SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨

Preliminary Proxy Statement ¨ Confidential, for Use of the Commission Only |

(as Permitted by Rule 14a-6(e)(2))

x |

|

Definitive Proxy Statement |

¨ |

|

Definitive Additional Materials |

¨ |

|

Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

QUANTUM CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| |

(1) |

|

Title of each class of securities to which transaction applies: |

| |

(2) |

|

Aggregate number of securities to which transaction applies: |

| |

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated

and state how it was determined): |

| |

(4) |

|

Proposed maximum aggregate value of transaction: |

¨ |

|

Fee paid previously with preliminary materials. |

¨ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

|

Amount Previously Paid: |

| |

(2) |

|

Form, Schedule or Registration Statement No.: |

Notes:

QUANTUM CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

September 12, 2002

TO THE STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Quantum Corporation (the “Company” or

“Quantum”), a Delaware corporation, will be held on Thursday, September 12, 2002 at 10:00 a.m., pacific standard time, at Quantum’s principal executive offices located at 501 Sycamore Drive, Milpitas, California 95035, for the

following purposes:

1. To elect seven directors to serve until the next Annual Meeting

of Stockholders or until their successors are elected and qualified;

2. To ratify the

appointment of Ernst & Young LLP as independent auditors of the Company for the fiscal year ending March 31, 2003; and

3. To transact such other business as may properly come before the meeting or any adjournment thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on July 17, 2002 are entitled to notice of and to vote at the meeting and any adjournment thereof.

All stockholders are cordially invited to attend the meeting in person. However, to ensure your representation at the meeting, you are urged to vote, sign, date and return

the enclosed Proxy as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Any stockholder attending the meeting may vote in person even if he or she previously returned a Proxy.

| By Order of the Board of Directors, |

| |

| By: |

|

|

| |

|

Shawn D. Hall Vice President, General

Counsel and Secretary |

Milpitas, California

July 25, 2002

QUANTUM CORPORATION

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed Proxy is solicited on behalf of

Quantum Corporation (the “Company” or “Quantum”) for use at the Annual Meeting of Stockholders to be held Thursday, September 12, 2002 at 10:00 a.m., pacific standard time, or at any adjournment or postponement thereof (the

“Annual Meeting” or “Meeting”), for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at the Company’s principal executive offices located at 501

Sycamore Drive, Milpitas, California 95035. The Company’s telephone number is (408) 944-4000.

These proxy

solicitation materials were mailed on or about July 25, 2002 to all stockholders entitled to notice of and to vote at the Meeting. A copy of the Company’s Annual Report to Stockholders for the year ended March 31, 2002 (“Fiscal

2002”), including financial statements, was sent to the stockholders of the Company prior to or concurrently with this Proxy Statement.

Record Date; Outstanding Shares

Stockholders of record at the close of business on July

17, 2002 (the “Record Date”) are entitled to notice of and to vote at the Meeting. At the Record Date, 156,620,052 shares of the Company’s Common Stock, $0.01 par value (the “Common Stock”) were issued and outstanding. The

closing price of the Common Stock on the Record Date, as reported by the New York Stock Exchange, was $3.23 per share.

Revocability

of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time

before it is voted. Proxies may be revoked by (i) filing a written notice of revocation bearing a later date than the proxy with the Secretary of the Company (currently Shawn D. Hall) at or before the taking of the vote at the Meeting,

(ii) duly executing a later dated proxy relating to the same shares and delivering it to the Secretary of the Company at or before the taking of the vote at the Annual Meeting or (iii) attending the Meeting and voting in person (although

attendance at the Meeting will not in and of itself constitute a revocation of a proxy). Any written notice of revocation or subsequent proxy should be delivered to the Secretary of the Company, or hand delivered to the Secretary of the Company at

or before the taking of the vote at the Meeting.

Voting and Solicitation

Each share of Common Stock has one vote, as provided in the Company’s Amended and Restated Certificate of Incorporation. Accordingly, a total of 156,620,052 votes

may be cast at the Meeting. The Common Stock votes together as a single class on all matters covered by this proxy statement. For voting with respect to the election of directors, stockholders may cumulate their votes. See “PROPOSAL

ONE—ELECTION OF DIRECTORS—REQUIRED VOTE.”

The cost of soliciting proxies will be borne by the

Company. The Company has not retained the services of a solicitor. The Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners.

Proxies may also be solicited by certain of the Company’s directors, officers and regular employees, without additional compensation, personally or by telephone, telegram, telefax, email or otherwise.

Stockholder Proposals

Proposals of stockholders of the Company which are to be presented by such stockholders at the Company’s Annual Meeting of Stockholders for the year ended March 31,

2003 must be received by the Secretary of the Company no later than March 28, 2003 to be considered for inclusion in the proxy materials relating to that meeting. Alternatively, under the Company’s Bylaws, a proposal that the stockholder does

not seek to include in the Company’s proxy materials for the 2003 Annual Meeting must be received by the Secretary of the Company not less than sixty (60) days nor more than ninety (90) days prior to the meeting; provided, however, that in the

event that less than seventy (70) days notice or prior public disclosure of the date of the meeting is given or made to stockholders, notice by the stockholder to be timely must be so received not later than the close of business on the tenth day

following the day on which such notice of the date of the Annual Meeting was mailed or such public disclosure was made. The stockholder’s submission must include the information specified in the Company’s Bylaws.

Proposals not meeting these requirements will not be entertained at the 2003 Annual Meeting. Stockholders should contact the Secretary of

the Company in writing at 501 Sycamore Drive, Milpitas, CA 95035 to make any submission or to obtain additional information as to the proper form and content of submissions.

The Company has not been notified by any stockholder of his or her intent to present a stockholder proposal from the floor at this year’s Annual Meeting. The enclosed

proxy card grants the proxy holders discretionary authority to vote on any matter properly brought before the Annual Meeting.

Quorum;

Abstentions; Broker Non-Votes

The required quorum for the transaction of business at the Annual Meeting is a

majority of the votes eligible to be cast by holders of shares of Common Stock and issued and outstanding on the Record Date. Shares that are voted “FOR,” “AGAINST,” “WITHHOLD ALL,” “FOR ALL EXCEPT” or

“ABSTAIN” on a matter are treated as being present at the meeting for purposes of establishing a quorum and are also treated as shares entitled to vote (the “Votes Cast”) at the Annual Meeting with respect to such matter.

Accordingly, with the exception of the proposal for the election of directors, abstentions will have the same effect as a vote against the proposal. Because directors are elected by a plurality vote, votes that are withheld from a candidate in the

election of directors have no impact once a quorum exists.

Broker non-votes will be counted for purposes of

determining the presence or absence of a quorum for the transaction of business, but will not be counted for purposes of determining the number of Votes Cast with respect to the particular proposal on which the broker has expressly not voted. Broker

non-votes with respect to proposals set forth in this Proxy Statement will therefore be counted only for purposes of determining the presence or absence of a quorum and will not be considered Votes Cast. Accordingly, broker non-votes will not affect

the determination as to whether the requisite majority of Votes Cast has been obtained with respect to a particular matter.

Section

16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s

Section 16 officers, directors and persons who own more than 10% of a registered class of the Company’s equity securities to file reports of ownership and changes in ownership with the Securities and Exchange Commission (the “SEC”).

Such executive officers, directors and greater than ten-percent stockholders are also required by SEC rules to furnish the Company with copies of all forms that they file pursuant to Section 16(a). Based solely on its review of the copies of such

reports received by the Company, or on written representations from certain reporting persons that no other reports were required for such persons, the Company believes that, during Fiscal 2002, all Section 16(a) filing requirements applicable to

its Section 16 officers, directors and greater than ten-percent stockholders were complied with.

