PRELIMINARY COPY SUBJECT TO COMPLETION

DATED JULY 18, 2014

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

July [__], 2014

Dear Fellow Quantum Stockholders:

Starboard Value and Opportunity Master Fund Ltd and the other participants in this solicitation (collectively, “Starboard” or “we”) are the beneficial owners of an aggregate of 44,342,278 shares of common stock, par value $0.001 per share (the “Common Stock”), of Quantum Corporation, a Delaware corporation ("QTM” or the “Company”), including 18,548,875 shares of Common Stock issuable upon the conversion of the Company’s 4.50% convertible senior notes due November 2017 held by Starboard. Our collective ownership position represents approximately 16.5% of the outstanding shares of Common Stock, making us one of the Company’s largest stockholders. While we were pleased that we were able to work with the Company in 2013 to reconstitute the Board of Directors (the “Board”) with mutually agreeable director candidates, we believe that additional representation is now necessary to ensure that there is proper oversight and accountability at QTM, as well as to ensure that the actions required to maximize stockholder value are given full and proper consideration in the boardroom. Specifically, we believe more action must be taken (i) to increase the accountability of management, (ii) to optimize the Company’s cost structure, (iii) to better-align compensation structures to properly incentivize employees, and (iv) to explore value-enhancing strategic alternatives.

By way of background, Starboard is an investment management firm that seeks to invest in undervalued and underperforming public companies. Our approach to such investments is to actively engage and work closely with management teams and boards of directors in a constructive manner to identify and execute on opportunities to unlock value for the benefit of all stockholders. Starboard has established a strong track record of creating stockholder value at many public companies for more than 11 years.

Given Starboard’s belief that additional representation is required to improve Board oversight and QTM’s performance, we have nominated a slate of [six] highly qualified director candidates for election to the Board at the Company’s upcoming 2014 Annual Meeting of Stockholders (the “Annual Meeting”). Three of our director candidates, Philip Black, Louis DiNardo, and Jeffrey C. Smith, are currently Board members. All [six] of our director candidates are highly qualified with valuable and relevant skill-sets and are ready to serve stockholders to help make QTM a stronger, more profitable, and, ultimately, more valuable company.

The Company has only nominated candidates for five of the nine Board seats that are up for election at the Annual Meeting. While it appears that the Board has acknowledged that shareholders deserve additional Board representation by leaving four seats open for our nominees, we question the genuineness of this tactic. This unusual approach instead appears to represent an intentional manipulation of the voting mechanics to help ensure a status quo majority of the Board remains in place following the Annual Meeting. That the Board has gone out of its way to give itself the best chance of preserving a majority of the Board gives us little confidence that the election of four of our nominees as a substantial minority of the Board would serve to have any different or more meaningful impact on Board discussions and actions than that enjoyed by Messrs. Black, DiNardo, and Smith as a minority of the Board over the past year.

Each of Messrs. Black, DiNardo, and Smith joined the Board last year with the goal of working constructively with the Board and management to substantially improve the operations of the Company in order to create value for stockholders. Over the past year, and for a substantial time prior, the Company has continued to miss its internal and external expectations and to push out its goals for both revenue growth and profitability improvement. Unfortunately, we believe that the perspectives presented by Messrs. Black, DiNardo, and Smith in the boardroom regarding ways to enhance stockholder value are not being fully explored or fully considered. Specifically, these directors believe that more action must be taken (i) to increase the accountability of management, (ii) to optimize the Company’s cost structure, (iii) to better-align compensation structures to properly incentivize employees, and (iv) to explore value-enhancing strategic alternatives.

We continue to believe there is significant value to be realized at QTM. We are therefore seeking your support at the Annual Meeting to elect our [six] director candidates, who are committed to representing the best interests of shareholders by providing accountable oversight and guidance while pursuing all opportunities to enhance value for stockholders.

The terms of nine (9) directors currently serving on the Board expire at the Annual Meeting.

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosed WHITE proxy card today. The attached Proxy Statement and the enclosed WHITE proxy card are first being furnished to the stockholders on or about _________ __, 2014.

If you have already voted for management's slate, you have every right to change your vote by signing, dating and returning a later dated proxy or by voting in person at the Annual Meeting.

If you have any questions or require any assistance with your vote, please contact Okapi Partners LLC, which is assisting us, at its address and toll-free numbers listed below.

|

Thank you for your support.

|

|

/s/ Jeffrey C. Smith

|

|

Jeffrey C. Smith

|

|

Starboard Value and Opportunity Master Fund Ltd

|

|

If you have any questions, require assistance in voting your WHITE proxy card,

or need additional copies of Starboard’s proxy materials,

please contact Okapi Partners at the phone numbers or email listed below.

OKAPI PARTNERS LLC

437 Madison Avenue, 28th Floor

New York, N.Y. 10022

(212) 297-0720

Stockholders Call Toll-Free at: (877) 279-2311

E-mail: info@okapipartners.com

|

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED JULY 18 , 2014

2014 ANNUAL MEETING OF STOCKHOLDERS

OF

QUANTUM CORPORATION

_________________________

PROXY STATEMENT

OF

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED WHITE PROXY CARD TODAY

Starboard Value LP (“Starboard Value LP”), Starboard Value and Opportunity Master Fund Ltd (“Starboard V&O Fund”), Starboard Value and Opportunity S LLC (“Starboard S LLC”), Starboard Value and Opportunity C LP (“Starboard C LP”), Starboard Value GP LLC (“Starboard Value GP”), Starboard Principal Co LP (“Principal Co”), Starboard Principal Co GP LLC (“Principal GP”), Starboard Value R LP (“Starboard R LP”), Starboard Value R GP LLC (“Starboard R GP”), Jeffrey C. Smith, Mark R. Mitchell, and Peter A. Feld (collectively, “Starboard” or “we”) are significant stockholders of Quantum Corporation, a Delaware corporation (“QTM” or the “Company”), who, together with the other participants in this solicitation, beneficially own approximately 16.5% of the outstanding shares of common stock, par value $0.001 per share (the “Common Stock”), of the Company, including shares of Common Stock issuable upon the conversion of the Company’s 4.50% convertible senior notes due November 2017 held by Starboard (the “Notes”). We are seeking additional representation on the Company’s Board of Directors (the “Board”) because our involvement at QTM over the past year has made it clear to us that the Board must be further reconstituted to ensure that the interests of the stockholders, the true owners of the Company, are appropriately represented in the boardroom. We have nominated highly qualified and capable candidates with relevant backgrounds and who are committed to fully exploring all opportunities to unlock stockholder value. We are seeking your support at the Company’s 2014 Annual Meeting of Stockholders scheduled to be held at ______________, on _________, _________ __, 2014, at _________, local time (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), for the following:

|

|

1.

|

To elect Starboard’s director nominees, Philip Black, Christopher F. Crowell, Louis DiNardo, Dale L. Fuller, Jeffrey C. Smith, and Edward Terino, (each a “Nominee” and, collectively, the “Nominees”) to hold office until the 2015 Annual Meeting of Stockholders (the “2015 Annual Meeting”) and until their respective successors have been duly elected and qualified;

|

|

|

2.

|

To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for the fiscal year ending March 31, 2015;

|

|

|

3.

|

To adopt a resolution approving, on an advisory basis, the compensation of the Company’s named executive officers (the “Say-on-Pay Proposal”);

|

|

|

4.

|

To approve and ratify an amendment to the Company’s 2012 Long-Term Incentive Plan;

|

|

|

5.

|

To approve and ratify an amendment to the Company’s Employee Stock Purchase Plan; and

|

|

|

6.

|

To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

|

This Proxy Statement is soliciting proxies to elect only our Nominees, and stockholders voting for the election of directors on our WHITE proxy card will be able to vote for only six Nominees for a nine-member Board and will not be able to vote for the three remaining director seats up for election at the Annual Meeting. See “Voting and Proxy Procedures” on page [17] for additional information. You can only vote for the Company’s director nominees by signing and returning a proxy card provided by the Company. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications, and other information concerning the Company’s nominees.

