SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

x Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

o Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material under §240.14a-12

Quantum Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee paid previously with preliminary materials.

o Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

1

1

Preliminary Proxy Statement - Subject to Completion

2

2

A Message from our Chairman and CEO

| | | | | | | | |

| | Dear Quantum Shareholders, |

| |

| Our fiscal year 2022 was a year of change. We continued our progress in building a robust recurring revenue stream by transitioning to subscription licensing models and increasing our as-a-Service offerings. We completed two acquisitions that helped us globally expand both our technology and physical footprints. We innovated new solutions, introducing a dozen new products and redesigning many others. We hired talented new leaders across the company with the experience to take us to the next level of our journey. As we exited fiscal 2022 and entered fiscal 2023, your oversubscription to our rights offering allowed us to strengthen our balance sheet, pay down debt, and continue to grow in this challenging environment. |

| |

James J. Lerner President and Chief Executive Officer Chairman of the Board | | All those changes were made with one goal in mind: Delivering long-term value to you. Part of that value includes enhancing our communication with you, and listening to your feedback. |

| |

| You told us you expect improvement in the reliability and profitability of our performance through consistent execution. We are implementing new initiatives to improve earnings through sales and services expansion, cost reductions, supply chain optimization, and margin improvements throughout our organization. We believe that these programs will improve our earnings performance in fiscal 2023 and beyond. |

| | |

| | You said you expect us to protect the power of your investment when we capitalize the company. While we believe it's good governance to ask you to approve an increase in our authorized share base, we've proposed a modest amount, well within the approval guidelines published by independent experts. We are not currently contemplating any acquisitions, equity offerings, or other uses of these shares. |

| | |

| | You also told us to reflect your input in our actions. We are very pleased to nominate Chris Neumeyer to join our board of directors at our 2022 annual meeting, and recommend you vote for him. We believe Chris, as an executive at one of our largest shareholders, will amplify your voices to ensure we continue to hear your feedback, and continue to respond. |

| | |

| | We know that you expect us to be careful stewards of your investment. Our singular focus in fiscal 2023 is on helping the value of that investment grow. |

| | |

| | |

3

3

Notice of Annual Meeting of Shareholders

Quantum Corporation (Quantum or the Company) invites you attend our 2022 annual meeting of shareholders (Annual Meeting) on Tuesday, August 16, 2022, beginning promptly at 11:30 a.m. Pacific Time. At the meeting, we will consider and vote on the following proposals:

4

4

Only shareholders of record at the close of business on June 24, 2022 (the Record Date), or their valid proxy holders, may vote at the meeting. Our Board of Directors (Board) recommends you vote for each of the proposals we're presenting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

Each of the proposals is explained more completely in our 2022 proxy statement, which also describes our Board procedures and candidates. This information is available at http://www.proxyvote.com.

Shareholders will not receive paper copies of our proxy statement and annual report so that we may reduce the environmental impact of the proxy process. We will instead send a Notice of Internet Availability with instructions for accessing the proxy materials and voting online. The notice also provides information about how shareholders may obtain paper copies of proxy materials if desired. Our Notice of Internet Availability is first being published on [_____], 2022 to all shareholders entitled to vote at the Annual Meeting. Please see Notice and Access for more information.

Quantum knows of no other matters to be submitted at the Annual Meeting. Our Corporate Secretary must receive any shareholder proposals intended for consideration at the Annual Meeting within the timeframes and including the information specified in our Bylaws. If any other matters properly come before the Annual Meeting, the persons named in the form of proxy intend to vote the shares they represent as the Board may recommend.

By Order of the Board of Directors,

Brian E. Cabrera

Senior Vice President, Chief Legal and Compliance Officer, and Corporate Secretary

[______], 2022

5

5

Table of Contents

| | | | | | | | | | | |

| BOARD OF DIRECTORS AND COMMITTEES | 7 | FISCAL 2022 COMPENSATION TABLES | 47 |

| Director Biographies | 8 | Fiscal 2022 Summary Compensation Table | 47 |

| Board Meetings and Independence | 15 | Fiscal 2022 Grants of Plan-Based Awards | 48 |

| Board Committees and Leadership Structure | 16 | Outstanding Equity Awards at Fiscal 2022 Year End | 49 |

| Director Candidate Evaluation | 17 | Fiscal 2022 Options Exercised and Stock Vested | 50 |

| | Potential Payments Upon Termination or Change of Control for Fiscal | |

| CORPORATE GOVERNANCE | 20 | 2022 | 50 |

| Ethics and Compliance | 20 | Equity Compensation Plan Information | 53 |

| Environmental, Social, and Governance Oversight | 21 | CEO Pay Ratio | 53 |

| Board Role in Risk Oversight | 23 | Security Ownership of Certain Beneficial Owners and Management | 53 |

| Board Evaluation | 23 | | |

| Stock Ownership Guidelines | 23 | BOARD COMMITTEE REPORTS AND RELATED INFORMATION | 56 |

| Non-Employee Director Compensation | 24 | Report of the Leadership and Compensation Committee of the | |

| | Board of Directors | 56 |

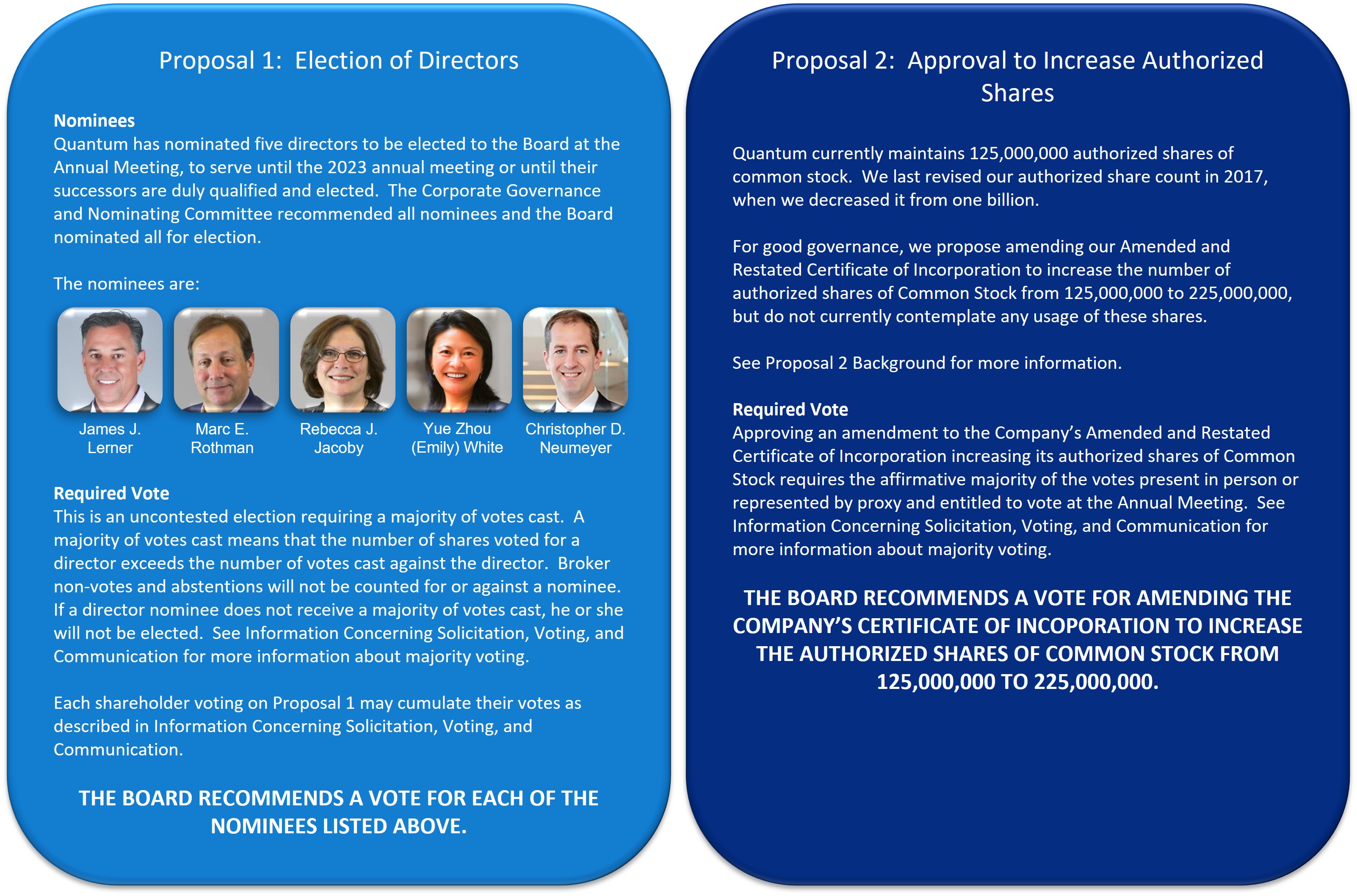

| PROPOSALS | 28 | Report of the Audit Committee of the Board of Directors | 56 |

| Proposal 1: Election of Directors | 28 | Audit and Audit-Related Fees | 57 |

| Proposal 2: Approval to Increase Authorized Shares | 28 | Related Party Transactions | 58 |

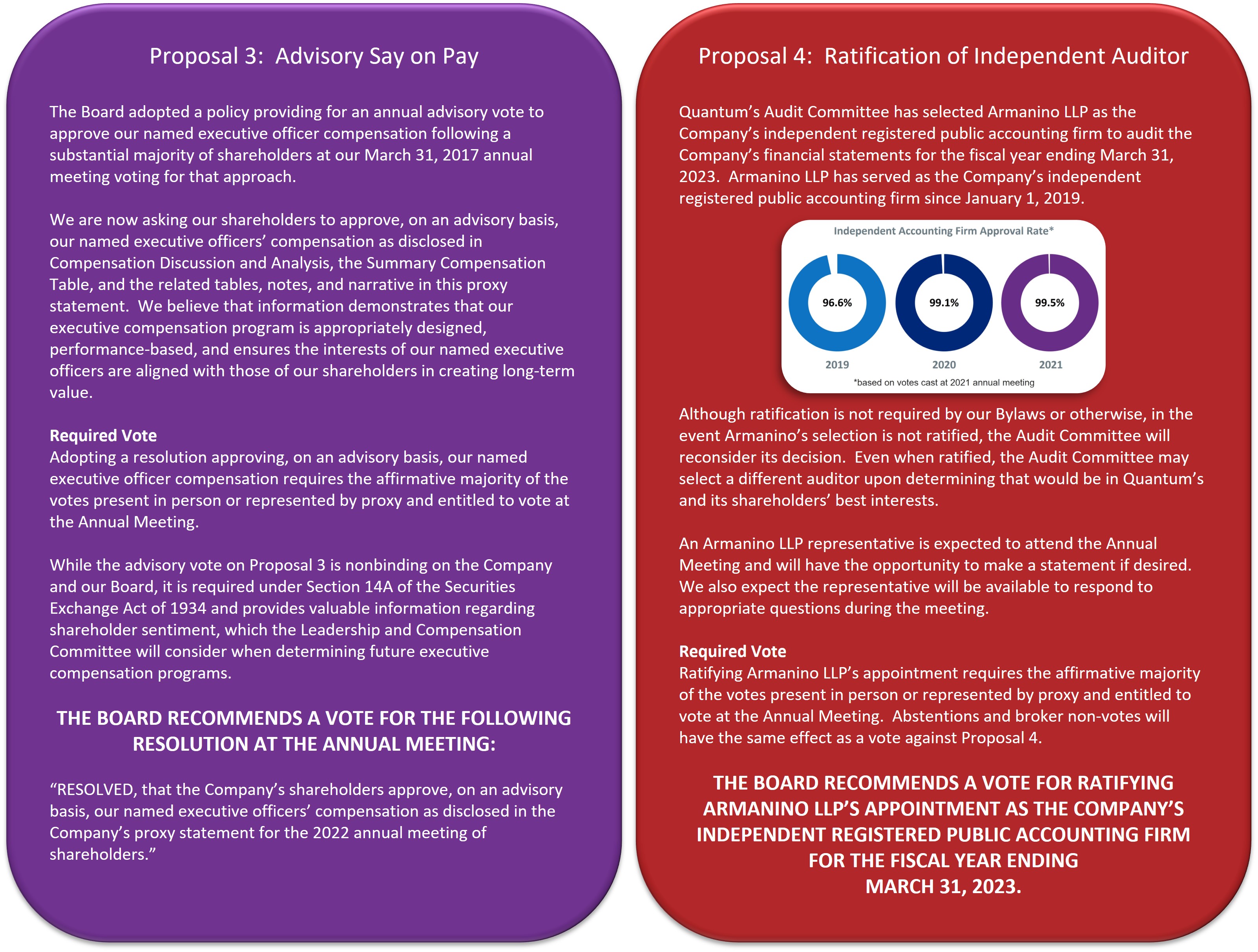

| Proposal 3: Advisory Say on Pay | 29 | | |

| Proposal 4: Ratification of Independent Auditor | 29 | INFORMATION CONCERNING SOLICITATION, VOTING, AND | |

| Proposal 2 Background | 30 | COMMUNICATION | 60 |

| | General Information | 60 |

| COMPENSATION DISCUSSION AND ANALYSIS | 31 | Notice and Access | 60 |

| Fiscal 2022 Executive Compensation Highlights | 31 | Record Date and Outstanding Shares | 60 |

| Executive Compensation Philosophy | 33 | Voting Procedures | 60 |

| Competitive Positioning | 34 | Householding | 62 |

| Compensation Elements | 35 | Solicitation | 62 |

| Perquisites and Other Benefits | 41 | Communicating With the Company | 63 |

| Executive Compensation Process and Decision Making | 42 | Shareholder Proposals for Our 2023 Annual Meeting | 63 |

| Compensation Governance Best Practices | 43 | | |

| Change of Control Severance Policy, Employment Agreements, and Severance | | APPENDIX A | 64 |

| Agreements | 45 | | |

| Tax and Accounting Considerations | 45 | PROXY CARD | 65 |

| Risks Related to Compensation Policies and Practices | 45 | | |

6

6

Board of Directors and Committees

The key roles of our Board include, but are not limited to:

•Selecting and evaluating the Company’s Chief Executive Officer (CEO), reviewing and approving the CEO’s objectives and compensation, and overseeing CEO succession planning.

•Advising the CEO and management on the Company’s fundamental strategies and approving acquisitions, divestitures, important organizational changes, and other significant corporate actions.

•Approving the annual operating plan.

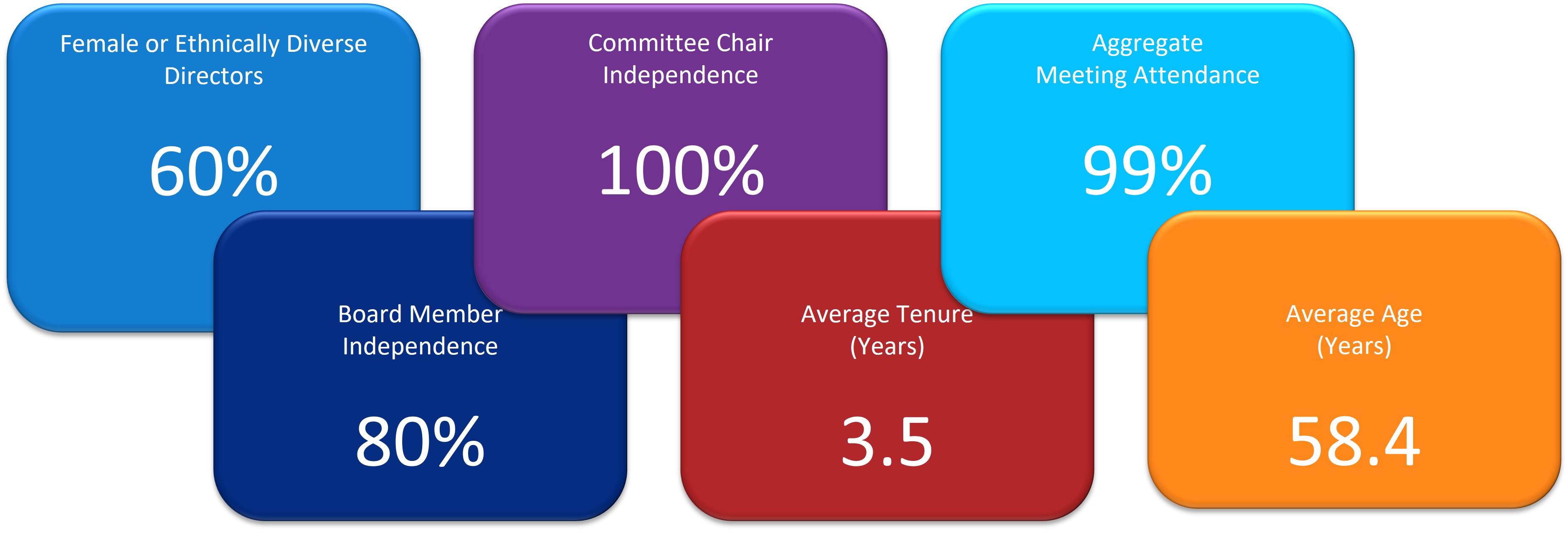

Mr. Lerner currently presides as Chairman of the Board. Mr. Rau was appointed Lead Independent Director in December 2021.

For the April 1 – September 21, 2021 portion of the fiscal year ending March 31, 2022 (Fiscal 2022), Mr. John A. Fichthorn served on our Board as the Lead Independent Director. Mr. Fichthorn did not stand for re-election at our 2021 shareholder meeting, and we did not name a new Lead Independent Director until Mr. Rau's appointment in December 2021.

Our current and nominated directors are introduced on the following pages. There are no familial relationships between any directors or executive officers of the Company.