2

PROPOSAL ONE

ELECTION OF DIRECTORS

Nominees

The Company’s Board of Directors currently consists of seven (7) persons. All seven (7) directors are to be elected at the Annual Meeting. Unless otherwise instructed,

the proxy holders will vote the proxies received by them for management’s nominees named below. Each nominee has consented to be named as a nominee in the proxy statement and to serve as a director if elected. In the event that any management

nominee becomes unable or declines to serve as a director, the proxies will be voted for any nominee who shall be designated by the current Board to fill the vacancy. In the event that additional persons are nominated at the time of the Annual

Meeting, the proxy holders intend to vote all proxies received by them in such a manner (in accordance with cumulative voting) as will ensure the election of as many of the nominees listed below as possible (or, if new nominees have been designated

by the Board, in such a manner as to elect such nominees). In such event, the specific nominees for whom such votes will be cumulated will be determined by the proxy holders. The Company is not aware of any reason that any nominee will be unable or

will decline to serve as a director. The term of office of each person elected as a director will continue until the next Annual Meeting of Stockholders or until a successor has been elected and qualified. There are no arrangements or understandings

between any director or executive officer and any other person pursuant to which he is or was to be selected as a director or officer of the Company.

The Board’s key roles include, but are not limited to, selection and evaluation of the Chief Executive Officer and other members of senior management, advising the Chief Executive Officer and the

management team on strategic goals and directions for the Company, approval of material acquisitions or strategic partnerships that support the Company’s goals and providing general guidance and counsel to senior management. The criteria used

by the Company in nominating directors include: a nominee’s knowledge and familiarity with high technology companies, a nominee’s prior board experience and a nominee’s personal characteristics, including objectivity, integrity and

independence of judgment. The Company believes its current board members meet each of these criteria.

The names

of the nominees, all of whom are currently directors of the Company, and certain information about them as of June 25, 2002, are set forth below.

| Name of Nominee

|

|

Age

|

|

Director Since

|

|

Principal Occupation Since

|

| Stephen M. Berkley |

|

58 |

|

1987 |

|

President of SMB Associates, 1992 |

| |

| David A. Brown |

|

57 |

|

1988 |

|

Retired management consultant to various high technology companies, 1992 |

| |

| Michael A. Brown |

|

43 |

|

1995 |

|

President and Chief Executive Officer of Quantum, 1995; Chairman of the Board of Quantum, 1998 |

| |

| Edward M. Esber, Jr.*+ |

|

50 |

|

1988 |

|

Chairman of the Board of The Esber Group, 1990 |

| |

| Kevin J. Kennedy* |

|

45 |

|

2001 |

|

Chief Operating Officer of Openwave Systems Inc., 2001 |

| |

| Edward J. Sanderson+ |

|

53 |

|

2002 |

|

Former Executive Vice President of Oracle Corporation, 1995 |

| |

| Gregory W. Slayton*+ |

|

42 |

|

2000 |

|

Chairman of the Board of ClickAction Inc., 1997 |

* |

|

Member of Audit Committee. |

+ |

|

Member of Compensation Committee. |

3

Except as set forth below, each of the nominees has been engaged in his principal

occupation described above during the past five years. There is no family relationship between any directors or executive officers of the Company.

Mr. Stephen M. Berkley joined the Company in October 1981 as Vice President, Marketing. In October 1983, he became the founding President and Chief Executive Officer of Plus Development Corporation,

then a wholly-owned subsidiary of the Company (“Plus”), where he continued to serve as such until July 1988. From May 1987 to March 1992, he served as Chairman of the Board and Chief Executive Officer of Quantum. From April 1992 to July

1993, Mr. Berkley served as Chairman of the Board of both Quantum and Plus. From August 1995 to May 1998, Mr. Berkley served as Chairman of the Board of Quantum. Mr. Berkley served as Chairman of the Board and Chief Executive Officer of Coactive

Computer Corporation, a computer networking company (“Coactive”), from February 1993 to June 1993 and from June 1993 to July 1994 he served solely as Chairman of the Board of Coactive. Mr. Berkley has been an investor in and has served as

a consultant to various high technology firms since May 1992. Mr. Berkley also served as a member of the Board of Directors of Edify Corporation until it was merged with Security First Corporation in November 1999.

Mr. David A. Brown, a founder of the Company, has been with the Company since its inception in February 1980. Initially, Mr. Brown served

as Vice President of Engineering of the Company. In 1983, he co-founded Plus and became its Executive Vice President of Operations. He returned to Quantum in September 1986 to lead the engineering organization and direct Quantum’s effort in the

3 1/2-inch disk drive market. From May 1987 to April 1990, Mr. Brown served as President of the Company and from

April 1990 to February 1992, he served as its Vice Chairman of the Board of Directors and Chief Operating Officer. Mr. Brown has also been a management consultant and board member for various high technology companies since February 1992.

Mr. Michael A. Brown has been Chairman of the Board and Chief Executive Officer since 1998 and 1995,

respectively. Mr. Brown was President of the Desktop Storage Division from 1993 to 1995 and Executive Vice President of Marketing from 1992 to 1993. Previously, Mr. Brown held senior positions in product and marketing management since joining

Quantum’s marketing organization in August 1984. Before joining Quantum, Mr. Brown served in the marketing organization at Hewlett-Packard and provided management consulting services at Braxton Associates. Mr. Brown is also a member of the

board of Digital Impact, Inc., a public Internet marketing company.

Mr. Edward M. Esber, Jr. has served as

Chairman of the Board of The Esber Group from 1990 to the present. He also served as chairman of the Board for Solopoint, Inc., a personal communications management products company (“Solopoint”), from March 1998 to January 2002. From

October 1993 to March 1998, he served as a director of Solopoint and also served as President and Chief Executive Officer of Solopoint from October 1995 to March 1998. He served as Chairman, President and Chief Executive Officer of Creative

Insights, Inc., a computer toys company, from March 1994 to June 1995. From May 1993 to May 1994, he was President and Chief Operating Officer of Creative Labs, Inc., a multimedia company. Mr. Esber is also a member of the boards of SonicBlue, a

maker of digital consumer electronics, Direct Capital Markets, Inc., a private company servicing the online financial services industry, and Motion Computing, a private company building tablet computers

Dr. Kevin J. Kennedy has been Chief Operating Officer of Openwave Systems, Inc., an IP-based communications company, since August 2001.

Between 1994 and August 2001, Dr. Kennedy was with Cisco Systems, Inc., most recently as Senior Vice President of the IOS Technologies Division (ITD) and the Service Provider Line of Business. Prior to joining Cisco, Dr. Kennedy spent 17 years at

Bell Laboratories where he was responsible for product definition and development.

Mr. Edward J. Sanderson was

with Oracle Corporation from July 1995 through April 2002, most recently as Executive Vice President responsible for Oracle Exchanges, Oracle Product Industries (OPI), Oracle Consulting and the Latin America Division. Prior to joining Oracle, Mr.

Sanderson held senior positions at companies including Unisys Corporation, McKinsey & Company, and Andersen Consulting.

4

Mr. Gregory W. Slayton has been Chairman of the Board of Directors of ClickAction

Inc., a public e-marketing services company, since December 1997 and was President and Chief Executive Officer from December 1997 to September 2001. From March 1996 to July 1997, Mr. Slayton was the President, Chief Operating Officer, and a Director

of ParaGraph International, a VRML tools provider. In August 1994, Mr. Slayton co-founded Worlds, Inc. and served as Senior Vice President and Chief Financial Officer until November 1995. Prior to founding Worlds, Inc., Mr. Slayton served as

Vice President and Chief Financial Officer of the Paramount Technology Group at Paramount Communications Inc. Mr. Slayton was also previously a management consultant with McKinsey & Company for four years. Mr. Slayton serves on the Board of

Directors of ClickAction, inTest Corporation, a public company providing products and services to the semiconductor manufacturing industry, Synesis, Inc., a private company providing Organizational IQ consulting services and Opportunity

International, a non-profit organization.