As of the date hereof, the members of Starboard and the Nominees collectively beneficially own 44,342,278 shares of Common Stock, including 18,548,875 shares of Common Stock underlying the Notes (the “Starboard Group Shares”). We intend to vote all of the Starboard Group Shares that are eligible to vote FOR the election of the Nominees, [FOR] the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm; [FOR/AGAINST] the Say-on-Pay Proposal; [FOR/AGAINST] an amendment to the Company’s 2012 Long-Term Incentive Plan; and [FOR/AGAINST] an amendment to the Company’s Employee Stock Purchase Plan.

The Company has set the close of business on ______ __, 2014 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is 224 Airport Parkway, San Jose, California 95110. Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were ______ shares of Common Stock outstanding.

THIS SOLICITATION IS BEING MADE BY STARBOARD AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH STARBOARD IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED WHITE PROXY CARD WILL VOTE ON SUCH MATTERS IN OUR DISCRETION.

STARBOARD URGES YOU TO SIGN, DATE AND RETURN THE WHITE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED WHITE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting—This Proxy Statement and our WHITE proxy card are available at

______________________

______________________________

2

IMPORTANT

Your vote is important, no matter how few shares of Common Stock you own. Starboard urges you to sign, date, and return the enclosed WHITE proxy card today to vote FOR the election of the Nominees and in accordance with Starboard’s recommendations on the other proposals on the agenda for the Annual Meeting.

|

|

·

|

If your shares of Common Stock are registered in your own name, please sign and date the enclosed WHITE proxy card and return it to Starboard, c/o Okapi Partners LLC (“Okapi Partners”) in the enclosed postage-paid envelope today.

|

|

|

·

|

If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock, and these proxy materials, together with a WHITE voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions.

|

|

|

·

|

Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form.

|

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our [six] Nominees only on our WHITE proxy card. So please make certain that the latest dated proxy card you return is the WHITE proxy card.

|

OKAPI PARTNERS LLC

437 Madison Avenue, 28th Floor

New York, N.Y. 10022

(212) 297-0720

Stockholders Call Toll-Free at: (877) 279-2311

E-mail: info@okapipartners.com

|

3

Background to the Solicitation

The following is a chronology of material events leading up to this proxy solicitation:

|

|

·

|

On November 1, 2012, Starboard filed a Schedule 13D with the Securities and Exchange Commission (the “SEC”) disclosing ownership of 15.9% of QTM’s Common Stock.

|

|

|

·

|

Between January 2013 and May 2013, Starboard and the Company engaged in a series of discussions regarding Board composition and strategy. Both Starboard and QTM believed it would be in the best interests of shareholders to agree on a new composition of the Board for election at the 2013 Annual Meeting of Stockholders (the “2013 Annual Meeting”).

|

|

|

·

|

Following such discussions, Starboard and QTM entered into an agreement (the “Agreement”) on May 13, 2013, pursuant to which the Company agreed to add Jeffrey Smith to the Board and to nominate Philip Black, Louis DiNardo, and Jeffrey Smith for election to the Board at the 2013 Annual Meeting.

|

|

|

·

|

On August 7, 2013, the Company held the 2013 Annual Meeting, at which the Company’s stockholders elected nine directors to the Board, including Messrs. Black, DiNardo, and Smith, to serve until the 2014 Annual Meeting.

|

|

|

·

|

Over the subsequent year, in their capacities as Board members, Messrs. Black, DiNardo, and Smith have worked constructively with the Board in an attempt to improve value. Unfortunately, the Company has continued to underperform and underexecute strategically and operationally, resulting in a continued underperformance of QTM shares when compared to peers.

|

|

|

·

|

In November 2013, Mr. Smith provided information to the Board illustrating the consistent pattern of missed execution and lowered internal forecasts. Given Mr. Smith’s view of the consistent execution challenges, and in order to provide the Board with the ability to better oversee and guide management, Mr. Smith proposed that the Board add a new director to be Executive Chairman. This concept was rejected by a majority of the Board.

|

|

|

·

|

On March 26, 2014, Michael Brown resigned from the Board after accepting a position as interim CEO of Symantec, a competitor to QTM’s DXi business. Mr. Smith thereafter submitted the names and resumes of several highly qualified individuals to the Nomination and Governance Committee for consideration to fill the vacancy on the Board created by Mr. Brown’s resignation.

|

|

|

·

|

In April 2014, with the deadline for nominating director candidates for election at the 2014 Annual Meeting (the “Nomination Deadline”) approaching, Mr. Smith expressed his desire to reconstitute the Board without the need for a proxy contest. Mr. Smith also conveyed that any reconstitution of the Board would need to include a mechanism to ensure that if the Company continues to miss its internal and external targets, there would be increased accountability and/or more significant operational and strategic initiatives would be implemented.

|

|

|

·

|

In May 2014, Mr. Smith suggested to the Company’s Chairman, Paul Auvil, that the Nomination Deadline be extended so that the Board could continue discussions regarding Board composition and that the Nominating and Governance Committee could fully consider candidates to replace the vacancy on the Board. Mr. Smith conveyed that this would be particularly helpful for the Company, since at that time certain Board members had interviewed one of the candidates introduced by Mr. Smith as a potentially mutually agreeable candidate, but the Board had not yet had the opportunity to fully review that candidate. The Board declined to extend the Nomination Deadline.

|

|

|

·

|

On May 9, 2014, Starboard delivered a letter to QTM nominating Christopher F. Crowell, Dale L. Fuller, and Edward Terino, in addition to Messrs. Black, DiNardo, and Smith, for election to the Board at the Annual Meeting.

|

|

|

·

|

On June 23, 2014, Starboard filed a preliminary proxy statement on Form PREC14A in connection with the Annual Meeting.

|

|

|

·

|

On June 26, 2014, QTM filed a preliminary proxy statement on Form PREC14A in connection with the Annual Meeting.

|

|

|

·

|

On July 10, 2014, QTM filed a revised preliminary proxy statement on Form PRER14A in connection with the Annual Meeting.

|

4

REASONS FOR THE SOLICITATION

We are soliciting your support to elect our Nominees at the Annual Meeting because we believe that the Board, as currently composed, lacks the objectivity and commitment to take the steps necessary to enhance stockholder value at QTM.

We are Concerned with the Company’s Poor Performance

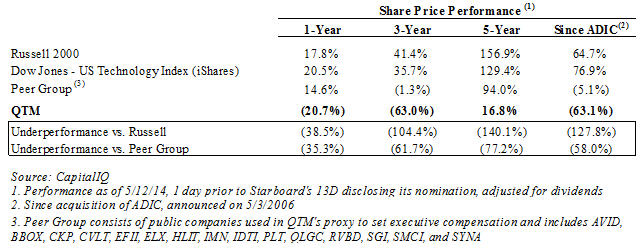

As shown below, QTM’s stock performance relative to competitors has been abysmal over almost any period.

We believe this stock price underperformance is a direct result of the Company’s poor operating performance.

