagnostics tool, we can resolve some issues before a failure or data loss even occurs. And, with built-in intelligence, your storage system needs fewer components, is less complicated—so you’ll spend less time managing it. We are dedicated to helping you minimize downtime, increase productivity, and resolve potential problems before they impact your backup and your data—wherever the root cause of the issue may occur. |