Board Meetings and Committees

The Board of Directors of the Company held a total of four (4) meetings during Fiscal 2002. During Fiscal 2002, no director attended fewer than 75% of the meetings of

the Board and the meetings of committees, if any, upon which such director served.

The Audit Committee of the

Board currently consists of Mr. Esber, Chairman of the Committee, Mr. Slayton and Dr. Kennedy. The Audit Committee, which generally meets prior to quarterly earnings releases, recommends engagement of the Company’s independent auditors and

is primarily responsible for approving the services performed by the Company’s independent auditors and for reviewing and evaluating the Company’s accounting principles and its systems of internal accounting controls. At each meeting, the

Audit Committee first meets with the Company’s management and the Company’s independent auditors in order to review financial results and conduct other appropriate business. Then, the Audit Committee typically meets solely with the

Company’s independent auditors. The Audit Committee held a total of four (4) meetings during Fiscal 2002.

The Compensation Committee of the Board is currently composed of Mr. Slayton, Chairman of the Committee, Mr. Esber and Mr. Sanderson. The Compensation Committee, which generally meets in conjunction with Board meetings and, as deemed

necessary by the Board, reviews and approves the Company’s executive compensation policy and makes recommendations concerning the Company’s employee benefit policies. The Compensation Committee held a total of five (5) meetings during

Fiscal 2002.

The Board does not currently have a nominating committee or any committee performing such function.

Director Compensation

During Fiscal 2002, each director who was not an employee of the Company (“Outside Director”) received an annual retainer of $34,000 per year. The Chairman of the Audit Committee and the

Chairman of the Compensation Committee each received an additional retainer of $7,500 per year. Each Outside Director was also paid $1,250 for each day on which such Director attended a Board meeting and $1,000 for each day on which such Director

attended a committee meeting. Outside Directors may also receive consulting fees for projects completed at the request of management. Employee directors are not compensated for their service on the Board or on committees of the Board.

Options may be granted to Outside Directors under the Company’s 1996 Board of Directors Stock Option Plan (“Director

Plan”). The Director Plan was originally approved by the Company’s stockholders at the 1996 Annual Meeting of Stockholders, and an amendment to the Director Plan was approved by the Company’s stockholders at the 2001 Annual Meeting of

Stockholders. The Board, in its discretion, selects Outside Directors to whom options may be granted, the time or times at which such options may be granted, the number of shares subject to each grant and the period over which such options become

exercisable. All options granted to Outside

5

Directors under the Director Plan contain the following provisions: the exercise price per share of Common Stock is 100% of the fair market value of the Company’s Common Stock on the date

the option is granted; the term of the option may be no more than ten years from the date of grant; and the option may be exercised only while the Outside Director remains a director or within 90 days after the date he or she ceases to be a director

of the Company; upon a proposed liquidation or dissolution of the Company, the options will terminate immediately prior to such action; and in the event of a merger or sale of substantially all of the Company’s assets, each option may be

assumed or an equivalent option substituted by the successor corporation. If such options are not assumed or substituted for, or if the options are assumed or substituted for and the Outside Director ceases to be a director following the assumption

or substitution (other than by voluntary resignation), the outstanding options will become fully vested and exercisable. The Board may at any time amend, alter, suspend or discontinue the Director Plan, subject to stockholder approval in certain

circumstances.

During Fiscal 2002, Mr. Berkley, Mr. David Brown and Mr. Slayton each received an option to

purchase 18,750 shares of Common Stock at an exercise price of $9.70 per share. In addition, Dr. Kennedy received an option to purchase 45,000 shares of Common Stock, Mr. Berkley received an option to purchase 30,000 shares of Common Stock and Mr.

David Brown and Mr. Esber each received an option to purchase 25,000 shares of Common Stock, each at an exercise price of $12.02 per share.

Compensation Committee Interlocks and Insider Participation

The members of the

Company’s Compensation Committee are Gregory W. Slayton, Chairman of the Committee, Edward M. Esber, Jr. and Edward J. Sanderson. No member of the Compensation Committee is currently, nor has any been at any time since the formation of the

Company, an officer or employee of the Company.

Required Vote

Each stockholder voting in the election of directors may cumulate such stockholder’s votes and give one candidate a number of votes equal to the number of directors to

be elected multiplied by the number of votes to which the stockholder’s shares are entitled. Alternatively, a stockholder may distribute the stockholder’s votes on the same principle among as many candidates as the stockholder thinks fit,

provided that votes cannot be cast for more than seven candidates. However, no stockholder shall be entitled to cumulate votes for a candidate unless such candidate’s name has been properly placed in nomination according to the Company’s

Bylaws and notice of the intention to cumulate votes is received at the principal executive offices of the Company at least twenty (20), and no more than sixty (60), days prior to the Annual Meeting. The proxy holders may exercise discretionary

authority to cumulate votes and to allocate such votes among management’s nominees in the event that additional persons are nominated at the Annual Meeting for election of directors.

If a quorum is present and voting, the seven nominees for director receiving the highest number of votes will be elected to the Board. Votes withheld from any director are

counted for purposes of determining the presence or absence of a quorum, but have no other legal effect under Delaware law. See “INFORMATION CONCERNING SOLICITATION AND VOTING—Quorum; Abstentions; Broker Non-Votes.”

MANAGEMENT RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES LISTED ABOVE.

6

PROPOSAL TWO

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Board has selected Ernst

& Young LLP as the Company’s independent auditors to audit the financial statements of the Company for the fiscal year ending March 31, 2003. The Board recommends that stockholders vote for ratification of such appointment. In the event of

a vote against such ratification, the Board of Directors will reconsider its selection. A representative of Ernst & Young LLP is expected to be available at the Annual Meeting with the opportunity to make a statement if such representative

desires to do so, and is expected to be available to respond to appropriate questions. The affirmative vote of a majority of the votes cast is required to ratify the appointment of Ernst & Young LLP.

MANAGEMENT RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY’S

INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING MARCH 31, 2003.

7

EXECUTIVE COMPENSATION

Summary Compensation

The following table shows, as to any person serving as Chief

Executive Officer during Fiscal 2002 and each of the four other most highly compensated executive officers whose salary plus bonus exceeded $100,000 (the “Named Executive Officers”), information concerning compensation paid for services to

the Company in all capacities during Fiscal 2002, as well as the total compensation paid to each such individual for the Company’s previous two fiscal years.

SUMMARY COMPENSATION TABLE

| |

|

Annual Compensation

|

|

|

Long-Term Compensation(1)

|

|

|

|

| Name and Principal Position

|

|

Fiscal Year

|

|

Salary ($)

|

|

|

Bonus ($)

|

|

Other Annual Compensation ($)(2)

|

|

|

Restricted Stock Awards($)(3)

|

|

Securities Underlying Options/ SARs(#)(4)

|

|

All Other Compensation ($)(5)

|

|

| Michael A. Brown Chief Executive Officer and Chairman of the Board |

|

2002 2001 2000 |

|

959,999 958,845 929,365 |

(6) |

|

250,000 378,640 500,000 |

|

— — — |

|

|

— — 894,526 |

|

900,000 311,407 465,655 |

|

10,169 5,100 5,830 |

|

| |

| John B. Gannon(7) President, DLTtape Group |

|

2002 2001 2000 |

|

370,196 549,039 519,231 |

|

|

689,652 231,908 325,000 |

|

182,813 85,500 80,250 |

(8) (8) (8) |

|

— — 496,965 |

|

200,000 194,023 401,628 |

|

1,107,983 5,100 5,834 |

(9) |

| |

| Michael J. Lambert(10) Executive Vice President and Chief Financial Officer |

|

2002 — — |

|

279,807 —

— |

|

|

53,238 — — |

|

76,671 — — |

(11) |

|

— — — |

|

225,000 —

— |

|

— — — |

|

| |

| Jerald L. Maurer Executive Vice President, Human Resources |

|

2002 2001 2000 |

|

461,105 460,599 451,232 |

(6) |

|

84,443 295,240 239,250 |

|

77,500 72,500 67,500 |

(8) (8) (8) |

|

— — 433,552 |

|

455,000 145,517 189,172 |

|

1,436,928 4,664 5,280 |

(12) |

| |

| Barbara Nelson Executive Vice President, Corporate Marketing and Strategy |

|

2002 2001 2000 |

|

400,001 398,604 348,500 |

|

|

57,000 230,550 344,525 |

|

101,500 94,500 — |

(8) (8) |

|

— — 695,756 |

|

395,000 194,023 225,698 |

|

9,088 5,100 3,151 |

|

(1) |

|

The Company has not granted any stock appreciation rights and does not have any long-term incentive plans as that term is defined in regulations promulgated by

the SEC. |

(2) |

|

Other annual compensation in the form of perquisites and other personal benefits, securities or property has been omitted in those cases where the aggregate

amount of such compensation is the lesser of either $50,000 or 10% of the total annual salary and bonus reported for such executive officer. |