5

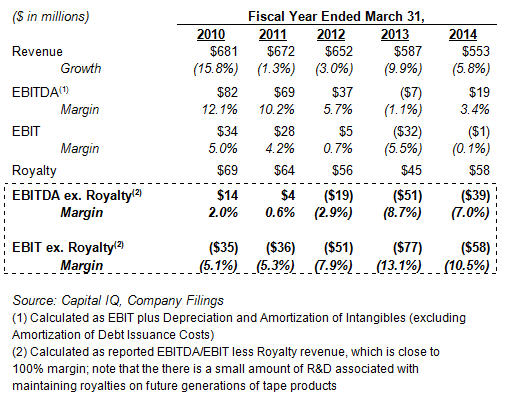

The Company has not generated profits, despite the advantage of a high-margin royalty stream of more than $40 million per year. Excluding royalties, the Company has lost money on an EBIT basis in each of the last five years, and has even lost money on an EBITDA basis for the last three years, with significantly higher losses in the last two years. Despite this unacceptable operating performance, we believe the Board has not taken sufficient action to improve operations or hold management accountable.

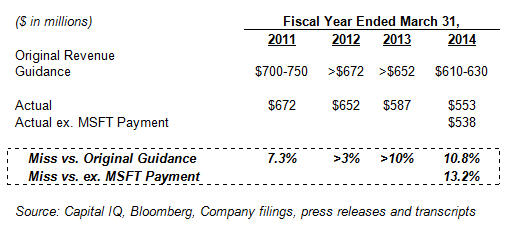

Management Has Repeatedly Missed Expectations

Management has an extended track record of missed expectations. For example, at this time last year, in its Q4 FY ’13 press release, management provided guidance for FY ’14 revenue of $610-630 million and GAAP earnings per share of (5)-0 cents. After a series of guidance reductions, the Company ultimately reported FY ’14 revenue of just $553 million, despite receiving an unexpected one-time $15 million royalty payment from Microsoft. Excluding this royalty, QTM’s sales of $538 million fell more than 13% short of guidance. Similarly, QTM’s GAAP EPS loss of 9 cents, or a loss of approximately 15 cents excluding the Microsoft payment, was far short of the original guidance of EPS of breakeven to a 5 cent loss.

FY ’14 represents just the most recent in a long string of missed expectations. In FY ’13, for example, management originally guided to positive consolidated revenue growth. Instead, revenue declined 10%. Similarly, in FY ’12 management originally guided to positive consolidated revenue growth, but revenue declined 3%. In FY ‘11, management guided to revenue of $700-750 million, but revenue came in at just $672 million, 7% below management’s original guidance. In the table below, the percentage misses reported are versus the midpoint of guidance.

As the table above demonstrates, QTM has missed its targets in each of the last four years, with the magnitude of the misses increasing in each of the last three years. However, despite this long and consistent history of missed expectations, we do not believe the Board has either insisted on or provided for increased accountability.

Our Nominees Have the Experience, Qualifications, and Commitment Necessary to Fully Explore Available Opportunities to Unlock Value for Stockholders

We have identified [six] highly qualified and capable independent directors with valuable and relevant credentials and skill-sets that are ready to identify and explore opportunities to unlock value for stockholders. Further, we believe that the current Board’s apparent unwillingness to insist on increased accountability despite continued missed expectations and poor execution warrants further reconstitution of the Board to ensure that the Board is fully committed to pursuing opportunities to enhance value for stockholders.

6

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board is currently composed of nine (9) directors, each with terms expiring at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our [six] Nominees, Philip Black, Christopher F. Crowell, Louis DiNardo, Dale L. Fuller, Jeffrey C. Smith, and Edward Terino.

THE NOMINEES

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five years of each of the Nominees. The nominations were made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes, and skills that led us to conclude that the Nominees should serve as directors of the Company are set forth below. This information has been furnished to us by the Nominees. All of the Nominees are citizens of the United States. Mr. Black is also a citizen of the United Kingdom.

Philip Black, age 59, has served as a director of QTM since August 2013, where he currently serves on the Audit Committee. Previously, Mr. Black served as President and CEO of Nexsan Technologies, a storage systems provider (“Nexsan”), from September 2004 to March 2014, where he also served as a member of the Board of Directors until December 2012. Prior to that, Mr. Black served as President and CEO of LightSand Communications, a storage networking provider, from 2001 to 2004, and as Managing Partner of IN_fusion, a storage industry consulting organization, from 2000 to 2001. Previously, Mr. Black served as co-CEO of Dot Hill Systems Corp (NASDAQ: HILL) (“Dot Hill”), a storage solutions company, from 1999 to 2000, and as CEO of Box Hill Systems Corp (NYSE: BXH) (“Box Hill”), a storage systems company and predecessor of Dot Hill, from 1995 to 1999. While at Dot Hill/Box Hill, Mr. Black also served as a member of the Board of Directors. Mr. Black also founded or co-founded a number of other technology companies, including Tekelec Inc. (NASDAQ: TKLC), a telecoms equipment company, where he served as President, CEO, and a member of the Board of Directors. Mr. Black also previously served as a member of the Board of Directors of Simtek Corporation (n/k/a Cypress Semiconductor Corporation) from September 2007 to September 2008. Additionally, Mr. Black served as Co-chair of SNIA’s ILM and Data Protection Initiatives. Mr. Black received A level certificates in Math and Physics from Christ’s College Finchley in the United Kingdom. Starboard believes that Mr. Black’s significant storage industry knowledge and extensive experience serving in senior executive positions and as a director of various public and private companies well qualifies him for service as a director of the Company.

Christopher F. Crowell, age 51, served as the Chief Operating Officer of Extreme Networks, Inc. (NASDAQ: EXTR) (“Extreme Networks”), a leading provider of network infrastructure equipment and services for enterprises, data centers, and service providers, from November 2013 to May 2014. Prior to that, Mr. Crowell served as the President and Chief Executive Officer of Enterasys Networks, Inc., a networking company (“Enterasys”), from January 2009 until it was acquired by Extreme Networks in November 2013. Mr. Crowell joined Enterasys as its Chief Technology Officer in 2006. Previously, Mr. Crowell was Senior Vice President at CA, Inc. through the acquisition of Concord Communications, Inc. (“Concord”) and Senior Vice President of Concord through the acquisition of Aprisma Management Technologies (“Aprisma”). Mr. Crowell spent several years with Aprisma, which began as the Spectrum business unit of Cabletron Systems, where Mr. Crowell led information technology, research and development, services, solution engineering, support, and training. Mr. Crowell received a Master’s in Computer Engineering from Rensselaer Polytechnic Institute, a MBA from Southern New Hampshire College (University), and a BSEE from Western New England College (University). Starboard believes that Mr. Crowell’s extensive industry knowledge and experience serving in senior executive positions at various public and private companies will make him an invaluable member of the Board.