Key demographics for our current Board members are:

7

7

| | | | | | | | |

| | Mr. Lerner has served as our President and CEO since July 2018. He was appointed to the Board at that time and named Chairman in August 2018. |

| |

| Some of Quantum’s key accomplishments during Mr. Lerner’s tenure include: |

| •Beginning and progressing in its transition from one-time hardware sales to a recurring software revenue model; |

| •Acquiring several technology features, products, and businesses that introduced incremental performance capabilities to Quantum’s product line; |

| •Launching 20 new products; and |

James J. Lerner President and Chief Executive Officer Chairman of the Board | | •Successfully closing an oversubscribed rights offering, raising gross proceeds of $67.5M. |

| |

| Mr. Lerner previously served in senior leadership positions at Pivot3 Inc., a smart infrastructure solutions company. |

| Age 52 | | •Vice President and Chief Operating Officer, from March 2017 to June 2018. |

| | •Chief Revenue Officer from November 2016 to March 2017. |

| | |

| | Prior to Pivot3, from March 2014 to August 2015, he served as President of Cloud Systems and Solutions at Seagate Technology Public Limited Company, a data storage company. |

| |

| Before working at Seagate, Mr. Lerner served in various executive roles at Cisco Systems, Inc., a publicly-traded networking hardware and software manufacturing company, including most recently as Senior Vice President and General Manager of the Cloud & Systems Management Technology Group. |

| |

| Prior to beginning his career as a technology company executive, he was a Senior Consultant at Andersen Consulting, a financial advisory and consulting firm. |

| |

| Since 2011, Mr. Lerner has served on the Board of Trustees of Astia, a global not-for-profit organization built on a community of men and women dedicated to the success of women-led, high-growth ventures. Currently, he serves as the Chair of the Board of Trustees. |

| |

| Mr. Lerner earned a Bachelor of Arts in Quantitative Economics and Decision Sciences from the University of California, San Diego. |

| |

| We believe Mr. Lerner’s extensive history in our industry, combined with his executive-level experience at large, well-established companies contributes significantly to our Board. He does not sit on any Board committees. |

8

8

| | | | | | | | |

| Mr. Rau joined our Board in March 2017 and has announced his decision not to stand for election to the Board at our Annual Meeting. He does not have any disagreements with the Board or Quantum management team on any matter relating to the Company’s operations, policies, or practices. | | |

| |

| Mr. Rau served as Quantum’s Chairman of the Board between August and September 2017 and between November 2017 and August 2018. He held the position of Executive Chairman between September and November 2017. | |

| |

| Mr. Rau has served in a number of board and executive leadership positions, including: | |

•Since June 2020, as a member of the board of directors of Xperi Holding Corporation, a public company which invents, develops, and delivers technologies. He is currently a member of its Corporate Governance and Nominating Committee. | | Raghavendra Rau Lead Independent Director Chair, Leadership and Audit Committee |

•From May 2015 until June 2020, when it merged with Xperi Holding Corporation, as a member of the board of directors and Vice Chairman of TiVo Corporation, which provides on-demand streaming services. Mr. Rau also served as Interim President and CEO of TiVo Corporation from July 2018 to May 2019. | | Age 73 |

•From November 2011 until October 2014, as the Chief Executive Officer of SeaChange International Inc., a publicly-traded provider of digital video systems, software and related services to cable, telecommunications, and broadcast television companies worldwide, where he also served as a director from July 2010 until October 2014. | | |

•From November 2010 until December 2014, as a director of Aviat Networks, Inc., a public global supplier of microwave networking solutions, where he also served as a member of the Audit Committee. | | |

•As a director of Microtune, Inc., a global leader in RF integrated circuits and subsystem modules, from May 2010 until its acquisition by Zoran Corporation, a multinational digital technology company, in December 2010, where he also served as a member of the Audit Committee. | |

•Several positions at Motorola, Inc., a multinational telecommunications company, including as the Senior Vice President of its Mobile TV Solutions Business from May 2007 until January 2008, and as Senior Vice President of Strategy and Business Development, Networks & Enterprise from March 2006 to May 2007. Mr. Rau served as Corporate Vice President of Global Marketing and Strategy from 2005 to 2006, as Corporate Vice President, Marketing and Professional Services, from 2001 to 2005, and in various other positions from October 1992 to 2001. | |

| |

| Mr. Rau is a former Chairman of the QuEST Forum, a collaboration of service providers and suppliers dedicated to telecom supply chain quality and performance, and was a director of the Center for Telecom Management at the University of Southern California. Mr. Rau also served on the Marketing Advisory Board of Cleversafe Inc., an object storage software and systems developer company acquired by IBM. | |

| |

| Mr. Rau holds a bachelor’s degree in Engineering from the National Institute of Technology (India) and an MBA from the Indian Institute of Management. | |

9

9

| | | | | | | | |

| | Mr. Rothman has served as a member of our Board since May 2017. |

| |

| Mr. Rothman has been Senior Vice President and Chief Financial Officer at BMC Software (BMC) since October 2020. BMC develops, delivers, and services IT operations management software that enable businesses in their ongoing evolution to an Autonomous Digital Enterprise. |

| |

| Before joining BMC, Mr. Rothman served as Executive Vice President and Chief Financial Officer of Verifone Systems, Inc., a multinational company providing technology for electronic payment transactions from 2013 to July 2020. |

| |

Marc E. Rothman Chair, Audit Committee | | Prior to Verifone, Mr. Rothman served as Senior Vice President and Chief Financial Officer of Motorola Mobility, Inc., a consumer electronics and telecommunications company, from 2010 to 2012. |

| •Led Motorola Mobility, Inc.'s spin off from its former parent company, Motorola, Inc., and its subsequent sale to Google in 2012. |

| Age 57 | | •Served in several executive finance positions at Motorola throughout his tenure, beginning in January 2000, including Chief Financial Officer of its Broadband Communications, Public Safety, Networks, and Enterprise and Mobile Devices global business segments, as well as Motorola's Senior Vice President, Corporate Controller and Chief Accounting Officer. |

| |

| From 1995 to 2000, Mr. Rothman served in multiple leadership finance roles at General Instrument, which developed integrated and interactive broadband access solutions, including as its Vice President and Corporate Controller. |

| | |

| From 1987 through 1995, he was with Deloitte & Touche LLP, a professional services company. |

| |

| Mr. Rothman graduated with a bachelor’s degree in Business from Stockton University (formerly Richard Stockton College) with Distinction and is a Certified Public Accountant in California (inactive). |

| |

| We believe that Mr. Rothman possesses specific attributes that qualify him to serve as a member of the Board, including his executive leadership experience and deep financial expertise in: |

| •Corporate finance, accounting, and treasury; |

| •Restructuring, mergers, and acquisitions; and |

| •Capital markets. |

| |

| | |

| | |

| | |

10

10

| | | | | | | | |

| Ms. Jacoby joined our Board in December 2019. | | |

| |

| Ms. Jacoby was Senior Vice President, Operations of Cisco Systems, Inc., a publicly-traded leader in IT networking, from July 2015 until her retirement in January 2018. | |

•Responsible for driving profitable growth and enabling operational excellence. | |

•Oversaw supply chain, global business services, security and trust, and IT organizations. | |

| |

| In her former role as Cisco’s Chief Information Officer from 2006 to July 2015, she made the Cisco IT organization a strategic business partner, producing significant business value in the form of: | |

•Financial performance; | | Rebecca J. Jacoby Chair, Corporate Governance and Nominating Committee |

•Customer satisfaction and loyalty; | |

•Market share; and | |

•Productivity. | | |

| | Age 60 |

| Since joining Cisco in 1995, Ms. Jacoby held a variety of leadership roles in operations, manufacturing and IT. Prior to joining Cisco, Ms. Jacoby held a range of planning and operations positions with other companies in Silicon Valley. | | |

| |

| Ms. Jacoby has served on several boards of directors, including: | |

| |

•Apptio, Inc., which provides cloud-based technology business management solutions to enterprises, from 2018 until its acquisition by Vista Equity Partners in January of 2019. | |

•S&P Global Inc., a public financial information and analytics company, including the Finance Committee and the Nominating and Corporate Governance Committee, since 2014. | |

•Cloudleaf, Inc., a supply chain software business, as an advisory board member since November 2019. | |

| |

| Ms. Jacoby earned a Bachelor of Science degree in Economics from University of the Pacific and a Master of Business Administration from the Leavey School of Business, Santa Clara University. | |

| |

| We believe Ms. Jacoby's senior management experience, particularly in operations, supply chain management, and global services, brings a valuable perspective to our Board and to the oversight of these critical functions within Quantum. | |

11

11

| | | | | | | | |

| | Ms. White was elected to Quantum’s Board in September 2021. |

| |

| Ms. White has served as Vice President of Enterprise Data and Analytics at NIKE, Inc., a public company that manufactures and sells athletic apparel, since April 2020. |

| |

| Prior to NIKE, from February 2017 to April 2020, Ms. White served as Vice President of Enterprise Data Engineering at Synchrony Financial, a publicly-traded consumer financial services company. |

| |

Emily White Independent Director | | Ms. White previously held multiple positions at General Electric entities, including: |

| •From November 2013 to June 2015, as Data Science Director and Global Commercial IT Director at General Electric Healthcare, a company that manufactures and distributes medical imaging modalities. |

| Age 50 | | •From May 2007 to October 2013, as Global Enterprise Resource Director and Senior Global Business Intelligence Program Manager for General Electric Transportation, a company that manufactures equipment for energy generation industries. |

| | |

| Ms. White’s education includes a: |

| •Bachelor of Science degree in Accounting and Finance from Shengyang Polytechnic University; |

| | •Master of Business Administration degree from Huron University; |

| •Master of Applied Mathematics degree in Computer Science at the University of Central Oklahoma; and |

| •Certificate in Health Economics & Outcomes Research from the University of Washington. |

| |

| We believe Ms. White’s extensive senior management experience, particularly in data science and analytics, brings valuable perspective to our Board and to the oversight of these functions within Quantum. |

| |

| |

| |

| | |

| | |

| | |

12

12

| | | | | | | | |

| Quantum is very pleased to nominate Mr. Neumeyer for election to our Board at our Annual Meeting. He has served as a non-voting Board observer since 2016. | | |

| |

| Mr. Neumeyer is an executive vice president and portfolio manager at Pacific Investment Management Company, LLC (PIMCO), a global investment management firm that provides investment solutions to companies, educational institutions, foundations, and endowments across the world. Since joining PIMCO in January 2010, Mr. Neumeyer has held multiple roles and is currently responsible for identifying, originating, and structuring corporate investments across the capital structure in a variety of industries for various PIMCO-managed investment funds. | |

| |

| Mr. Neumeyer’s previous experience includes: | | Christopher D. Neumeyer Director Nominee |

•Various positions at The Blackstone Group, a leading global investment business from April 2004 to May 2009. | |

•Work in the investment banking division of Credit Suisse First Boston, a global investment bank, from July 2002 to April 2004. | | Age 42 |

| | |

| Mr. Neumeyer earned a Bachelor of Science degree in business from Indiana University and is a CFA® charterholder. | |

| |

| We believe Mr. Neumeyer is qualified to serve on the Board due to his financial expertise. In addition, we expect his experience conveying shareholder interests to boards and management teams will bring valuable shareholder perspectives to our Board oversight and decision-making processes. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

13

13

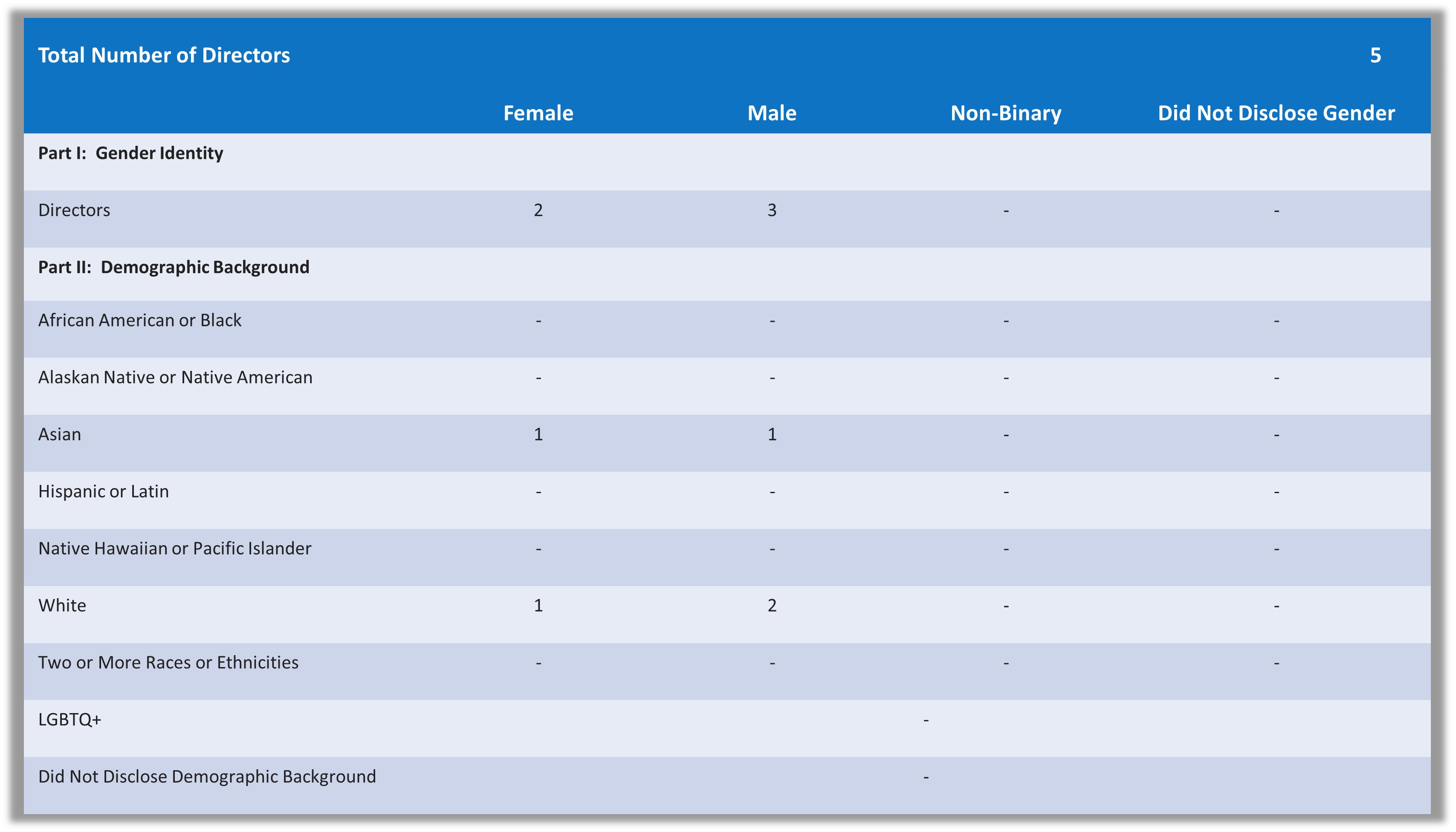

BOARD DIVERSITY MATRIX AS OF JUNE 3, 2022

14

14

BOARD MEETINGS AND INDEPENDENCE

BOARD MEETING ATTENDANCE

The Board met a total of fifteen times in Fiscal 2022. All Board members during Fiscal 2022, including Mr. Fichthorn, attended more than 75% of the Board and Committee meetings for which they were eligible. Each of the then-nominated directors attended our 2021 annual meeting.

DIRECTOR INDEPENDENCE

The Board has determined that all current members other than Mr. Lerner are independent directors as defined under the rules of the Nasdaq Stock Market LLC (Nasdaq). In addition to the listing standards and the SEC’s independence requirements, we are subject to additional independence criteria as defined in the April 2019 Stipulation of Settlement we executed upon settlement of the In re Quantum Corp. Derivative Litigation shareholder derivative action.

This additional independence criteria requires that independent directors:

•Have not received, during the current calendar year or any of the three immediately preceding calendar years, direct or indirect remuneration (other than de minimis remuneration less than $5,000) resulting from service as our significant supplier or customer, or as an advisor, consultant, or legal counsel to Quantum or a member of our senior management team.

•Are not employed by a private or public company at which any of our executive officers serves as a director.

We also exceed Nasdaq listing requirements by requiring approximately 75% of our Board to be comprised of independent directors.

Our independent directors meet in executive session, without employee directors, at least as often as each regularly scheduled quarterly Board meeting. The independent directors are empowered to request reporting from any employee during the executive session, including audit and compliance personnel.

15

15

BOARD COMMITTEES AND LEADERSHIP STRUCTURE

BOARD COMMITTEES

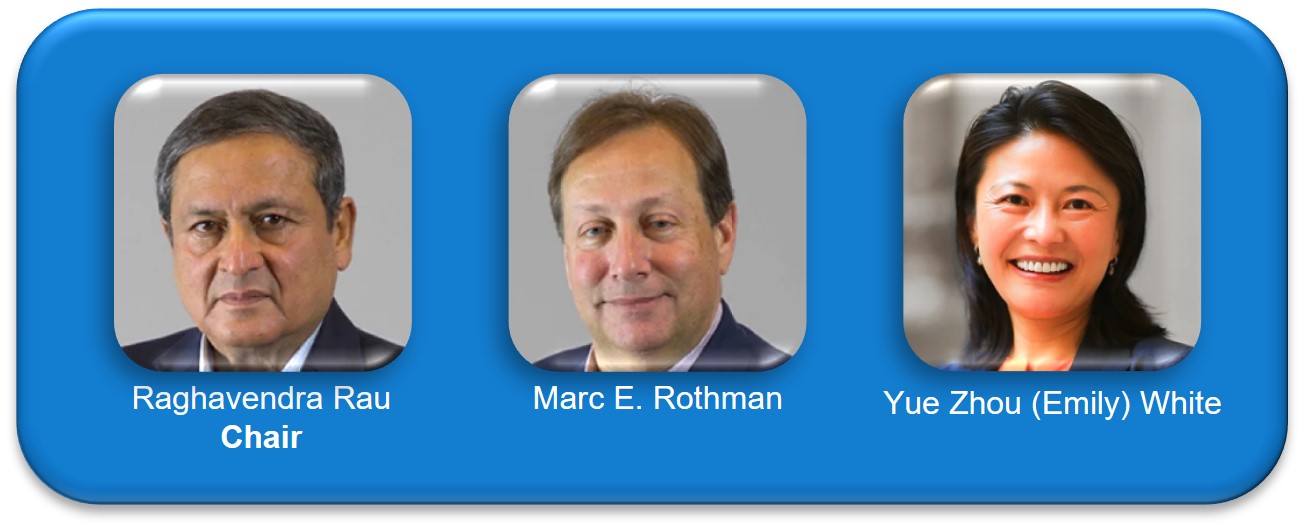

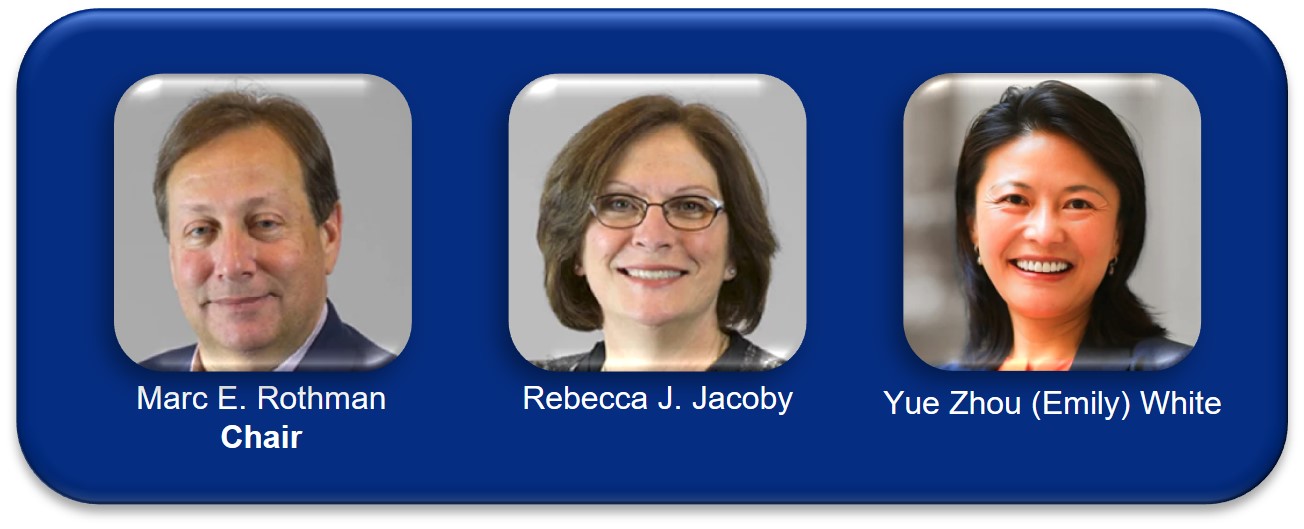

Current members of the Board’s Fiscal 2022 standing committees are:

| | | | | | | | |

|

| Mr. Rau also served on the Audit Committee in Fiscal 2022, until the appointment of Ms. White in September 2021. | Mr. Fichthorn and Ms. Jacoby also served on the Leadership and Compensation Committee during Fiscal 2022, until the appointment of Ms. White in September 2021. | Mr. Fichthorn also served on the Corporate Governance and Nominating Committee in Fiscal 2022 until the last annual meeting in September 2021. |

16

16

Each of our standing committees is governed by a written charter, available on the Corporate Governance page of our website. Copies of the charters may be requested from Quantum’s Investor Relations team at 224 Airport Parkway, Suite 550, San Jose, California, 95110.