(3) |

|

Beginning on August 4, 1999, and through April 1, 2001, Quantum’s common stock was divided into two tracking stocks, the HDD Common Stock, which tracked

Quantum’s hard disk drive business (“HDD Business”), and the Common Stock, which tracked Quantum’s other businesses. These stocks were traded on the New York Stock Exchange under the symbols HDD and DSS, respectively. On April 2,

2001, Quantum sold the HDD Business to Maxtor Corporation (the “Merger”), and, in connection with the Merger, HDD Common Stock and HDD Common Stock options held by Named Executive Officers were converted into Common Stock and Common Stock

options. These restricted stock grants were made prior to the Merger, and the aggregate value is based on $8 11/16 per share of Common Stock and $8 per share of HDD Common Stock, the fair market value of the Common Stock and HDD Common Stock, respectively, on the date of grant. These grants vested 50% on January 1, 2001 and 50% on January 1,

2002. Shares of restricted stock are entitled to receive dividends payable on Common Stock when, as and if declared by the Board of Directors of the Company. Cash dividends have not been paid on Common Stock. The number of shares of the restricted

stock held by the Named Executive Officers, and their aggregate value, as of March 31, 2002, the end of Fiscal 2002, after taking into account the Merger, are set forth in the following table. The aggregate value is based on $7.96 per share of

Common Stock, the fair market value of the Common Stock on March 31, 2002. |

| |

|

Number of Shares

|

|

Value at Fiscal Year End

|

| Michael A. Brown |

|

102,718 |

|

$ |

891,335 |

| John B. Gannon |

|

57,067 |

|

|

495,199 |

| Jerald L. Maurer |

|

49,647 |

|

|

432,737 |

| Barbara Nelson |

|

79,892 |

|

|

693,263 |

8

(4) |

|

The Fiscal 2000 and 2001 numbers were calculated as if the Merger occurred prior to the time the options were granted. |

(5) |

|

Represents 401(k) plan matching contributions, except as expressly indicated otherwise. In addition, on January 2, 2001, Quantum provided interest-free loans to

its executive officers. These loans were made to cover taxes that became due and payable as a result of the vesting of restricted stock held by these individuals. Due to restrictions placed on them pursuant to the terms of the Merger, the officers

were not able to sell securities of Quantum to cover these tax liabilities when they became due. Therefore, these loans were made to assist the individuals with the payment of these taxes. The loans were made in the following amounts: $211,000 to

Michael A. Brown, $120,000 to John B. Gannon, $105,000 to Jerald L. Maurer and $166,000 to Barbara H. Nelson. The loans became due and were fully paid as of May 2, 2001. The interest-free nature of the loans resulted in imputed interest for

Fiscal 2002 in the following amounts, which are reflected in this table: $5,069 for Mr. Brown, $2,883 for Mr. Gannon, $2,523 for Mr. Maurer and $3,988 for Ms. Nelson. |

(6) |

|

Effective April 1, 2002, Mr. Brown voluntarily elected to reduce his annual base salary by 37.5%, to $600,000, and Mr. Maurer voluntarily elected to reduce his

annual base salary by 13.2%, to $400,008. During Fiscal 2002, Mr. Brown voluntarily cancelled 300,000 of his outstanding stock options. |

(7) |

|

Mr. Gannon was President of the HDD Business and, in connection with the Merger, his employment with Quantum was terminated. Mr. Gannon was later hired as

President of the DLTtape Group in October 2001. |

(8) |

|

Represents loan forgiveness. |

(9) |

|

$1,100,000 represents severance that Mr. Gannon received in connection with the termination of his employment with Quantum in connection with the Merger, $2,883

represents imputed interest incurred in connection with the loan specified in footnote 5 above and the remainder represents 401(k) plan matching contributions. |

(10) |

|

Quantum hired Mr. Lambert in June 2001. |

(11) |

|

Represents reimbursement for expenses associated with relocation to California. |

(12) |

|

$1,429,410 represents a one-time cash payment to Mr. Maurer in connection with the Merger, $2,523 represents imputed interest incurred in connection with the

loan specified in footnote 5 above and the remainder represents 401(k) plan matching contributions. |

9

Stock Option Grants and Exercises

The following tables show, as to each Named Executive Officer, information concerning stock options granted during Fiscal 2002.

OPTION GRANTS IN FISCAL 2002

| |

|

Individual Grants

|

|

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Terms(3)

|

| |

|

Number of Securities Underlying Options Granted(#)(1)

|

|

Percent of Total Options Granted to Employees

in Fiscal Year(2)

|

|

Exercise Price ($/share)

|

|

Expiration Date

|

|

| Name

|

|

|

|

|

|

5% ($)

|

|

10% ($)

|

| Michael A. Brown |

|

600,000 300,000 |

|

3.0 1.5 |

|

12.02 9.70 |

|

5/29/11 7/31/11 |

|

4,535,587 1,830,083 |

|

11,494,071 4,637,791 |

| |

| John B. Gannon |

|

200,000 |

|

1.0 |

|

8.34 |

|

10/30/11 |

|

1,048,996 |

|

2,658,362 |

| |

| Michael J. Lambert |

|

225,000 |

|

1.1 |

|

9.90 |

|

6/26/11 |

|

1,400,863 |

|

3,550,061 |

| |

| Jerald L. Maurer |

|

255,000 50,000 150,000 |

|

1.3 0.3 0.8 |

|

12.02 9.70 8.84 |

|

5/29/11 7/31/11 2/26/12 |

|

1,927,625 305,014 833,914 |

|

4,884,980 772,965 2,113,303 |

| |

| Barbara Nelson |

|

195,000 200,000 |

|

1.0 1.0 |

|

12.02 9.70 |

|

5/29/11 7/31/11 |

|

1,474,066 1,220,056 |

|

3,735,573 3,091,860 |

(1) |

|

The exercise price of each option is determined by the Compensation Committee of the Board of Directors and in fiscal 2002 was not less than 100% of the fair

market value of the Common Stock on the date of grant. The options expire not more than ten years from the date of grant, and may be exercised only while the optionee provides services to the Company or within such period of time following

termination of services as is determined by the Compensation Committee. These options vest monthly over four years beginning at or about the time of grant. |

(2) |

|

Based on options to purchase an aggregate of 20,574,000 shares of the Company’s Common Stock granted to employees of the Company in Fiscal 2002, including

the Named Executive officers. The aggregate number includes options to purchase HDD Common Stock that were converted into options to purchase Common Stock in connection with the Merger. |

(3) |

|

Potential realizable value is based on an assumption that the stock price of the Common Stock appreciates at the annual rate shown (compounded annually) from

the date of grant until the end of the ten-year option term. These numbers are calculated based on the regulations promulgated by the SEC based on an arbitrarily assumed annualized compound rate of appreciation of the market price of 5% and 10% from

the date the option was granted to the end of the option term, less the exercise price. Actual gains, if any, on option exercises are dependent on the future performance of the Common Stock. |

Stock Option Exchange Program

On June 4, 2001, the Company announced a voluntary stock option exchange program for its employees. Under the program, employees were given the opportunity to elect to cancel outstanding stock options held by them with an exercise

price of at least $14 per share or more in exchange for an equal number of new options to be granted at a future date at the then current fair market value. These elections needed to be made by July 3, 2001 and were required to include all options

granted during the prior six-month period. A total of 130 employees elected to participate in the exchange program. Those 130 employees tendered a total of 936,787 options to purchase the Company’s common stock in return for its promise to

grant new options on the grant date of January 7, 2002. A total of 1,651,433 options were granted at the fair market value of $10.93 on January 7, 2002 to those employees who had been continuously employed by the Company from the date they tendered

their original options through January 7, 2002. The exchange program was not made available to the Company’s executive officers, directors, consultants, transition employees or employees residing or employed in France, Canada, Korea, China,

Japan or Taiwan.