7

Louis DiNardo, age 54, has served as President, Chief Executive Officer, and a director of Exar Corporation (NASDAQ: EXAR), a fabless semiconductor company that designs, sub-contracts manufacturing, and sells highly differentiated silicon, software, and subsystem solutions for industrial, telecom, networking, and storage applications, since January 2012. Mr. Dinardo also has served as a director of QTM since August 2013. Previously, Mr. DiNardo was a Partner at Crosslink Capital, a stage-independent venture capital and growth equity firm based in San Francisco, which he joined in January of 2008, and focused on semiconductor and alternative energy technology investment in private companies. Mr. DiNardo also previously served as a partner at VantagePoint Venture Partners, a venture capital firm, from January 2007 through January 2008. Prior to that, Mr. DiNardo served as President and Chief Operating Officer of Intersil Corporation (NASDAQ: ISIL) (“Intersil”), a leader in the innovation of power management and precision analog ICs, from January 2005 through October 2006. Mr. DiNardo also previously held the position of Executive Vice President of the Power Management Business at Intersil. Prior to that, Mr. DiNardo served as President and CEO as well as Co-Chairman of the Board of Directors of Xicor, Inc., a leader in digital potentiometers and system management products, from 2000 until Intersil acquired it in July of 2004. Previously, Mr. DiNardo spent 13 years at Linear Technology where he served as Vice President of Worldwide Marketing and General Manager of the Mixed-Signal Business Unit. He began his career in the semiconductor industry at Analog Devices Incorporated, where he served for eight years in a variety of technical and management roles. Mr. DiNardo currently serves on the Board of Directors of Conexant Systems, Inc., an audio and imaging innovation leader, which combines its significant IP portfolio in DSP and mixed signal technology with embedded software to deliver highly innovative software and silicon solutions to enrich and expand audio and imaging capabilities, a position he has held since August 2013. Starboard believes that Mr. DiNardo’s over 25 years of experience as a successful semiconductor executive and venture investor coupled with his executive leadership positions with and service on the boards of directors of a variety of technology companies well qualifies him for service as a director of the Company.

Dale L. Fuller, age 55, currently serves as Chairman of the Supervisory Board of AVG Technologies N.V. (NYSE: AVG) (“AVG”), a global leader in mobile security, PC optimization, Internet security, and privacy software, a position he has held since November 2009. He joined AVG’s Board of Directors in October 2008. Mr. Fuller also has served as Chairman of the Board of Directors of MobiSocial, Inc., a Stanford-based technology startup, since January 2013. Previously, Mr. Fuller served as President and Chief Executive Officer of MokaFive (n/k/a moka5, Inc.), a venture-backed private company, from 2008 to January 2013. Mr. Fuller also previously served on the Board of Directors of Zoran Corporation, a multinational digital technology company, from March 2011 until its merger with CSR plc (NASDAQ: CSRE) in August 2011, and as Chairman of the Board of Directors of Webgistix Corporation, a global leader in e-commerce fulfillment, from October 2008 through January 2013. Prior to that, Mr. Fuller served as a director of Phoenix Technologies, Ltd. (NASDAQ: PTEC), a BIOS software company, from November 2009 until its sale to Marlin Equity Partners in November 2010. Mr. Fuller also previously served on the Boards of Directors of Guidance Software, Inc. (NASDAQ: GUID), Krugle, Inc., Quest Aircraft Company, LLC and McAfee, Inc. (“McAfee”). In addition, Mr. Fuller served as interim President and CEO of McAfee, from October 2006 through March 2007. Prior to joining McAfee, he was President and CEO of Borland Software Corporation, from 1999 until 2005. Mr. Fuller also founded and served as President and CEO of WhoWhere? Corporation, which was later acquired by Lycos, Inc. As a start-up company CEO, Mr. Fuller led the expansion of several domain sites, including angelfire.com and Mailcity. In addition, he has held various senior executive positions at Apple Computer, NEC, Motorola, and Texas Instruments. Mr. Fuller holds an honorary doctorate from St. Petersburg State University. Starboard believes that Mr. Fuller’s deep experience in the technology industry both as an executive officer and a director of private and publicly traded technology companies well qualifies him to serve on the Company’s Board.

8

Jeffrey C. Smith, age 42, is a Managing Member, Chief Executive Officer and Chief Investment Officer of Starboard Value LP. Prior to founding Starboard Value LP, Mr. Smith was a Partner Managing Director of Ramius LLC (“Ramius”), a subsidiary of the Cowen Group, Inc. (“Cowen”), and the Chief Investment Officer of the Ramius Value and Opportunity Master Fund Ltd. Mr. Smith was also a member of Cowen’s Operating Committee and Cowen’s Investment Committee. Prior to joining Ramius in January 1998, he served as Vice President of Strategic Development and a member of the Board of Directors of The Fresh Juice Company, Inc. (“The Fresh Juice Company”). Mr. Smith has served on the Board of Quantum since May 2013. Mr. Smith has served on the Board of Directors of Office Depot, Inc. (NYSE: ODP), an office supply company, since August 2013. Mr. Smith also served as a member of the Board of Directors of Regis Corporation (NASDAQ: RGS), a global leader in beauty salons, hair restoration centers and cosmetology education, from October 2011 until October 2013. Mr. Smith previously served as a member of the Board of Directors of Surmodics, Inc. (NASDAQ: SRDX), a leading provider of drug delivery and surface modification technologies to the healthcare industry, from January 2011 to August 2012. He served on the Board of Directors of Zoran Corporation, a leading provider of digital solutions in the digital entertainment and digital imaging market, from March 2011 until its merger with CSR plc (NASDAQ: CSRE) in August 2011. Mr. Smith was the Chairman of the Board of Phoenix Technologies Ltd., a provider of core systems software products, services, and embedded technologies, from November 2009 until the sale of the company to Marlin Equity Partners in November 2010. He also served as a director of Actel Corporation, a provider of power management solutions, from March 2009 until its sale to Microsemi Corporation (NASDAQ: MSCC) in October 2010. Mr. Smith is a former member of the Board of Directors of S1 Corporation, a provider of customer interaction software for financial and payment services, where he served from May 2006 to September 2008. Mr. Smith also served on the Board of Directors of Kensey Nash Corporation (NASDAQ: KNSY), a leading medical technology company from December 2007 to February 2009. Mr. Smith was also on the Board of Directors of The Fresh Juice Company (FRSH) from 1996 until its sale to the Saratoga Beverage Group (TOGA) in 1998. Mr. Smith began his career in the Mergers and Acquisitions department at Société Générale. Mr. Smith graduated from The Wharton School of Business at The University of Pennsylvania, where he received a B.S. in Economics. Starboard believes that Mr. Smith’s extensive public board experience and experience in a variety of industries together with his management experience in a variety of roles will enable him to provide invaluable oversight to the Company’s Board.

Edward Terino, age 60, is the President of GET Advisory Service LLC, a strategic and financial management consulting firm focused on the technology and maritime industries, a position he has held since March 2009. Mr. Terino is the founder of Novium Learning, Inc., a start-up, privately-held, post-secondary vocational education publishing company, which he founded in January 2011. Mr. Terino currently serves on the Board of Directors of Baltic Trading Ltd. (NYSE: BALT), an international dry bulk shipping company, a position he has held since March 2010, where he is Chairman of the Audit Committee and a member of the Compensation Committee. Since July 2010, Mr. Terino has served as a director of SeaChange International Inc. (NASDAQ: SEAC), a digital video software company, where he is Chairman of the Audit Committee and a member of the Compensation Committee. From October 2012 through November 2013, Mr. Terino served as a director of Extreme Networks, Inc. (NASDAQ: EXTR), a network switching and services company, where he was a member of the Audit Committee. Prior to that, Mr. Terino served as a director of S1 Corporation (NASDAQ: SONE), an internet banking and payments software company, from April 2007 until February 2012, when S1 Corporation was acquired by ACI Worldwide Inc. While at S1 Corporation, Mr. Terino served as Chairman of the Audit Committee and a member of the Compensation Committee. Mr. Terino also served as a director of Phoenix Technologies Ltd. (NASDAQ: PTEC), a BIOS software company, where he was Chairman of the Audit Committee and a member of the Compensation Committee, from November 2009 until its sale to Marlin Equity Partners in November 2010. From October 1999 to March 2006, Mr. Terino served as a director of EBT International, Inc. (NASDAQ: EBTI), a then publicly traded web content management software company, where he was Chairman of the Audit Committee and a member of the Compensation Committee. Mr. Terino also previously served as Chief Executive Officer and Chief Financial Officer of Arlington Tankers Ltd. (NYSE: ATB), an international seaborne transporter of crude oil and petroleum products, from July 2005 until December 2008, when it merged with General Maritime Corporation. From September 2001 to June 2005, Mr. Terino was Senior Vice President, Chief Financial Officer and Treasurer of Art Technology Group, Inc. (NASDAQ: ARTG), a then publicly traded eCommerce software company. Prior to 2001, Mr. Terino held senior financial and operational management positions over a 15-year period with several publicly traded technology and educational publishing companies. Mr. Terino began his career at Deloitte & Touche and spent nine years in their consulting services organization. Mr. Terino earned a BS degree in Management from Northeastern University and an MBA from Suffolk University. Starboard believes that Mr. Terino’s depth of experience serving for over a decade on the Boards of Directors of public and private companies and in senior executive roles of various companies will enable him to assist in the effective oversight of the Company.