LEADERSHIP STRUCTURE

Quantum’s Board is committed to strong, independent Board leadership and oversight of management’s performance. The Board believes it should determine whether the CEO should also serve as Board Chair. This determination is made, from time to time, in the Board’s business judgement after considering relevant factors, including Quantum’s needs and our shareholders’ best interests. Following a thorough evaluation, the Board has determined that Mr. Lerner should serve as both Chairman and CEO. The Board believes this structure promotes aligning strategic development and execution, effectively implementing strategic initiatives, and exercising accountability for the Company’s performance.

The Chair focuses on effectively leading and managing the Board. The Board may also appoint a Lead Independent Director to help provide robust, independent Board leadership. The roles and responsibilities of the Chair and Lead Independent Director are described in more detail in our Corporate Governance Principles.

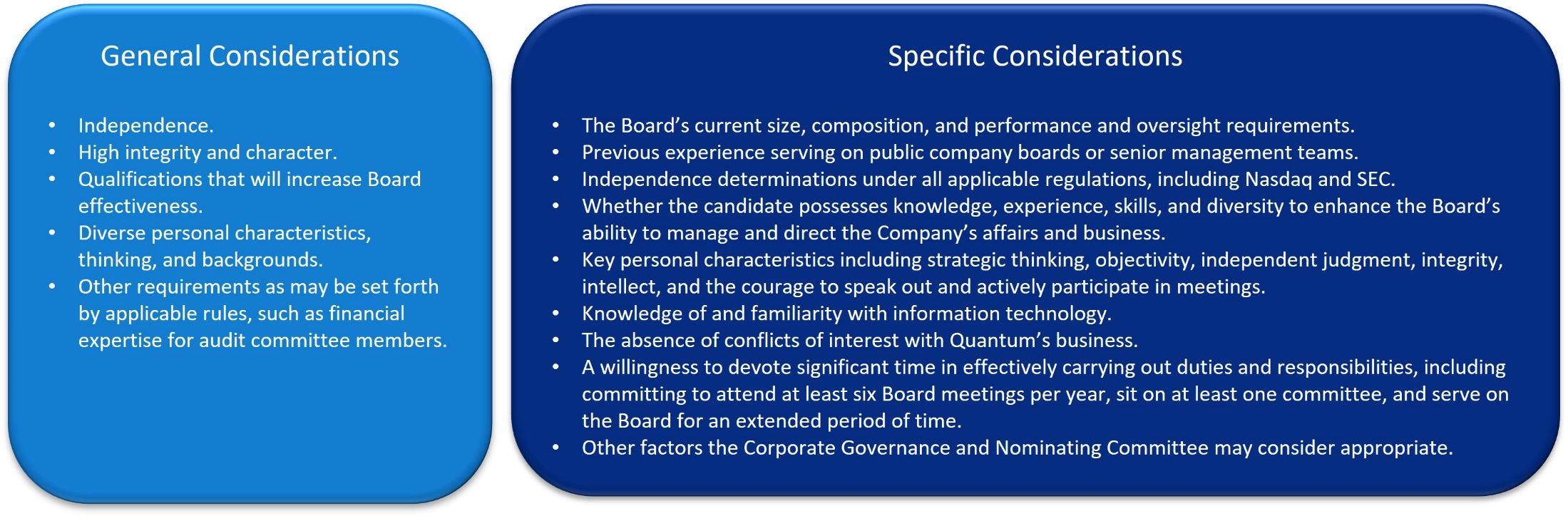

DIRECTOR CANDIDATE EVALUATION

The Corporate Governance and Nominating Committee is responsible for identifying, evaluating, recruiting, and recommending qualified director candidates to our Board. The Board nominates directors for election at each annual shareholder meeting and appoints new Board members at other times determined to be appropriate. Directors are not permitted to serve on the Board for more than ten years.

17

17

IDENTIFYING AND EVALUATING DIRECTOR NOMINEES

The Corporate Governance and Nominating Committee uses the following procedures to identify and evaluate potential director nominees:

•Regularly reviewing the Board’s size, composition, and performance as a whole, in addition to individual member performance and qualifications.

•Determining whether to exercise its authority to retain or terminate any third-party search firm used to identify director candidates, including approving the fees paid.

•Reviewing qualifications of any properly identified, recommended, or nominated candidate. The committee’s review, in its discretion, may consider solely the information provided to it or include discussions with third parties familiar with the candidate, candidate interviews, or other actions the committee deems proper.

•Evaluating each candidate according to the General and Specific Considerations outlined below.

•Recommending a slate of director nominees to be approved by the Board.

•Endeavoring to promptly notify director candidates of its decision regarding whether to nominate a candidate for Board election.

The Board has not historically maintained a formal diversity policy for its members. However, in evaluating the Board’s composition, the Board and Corporate Governance and Nominating Committee consider diversity of:

18

18

The Board believes that directors with a diverse range of perspectives, skills, and experiences enable it to more effectively oversee all aspects of Quantum’s business. The Board will consider underrepresented populations when seeking candidates for future nomination to the Board, and will ensure each nominee candidate pool includes at least one woman and one member of an underrepresented group. The Board believes that approach will ensure that groups underrepresented on the Board will be considered as candidates with appropriate consistency.

SHAREHOLDER RECOMMENDATIONS

The Corporate Governance and Nominating Committee’s policy is to consider shareholder recommendations for Board candidates. A shareholder must submit a written recommendation for a Board candidate to the attention of:

Submissions must include:

•Candidate name and contact information;

•Detailed biographical data and relevant qualifications;

•Descriptions of any relationships between the candidate and Quantum;

•The shareholder’s statement in support of the candidate;

•Candidate references;

•The candidate’s written indication of his or her willingness to serve if elected; and

•Other nominee information that our Bylaws and applicable SEC regulations require to be disclosed.

SHAREHOLDER NOMINEES

Shareholders may also nominate director candidates for election to the Board. A shareholder that desires to nominate a candidate directly for election must meet the deadlines and other requirements set forth in our Bylaws and SEC rules and regulations. See Shareholder Proposals for Next Year's 2023 Annual Meeting for more information. Our Bylaws are available on the Corporate Governance page of our website and as an exhibit to our annual report on Form 10-K.

The Corporate Governance and Nominating Committee may require any prospective nominee to furnish other information it reasonably desires to determine the nominee’s independence or eligibility to serve as a director.

19

19

Corporate Governance

ETHICS AND COMPLIANCE

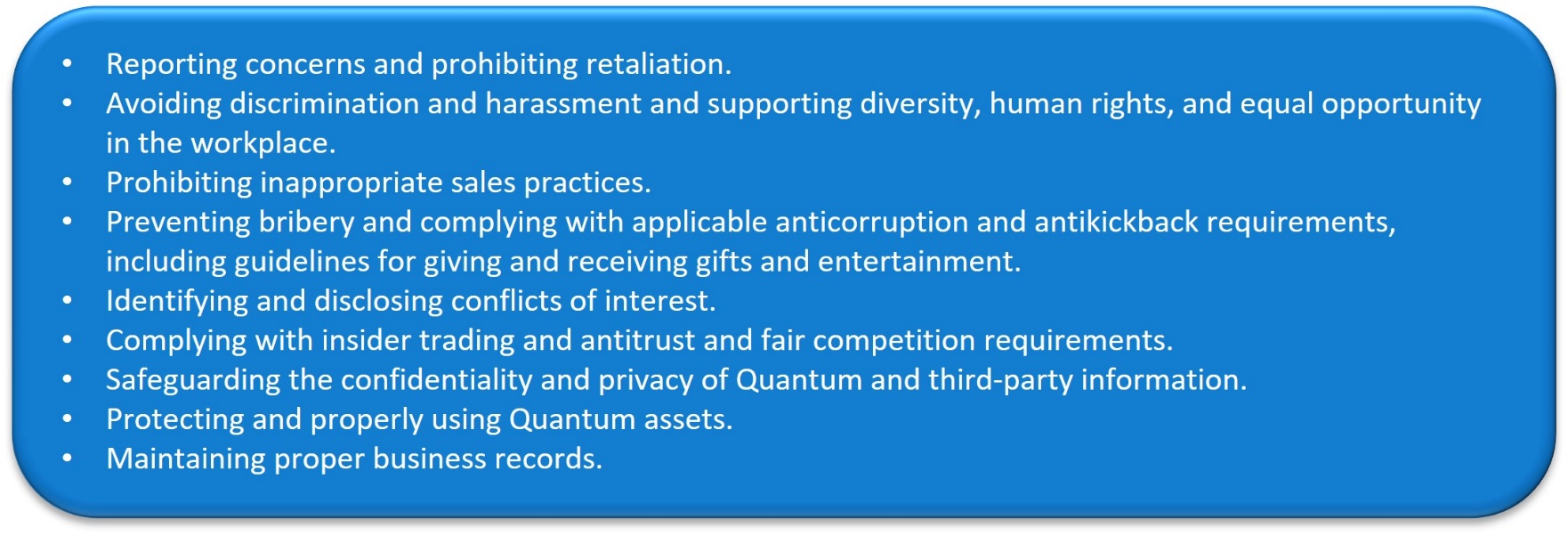

We constantly strive to provide an unparalleled customer experience, built on an unparalleled commitment to doing the right thing. Our code of conduct is meant to help us successfully navigate both new opportunities and challenges by enabling effective business processes, relationships, and solutions.

The code applies to anyone conducting business on behalf of Quantum or our subsidiaries, including all directors, officers, and employees, and defines expectations in each of the following key areas:

20

20

The Board most recently revised the code in August 2021. It includes policies regarding general compliance with laws, rules, and regulations, including:

In addition, we maintain an internal ethics committee comprised of leaders from our finance, internal audit, human resources, and legal teams. The ethics committee advises and supports the Chief Legal and Compliance Officer regarding Quantum’s compliance program and provides appropriate assistance in reviewing, investigating, and responding to reported concerns. We have also implemented a whistleblower policy and encourage reporting of ethics and compliance concerns, including by providing a confidential and anonymous third-party reporting hotline.

Concerns that may relate to material accounting or auditing matters are communicated promptly to our Audit Committee.

Waivers of the code's applicability to a Quantum director or executive officer may only be granted by our Board or its committees and must be timely disclosed as required by applicable law.

The code of conduct is available on the Corporate Governance page of our website. Copies of the code may be requested from Quantum’s Investor Relations team at 224 Airport Parkway, Suite 550, San Jose, California, 95110.

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE OVERSIGHT

We all share one world, interconnected by not just the data we manage, but by the water we drink, the air we breathe, the natural resources we share, and the people we impact. Quantum believes it is our responsibility to positively impact that world through our products, our programs, and our people. We also believe that making responsible decisions in environmental, social, and governance (ESG) matters drives long-term sustainable success. The Corporate Governance and Nominating Committee oversees our ESG strategy, initiatives and policies, including communicating with employees, investors, and other stakeholders.

The Board is dedicated to, and invested in, Quantum's human capital management strategy, which includes the following elements:

21

21

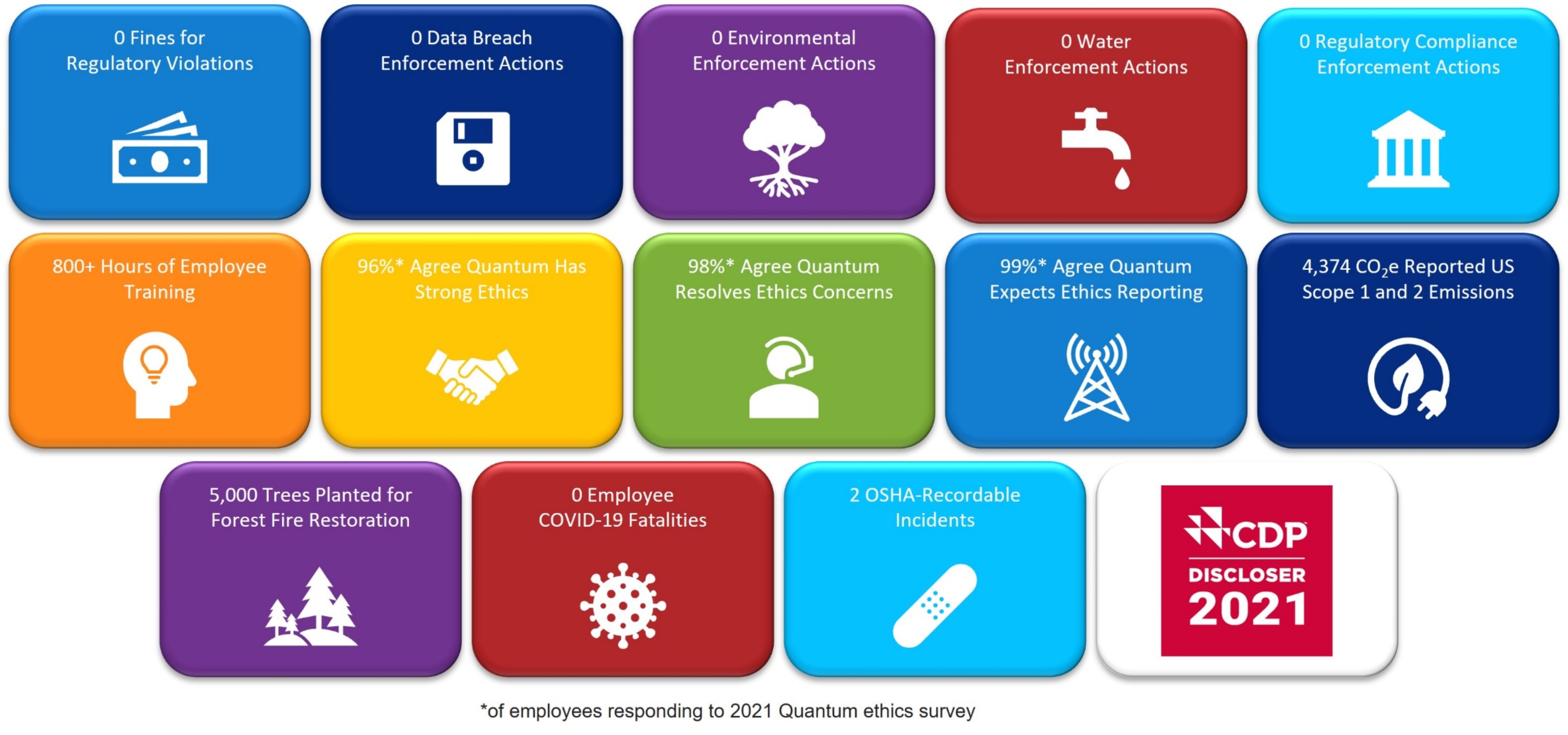

Some of our key ESG achievements in Fiscal 2022 included:

22

22

BOARD ROLE IN RISK OVERSIGHT

Quantum faces a wide spectrum of risks, including financial, strategic, operational, and regulatory exposures. The Audit Committee is primarily responsible for overseeing the Company’s management of those risks and providing appropriate updates to the Board. The Audit Committee guides our risk identification, assessment, and management policies and procedures, including discussions of our major risk exposures, associated risk mitigation activities, and risk management practices implemented throughout the Company. The Audit Committee also actively monitors the Company's product and information technology cybersecurity risks and mitigation procedures.

The Board’s other committees also oversee risks associated with their respective areas of responsibility, including:

•The Leadership and Compensation Committee’s review of compensation practices risks.

•The Corporate Governance and Nominating Committee’s oversight of compliance risks.

The committees update the Board regarding their risk oversight practices through regular reporting and discussion.

While the Board is responsible for risk oversight, risk management accountability lies with our management team. Quantum’s enterprise risk management practices and formal risk assessments are led by our internal audit and legal teams, which periodically report status to the Audit Committee or Board, where appropriate. Our functional teams apply other appropriate risk assessment and mitigation techniques, with the involved management representatives updating the Board as needed.

BOARD EVALUATION

Our Board, committees, and individual directors perform annual self-evaluations in accordance with our corporate governance principles. The evaluations ensure our Board is strategic, productive, and effective, and contributes to long-term shareholder value. As part of the evaluation process, the Board and selected executive staff members hold ongoing discussions regarding Board and committee composition, effectiveness, and decision-making, as well as individual director performance.

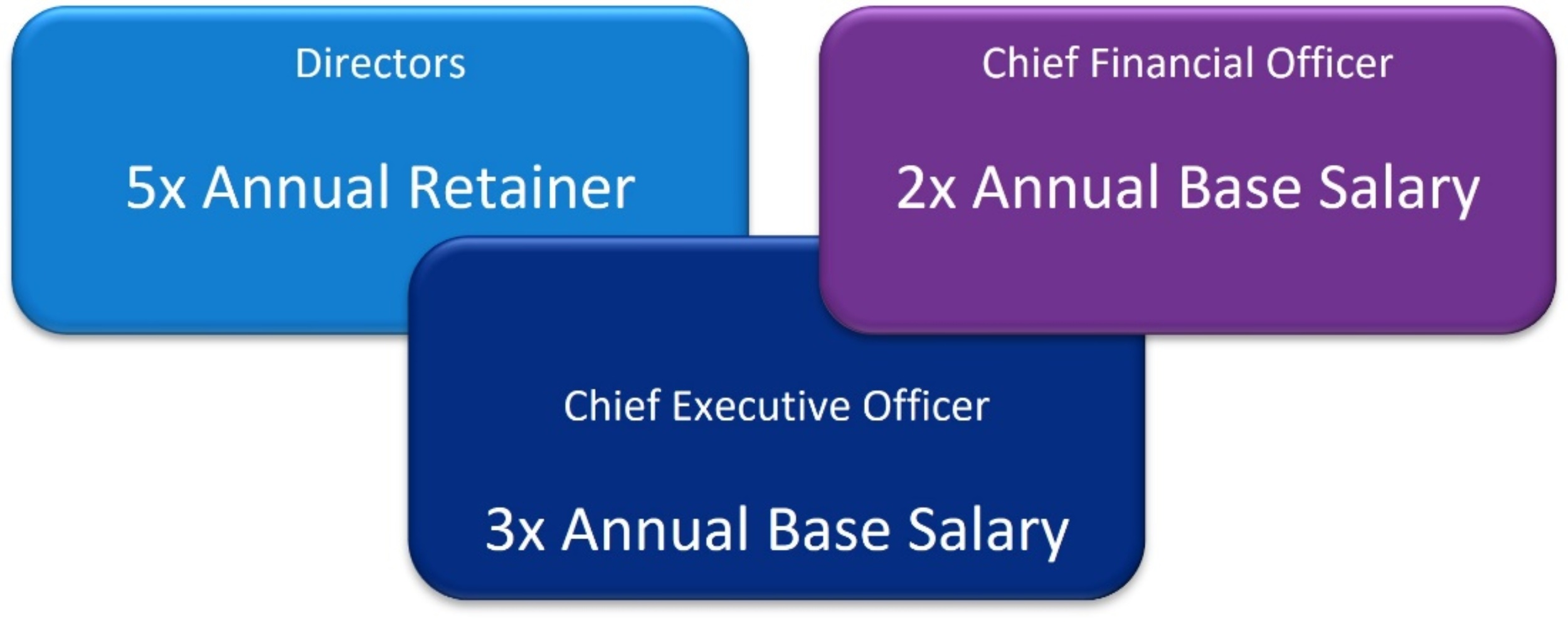

STOCK OWNERSHIP GUIDELINES

We annually review our stock ownership guidelines for our CEO, directors, and other officers. We compare our guidelines with those of peer group companies and consider ISS ownership governance best practices. Our Board believes that best aligning with shareholder interests requires our directors to hold Common Stock amounts on the larger end of our peer group and the ISS guidelines.