10

The following table provides information regarding options exercised by Named

Executive Officers during Fiscal 2002 and options held by them at fiscal year end.

AGGREGATED OPTION EXERCISES IN

FISCAL 2002 AND

FISCAL YEAR-END OPTION VALUES

| |

|

Shaes Acquired on Exercise(#)

|

|

Value Realized ($)(1)

|

|

Number of Securities Underlying Unexercised Options Held at Fiscal Year-End(#)

|

|

Value of Unexercised In-the-Money Options Held at Fiscal

Year-End($)(2)

|

| Name

|

|

|

|

Exercisable

|

|

Unexercisable

|

|

Exercisable

|

|

Unexercisable

|

| Michael A. Brown |

|

276,217 |

|

2,519,360 |

|

1,956,892 |

|

927,496 |

|

266,630 |

|

33,589 |

| John B. Gannon |

|

— |

|

— |

|

678,654 |

|

200,000 |

|

76,504 |

|

— |

| Michael J. Lambert |

|

— |

|

— |

|

— |

|

225,000 |

|

— |

|

— |

| Jerald L. Maurer |

|

— |

|

— |

|

995,229 |

|

121,875 |

|

121,198 |

|

— |

| Barbara Nelson |

|

45,088 |

|

261,649 |

|

528,105 |

|

445,253 |

|

10,689 |

|

13,113 |

(1) |

|

Total value realized is calculated based on the fair market value of the Common Stock at the close of business on the date of exercise, less the exercise price.

|

(2) |

|

Total value of unexercised options is based on $7.96 per share of Common Stock, the fair market value of the Common Stock as of March 31, 2002.

|

Employment Terms, Termination of Employment and Change-In-Control Arrangements

The Company has entered into agreements (the “Agreements”) with its Named Executive Officers whereby in the event that there is

a “change of control” of the Company (which is defined in the Agreements to include, among other things, a merger or sale of assets of the Company or a reconstitution of the Company’s Board) the exercisability and vesting of all

stock-based compensation awards granted to the officers shall accelerate. Under the Agreements, upon a change of control, 50% of the unvested shares or options to purchase shares held by an officer become vested and exercisable and the remaining 50%

of such unvested shares or options to purchase shares become vested and exercisable upon the earlier of the date of the first anniversary of the change of control or upon such officer’s “Involuntary Termination” after the change of

control. Under the Agreements, “Involuntary Termination” is defined to include, among other things, any termination of the employee by the Company without “cause” without such employee’s express written consent or a

significant reduction of or addition to the employee’s duties. Additionally, if, within 18 months of the change of control, there is an Involuntary Termination of employment, the CEO receives three years, and the other Named Executive officers

receive two years, severance pay and continued health and medical benefits during the severance period. The purpose of the Agreements is to assure that the Company will have the continued dedication of its officers by providing such individuals with

certain compensation arrangements, competitive with those of other corporations, to provide sufficient incentive to the individuals to remain with the Company, to enhance their financial security, as well as protect them against unwarranted

termination in the event of a change of control.

11

REPORT OF

THE LEADERSHIP AND COMPENSATION COMMITTEE

OF THE BOARD OF DIRECTORS1

Introduction

In light of the responsibilities and duties added to the Compensation Committee, we have recently renamed

this Committee the “Leadership and Compensation Committee of the Board of Directors” (the “Committee”).

During Fiscal 2002, the Committee consisted of Messrs. Slayton and Esber. Mr. Slayton serves as Chairman of the Committee, and neither member of the Committee is an officer or an employee of the Company. For Fiscal 2003, Mr.

Sanderson, who is not an officer or employee of the Company, has joined the Committee as a member. The Committee has overall responsibility for reviewing and approving the Company’s total compensation philosophy, strategy and practices and

administering the Company’s executive compensation plans and stock incentive plans. Each year, the Committee compares the Company’s performance to a group of peer companies in making determinations with respect to overall total

compensation programs. The Committee also provides advice and recommendations to the Board and to the Chief Executive Officer on matters relating to Quantum’s leadership, including the review of executive bench-strength, plans and programs for

the development of key executives, and the identification and selection of candidates for succession purposes.

Philosophy of

Executive Compensation

The Company has a “pay for performance” compensation philosophy for its

employees, including its executive officers. The Company’s executive compensation policies are designed to attract and retain experienced and qualified executive officers critical to the success of the Company, and to provide incentives for

such individuals to maximize the Company’s corporate performance and accomplishment of strategic objectives. Total compensation for the Company’s executive officers includes base salary, short-term incentives, long-term incentives,

executive perquisites, and participation in the Company’s qualified and non-qualified employee benefit plans. The target level of any executive officer’s total compensation package is intended to align with the median or average total

compensation package of similarly positioned executive officers in the Company’s peer group. The total compensation packages for executive officers is intended to be average in average performance years, above average when the Company’s

performance is above average, and below average when the Company’s performance is below average, as compared to executives in the Company’s peer group before reflecting any adjustments for individual performance.

Executive Officer Compensation Plans

The principal components of executive officer compensation are described below:

Base

Salary

Base salaries for executive officers are set by the Committee, in consultation with the Chief

Executive Officer, after considering factors such as position and responsibility, the competitive environment, corporate size, corporate performance and overall experience and contribution levels of the individuals. The Company obtains competitive

compensation information from independent survey sources of peer companies, which includes both direct competitors of the Company and other companies in competition for similar executive talent. These survey data are analyzed by independent

consultants and the Company to provide necessary information to the Committee.

1 |

|

This section is not “soliciting material,” is not deemed filed with the SEC, and is not to be incorporated by reference in any filing of the Company

under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

|

12

Short-Term Incentive Compensation

At the 2001 Annual Meeting, stockholders ratified and approved the adoption of the Executive Officer Incentive Plan

(“Incentive Plan) as a replacement for them for the general employee All-Inclusive Bonus Plan (“AIBP”). The purposes of the Incentive Plan are to motivate and reward the achievement of Company objectives that create stockholder value

and to provide a competitive level of compensation, taking into account the Company’s performance against its peers. Under the Incentive Plan, executive officers are eligible to earn a bonus in an amount up to an established percentage of

annual base salary depending upon achievement of specific performance goals. The Incentive Plan is a cash-based quarterly incentive program. Bonuses are paid under the Incentive Plan only if the individual achieves his or her performance goals that

the Committee sets at the beginning of the fiscal year (or other performance period selected by the Committee). In general, the Committee sets performance goals that are linked to factors such as (1) earnings per share, (2) net income,

(3) operating cash flow, (4) pre-tax net income, (5) return on assets, (6) return on equity, (7) return on sales, (8) revenue, or (9) total shareholder return. In Fiscal 2002, performance was at or below the Incentive Plan levels and

Committee paid bonuses for the executive officers in accordance with the Incentive Plan guidelines.