9

Mr. Black’s principal business address is c/o Quantum Corporation, 224 Airport Parkway, Suite 300, San Jose, CA 95110. Mr. Crowell does not currently have a principal business address. Mr. DiNardo’s principal business address is c/o Exar Corporation, 48720 Kato Road, Fremont, CA 94538. Mr. Fuller’s principal business address is 62 Cedar Street, Suite 1204, Seattle, WA 98121. Mr. Smith’s principal business address is c/o Starboard Value LP, 830 Third Avenue, 3rd Floor, New York, NY 10022. Mr. Terino’s principal business address is 25 Indian Rock Road, Suite 23, Windham, NH 03087.

As of the date hereof, Mr. DiNardo directly owns 50,000 shares of Common Stock and Mr. Fuller directly owns 5,000 shares of Common Stock. As of the date hereof, Messrs. Black, Crowell, and Terino do not own beneficially or of record any shares of Common Stock. As of the date hereof, Mr. Smith directly owns 43,403 shares of Common Stock received upon the vesting of RSUs (defined below) granted to Mr. Smith as compensation for his service on the Board. In addition, Mr. Smith, by virtue of his relationship with Starboard Value LP, may be deemed the beneficial owner of the 44,243,875 shares of Common Stock owned in the aggregate by Starboard Value LP, including 18,548,875 shares of Common Stock underlying the Notes.

On September 1, 2013, Messrs. Black, DiNardo and Smith were granted Restricted Stock Units (“RSUs”) as compensation for their service on the Board. Each of Messrs. Black and DiNardo received 86,806 RSUs, which will vest as follows: 50% will vest on the date of the Annual Meeting; and the remainder will vest in equal installments on (i) December 1, 2014, (ii) March 1, 2015, (iii) June 1, 2015, and (iv) the date of the 2015 Annual Meeting. Mr. Smith received 86,806 RSUs, 50% of which vested on June 1, 2014 and the remainder of which will vest in equal installments on (i) the date of the Annual Meeting, (ii) December 1, 2014, (iii) March 1, 2015, and (iv) June 1, 2015. Mr. Smith also received an additional 17,361 RSUs that will vest on the date of the Annual Meeting.

Each of the Nominees, as a member of a “group” for the purposes of Section 13(d)(3) of the Exchange Act, may be deemed to beneficially own the shares of Common Stock owned in the aggregate by the other members of the group. Each of the Nominees disclaims beneficial ownership of such shares of Common Stock, except to the extent of his pecuniary interest therein. For information regarding purchases and sales during the past two years by the Nominees and by the members of the Group (defined below) of securities of the Company that may be deemed to be beneficially owned by the Nominees, see Schedule I.

Starboard V&O Fund and certain of its affiliates have signed letter agreements, pursuant to which they agreed to indemnify each of Messrs. Black, Crowell, DiNardo, Fuller, and Terino against claims arising from the solicitation of proxies from the Company stockholders in connection with the Annual Meeting and any related transactions.

10

Starboard V&O Fund has signed compensation letter agreements with each of Messrs. Crowell, Fuller, and Terino, pursuant to which Starboard V&O Fund agrees to pay each of Messrs. Crowell, Fuller and Terino: (i) $10,000 in cash as a result of the submission by Starboard of its nomination of each of Messrs. Crowell, Fuller, and Terino to the Company; and (ii) $10,000 in cash upon the filing of a definitive proxy statement by Starboard with the SEC relating to the solicitation of proxies in favor of each of Messrs. Crowell, Fuller, and Terino’s election as a director of QTM at the Annual Meeting. Pursuant to the compensation letter agreements, each of Messrs. Crowell, Fuller, and Terino has agreed to use the after-tax proceeds from such compensation to acquire securities of the Company (the “Nominee Shares”) at such time that each of Messrs. Crowell, Fuller, and Terino shall determine, but in any event no later than 14 days after receipt of such compensation, unless otherwise agreed by Starboard and each of Messrs. Crowell, Fuller, and Terino. If elected or appointed to serve on the Board, each of Messrs. Crowell, Fuller, and Terino agrees not to sell, transfer or otherwise dispose of any Nominee Shares within two years of his election or appointment; provided, however, in the event that the Company enters into a business combination with a third party, each of each of Messrs. Crowell, Fuller, and Terino may sell, transfer or exchange the Nominee Shares in accordance with the terms of such business combination.

On May 13, 2014, Starboard Value LP, Starboard V&O Fund, Starboard S LLC, Starboard C LP, Starboard Value GP, Principal Co, Principal GP, Starboard R LP, Starboard R GP, Mark R. Mitchell, Peter A. Feld, and the Nominees (collectively the “Group”) entered into a Joint Filing and Solicitation Agreement in which, among other things, (a) the Group agreed to the joint filing on behalf of each of them of statements on Schedule 13D, and any amendments thereto, with respect to the securities of the Company, (b) the Group agreed to solicit proxies or written consents for the election of the persons nominated by the Group to the Board at the Annual Meeting (the “Solicitation”), and (c) Starboard V&O Fund, Starboard S LLC, and Starboard C LP agreed to bear all expenses incurred in connection with the Group’s activities, including approved expenses incurred by any of the parties in connection with the Solicitation, subject to certain limitations.

Other than as stated herein, and except for compensation received by Mr. Smith as an employee of Starboard, there are no arrangements or understandings between members of Starboard and any of the Nominees or any other person or persons pursuant to which the nomination of the Nominees described herein is to be made, other than the consent by each of the Nominees to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. None of the Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceedings.

Starboard believes that each Nominee presently is, and if elected as a director of the Company, each of the Nominees would be, an “independent director” within the meaning of (i) applicable New York Stock Exchange listing standards applicable to board composition and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. No Nominee is a member of the Company’s compensation, nominating or audit committee that is not independent under any such committee’s applicable independence standards.