In Fiscal 2022, our Board agreed to continue the following stock ownership guidelines, which were increased in 2020:

23

23

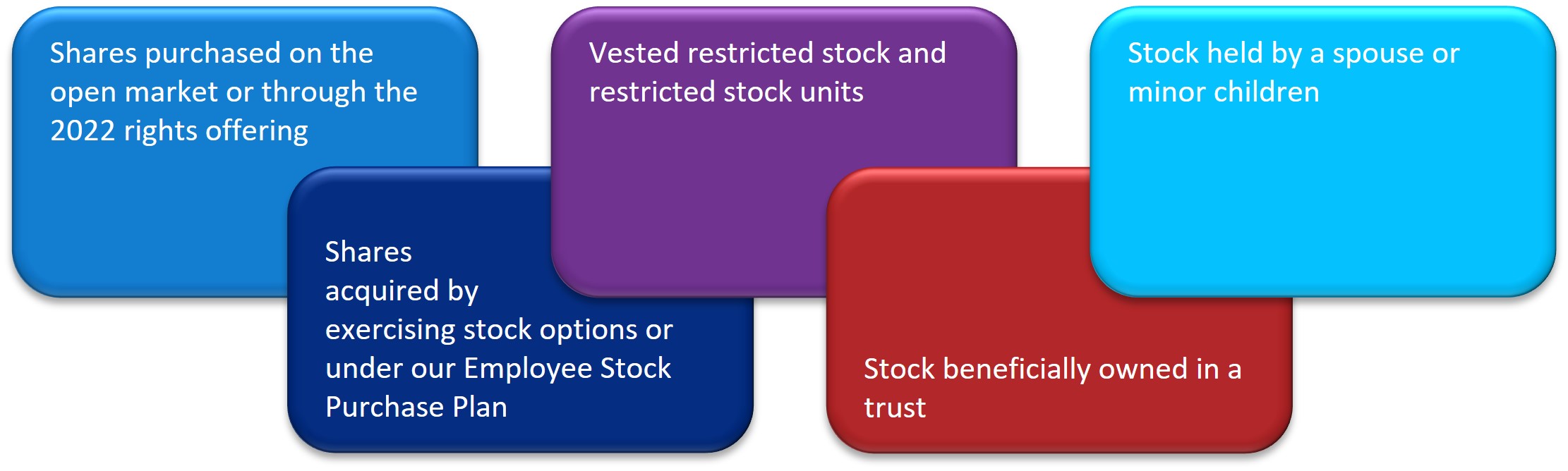

Eligible stock ownership includes the following elements. Vested and unvested outstanding stock options, unvested restricted stock and restricted stock units, and unearned performance stock and performance stock units are not counted in share ownership under our policy.

Our CEO’s, Chief Financial Officer’s, and each director’s compliance with our stock ownership guidelines is due on the later of five years from:

•The date they first became subject to our stock ownership guidelines; or

•February 4, 2020.

If the dollar value of required holdings increases due to base salary or director cash compensation increases, stock ownership must also be increased within five years. We measure compliance with these guidelines at the end of each fiscal year. At the end of Fiscal 2022, all directors were on track to comply with their stock ownership guidelines.

NON-EMPLOYEE DIRECTOR COMPENSATION

The Board and Leadership and Compensation Committee (Committee) determine the amount and form of non-employee director compensation. Management provides information and recommendations regarding competitive market practices, target compensation levels, and compensation program design. The Committee also retains an independent compensation consultant to provide analysis and advice regarding:

•The market competitiveness of our compensation program, including current compensation trends and developments;

•Specific compensation recommendations; and

•Benchmarking against peer group and technology industry practices.

While the Committee carefully considers the information and recommendations it receives, the Board maintains ultimate authority for decisions relating to non-employee director compensation. Mr. Lerner is the only Quantum employee on the Board and receives no additional compensation for his Board service.

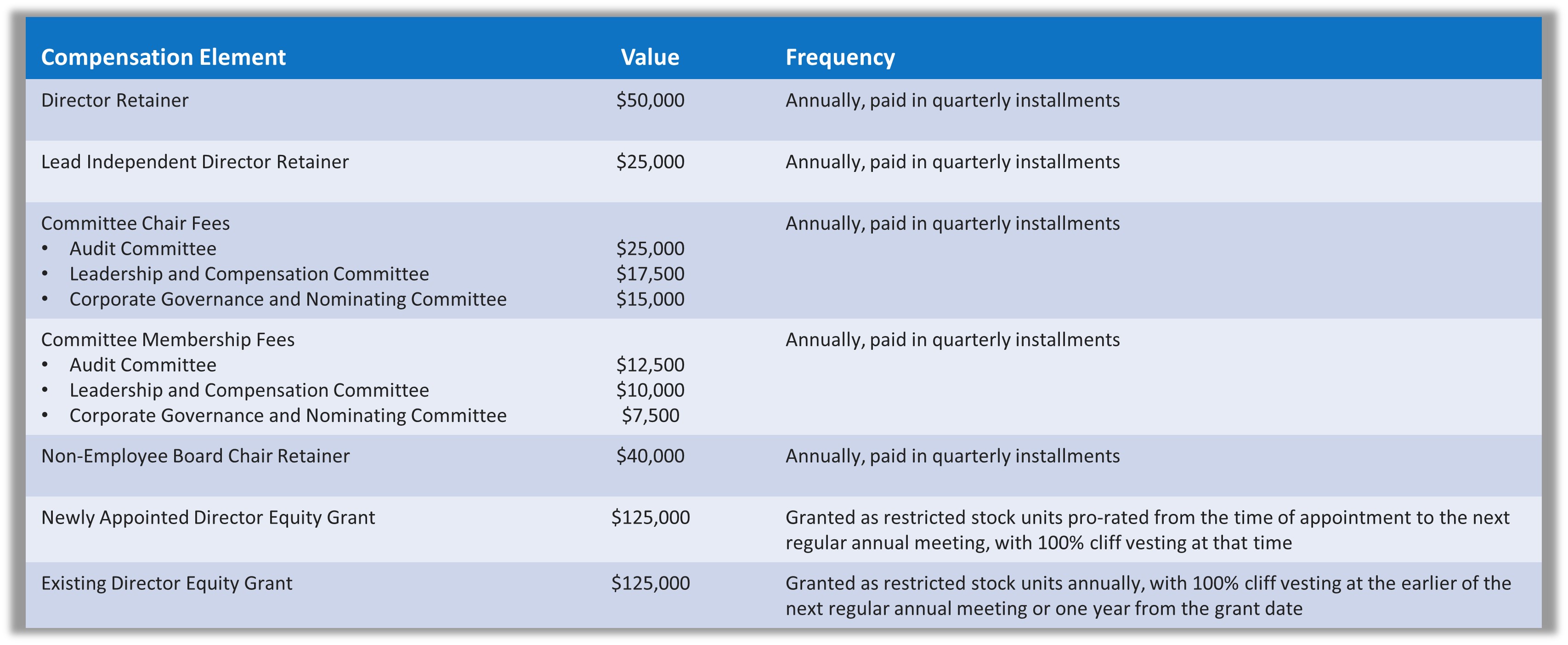

The Committee generally conducts a comprehensive biannual review of the Company’s compensation program, most recently in Fiscal 2022. Quantum engaged Compensia to complete an independent review, which compared the Company’s compensation program, design, and practices to those of our peer group. Our current non-employee director compensation program elements include:

24

24

We have executed change of control agreements with each of our non-employee directors. The agreements provide for automatic acceleration of equity-based compensation award vesting if the director’s association with the Company ends within twelve months following a change of control, other than for termination due to death or disability.

We allow our non-employee directors to defer some or all of their cash fees, which defers federal and state income taxes. Plan participants direct the deemed investment of their deferred accounts among a preselected group of investment funds which excludes shares of Quantum Common Stock. The deemed investment accounts mirror the investment options available under Quantum’s 401(k) Savings Plan. Plan participants’ deferred accounts are credited with interest based on their selected deemed investments. During Fiscal 2022, only Ms. White elected to participate in the deferred compensation plan, beginning in December 2021.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Mr. Rau, Mr. Rothman, and Ms. White comprise the Committee. None is currently, nor has been at any time since Quantum was formed, an officer or employee of the Company or any of its subsidiaries. Likewise, no Committee member has entered into any transactions in which they will have a direct or indirect material interest adverse to the Company. No interlocking relationships exist between any Board or Committee members and any other company’s board or compensation committee members, nor have they previously existed.

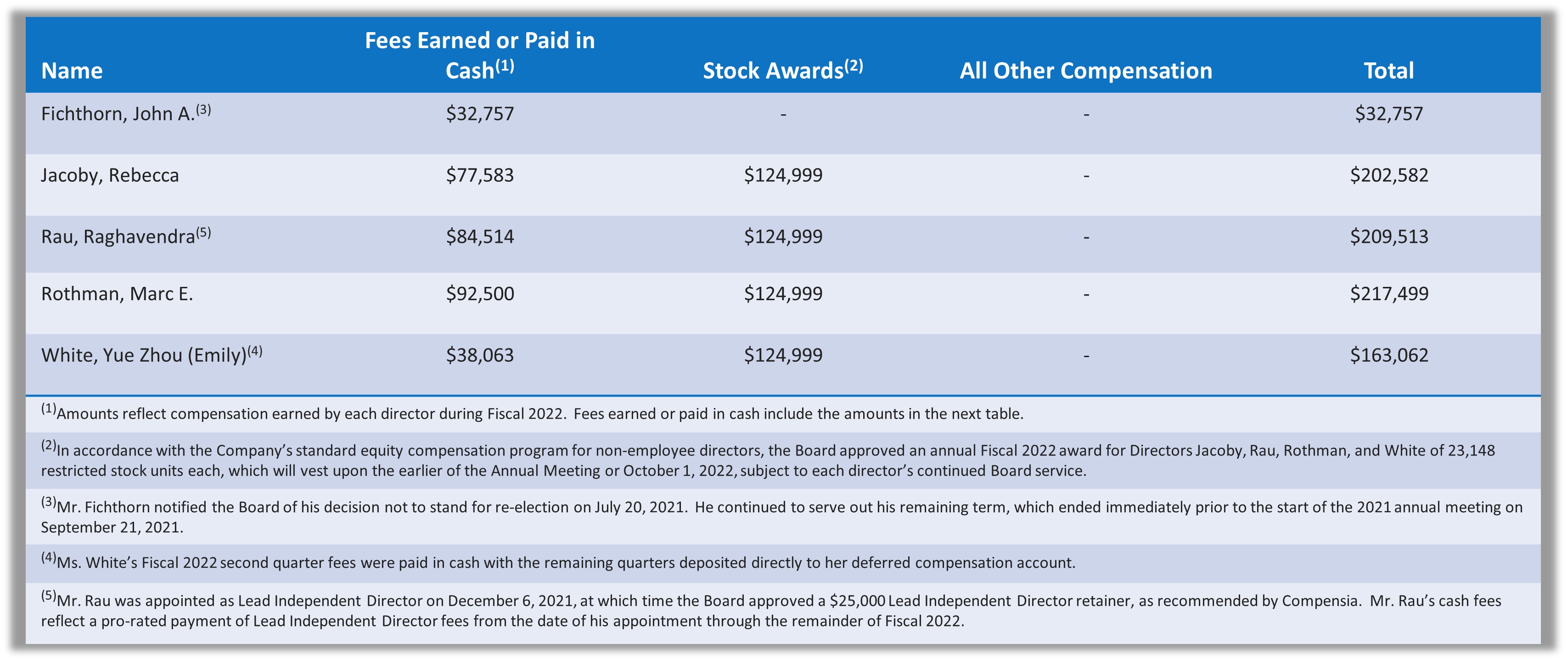

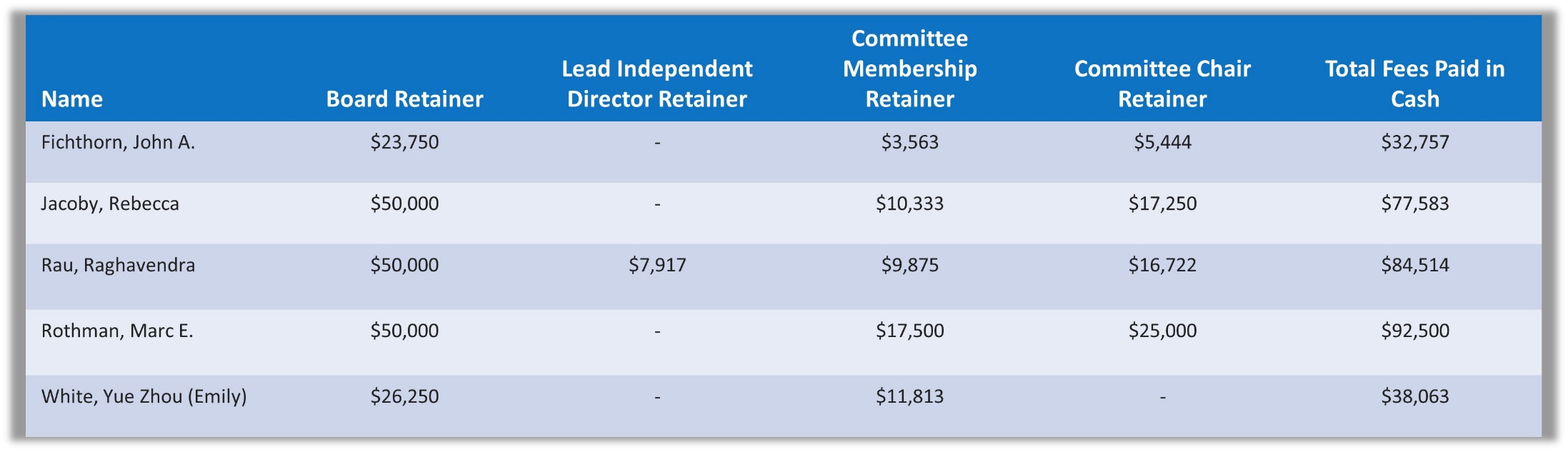

FISCAL 2022 NON-EMPLOYEE DIRECTOR COMPENSATION TABLES

The following tables detail the Fiscal 2022 annual cash retainers, applicable committee service fees, and applicable Chair retainers paid to our directors. Quantum does not pay meeting fees to our Board members.

25

25

26

26

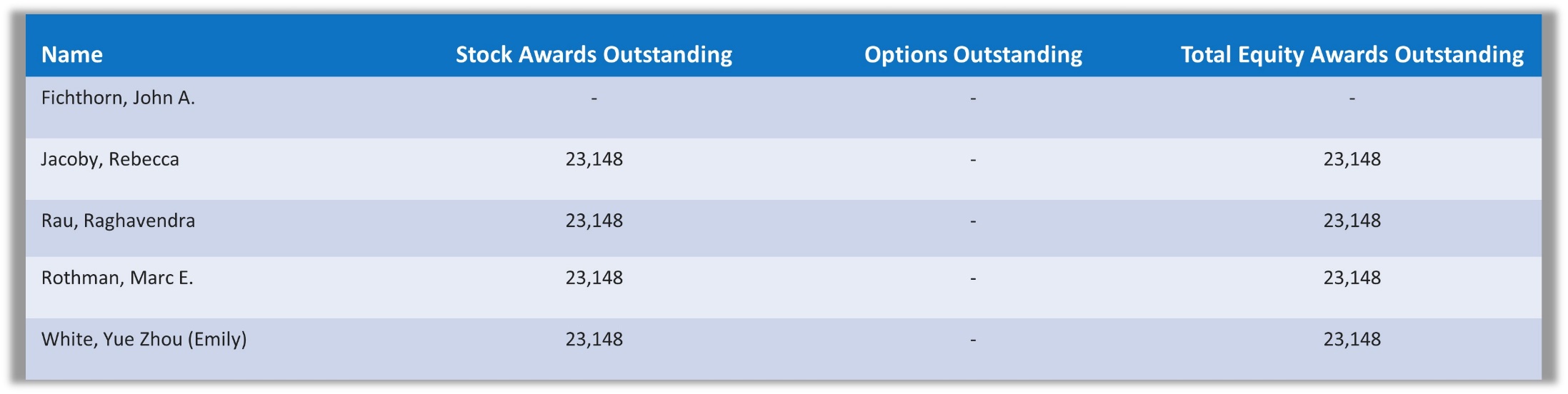

The non-employee directors held the following outstanding and unvested equity awards as of March 31, 2022:

27

27

Proposals

28

28

29

29

As of the date of this proxy statement, Quantum is not aware of:

•Any other matter properly raised to be voted on at the Annual Meeting; or

•Any shareholder intending to present a proposal from the floor at the Annual Meeting.

The Annual Meeting proxy solicited by the Board grants the proxy holders discretionary authority to vote on any matters other than Proposals 1 through 4 that may be properly brought before the Annual Meeting.