Long-Term

Incentive Compensation

A key component of the total compensation package for the Company’s executive

officers is in the form of stock option awards. The Company’s 1993 Long-Term Incentive Plan provides for long-term incentive compensation for employees of the Company, including executive officers. An important objective of the 1993 Long-Term

Incentive Plan is to align the interests of executive officers with those of stockholders by providing significant equity interest in the Company that vest over periods of time. This encourages retention of executive officers, rewards long-term

commitment to the Company and provides incentive for such executive officers to maximize stockholder value. Option awards directly tie executive compensation to the performance of the Company’s common stock. The Committee is responsible for

determining, subject to the terms of such plan, the individuals to whom grants should be made, the timing of grants, the exercise or purchase price per share and the number of shares subject to each grant. In granting options to the executive

officers under the Company’s 1993 Long-Term Incentive Plan, the Committee bases the size of stock option awards on such considerations as the value of options awarded to executive officers in comparable positions in peer group companies,

Company and individual performance against plan, the number of options currently held by the executive officer, the allocation of overall share usage attributed to executive officers and the relative proportion of long-term incentives within the

total compensation mix.

Deferred Compensation Plan

Executive officers are entitled to participate in the Company’s 401(k) plan under the same terms available to all eligible employees. Additionally, executive

officers are able to participate in the Company’s non-qualified deferred compensation plan. The deferred compensation plan allows officers and other select employees to contribute a portion of their base salary and short term incentives to an

irrevocable trust for the purposes of deferring federal and state income taxes.

Chief Executive Officer Compensation

The Company’s compensation program is designed to support the achievement of corporate and individual

objectives. As with other executive officers, the Chief Executive Officer’s compensation reflects this “pay for performance” philosophy. Mr. Brown does not have an employment contract (though Mr. Brown, like all Named Executive

Officers, does have a Change-in-Control Agreement—see above). The process of determining the compensation for Mr. Brown and the factors taken into consideration in such determination are generally the same as the process and factors used in

determining the compensation of all of the Company’s executive officers.

13

During Fiscal 2002, Mr. Brown received a base salary of $960,000. After

conducting an independent analysis of salaries of Chief Executive Officers of peer companies, Mr. Brown recommended to the Committee that his base salary not be increased from the amount received in Fiscal 2001.

For Fiscal 2003, Mr. Brown requested that the Committee reduce his base salary to $600,000 and recommended that the base salaries of all

of the executive officers and all other executives not be increased from their current levels. In addition, the salaries of several other key executives were reduced to reflect a realignment of executive salaries with those of executives of peer

companies. The Committee approved these recommendations effective April 1, 2002.

Mr. Brown participates in the

Incentive Plan. Mr. Brown’s bonus target under this Incentive Plan is 80% of base salary. When setting bonuses for Mr. Brown under the Incentive Plan, the Committee develops and approves specific performance goals. Bonuses are paid under the

Incentive Plan only if performance goals that the Committee sets at the beginning of the fiscal year (or for such other performance period selected by the Committee) are achieved. For Fiscal 2002, the Committee chose to use the performance goals

related to Quantum’s achievement of certain levels of earnings per share (“EPS”) for the Common Stock. Mr. Brown’s actual bonus was determined according to a formula that the Committee developed at the time the Committee set the

performance goals, based on the level of EPS achieved. Based on actual EPS performance, Mr. Brown did not earn or receive a bonus under this Incentive Plan. After reviewing the annual objectives for the Company’s Chief Executive Officer as

approved by the Board in April 2001, the Committee awarded Mr. Brown a special bonus of $250,000 to reflect his individual performance in successfully rebuilding a strong leadership team, defining a storage solution strategy, and better positioning

the Company for future growth and profitability.

Tax Deductibility of Executive Compensation

Under Section 162(m) of the Internal Revenue Code, the Company generally receives a federal income tax deduction for compensation paid to

any of its named executive officers only if the compensation is less than $1,000,000 or is “performance-based” under Section 162(m). Both the Incentive Plan and the 1993 Long-Term Incentive Plan have been designed to permit the Committee

to pay compensation that will qualify as “performance-based” compensation under Section 162(m) and thus be fully deductible to the Company. The Committee will continue to evaluate its other compensation programs and retains discretion to

pay nondeductible compensation, to the extent consistent with the Company’s interests and taking into consideration the financial effects such action may have on the Company.

Summary

The Committee believes that the Company’s

total compensation programs are successful in attracting and retaining experienced and qualified executives and in tying compensation directly to corporate performance. The Committee will continue to closely monitor each of the compensation

components to ensure effectiveness, appropriateness and alignment with the Company’s corporate performance.

MEMBERS OF THE LEADERSHIP AND COMPENSATION COMMITTEE

Gregory W. Slayton,

Chairman

Edward M. Esber, Jr.

14

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS2

On behalf of the Board, the Audit Committee of the Board (the “Audit Committee”) is responsible for providing independent, objective review of the Company’s financial reporting process, internal audit function and

internal control. The Audit Committee is composed of independent directors, and is governed by a written charter adopted and approved by the Board in January 2001. Each of the members of the Audit Committee is independent as defined by the New York

Stock Exchange listing standards. A copy of the Audit Committee Charter (the “Charter”) was attached to the Proxy Statement for Fiscal 2001 as Appendix A.

Management has the primary responsibility for the financial statements and the financial reporting process, including the system of internal control. The Audit Committee

oversees the Company’s financial reporting process and internal control on behalf of the Board. In this regard, it helps to ensure the independence of the Company’s auditors, the integrity of management and the adequacy of disclosure to

stockholders. Representatives of the internal audit function, independent auditors and financial management have unrestricted access to the Audit Committee. The Company’s independent auditors periodically meet privately with the Audit

Committee.

The Audit Committee members are not professional accountants or auditors, and their functions are not

intended to duplicate or to certify the activities of management and the independent auditors, nor can the Audit Committee certify that the independent auditor is “independent” under applicable rules. The Audit Committee serves a

board-level oversight role, in which it provides advice, counsel and direction to management and the internal and external auditors on the basis of the information it receives, discussions with management and the auditors and the experience of the

Audit Committee’s members in business, financial and accounting matters. The Audit Committee, as appropriate, reviews and evaluates, and discusses and consults with Company management and the independent auditors regarding the following:

| |

• |

|

activity and performance of the Company’s internal and external auditors, including the audit scope, external audit fees, and auditor independence matters;

|

| |

• |

|

the extent to which the independent auditors may be retained to perform non-audit services; |

| |

• |

|

the plan for, and the independent auditor’s report on, each audit of the Company’s financial statements; |

| |

• |

|

the Company’s financial disclosure documents, including all financial statements and reports filed with the SEC or sent to stockholders, as well as the

adequacy and appropriateness of the Company’s financial, accounting, and internal auditing personnel; |

| |

• |

|

selection, evaluation, and when appropriate, replacement of the Company’s independent auditors; and |

| |

• |

|

changes in the Company’s accounting practices, principles, controls or methodologies, or in the Company’s financial statements, and recent

developments in accounting rules. |

This year, the Audit Committee, after appropriate review and

discussion, determined that the Audit Committee had fulfilled its responsibilities under the Charter.