In 2013, as described above, Starboard and the Company engaged in a series of productive discussions regarding the composition of the Board and the election of director candidates at the 2013 Annual Meeting. The Company and Starboard entered into the Agreement in which among other things, the Company agreed to nominate Messrs. Black, DiNardo, and Smith for election to the Board at the 2013 Annual Meeting. The Agreement was not the result of any formal nomination by Starboard or public threat of a proxy contest, but was rather the culmination of the discussions between Starboard and the Company regarding a reconstitution of the Board without the need for an actual or threatened proxy contest. We do not believe that the election of our entire slate would trigger a change of control under the Company’s severance and change of control agreements, or any other contracts with third parties. Although the election of at least five of our director candidates at the Annual Meeting may on its face seem to constitute a majority of the Board, we believe that under the current facts and circumstances, such election would not be deemed a change in a majority of the Board. Messrs. Smith, DiNardo, and Black are currently serving on the Board and would be deemed “continuing directors”, if re-elected, under the definition of “change of control” as found in the severance and change of control agreements that the Company maintains with certain members of management, and as found in certain of the Company’s contracts with third parties. Even if it should be determined that electing our nominees would result in a change of control, we do not believe any potential effects from such a change of control would outweigh the overwhelming benefits from an improved Board. Of further note, the change of control provisions are double-trigger provisions, meaning that a change of control in and of itself does not trigger any payments, but rather there would also need to be a termination of the affected employees before any benefits are triggered. According to the Company’s Proxy Statement, certain severance payments may be triggered following a change of control, if an event constituting a qualifying termination occurs within twelve months of such change of control. The Company’s Proxy Statement further provides that a change in a majority of the seats on the Board may also result in a change of control under certain of the Company’s contracts with third parties, including its Credit Agreement with Wells Fargo and its Directors’ and Officers’ Liability Insurance Policy, if the Company is unable to secure appropriate waivers or amendments to any such contracts.

11

We do not expect that any of the Nominees will be unable to stand for election, but, in the event any Nominee is unable to serve or for good cause will not serve, the shares of Common Stock represented by the enclosed WHITE proxy card will be voted for substitute nominee(s), to the extent this is not prohibited under the Company’s Amended and Restated By-laws, as amended (the “Bylaws”) and applicable law. In addition, we reserve the right to nominate substitute person(s) if the Company makes or announces any changes to the Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying any Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, shares of Common Stock represented by the enclosed WHITE proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s), to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations made pursuant to the preceding sentence are without prejudice to the position of Starboard that any attempt to increase the size of the current Board or to classify the Board constitutes an unlawful manipulation of the Company’s corporate machinery.

WE URGE YOU TO VOTE FOR THE ELECTION OF THE NOMINEES ON THE ENCLOSED WHITE PROXY CARD.

12

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further detail in the Company’s proxy statement, the Board has selected PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm to audit the financial statements of the Company for the fiscal year ending March 31, 2015. The Company is submitting the appointment of PricewaterhouseCoopers LLP for ratification of the stockholders at the Annual Meeting.

[WE MAKE NO RECOMMENDATION WITH RESPECT TO THE RATIFICATION OF THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR ITS FISCAL YEAR ENDING MARCH 31, 2015 AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.]

13

PROPOSAL NO. 3

ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION

As discussed in further detail in the Company’s proxy statement, the Company is asking stockholders to indicate their support for the compensation of the Company’s named executive officers. This proposal, commonly known as a “say-on-pay” proposal, is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers and the philosophy, policies and practices described in the Company’s proxy statement. Accordingly, the Company is asking stockholders to vote for the following resolution:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the Summary Compensation table and the supporting tabular and narrative disclosure on executive compensation.”

According to the Company’s proxy statement, the stockholder vote on the Say-on-Pay Proposal is an advisory vote only, and is not binding on the Company, the Board, or the Leadership and Compensation Committee of the Board.

[WE MAKE NO RECOMMENDATION WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES [“FOR”/“AGAINST”] THIS PROPOSAL.]

14

PROPOSAL NO. 4

APPROVAL OF AN AMENDMENT TO THE 2012 LONG-TERM INCENTIVE PLAN

As discussed in further detail in the Company’s proxy statement, the Company is proposing that stockholders approve an amendment to the Company’s 2012 Long-Term Incentive Plan (the “Plan”) to increase the number of shares of Common Stock available for issuance under the Plan by 4,800,000. In addition, the Company is seeking stockholder approval under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”) to enable the Company to receive a federal income tax deduction for any compensation paid under the Plan that constitutes “performance-based compensation” within the meaning of Section 162(m) of the Code.

A summary of the Plan and the complete text of the Plan are set forth in the Company’s proxy statement.

[WE MAKE NO RECOMMENDATION WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES [“FOR”/“AGAINST”] THIS PROPOSAL.]

15

PROPOSAL NO. 5

APPROVAL OF AN AMENDMENT TO THE EMPLOYEE STOCK PURCHASE PLAN

As discussed in further detail in the Company’s proxy statement, the Company is proposing that stockholders approve an amendment to the Company’s Employee Stock Purchase Plan (the “ESPP”) to increase the number of shares made available for issuance under the ESPP by 6,500,000. According to the Company, the ESPP allows eligible employees to purchase shares of its Common Stock at a price equal to 85% of the lower of the closing price of the Common Stock on the NYSE on either the opening or closing date of the respective offering period.

A summary of the ESPP and the complete text of the ESPP are set forth in the Company’s proxy statement.

[WE MAKE NO RECOMMENDATION WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES [“FOR”/“AGAINST”] THIS PROPOSAL.]

16

VOTING AND PROXY PROCEDURES

Stockholders are entitled to one vote for each share of Common Stock held of record on the Record Date with respect to each matter to be acted on at the Annual Meeting. Only stockholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Stockholders who sell their shares of Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares of Common Stock. Stockholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares of Common Stock after the Record Date. Based on publicly available information, Starboard believes that the only outstanding class of securities of the Company entitled to vote at the Annual Meeting is the Common Stock.

Stockholders have the right to cumulate their votes in the election of directors. Cumulative voting means that each stockholder may cumulate his, her or its voting power for the election by distributing a number of votes, determined by multiplying the number of directors to be elected at the Annual Meeting times the number of the stockholder’s Shares. The stockholder may distribute all of the votes to one individual director nominee, or distribute his, her or its votes among two or more director nominees, as the stockholder chooses. Unless otherwise instructed, Shares represented by properly executed WHITE proxy cards will be voted cumulatively at the Annual Meeting in favor of one or more of our Nominees, at our sole discretion, in order to elect as many of our Nominees as possible.

Shares of Common Stock represented by properly executed WHITE proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the election of the Nominees, [FOR] the ratification of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm, [FOR/AGAINST] the approval of the Say-on-Pay Proposal, [FOR/AGAINST] the approval of an amendment to the Company’s 2012 Long-Term Incentive Plan, [FOR/AGAINST] the approval of an amendment to the Company’s Employee Stock Purchase Plan and in the discretion of the persons named as proxies on all other matters as may properly come before the Annual Meeting, as described herein.

According to the Company’s proxy statement for the Annual Meeting, the current Board intends to nominate only five candidates for a nine-member Board at the Annual Meeting. This Proxy Statement is soliciting proxies to elect only our Nominees, and stockholders voting for the election of directors on our WHITE proxy card will be able to vote for only six Nominees for a nine-member Board and will not be able to vote for the three remaining director seats up for election at the Annual Meeting. If a stockholder voting for the election of directors at the Annual Meeting on our WHITE proxy card cumulates votes, such stockholder will only be able to allocate their total number of votes among our six Nominees. The participants in this solicitation intend to vote the Starboard Group Shares in favor of the Nominees. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications and other information concerning the Company’s nominees. In the event that some of the Nominees are elected, there can be no assurance that the Company nominee(s) who get the most votes and are elected to the Board will choose to serve as on the Board with the Nominees who are elected.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business at the meeting. For the Annual Meeting, the presence, in person or by proxy, of the holders of at least ___________ shares of Common Stock, which represents a majority of the ___________ shares of Common Stock outstanding as of the Record Date, will be considered a quorum allowing votes to be taken and counted for the matters before the stockholders.