PROPOSAL 2 BACKGROUND

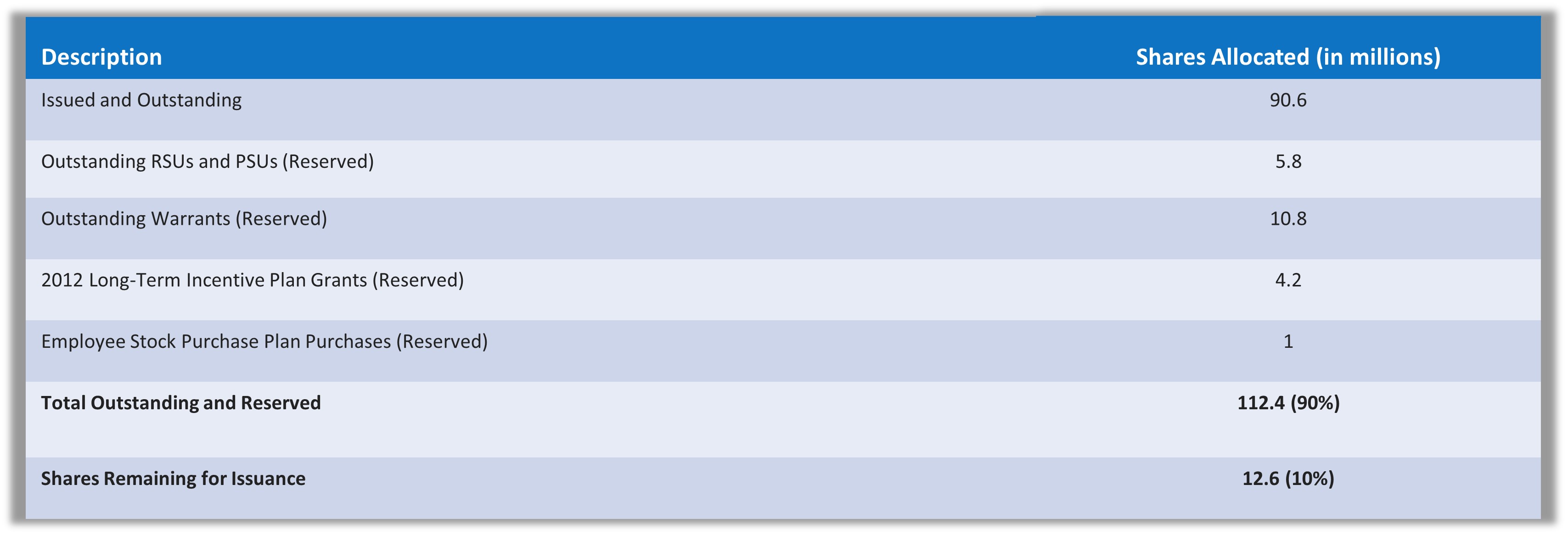

Quantum currently maintains 125 million authorized shares of common stock, each with a par value of $0.01 per share (Common Stock). As of June 10, 2022, our authorized shares of Common Stock were allocated as follows:

The Board reviewed the allocation and considered that:

•Only 10% of authorized shares remain available for issuance.

•Increasing the authorized share base would provide additional flexibility for potential future general corporate capital needs.

•Independent governance experts typically recommend approval of share authorization increases up to 100%.

After determining it was in Quantum’s and our shareholders’ best interests, on June 14, 2022, the Board approved amending our Amended and Restated Certificate of Incorporation (the Restated Certificate) to increase our authorized shares of Common Stock from 125 million to 225 million, subject to shareholder approval. The substantial form of the proposed Restated Certificate amendment is provided in Appendix A.

We are not currently contemplating any specific usage of these additional shares.

All other terms of the Restated Certificate, which is available on the Corporate Governance page of our website, remain unchanged.

30

30

Compensation Discussion and Analysis

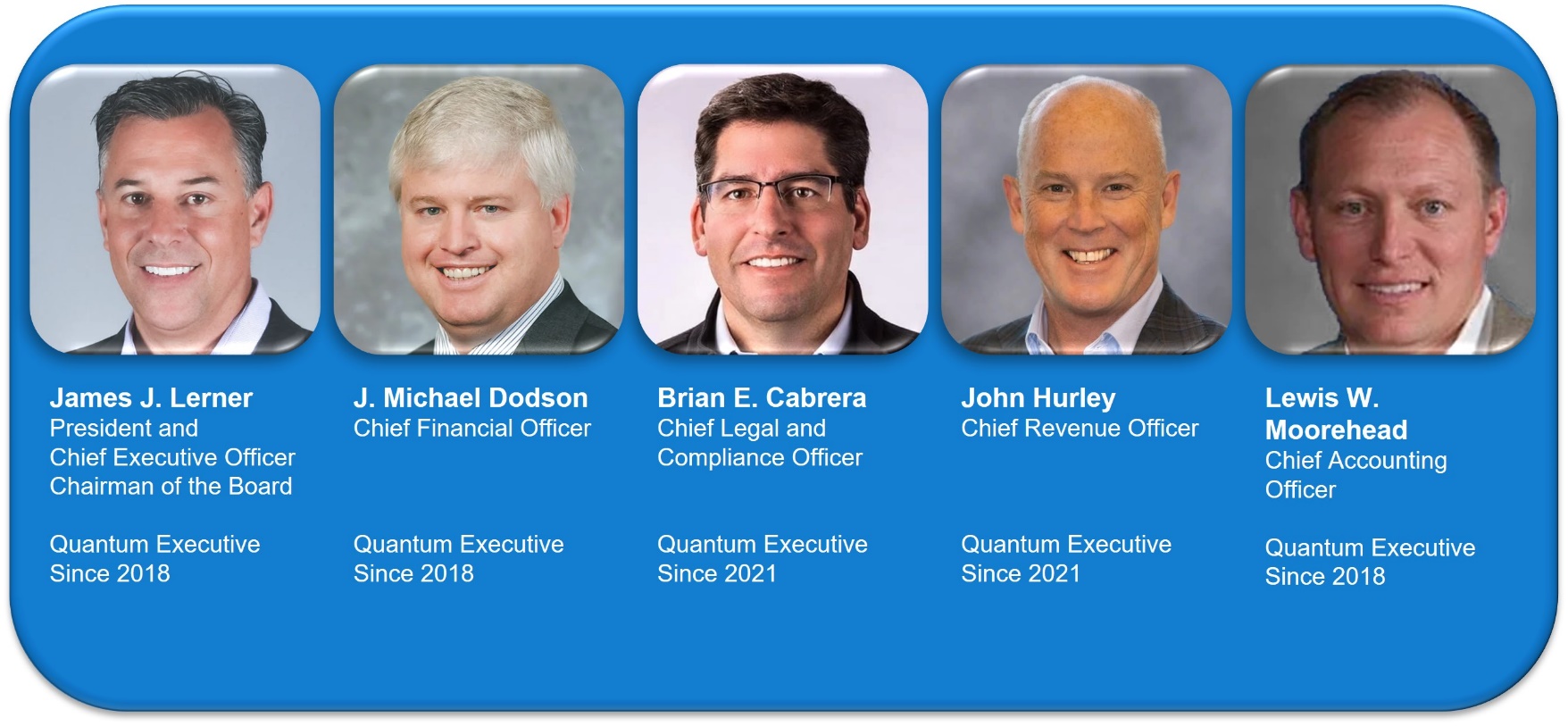

This Compensation Discussion and Analysis (CD&A) describes Quantum’s overall philosophy and criteria for determining our executive officer compensation practices. The CD&A disclosures relate to Fiscal 2022 for our principal executive officer, principal financial officer, and three other most highly compensated executive officers.

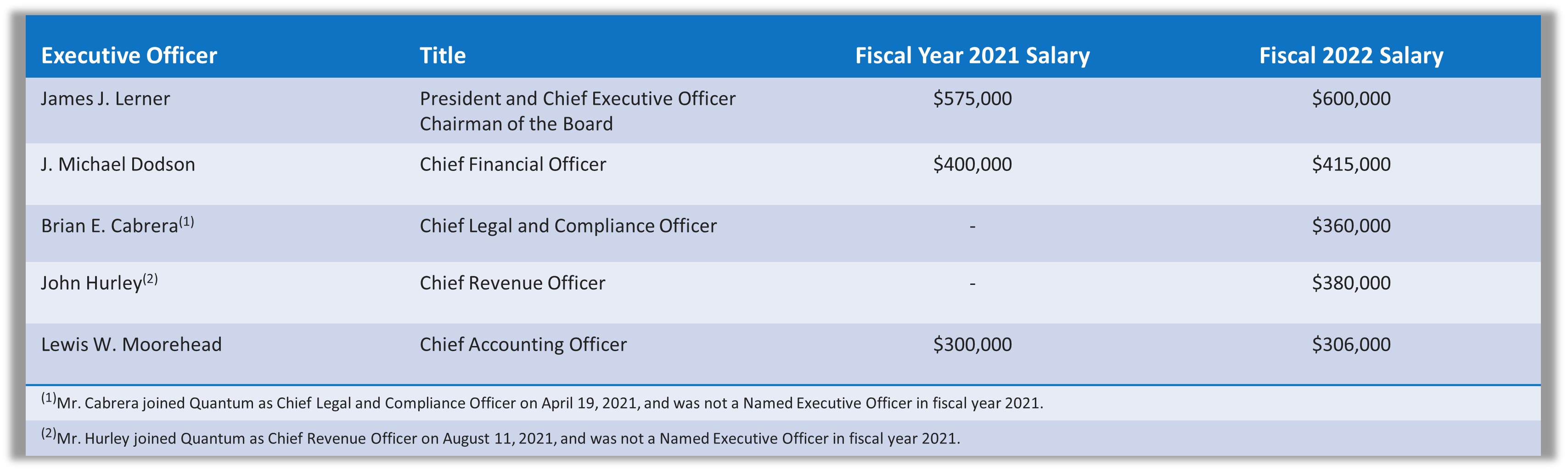

Our named executive officers for Fiscal 2022 were:

FISCAL 2022 EXECUTIVE COMPENSATION HIGHLIGHTS

In Fiscal 2022, the Board and management team focused on executing the Company’s vision to be leader in end-to-end solutions for video and unstructured data. We continued implementing our transformation and growth strategy, accelerating the pace of innovation through strategic acquisitions and shifting more significantly to a recurring software and services licensing model. We also paid special attention to attracting and retaining top talent with the experience required to accomplish our goals and drive Quantum’s performance. As Fiscal 2022 unfolded, our performance was impacted by ongoing pandemic effects, supply chain constraints, and inflationary movement that pressured our financial results, including our revenue, profitability, and stock price. These challenges resulted in our executive officers not earning incentive compensation under our Fiscal 2022 executive compensation program and a corresponding 15% to 23% year over year reduction in total direct compensation for our executive officers, including our CEO.

31

31

Our major Fiscal 2022 influences were:

We were also challenged by supply chain constraints that persisted throughout Fiscal 2022, reducing our ability to ship products, recognize revenue, and generate profitability and cash. All U.S.-based employees, including our executive officers, were furloughed for one week during Fiscal 2022, reducing pay accordingly.