The Audit

Committee is responsible for recommending to the Board that the Company’s financial statements be included in the Company’s annual report. The Audit Committee took a number of steps in making this recommendation for Fiscal 2002. First, the

Audit Committee discussed with Ernst & Young LLP, the Company’s independent auditors for Fiscal 2002, those matters Ernst & Young LLP communicated to and discussed with the Audit Committee under applicable auditing standards, such as

Statement on Auditing

2 |

|

This section is not “soliciting material,” is not deemed filed with the SEC, and is not to be incorporated by reference in any filing of the Company

under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

|

15

Standards No. 61, as amended, “Communications with Audit Committees,” including information concerning the scope and results of the audit. These communications and discussions are

intended to assist the Audit Committee in overseeing the financial reporting and disclosure process. Second, the Audit Committee discussed with Ernst & Young LLP their independence and received a letter from Ernst & Young LLP regarding

their independence as required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committee,” for auditors of public companies. This discussion and disclosure informed the Audit Committee of Ernst &

Young LLP’s independence, and assisted the Audit Committee in evaluating such independence. Finally, the Audit Committee reviewed and discussed, with Company management and Ernst & Young LLP, the Company’s audited consolidated balance

sheets at March 31, 2001 and 2002, and consolidated statements of income, cash flows and stockholders’ equity for the three years ended March 31, 2002. Based on discussions with Ernst & Young LLP concerning the audit, the independence

discussions, and the financial statement review, and additional matters deemed relevant and appropriate by the Audit Committee, the Audit Committee recommended to the Board that the Company’s Annual Report on Form 10-K for the year ended March

31, 2002 include these financial statements.

Fees Paid to Ernst & Young LLP

The following table shows the fees paid or accrued by the Company for the audit and other services provided by Ernst & Young LLP for

Fiscal 2002:

| |

|

(in thousands) |

| Audit Fees(1) |

|

$ |

882 |

| Financial Information Systems Design and Implementation Fees |

|

|

— |

| All Other Fees(2) |

|

|

2,266 |

| |

|

|

|

| Total |

|

$ |

3,148 |

| |

|

|

|

(1) |

|

Audit services of Ernst & Young LLP for Fiscal 2002 consisted of the examination of the annual consolidated financial statements of the Company and

quarterly reviews of financial statements. |

(2) |

|

All Other Fees relate predominately to tax advisory and other divestiture related services associated with the sale of Quantum’s hard disk drive business

to Maxtor Corporation. Other Fees also include domestic and foreign tax advisory services associated with Quantum’s ongoing business, business ventures, and merger and acquisition activities |

Quantum generally does not engage its independent auditors for consulting services in areas such as information systems design and

implementation, and corporate strategy development and implementation.

MEMBERS OF THE AUDIT

COMMITTEE

Edward M. Esber, Jr., Chairman

Kevin J. Kennedy

Gregory W. Slayton

16

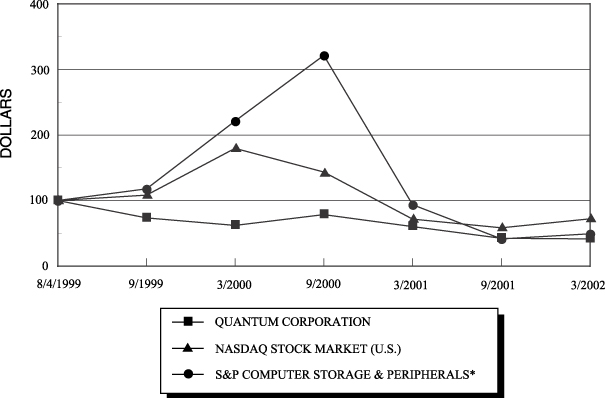

PERFORMANCE GRAPH3

The following graph compares the cumulative

total return to stockholders of the Company’s Common Stock at March 31, 2002, for the period since August 4, 1999, the date the Common Stock first began trading, to the cumulative total return over such period of (i) the NASDAQ Stock Market

(U.S.) Index, and (ii) the S&P Computer Storage & Peripherals Index. The graph assumes the investment of $100 on August 4, 1999 in Common Stock and each of such indices and reflects the change in the market price of the Common Stock relative

to the noted indices at September 30, 1999, March 31, 2000, September 30, 2000, March 31, 2001, September 30, 2001 and March 31, 2002. The performance shown is not necessarily indicative of future price performance.

32 MONTH CUMULATIVE TOTAL RETURN

* |

|

Copyright ©

2002, Standard & Poor’s, a division of the McGraw-Hill Companies, Inc. All rights reserved. www.researchdatagroup.com/S&P.htm. |

3 |

|

This section is not “soliciting material,” is not deemed filed with the sec, and is not to be incorporated by reference in any filing of the company

under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

|

17

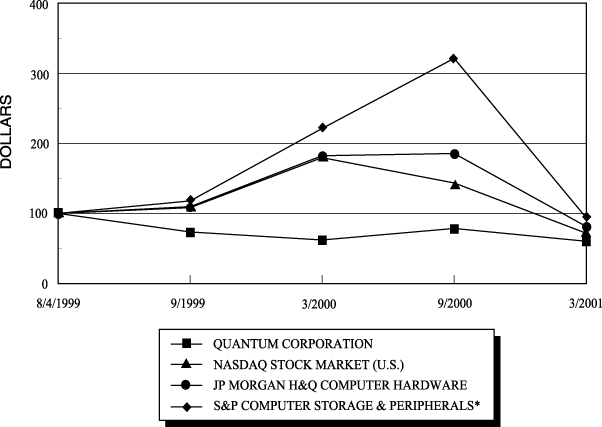

The Performance Graphs included in the Company’s Proxy Statements for Fiscal

2000 and 2001 compared cumulative total return against the JP Morgan H&Q Computer Hardware Index. The JP Morgan H&Q Index has been discontinued for periods following the end of Quantum’s Fiscal 2002. Beginning with the Proxy Statement

for Fiscal 2002, Quantum will use a new Index. The following graph compares the cumulative total return to stockholders of the Company’s Common Stock at March 31, 2001, for the period since August 4, 1999, the date the stock first began

trading, to the cumulative total return over such period of (i) the NASDAQ Stock Market (U.S.) Index, (ii) the S&P Computer Storage & Peripherals Index; and (iii) the JP Morgan H&Q Computer Hardware Index. The graph assumes the

investment of $100 on August 4, 1999 in Common Stock and each of such indices and reflects the change in the market price of the Common Stock relative to the noted indices at September 30, 1999, March 31, 2000, September 30, 2000 and March 31, 2001.

The performance shown is not necessarily indicative of future price performance.

20 MONTH CUMULATIVE TOTAL RETURN

* |

|

Copyright ©

2002, Standard & Poor’s, a division of the McGraw-Hill Companies, Inc. All rights reserved. www.researchdatagroup.com/S&P.htm. |

18

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth as of July 17, 2002 certain information with respect to the beneficial ownership of the Company’s Common Stock by (i) each person known

by the Company to be the beneficial owner of more than five percent of the outstanding shares of Common Stock, (ii) each of the Company’s directors, (iii) each of the Named Executive Officers and (iv) all current directors and executive

officers as a group.

| Name

|

|

Number of Shares Beneficially Owned(1)

|

|

|

Approximate Percentage of Shares Owned(2)

|

| Citigroup Inc. 399 Park Avenue New York, NY 10043 |

|

28,543,244 |

(3) |

|

18.2 |

| Private Capital Management, Inc. 8889 Pelican Bay Blvd. Naples, FL 34108 |

|

25,343,172 |

(3) |

|

16.2 |

| AXA Financial, Inc. 1290 Avenue of the Americas New York, NY 10104 |

|

18,242,504 |

(3) |

|

11.6 |

| Michael Brown |

|

2,234,456 |

(4) |

|

1.4 |

| Jerald L. Maurer |

|

1,108,763 |

(5) |

|

* |

| Stephen M. Berkley |

|

875,327 |

(6) |

|

* |

| John B. Gannon |

|

795,515 |

(7) |

|

* |

| Barbara Nelson |

|

677,201 |

(8) |

|

* |

| David A. Brown |

|

245,649 |

(9) |

|

* |

| Edward M. Esber, Jr. |

|

161,962 |

(10) |

|

* |

| Michael J. Lambert |

|

99,478 |

(9) |

|

* |

| Gregory W. Slayton |

|

67,041 |

(11) |

|

* |

| Kevin J. Kennedy |

|

15,000 |

(9) |

|

* |

| Edward J. Sanderson |

|

0 |

|

|

* |

| All directors and executive officers as a group (12 persons) |

|

6,280,392 |

(12) |

|

3.9 |

(1) |

|

Except pursuant to applicable community property laws or as indicated in the footnotes to this table, to the Company’s knowledge, each stockholder

identified in the table possesses sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by such stockholder. |