Abstentions are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker non-votes” also are counted as present and entitled to vote for purposes of determining a quorum. However, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote (a “broker non-vote”). Under rules of the New York Stock Exchange, your broker will not have discretionary authority to vote your shares at the Annual Meeting on any of the proposals.

17

If you are a stockholder of record, you must deliver your vote by mail or attend the Annual Meeting in person and vote in order to be counted in the determination of a quorum.

If you are a beneficial owner, your broker will vote your shares pursuant to your instructions, and those shares will count in the determination of a quorum. Brokers do not have discretionary authority to vote on any of the proposals at the Annual Meeting. Accordingly, unless you vote via proxy card or provide instructions to your broker, your shares of Common Stock will count for purposes of attaining a quorum, but will not be voted on those proposals.

VOTES REQUIRED FOR APPROVAL

Election of Directors ─ The Company has adopted a majority vote standard for non-contested director elections and a plurality vote standard for contested director elections. As a result of our nomination of the Nominees, the director election at the Annual Meeting will be contested, meaning that the nine (9) nominees for director receiving the highest vote totals will be elected as directors of the Company. With respect to the election of directors, only votes cast “FOR” a nominee will be counted. Proxy cards specifying that votes should be withheld with respect to one or more nominees will result in those nominees receiving fewer votes but will not count as a vote against the nominees. Neither an abstention nor a broker non-vote will count as a vote cast “FOR” or “AGAINST” a director nominee. Therefore, abstentions and broker non-votes will have no direct effect on the outcome of the election of directors.

If a stockholder wishes to cumulate his or her votes, he or she should multiply the number of votes he or she is entitled to cast by nine (9) (the number of directors to be elected) to derive a cumulative total and then write the number of votes for each director next to each director’s name on the proxy card. The total votes cast in this manner may not exceed the cumulative total. If a stockholder voting for the election of directors at the Annual Meeting on our WHITE proxy card cumulates votes, such stockholder will only be able to allocate their total number of votes among our six Nominees.

If a stockholder does not wish to cumulate votes for directors, he or she should indicate a vote “FOR” the nominees or a “WITHHOLD” vote with respect to the nominees, as provided on the proxy card. A properly executed proxy marked “WITHHOLD” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum.

Other Proposals ─ Stockholders may vote “FOR” or “AGAINST” or may “ABSTAIN” from voting on each of the other proposals. Neither an abstention nor a broker non-vote will count as voting with respect to each of the other proposals. Therefore, abstentions and broker non-votes will have no direct effect on the outcome of these proposals. According to the Company’s proxy statement, the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2015 and the adoption of a resolution approving, on an advisory basis, the Say-on-Pay Proposal, requires the affirmative vote of a majority of the votes present in person or represented by proxy and entitled to vote on the matter. The Say-on-Pay proposal is advisory only and is not binding on the Company, the Board, or the Leadership and Compensation Committee of the Board. According to the Company’s proxy statement, the approval and ratification of an amendment to the Company’s 2012 Long Term Incentive Plan and the approval and ratification of an amendment to the Company’s Employee Stock Purchase Plan, requires approval by a majority of votes cast at the Annual Meeting. If you sign and submit your WHITE proxy card without specifying how you would like your shares voted, your shares will be voted in accordance with Starboard’s recommendations specified herein and in accordance with the discretion of the persons named on the WHITE proxy card with respect to any other matters that may be voted upon at the Annual Meeting consistent with Rule 14a-4(c)(3) promulgated under the Exchange Act.

18

REVOCATION OF PROXIES

Stockholders of the Company may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation. The delivery of a subsequently dated proxy which is properly completed will constitute a revocation of any earlier proxy. The revocation may be delivered either to Starboard in care of Okapi Partners at the address set forth on the back cover of this Proxy Statement or to the Company at 224 Airport Parkway, San Jose, California 95110 or any other address provided by the Company. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed to Starboard in care of Okapi Partners at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the outstanding shares of Common Stock. Additionally, Okapi Partners may use this information to contact stockholders who have revoked their proxies in order to solicit later dated proxies for the election of the Nominees.

IF YOU WISH TO VOTE FOR THE ELECTION OF THE NOMINEES TO THE BOARD, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED WHITE PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by Starboard. Proxies may be solicited by mail, facsimile, telephone, telegraph, Internet, in person and by advertisements.

Starboard V&O Fund has entered into an agreement with Okapi Partners for solicitation and advisory services in connection with this solicitation, for which Okapi Partners will receive a fee not to exceed $[_____], together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws. Okapi Partners will solicit proxies from individuals, brokers, banks, bank nominees, and other institutional holders. Starboard V&O Fund has requested banks, brokerage houses, and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares of Common Stock they hold of record. Starboard V&O Fund will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. It is anticipated that Okapi Partners will employ approximately [__] persons to solicit stockholders for the Annual Meeting.

The entire expense of soliciting proxies is being borne by Starboard. Costs of this solicitation of proxies are currently estimated to be approximately $[_____]. Starboard estimates that through the date hereof its expenses in connection with this solicitation are approximately $[_____]. Starboard intends to seek reimbursement from the Company of all expenses it incurs in connection with this solicitation. Starboard does not intend to submit the question of such reimbursement to a vote of security holders of the Company.

ADDITIONAL PARTICIPANT INFORMATION

The Nominees and the members of Starboard are participants in this solicitation. The principal business of Starboard V&O Fund, a Cayman Islands exempted company, is serving as a private investment fund. Starboard V&O Fund has been formed for the purpose of making equity investments and, on occasion, taking an active role in the management of portfolio companies in order to enhance stockholder value. Each of Starboard S LLC, a Delaware limited liability company, and Starboard C LP, a Delaware limited partnership, has been formed for the purpose of investing in securities and engaging in all related activities and transactions. Starboard Value LP provides investment advisory and management services and acts as the investment manager of Starboard V&O Fund, Starboard C LP and of a certain managed account (the “Starboard Value LP Account”) and is the manager of Starboard S LLC. The principal business of Starboard Value GP is providing a full range of investment advisory, pension advisory and management services and serving as the general partner of Starboard Value LP. The principal business of Principal Co is providing investment advisory and management services. Principal Co is a member of Starboard Value GP. Principal GP serves as the general partner of Principal Co. Starboard R LP serves as the general partner of Starboard C LP. Starboard R GP serves as the general partner of Starboard R LP. Messrs. Smith, Feld and Mitchell serve as members of Principal GP and the members of each of the Management Committee of Starboard Value GP and the Management Committee of Principal GP.

19

The address of the principal office of each of Starboard Value LP, Starboard S LLC, Starboard C LP, Starboard Value GP, Principal Co, Principal GP, Starboard R LP, Starboard R GP and Messrs. Smith, Feld and Mitchell is 830 Third Avenue, 3rd Floor, New York, New York 10022. The address of the principal office of Starboard V&O Fund is 89 Nexus Way, Camana Bay, PO Box 31106, Grand Cayman KY1-1205, Cayman Islands.