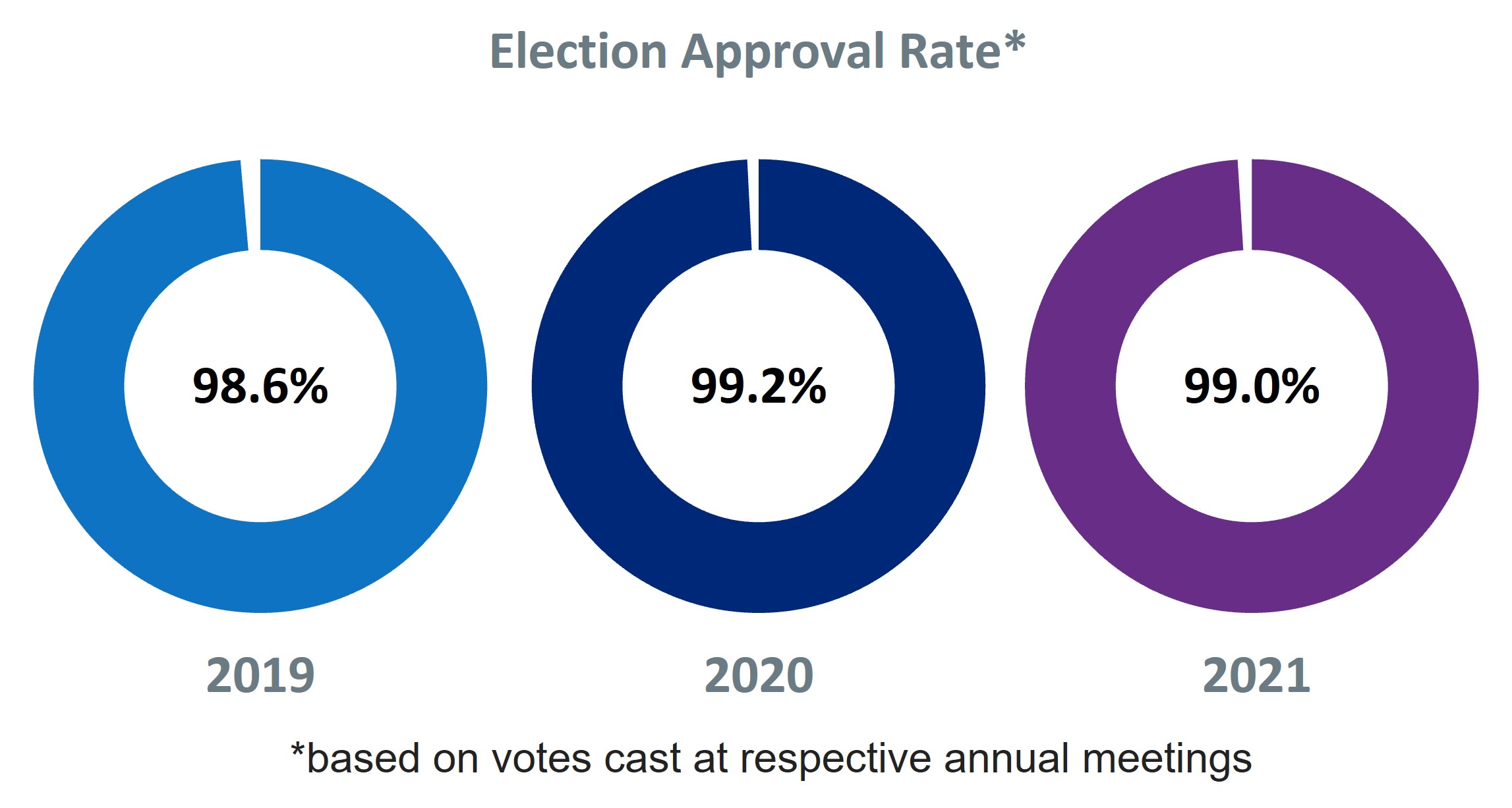

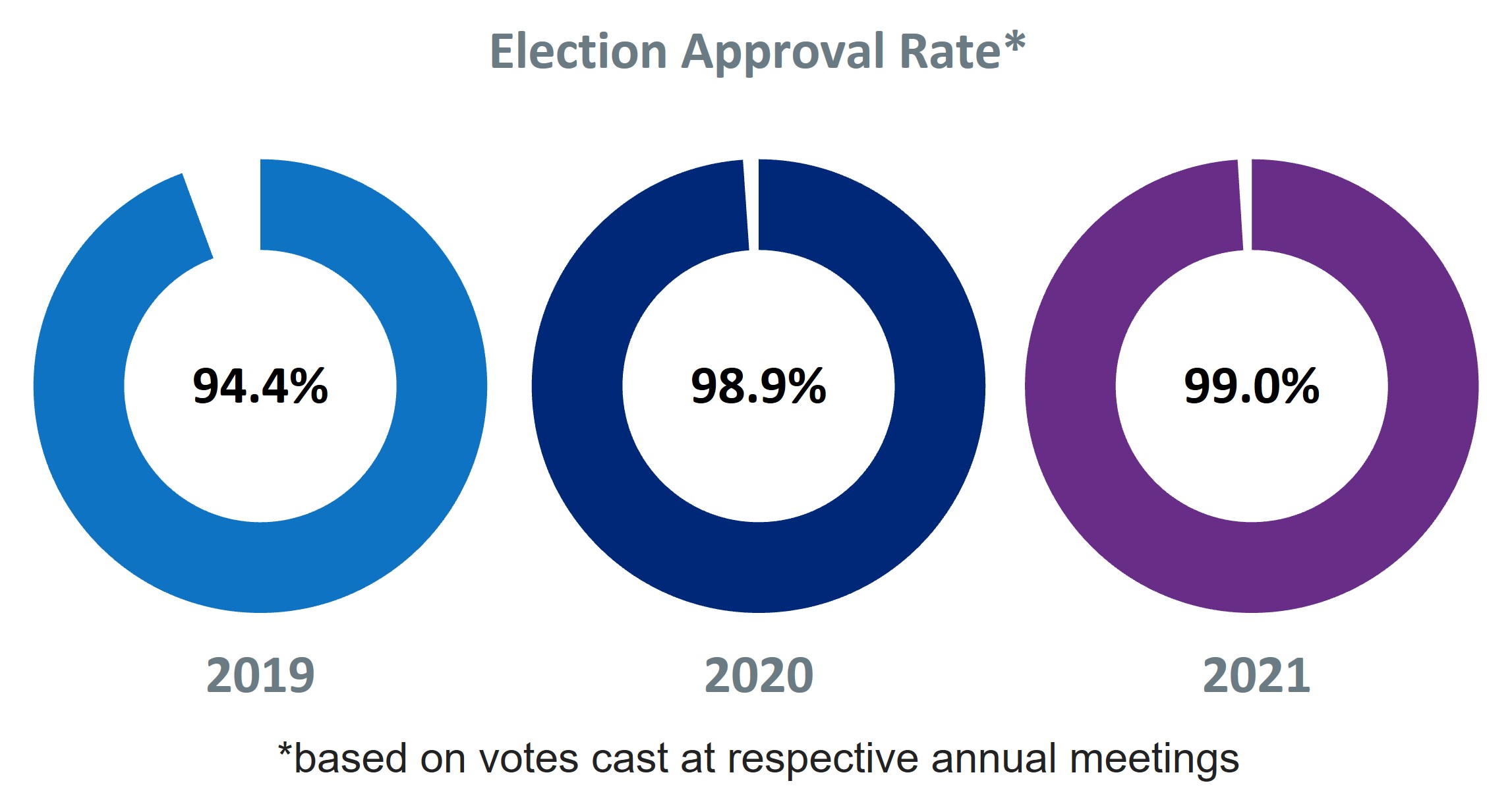

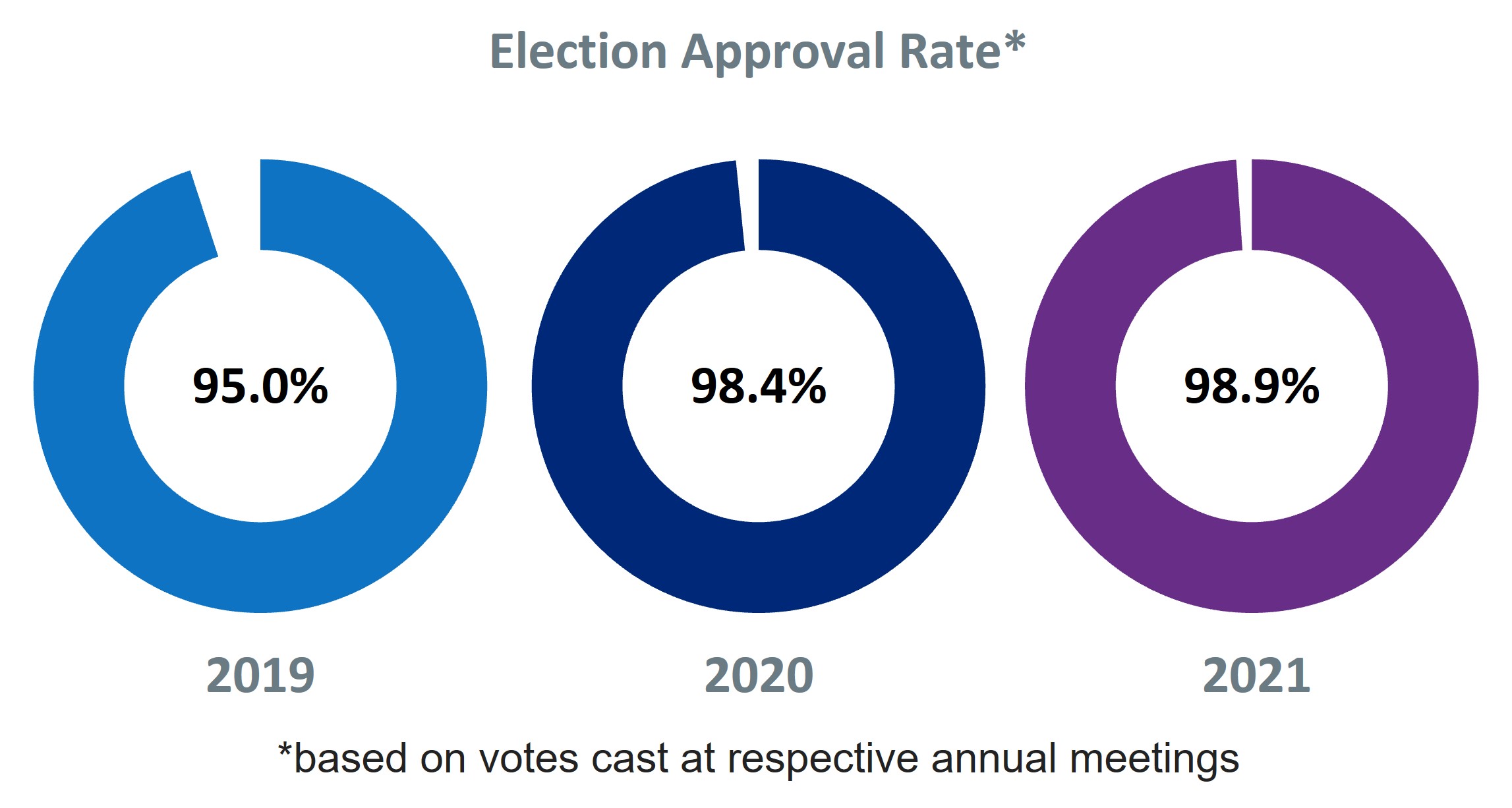

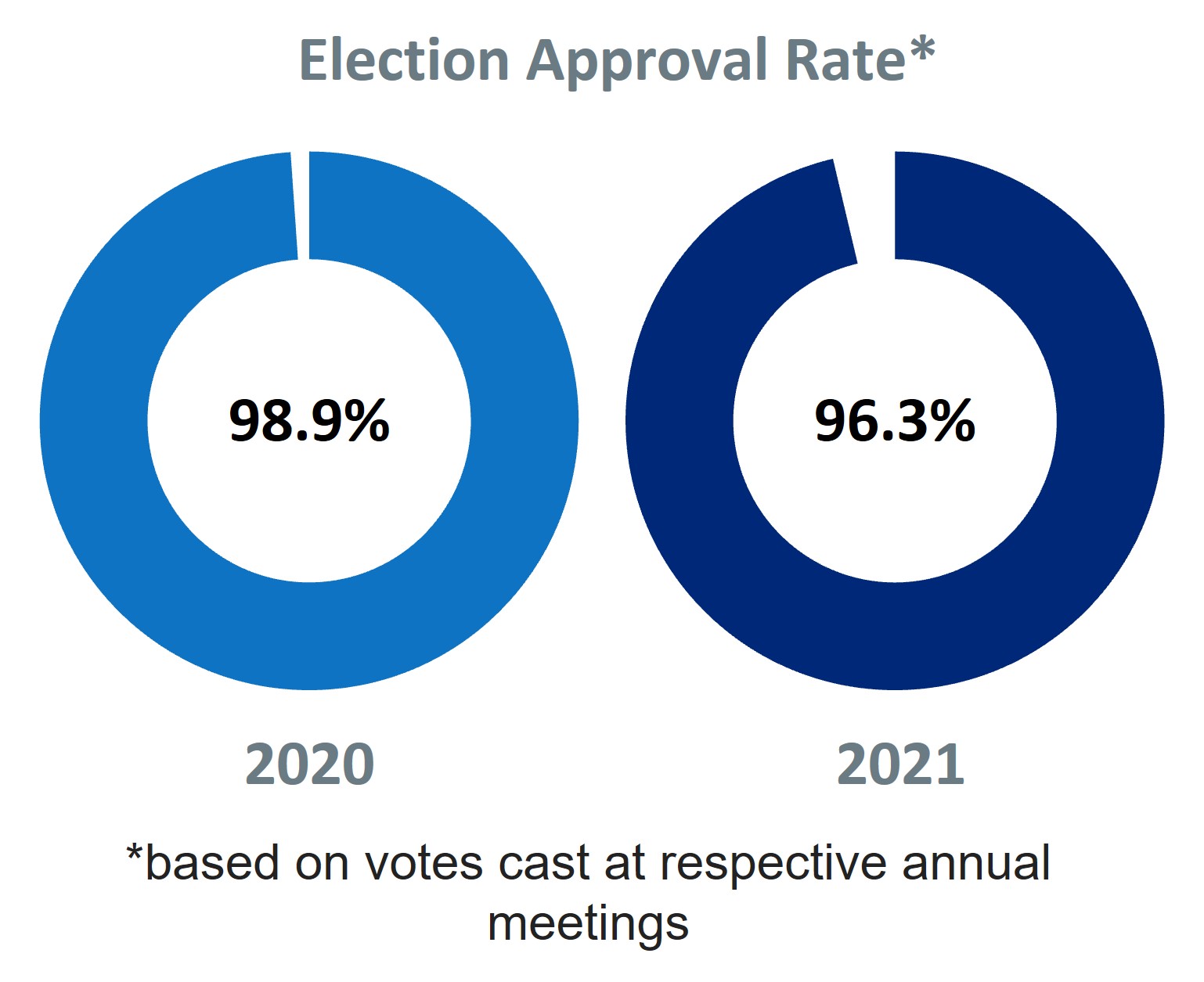

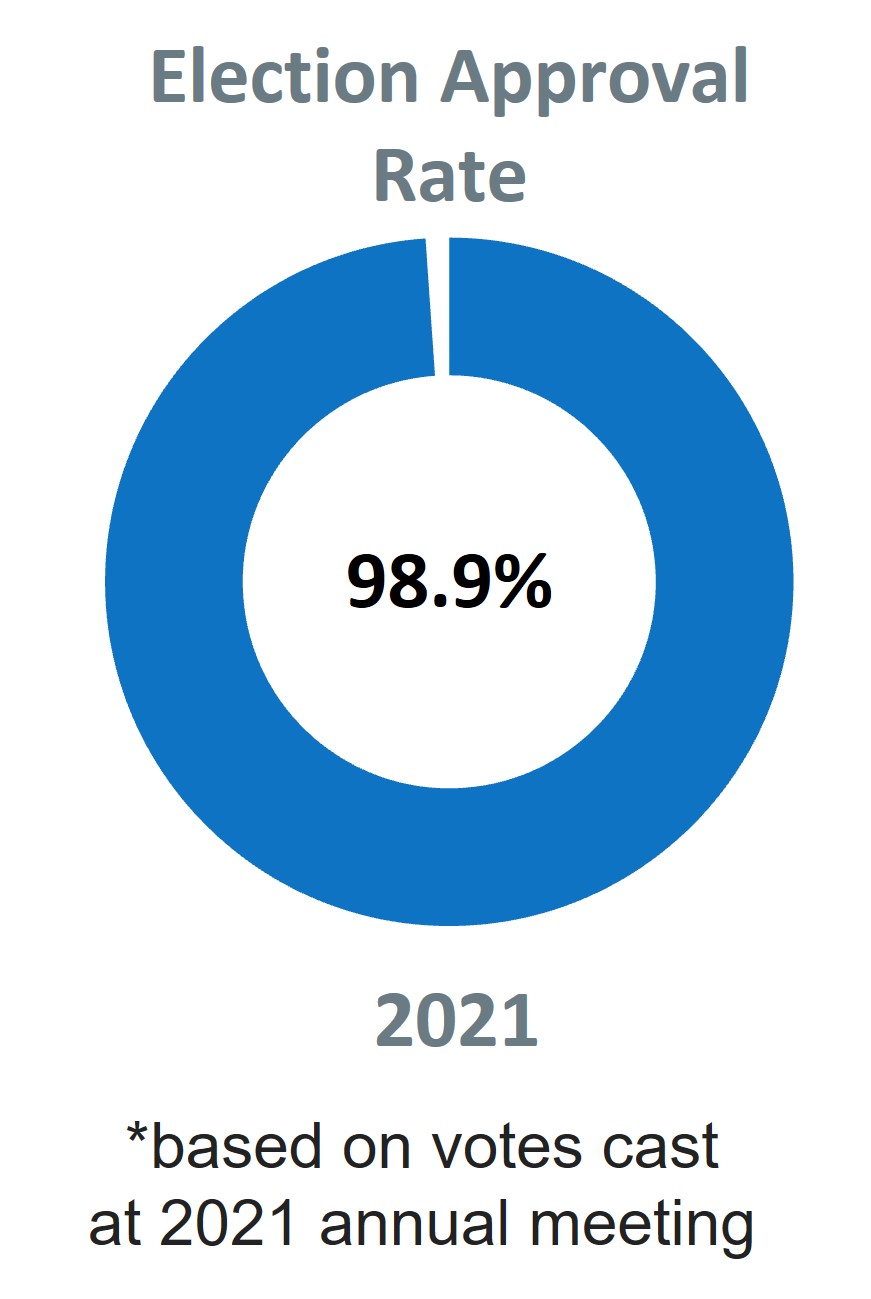

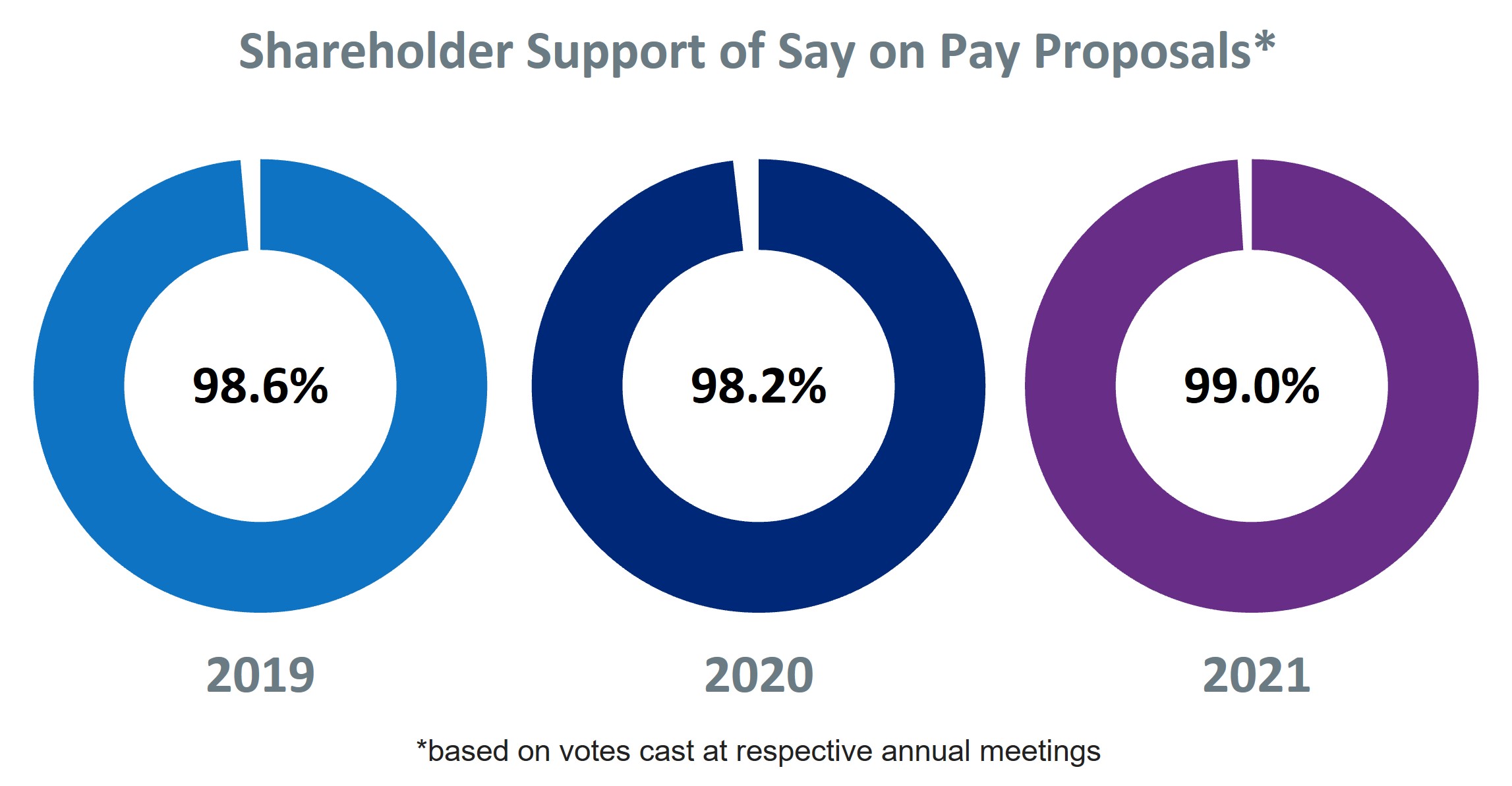

LISTENING TO OUR SHAREHOLDERS

The Committee is committed to listening to our shareholders’ views. We regularly meet with our shareholders in an effort to be transparent about our business direction and ensure we are aligned with and supported by them. Quantum held a non-binding advisory vote on our named executive officer compensation at our 2021 annual shareholder meeting, with a substantial majority of our shareholders voting for our annual executive compensation programs. The vote outcome was consistent with voting results in the two prior years.

32

32

EXECUTIVE COMPENSATION PHILOSOPHY

The Committee annually reviews Quantum’s executive compensation philosophy. We focus on maintaining a competitive pay-for performance total compensation program that rewards executives for delivering results and long-term shareholder value. Our compensation philosophy is founded on four guiding principles designed to:

Our compensation philosophy also:

•Promotes achievement of Quantum’s short- and long-term strategic objectives established by the Board and the Company’s senior management team.

•Provides a strong link between pay and performance, while motivating and rewarding employees for significant contributions to Quantum’s success.

•Aligns the interests of Quantum’s employees with our shareholders’ and the Company’s success.

•Considers relevant economic and market factors.

•Maintains equitable and defensible compensation programs that incorporate best-practice internal and external controls.

33

33

COMPETITIVE POSITIONING

Market competitiveness is an important feature of our executive compensation program and helps motivate and retain our executive officers. In assessing competitiveness, we compare individual elements including base salary, target annual incentive opportunity, annual equity awards, and total aggregate compensation for each executive officer, to those of executive officers holding similar positions or comparable levels of responsibility in our Peer Group and other similarly sized technology companies.

The Company uses applicable compensation data from our Peer Group as well as the Radford Global Compensation Database of technology companies with annual revenue less than $1B.

PEER GROUP

Quantum annually evaluates its competitive peer group to identify companies similar in financial scope, size, and industry (Peer Group). Peer Group selection criteria include revenue, market capitalization, industry, and companies with which we compete in recruiting new employee talent. We also consider shareholder perspective by including companies with similar business structures, end markets, and competitors that align with our business. The Committee then approves the Peer Group and uses it to guide executive compensation decisions for the next fiscal year, following compensation assessments, performance evaluations, and potential pay gap resolutions. However, the Peer Group is not the only determinant for executive compensation decisions. Other factors that also influence our compensation practices include:

•Company and individual performance;

•Compensation program affordability; and

•Market conditions.

Based on input from Compensia, our independent compensation consultant, the Committee continued to use the fiscal year 2021 peer group for initial Fiscal 2022 compensation decisions. However, during Fiscal 2022, Compensia recommended that the Committee approve a modified peer group that more accurately captured our current market position. The Committee approved the updated Fiscal 2022 Peer Group shown below at that time and will use it for fiscal year 2023 compensation decisions.

34

34

COMPENSATION ELEMENTS

Quantum provides a mix of compensation elements that emphasizes annual cash and long-term equity incentives, in a manner that is consistent with our

compensation philosophy and objectives. The primary elements of our executive compensation program consist of:

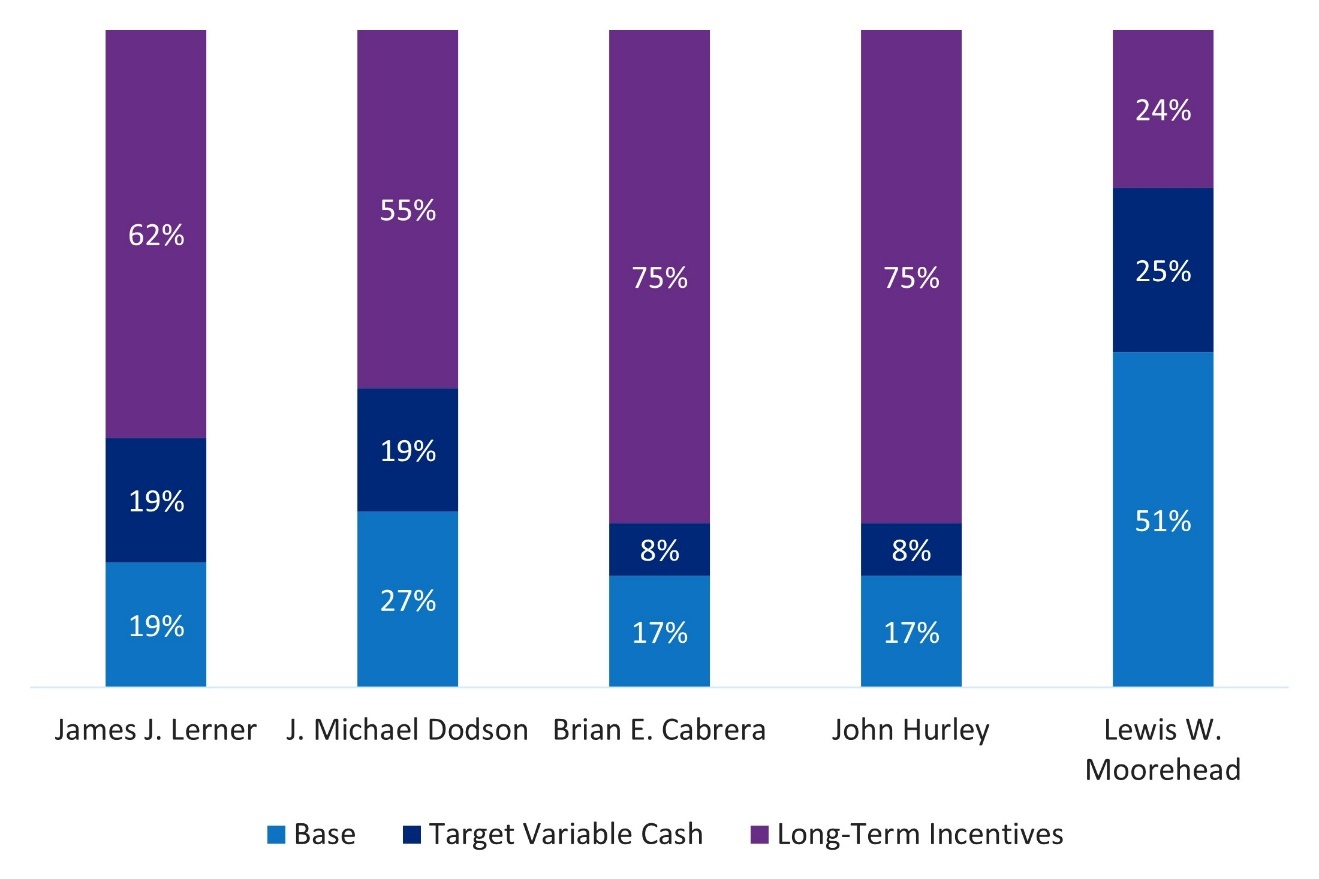

FISCAL 2022 PAY MIX

As part of our employment agreements, we offer our named executive officers a total direct compensation package that includes a mix of both fixed and variable compensation. The chart below shows the target Fiscal 2022 compensation mix for our CEO and other named executive officers.