(2) |

|

Applicable percentage ownership is based on 156,620,052 shares of Common Stock outstanding as of July 17, 2002. Beneficial ownership is determined in

accordance with the rules of the SEC, based on factors including voting and investment power with respect to shares. Shares of Common Stock subject to options currently exercisable, or exercisable within 60 days after July 17, 2002, are considered

beneficially owned by the holder, but such shares are not deemed outstanding for computing the percentage ownership of any other person. |

(3) |

|

Based on the most recent public information available to the Company as of July 17, 2002. |

(4) |

|

Represents 53,939 shares of Common Stock and 2,180,517 shares subject to Common Stock options that were exercisable at July 17, 2002 or within sixty (60) days

thereafter. |

(5) |

|

Represents 49,647 shares of Common Stock and 1,059,116 shares subject to Common Stock options that were exercisable at July 17, 2002 or within sixty (60) days

thereafter. |

(6) |

|

Represents 8,050 shares of Common Stock and 867,277 shares subject to Common Stock options that were exercisable at July 17, 2002 or within sixty (60) days

thereafter. These totals include 351,058 shares subject to Common Stock options for which voting power was transferred to Mary Hall. Mr. Berkley disclaims beneficial ownership of the 351,058 shares subject to Common Stock options that Ms. Hall

controls. |

19

(7) |

|

Represents 60,439 shares of Common Stock and 735,076 shares subject to Common Stock options that were exercisable at July 17, 2002 or within sixty (60)

days thereafter. |

(8) |

|

Represents 30,213 shares of Common Stock and 646,988 shares subject to Common Stock options that were exercisable at July 17, 2002 or within sixty (60)

days thereafter. |

(9) |

|

Represents shares subject to Common Stock options that were exercisable at July 17, 2002 or within sixty (60) days thereafter. |

(10) |

|

Represents 40,000 shares of Common Stock and 121,962 shares subject to Common Stock options that were exercisable at July 17, 2002 or within sixty (60)

days thereafter. |

(11) |

|

Represents 1,000 shares of Common Stock and 66,041 shares subject to Common Stock options that were exercisable at July 17, 2002 or within sixty (60) days

thereafter. |

(12) |

|

Represents 243,288 shares of Common Stock and 6,037,104 shares subject to Common Stock options that were exercisable at July 17, 2002 or within sixty (60) days

thereafter. |

20

CERTAIN TRANSACTIONS

The Company issued a forgivable loan to Jerald L. Maurer on December 2, 1998, in the amount of $250,000 at an annual interest rate of 8%, none of which was outstanding on July 17, 2002. The Company

issued forgivable loans to Barbara H. Nelson on November 16, 1999 and December 28, 1999. Both loans are in the amount of $175,000, are forgivable over 4 years, and accrues interest at an annual rate of 8%. $175,000 of these loans was outstanding on

July 17, 2002. The Company issued a forgivable loan to Michael J. Lambert on June 26, 2001. This loan is in the amount of $200,000, is forgivable over 4 years, and accrues interest at an annual rate of 8%. $150,000 of this loan was outstanding

on July 17, 2002. The Company issued a forgivable loan to John B. Gannon on October 18, 2001. This loan is in the amount of $100,000, is forgivable over 4 years, and accrues interest at an annual rate of 6%. $100,000 of this loan was outstanding on

July 17, 2002.

In connection with the hiring of Lawrence M. Orecklin as President of the Company’s Storage

Solutions Group in October 2001, Mr. Orecklin and the Company entered into a severance arrangement that provides for the following in the event of his involuntary termination under specified circumstances: i) the equivalent of 12 months of base

salary; ii) the equivalent of 12 months of payments relating to mortgage assistance; iii) 12 months forgiveness of a $350,000 forgivable loan (as further described below); iv) a 90-day grace period to repay the outstanding balance on

Mr. Orecklin’s $250,000 non-forgivable loan (as further described below); and v) a minimum of 12 months of accelerated vesting of Mr. Orecklin’s stock options.

In addition, the Company issued loans to Mr. Orecklin as follows: i) a forgivable loan in the amount of $350,000, forgivable over 4 years, that accrues interest at an

annual rate of 6%, issued on October 18, 2001. $350,000 of this loan was outstanding on July 17, 2002; ii) a nonforgivable loan in the amount of $250,000, payable over 4 years, that accrues interest at an annual rate of 6%, issued on October 18,

2001. $250,000 of this loan was outstanding on July 17, 2002; iii) a bridge loan in the amount of $367,230, payable June 30, 2002, that accrues interest at an annual rate of 6%, issued on October 18, 2001. None of this loan was outstanding on

July 17, 2002; and iv) a forgivable loan in the amount of $25,000, forgivable over 4 years, that accrues interest at an annual rate of 6%, issued on May 1, 2002. $25,000 of this loan was outstanding on July 17, 2002.

The Company issued interest-free loans to certain Named Executive Officers in connection with tax matters for those Named Executive

Officers. See footnote 5 under “Executive Compensation.”

The Company has entered into indemnification

agreements with its executive officers, directors and certain significant employees containing provisions that are in some respects broader than the specific indemnification provisions contained in the General Corporation Law of Delaware. These

agreements provide, among other things, for indemnification of the executive officers, directors and certain significant employees in proceedings brought by third parties and in stockholder derivative suits. Each agreement also provides for

advancement of expenses to the indemnified party.

21

COMMUNICATING WITH THE COMPANY

We have from time-to-time received calls from stockholders inquiring about the available means of communication with the Company. We thought that it would be helpful to describe these arrangements,

which are available for your use. If you would like to receive information about the Company, without charge, you may use one of these convenient methods:

1. To have information such as the Company’s latest Quarterly Earnings Release, Form 10-K, Form 10-Q or Annual Report mailed to you,

stockholders residing in the U.S., please call Quantum’s toll-free shareholder information line at (877) 999-7686.

2. To view the Company’s website on the Internet, use the Company’s Internet address located at www.quantum.com. The Company’s website includes product, corporate and

financial data, job listings, recent earnings releases, the current stock price, and electronic files of this Proxy Statement and the Company’s Form 10Ks, Form 10Qs, and Annual Reports to Stockholders. Internet access to this information has

the advantage of providing you with up-to-date information about the Company throughout the year.

3. To reach our Investor Relations representative, please call (408) 944-4450. If you would like to write to us, please send your correspondence to the following address:

Quantum Corporation

Attention: Investor Relations Department

501 Sycamore Drive

Milpitas, California 95035

22

OTHER MATTERS

The Company knows of no other matters to be submitted at the Meeting. Any proposal that a stockholder intends to submit consideration at for the Meeting must be received by the Secretary of the Company

not later than the close of business on the tenth day following the mailing date of this Notice. Any such submission must include the information specified in the Company’s Bylaws. If any other matters properly come before the Meeting,

it is the intention of the persons named in the enclosed form of Proxy to vote the shares they represent as the Board of Directors may recommend.

| By the Order of the Board of Directors |

| |

| By: |

|

|

| |

|

Shawn D. Hall Vice President, General

Counsel and Secretary |

Dated: July 25, 2002

23

| |

|

VOTE BY INTERNET—www.proxyvote.com |

| QUANTUM CORPORATION C/O PROXY SERVICES P.O.

BOX 9112 FARMINGDALE, NY 11735 |

|

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off

date or meeting date. Have your proxy card in hand when you access the web site. You will be prompted to enter your 12-digit Control Number which is located below to obtain your records and to create an electronic voting instruction

form. |

| |

| |

|