As of the date hereof, Starboard V&O Fund owned directly 26,128,823 shares of Common Stock, including 11,511,839 shares of Common Stock underlying the Notes. As of the date hereof, Starboard S LLC owned directly 5,862,924 shares of Common Stock, including 2,586,521 shares of Common Stock underlying the Notes. As of the date hereof, Starboard C LP owned directly 3,008,940 shares of Common Stock, including 333,940 shares of Common Stock underlying the Notes. Starboard R LP, as the general partner of Starboard C LP, may be deemed the beneficial owner of the 3,008,940 shares owned by Starboard C LP. Starboard R GP, as the general partner of Starboard R LP, may be deemed the beneficial owner of the 3,008,940 shares owned by Starboard C LP. As of the date hereof, 9,243,188 Shares were held in the Starboard Value LP Account, including 4,116,575 Shares underlying the Notes. Starboard Value LP, as the investment manager of Starboard V&O Fund, Starboard C LP and the Starboard Value Account and the manager of Starboard S LLC, may be deemed the beneficial owner of the 44,243,875 Shares owned by Starboard V&O Fund, Starboard S LLC and Starboard C LP and held in the Starboard Value LP Account. Starboard Value GP, as the general partner of Starboard Value LP, may be deemed to beneficially own the 44,243,875 shares of Common Stock beneficially owned by Starboard Value LP. Principal Co, as a member of Starboard Value GP, may be deemed to beneficially own the 44,243,875 shares of Common Stock beneficially owned by Starboard Value GP. Principal GP, as the general partner of Principal Co, may be deemed to beneficially own the 44,243,875 shares of Common Stock beneficially owned by Principal Co. Each of Messrs. Smith, Feld and Mitchell, as a member of Principal GP and as a member of the Management Committee of Starboard Value GP and the Management Committee of Principal GP, may be deemed to beneficially own the 44,243,875 shares of Common Stock beneficially owned by Principal GP.

Each participant in this solicitation, as a member of a “group” with the other participants for the purposes of Section 13(d)(3) of the Exchange Act, may be deemed to beneficially own the 44,342,278 shares of Common Stock owned in the aggregate by all of the participants in this solicitation. Each participant in this solicitation disclaims beneficial ownership of the shares of Common Stock he or it does not directly own. For information regarding purchases and sales of securities of the Company during the past two years by the participants in this solicitation, see Schedule I.

The shares of Common Stock and the Notes purchased by each of Starboard V&O Fund, Starboard S LLC and Starboard C LP and held in the Starboard Value LP Account were purchased with working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business).

On October 26, 2012, Starboard purchased in a private placement an aggregate of $30,000,000 principal amount of the Notes. The Notes are convertible at an initial conversion rate of 607.1645 Shares of the Common Stock per $1,000 principal amount of the Notes (representing an initial conversion price of approximately $1.65 per Share), subject to adjustment in certain circumstances, and will mature on November 15, 2017. Starboard may convert the Notes at any time prior to the close of business on the business day immediately preceding November 15, 2017.

20

Except as set forth in this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no participant in this solicitation has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant in this solicitation directly or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation owns any securities of the Company which are owned of record but not beneficially; (iv) no participant in this solicitation has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the securities of the Company owned by any participant in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no participant in this solicitation is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any participant in this solicitation owns beneficially, directly or indirectly, any securities of the Company; (viii) no participant in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no participant in this solicitation or any of his or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no participant in this solicitation or any of his or its associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; and (xi) no participant in this solicitation has a substantial interest, direct or indirect, by securities holdings or otherwise, in any matter to be acted on at the Annual Meeting.

There are no material proceedings to which any participant in this solicitation or any of his or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to each of the Nominees, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past 10 years.

OTHER MATTERS AND ADDITIONAL INFORMATION

Starboard is unaware of any other matters to be considered at the Annual Meeting. However, should other matters, which Starboard is not aware of a reasonable time before this solicitation, be brought before the Annual Meeting, the persons named as proxies on the enclosed WHITE proxy card will vote on such matters in their discretion consistent with Rule 14a-4(c)(3) promulgated under the Exchange Act.

STOCKHOLDER PROPOSALS

Proposals of stockholders intended to be presented at the 2015 Annual Meeting must, in order to be included in the Company’s proxy statement and the form of proxy for the 2015 Annual Meeting, be received by the Company’s Corporate Secretary at its principal executive offices no later than _______. Such proposals must also comply with SEC regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials and with the notice procedures set forth in the Bylaws.

Under the Bylaws, any stockholder intending to present any proposal (other than a proposal made by, or at the direction of, the Board) at the 2015 Annual Meeting who is not seeking inclusion of the proposal in the Company’s proxy statement or information statement, must give written notice of that proposal to the Company’s Secretary not later than the 45th day nor earlier than the 75th day before the one-year anniversary of the date on which the Company first mailed its proxy materials or a notice of availability of proxy materials (whichever is earlier) for this year’s Annual Meeting (see Section 2.4(i)(a) of the Bylaws). The stockholder’s submission must include the information specified in Section 2.4(i)(b) of the Bylaws.

21

Stockholders should contact the Secretary of the Company in writing at 224 Airport Parkway, San Jose, California 95110, to make any submission or to obtain additional information as to the proper form and content of submissions.

The information set forth above regarding the procedures for submitting stockholder proposals for consideration at the 2015 Annual Meeting is based on information contained in the Company’s proxy statement. The incorporation of this information in this proxy statement should not be construed as an admission by Starboard that such procedures are legal, valid or binding.

INCORPORATION BY REFERENCE

WE HAVE OMITTED FROM THIS PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS INCLUDED IN THE COMPANY’S PROXY STATEMENT RELATING TO THE ANNUAL MEETING. THIS DISCLOSURE INCLUDES, AMONG OTHER THINGS, CURRENT BIOGRAPHICAL INFORMATION ON THE COMPANY’S DIRECTORS, INFORMATION CONCERNING EXECUTIVE COMPENSATION, AND OTHER IMPORTANT INFORMATION. SEE SCHEDULE II FOR INFORMATION REGARDING PERSONS WHO BENEFICIALLY OWN MORE THAN 5% OF THE SHARES AND THE OWNERSHIP OF THE SHARES BY THE DIRECTORS AND MANAGEMENT OF THE COMPANY.

The information concerning the Company contained in this Proxy Statement and the Schedules attached hereto has been taken from, or is based upon, publicly available information.

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

____________ __, 2014

22

SCHEDULE I

TRANSACTIONS IN SECURITIES OF THE COMPANY

DURING THE PAST TWO YEARS

|

Shares of Common Stock

Purchased / (Sold)

|

Date of

Purchase / Sale

|

|

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

|

|

|

159,250

|

09/04/2012

|

|

159,250

|

09/05/2012

|

|

158,000

|

10/04/2012

|

|

63,200

|

10/05/2012

|

|

569

|

10/05/2012

|

|

94,231

|

10/17/2012

|

|

63,200

|

10/18/2012

|

|

517

|

10/18/2012

|

|

69,003

|

10/19/2012

|

|

25,280

|

10/19/2012

|

|

12,640

|

10/24/2012

|

|

685,183

|

10/25/2012

|

|

1,535,441

|

10/25/2012

|

|

2,364,484

|

10/25/2012

|

|

316,000

|

10/25/2012

|

|

632,000

|

10/25/2012

|

|

667,049

|

10/25/2012

|

|

751,842

|

10/25/2012

|

|

11,511,839*

|

10/26/2012

|

|

STARBOARD VALUE AND OPPORTUNITY S LLC

|

|

|

35,250

|

09/04/2012

|

|

35,250

|

09/05/2012

|

|

35,500

|

10/04/2012

|

|

14,200

|

10/05/2012

|

|

128

|

10/05/2012

|

|

21,172

|

10/17/2012

|

|

14,200

|

10/18/2012

|

|

116

|

10/18/2012

|

|

15,504

|

10/19/2012

|

|

5,680

|

10/19/2012

|

|

2,840

|

10/24/2012

|

|

153,950

|

10/25/2012

|

|

344,988

|

10/25/2012

|

|

531,261

|

10/25/2012

|

|

71,000

|

10/25/2012

|

|

142,000

|

10/25/2012

|

|

149,875

|

10/25/2012

|

|

168,927

|