35

35

FISCAL 2022 ANNUAL BASE SALARY

Our executive officers receive a moderate base salary in comparison to their total target direct compensation package and our Peer Group. The Committee annually reviews our named executive officers’ base salaries with Compensia.

In the second quarter of Fiscal 2022, the Committee reviewed the competitiveness of Mr. Lerner’s compensation against the Peer Group and considered his prior year performance. Mr. Lerner continued to lead Quantum through post-pandemic challenges, including external supply chain constraints, which resulted in financial pressures to the Company’s revenue and profitability. He also identified multiple acquisition opportunities to help position Quantum for growth and success. Mr. Lerner’s total compensation continues to be highly leveraged on performance-based compensation. The Committee determined that a small increase to Mr. Lerner’s base compensation was appropriate given his contributions, and necessary to remain competitive to the market.

The Committee also reviewed Mr. Dodson's and Mr. Moorehead's base compensation and determined that increases to their base salaries were appropriate to remain market competitive. Neither Mr. Dodson’s nor Mr. Moorehead’s cash compensation had been adjusted since they joined Quantum in 2018, even after their actions in stabilizing the Company's financials following the 2018 SEC investigation.

Messrs. Lerner, Dodson, and Moorehead were also included in the Company's one-week furlough of all U.S.-based employees in March 2022, and did not receive their full base compensation for the year. The furlough was driven by supply chain constraints throughout Fiscal 2022, which put significant stress on Quantum’s revenue and liquidity position.

Named executive officer annual base salaries in Fiscal 2022 were:

FISCAL 2022 QUANTUM INCENTIVE PLAN

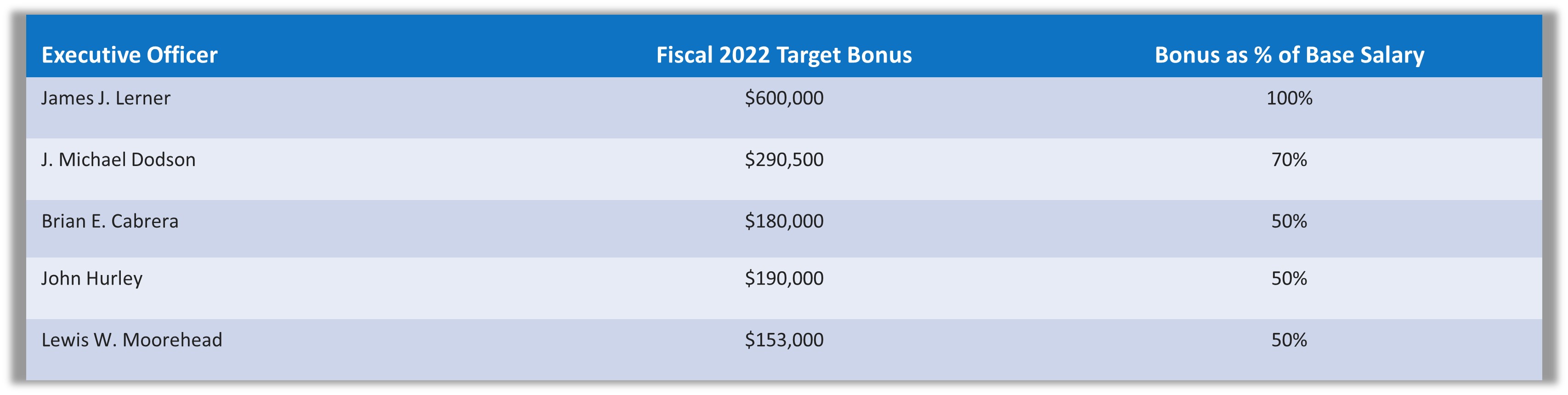

The Quantum Incentive Plan (QIP) is the Company’s short-term incentive bonus program, structured to provide competitive compensation to our executive officers for achieving predetermined corporate and individual performance goals. Each year, the Committee approves financial performance metrics that include threshold, target, and maximum levels of performance that serve as the bonus structure for the year, and must be achieved to fund the plan. The Committee also ensures the plan aligns with our pay-for-performance philosophy.

Each executive officer has an annual bonus target expressed as a percentage of his or her base salary and linked to both Company and individual performance. All of our executive officers participate in the QIP.

36

36

The Committee reviews the target bonus percentages as part of its annual total executive compensation market assessment. The Committee, consulting with Compensia, considers Peer Group pay levels combined with other market data to identify potential pay gaps. As a result of that analysis, Mr. Lerner identified that Mr. Dodson’s target bonus percentage was lagging the market and had not been adjusted since he joined the Company in 2018. Upon Mr. Lerner’s recommendation, the Committee approved an increase in Mr. Dodson’s annual bonus target from 50% to 70% to more closely align with our Peer Group.

The annual target cash incentives for each of our named executive officers were:

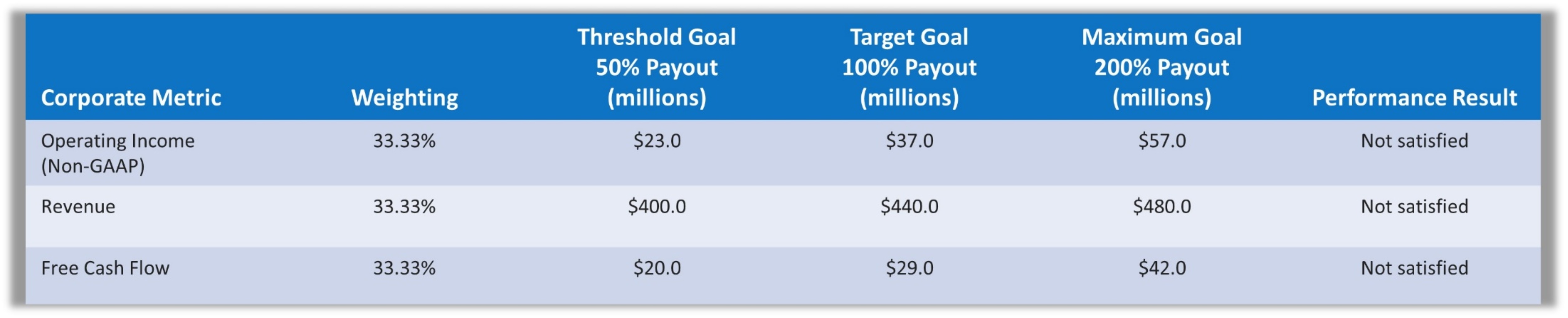

FISCAL 2022 QIP PERFORMANCE METRICS

The following table includes the financial performance metrics approved by the Committee at the start of Fiscal 2022. At the time the goals were approved, executive management and the Committee believed each of these targets were achievable and supported Quantum’s growth strategy. Consistent with our historical approach, the QIP performance metrics incorporated challenging financial targets that require consistent high performance before any payout is earned.

37

37

Throughout Fiscal 2022, supply chain constraints made securing key components a challenge and pressured our ability to recognize revenue and profitability. As a result, Quantum did not meet the threshold performance criteria on any of the financial metrics and no bonuses were earned. Specifically, in Fiscal 2022, we experienced net losses of $32.3 million, recognized $372.8 million in revenue, and consumed $27.6 million in cash.

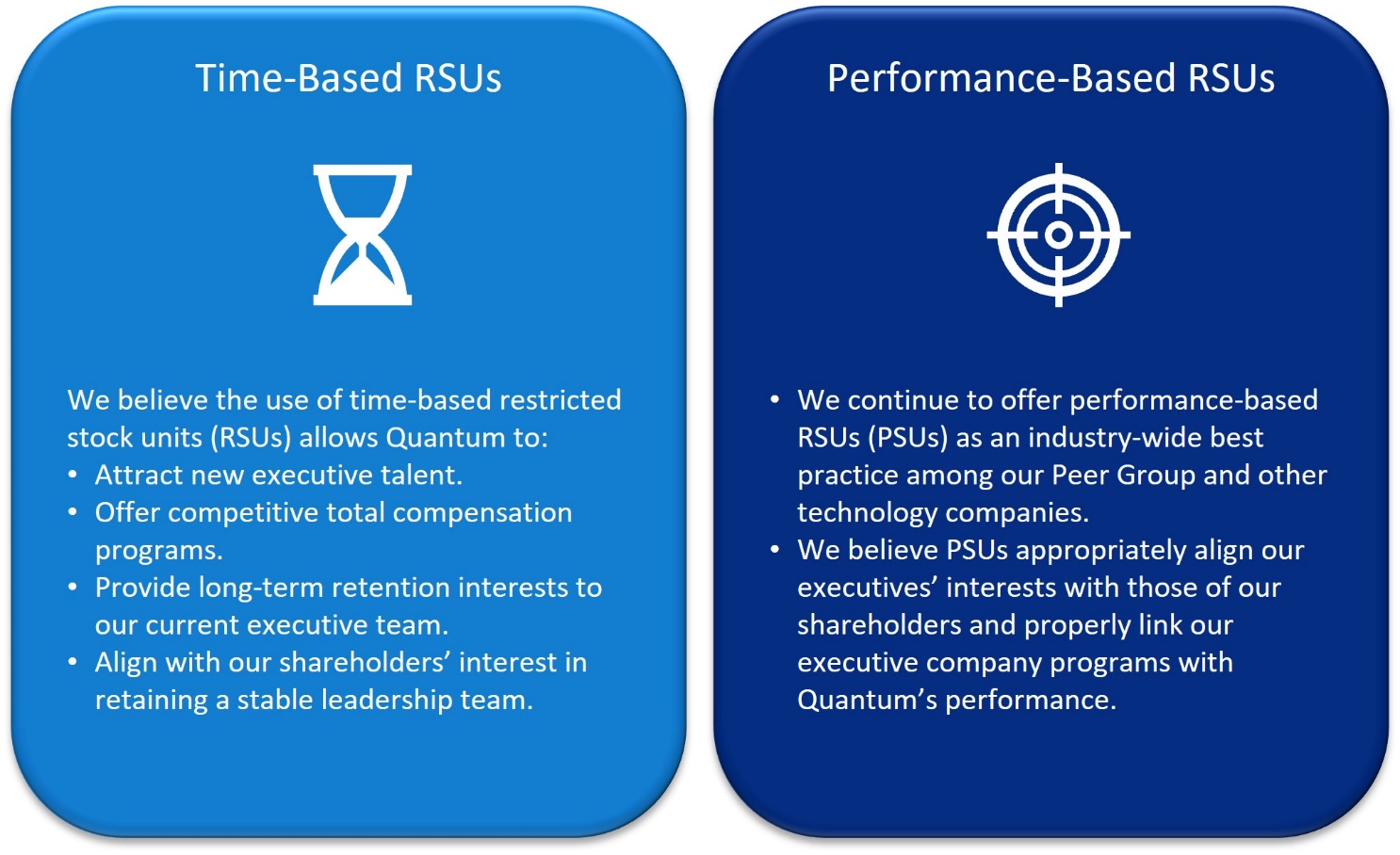

FISCAL 2022 EQUITY OVERVIEW

All of our executive officers are eligible to receive long-term equity awards granted in alignment with our pay-for-performance philosophy, rewarding executives for achieving short- and long-term Company performance goals and resulting in long-term shareholder value.

The Committee oversees all aspects of our equity program, including the annual budget and the associated maximum number of shares that may be granted in a fiscal year, eligibility to participate in the Company’s long-term incentive plan, the size and mix of equity awards, and the annual structure of performance-based stock unit metrics. Quantum management and Compensia advise the Committee on all aspects of our long-term incentive program, including the appropriate mix of time- and performance-based restricted stock units granted to our officers and new hires during the fiscal year. The Committee monitors the use of equity awards throughout the fiscal year, as well as their impact to burn rate, dilution, and the financial accounting for compensation expense.

We offer two types of equity awards:

Generally speaking, annual equity awards for continuing executive officers consist of 50% RSUs and 50% PSUs.

VESTING

Due to the high volatility of Quantum’s stock price over the years, the Committee maintains three-year vesting schedules for both our RSUs and PSUs, subject to satisfying pre-established performance goals and ongoing employment.

38

38

GRANT VALUES

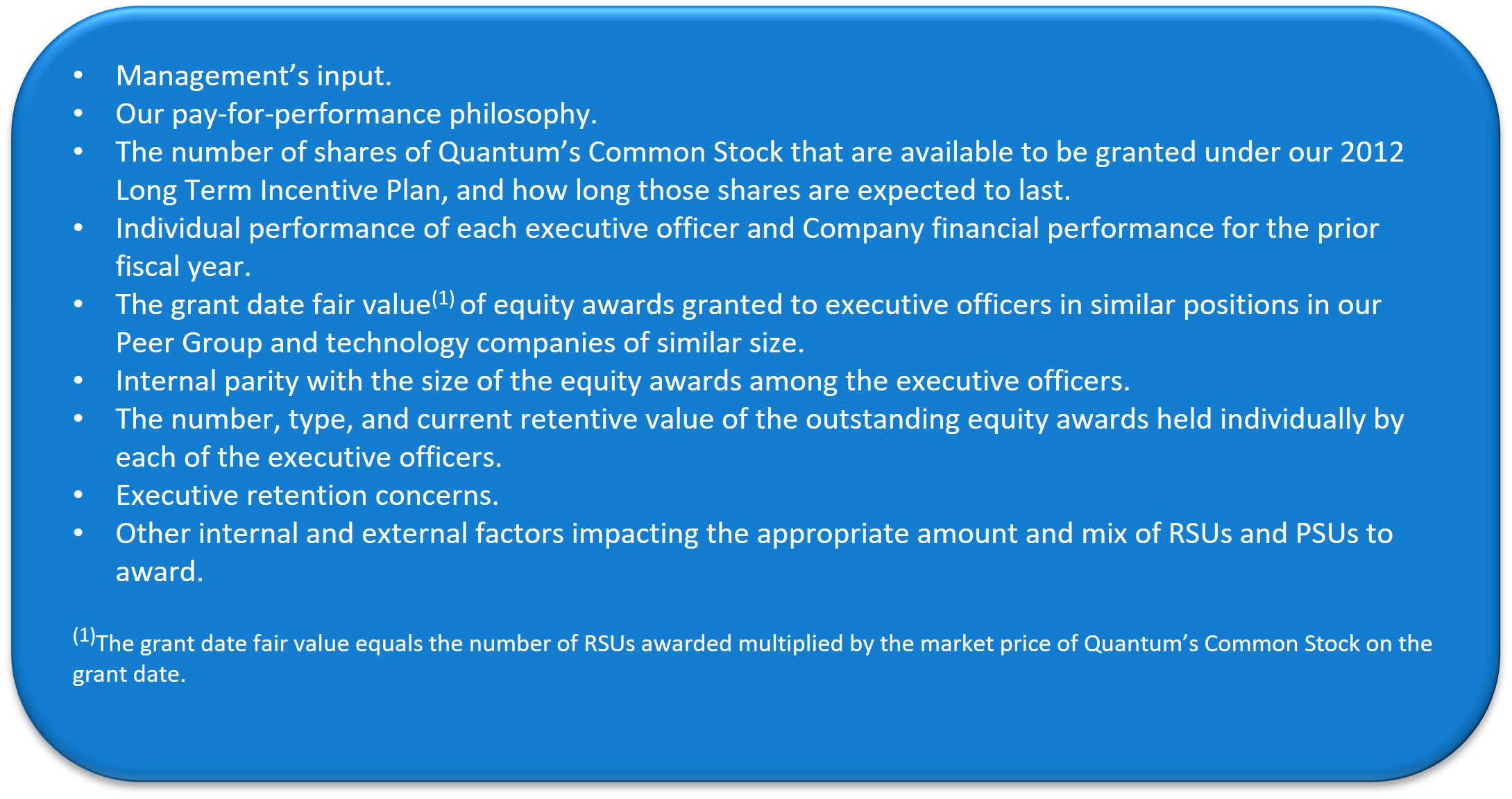

In determining the size of the individual equity awards to our executive officers, the Committee considers:

Our historically rigorous QIP performance targets have caused our executive's total compensation to lag behind our Peer Group and the market. We have used more meaningful equity awards to supplement this gap and attract, reward, and retain talent. This method also ties overall executive compensation to Quantum’s Common Stock price performance over a period of time.

39

39

FISCAL 2022 EQUITY AWARDS

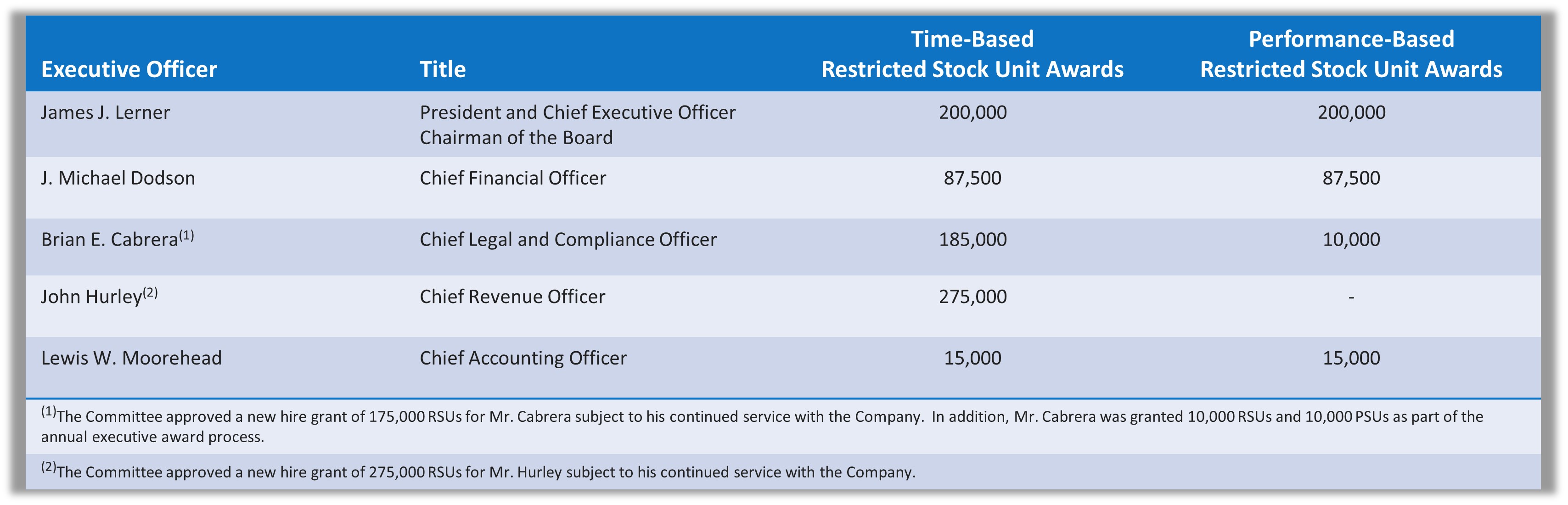

The Committee met in the beginning of Fiscal 2022 to determine the appropriate equity awards for our executive officers using the above criteria. After considering management's recommendations and Compensia’s advice, the Committee approved the following Fiscal 2022 equity awards:

TIME-BASED RESTRICTED STOCK UNITS

Messrs. Lerner, Dodson, and Moorehead were granted the equivalent of 50% of their total Fiscal 2022 equity awards in RSUs scheduled to vest in equal installments on each grant date anniversary, with full vesting after three years. Mr. Cabrera was granted 175,000 RSUs as part of his new hire agreement and was awarded an additional 10,000 RSUs during the Company’s annual grant cycle. Mr. Hurley was granted 100% of his award in RSUs as part of his new hire employment agreement and was not eligible to participate in the Company’s Fiscal 2022 annual equity grant. All of these RSUs vest over three years in equal annual installments and are subject to continued employment.

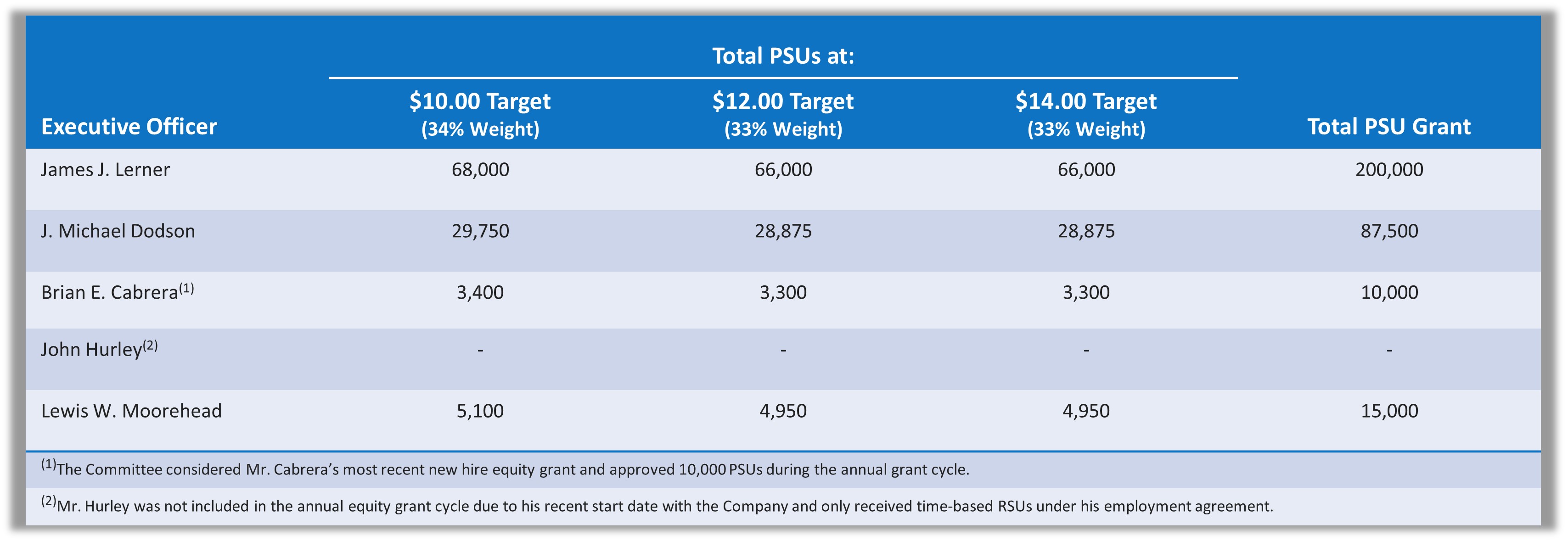

FISCAL 2022 PERFORMANCE-BASED RESTRICTED STOCK UNITS

The Committee received recommendations from Quantum management, outside legal counsel, and Compensia regarding structuring PSU performance metrics that were challenging, but achievable, and aligned our long-term executive performance to the Company’s strategic objectives and shareholders’ interests. The Committee approved three PSU metrics for Fiscal 2022, subject to time-based vesting requirements and continued employment.

The Fiscal 2022 grants included stock price-based performance metrics for all of our executive officers, excluding Messrs. Cabrera and Hurley who started their employment with Quantum during Fiscal 2022, measured as follows:

•34% of PSUs granted were subject to a $10.00 stock price hurdle where performance is satisfied if, at any time prior to October 1, 2026, the average closing stock price over a 100-calendar day period (100-Calendar Day Average Price) is at least $10.00. The vest date will be 12 months from the grant date, or October 1, 2022, if the performance target is met by that date. Otherwise, the PSUs will vest on the date the Committee certifies the performance criteria have been achieved.

•33% of PSUs granted are subject to a $12.00 stock price hurdle where performance is satisfied if, at any time prior to October 1, 2026, the 100-Calendar Day Average Price is at least $12.00. The vest date will be 24 months from the grant date, or October 1, 2023, if the performance target is met by that date. Otherwise, the PSUs will vest on the date the Committee certifies the performance criteria have been achieved.

•33% of PSUs granted are subject to a $14.00 stock price hurdle where performance is satisfied if, at any time prior to October 1, 2026, the 100-Calendar Day Average Price is at least $14.00. The vest date will be 36 months from the grant date, or October 1, 2024, if the performance target is met by that date. Otherwise, the PSUs will vest on the date the Committee certifies the performance criteria have been achieved.

40

40

If the stock price hurdle metrics are not achieved by October 1, 2026, the PSUs subject to the performance criteria will be forfeited.

A summary of the Fiscal 2022 performance-based equity grants and PSU stock price metrics is provided in the following table.

In setting these performance metrics, the Committee considered the success of our fiscal year 2021 PSUs, which paid out at maximum upon attaining a free cash flow target and an $8.00 stock price hurdle, and our then 30-day average stock price of $8.66. Given the stock price and recommendations from management and Compensia, the Committee believed that setting PSU targets with $10, $12, and $14 stock price hurdles would be appropriately challenging yet achievable over a five-year performance period. These targets were not yet met by the end of Fiscal 2022.

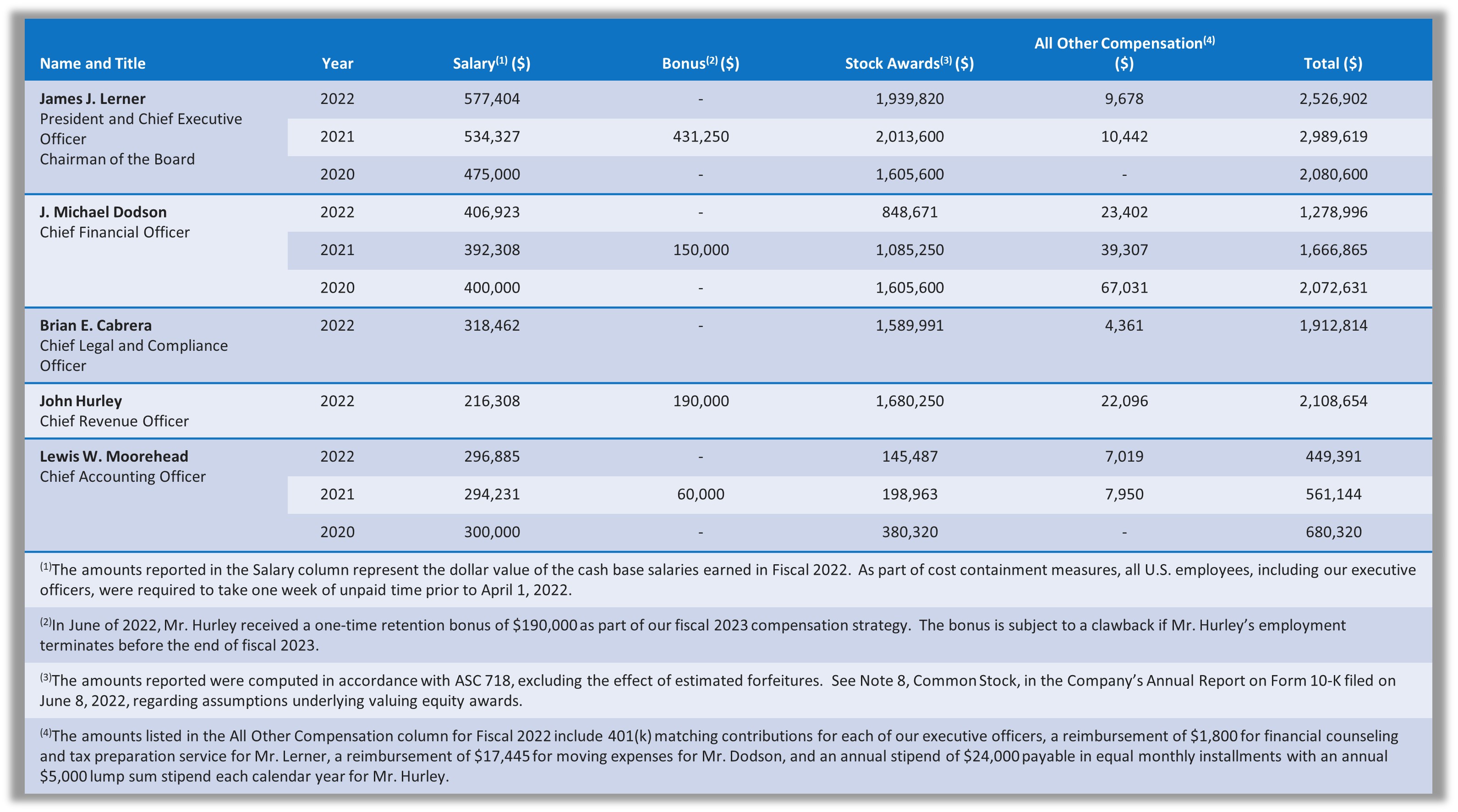

PERQUISITES AND OTHER BENEFITS

We offer Company-paid tax preparation services to our executive officers and non-executive vice presidents. We reimburse Mr. Dodson’s housing and moving expenses. Mr. Hurley receives medical, dental, and vision benefits from a third party not associated with Quantum and does not participate in our corresponding benefit plans. We provide him a taxable annual stipend of $24,000, payable in monthly installments, to cover the premiums associated with those benefits. We also provide him a taxable annual lump sum stipend of $5,000 to cover the costs of his comprehensive annual medical assessment. The stipends will be cancelled if Mr. Hurley elects to participate in Quantum’s medical benefits programs in the future. The Company believes these perquisites are limited and reasonable given the executive officers' responsibilities.

Except for these items and the non-qualified deferred compensation plan discussed below, we do not provide any other perquisites or personal benefits to our executive officers that are not available to all other full-time employees.

EMPLOYEE STOCK PURCHASE PLAN

We offer all employees, including our executive officers, the ability to acquire shares of Quantum’s Common Stock through a tax-qualified Employee Stock Purchase Plan. The plan allows employees to purchase the Company’s stock at a 15% discount relative to the market price. The Committee believes that the plan provides a cost-efficient method of encouraging employee stock ownership.

41

41

HEALTH AND WELFARE BENEFITS

We offer health, welfare, and other benefit programs to substantially all full-time employees. We share the cost of health and welfare benefits with our employees, with amounts depending on the level of coverage elected. The health and welfare benefits offered to our executive officers are identical to those offered to other full-time employees.

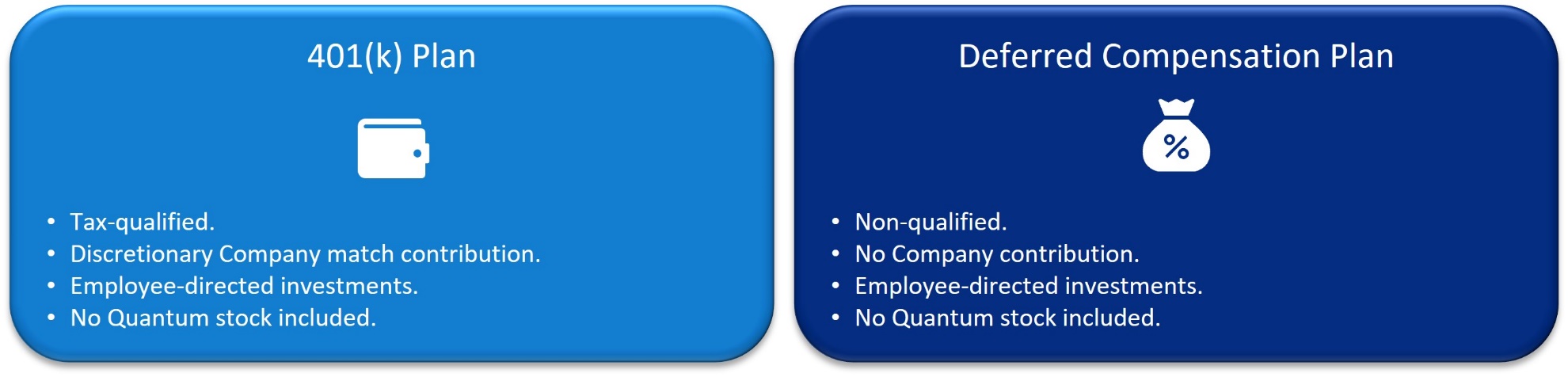

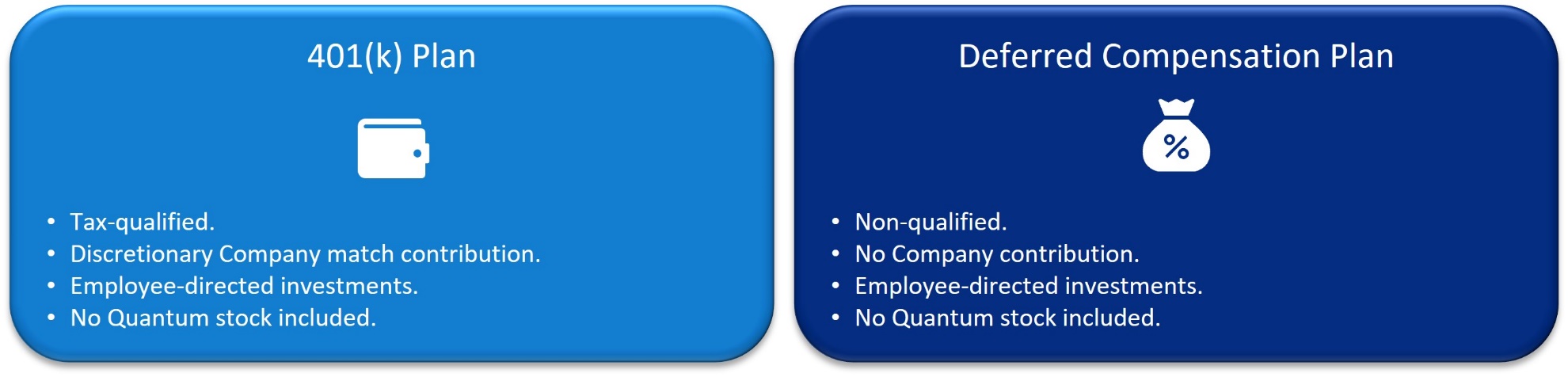

QUALIFIED RETIREMENT BENEFITS

All U.S.-based employees, including our executive officers, are eligible to participate in Quantum’s tax-qualified 401(k) Savings Plan. Participants may defer cash compensation up to statutory IRS limits and may receive a discretionary matching Company contribution. Participants direct their own investments in the plan, which does not include an opportunity to invest in Quantum’s Common Stock.

NON-QUALIFIED DEFERRED COMPENSATION PLAN

We maintain a non-qualified deferred compensation plan which enables select employees, including our executive officers, to defer a portion of their base salary and annual bonus payouts, and associated federal and state income taxes. Plan participants direct the deemed investment of their deferred accounts among a preselected group of investment funds which excludes shares of Quantum Common Stock. The deemed investment accounts mirror the investment options available under Quantum’s 401(k) Savings Plan, including the ability to make daily changes to elected investments. Plan participants’ deferred accounts are credited with interest based on their selected deemed investments. We do not make employer or matching contributions to the non-qualified deferred compensation accounts, but offer the plan as a competitive practice enabling us to attract and retain top talent. During Fiscal 2022, none of our executive officers participated in the plan.

EXECUTIVE COMPENSATION PROCESS AND DECISION MAKING

BOARD AND COMMITTEE ROLES

The Committee oversees and approves all compensation and benefits for our executive officers, excluding the CEO. The independent directors review and approve CEO compensation based on the Committee's recommendations.

The Committee reviews and approves corporate goals and objectives relevant to executive officer compensation. It also measures, at least annually, executive officer performance against those goals and objectives and communicates results to the CEO and Board.

EXECUTIVE COMPENSATION CONSULTANT ROLE

In Fiscal 2022, the Committee also regularly engaged Compensia on a number of matters, including setting executive compensation. Compensia performs services only for the Committee, at its discretion. The Committee regularly review its advisors’ independence and determined that no relationship or conflict of interest exists that would preclude Compensia from independently advising the Committee.

42

42

EXECUTIVE MANAGEMENT ROLE

The Committee reviews recommendations regarding compensation leveling and market trends from our executive management team, including the CEO, Chief Financial Officer, and Chief Human Resources Officer. The Board and Committee retain final authority over executive compensation decisions. Management also assists the Committee in monitoring compensation related risk by reporting to the Committee on:

•Budgetary guidelines;

•Equity pool size restrictions;

•Burn rate and dilution;

•Shareholder return; and

•Quantum’s strategic goals.

PEER GROUP ROLE

The Committee examines Peer Group pay practices and programs and compares the total target compensation for our CEO and officers to similar roles as market reference points. While it is the Committee’s goal to ensure our compensation practices are competitive, the Committee also considers other factors when making compensation decisions, including Quantum’s financial position and individual and Company performance.

COMPENSATION GOVERNANCE BEST PRACTICES

We are committed to designing and implementing sound executive compensation policies and practices. The Committee seeks guidance from varying levels of management within the Human Resources, Finance, and Legal teams, and engages with outside legal counsel and other external advisors to ensure proper governance protocols are in place and executed. Our Fiscal 2022 governance practices included the following elements.

43

43

INDEPENDENT CONSULTANT

The Committee regularly engages with our external independent compensation consultant on Board and executive compensation matters.

CLAWBACK POLICY

We have a clawback policy for cash and equity incentive or bonus compensation paid to all Section 16 executive officers, all officers who directly report to the CEO, and the Vice President of Supply Chain (Covered Employees). If the Company is required to materially restate its financial statements due to the knowing misconduct of Covered Employees, it is entitled to recover any bonus or other incentive- or equity-based compensation paid to the involved Covered Employees during the twelve months following the first SEC filing or other public issuance of the financial statement containing the error. The Company may also recover any net profits the Covered Employees realized from selling Quantum securities during that twelve-month period.

STOCK OWNERSHIP GUIDELINES

Please refer to page 23 for an explanation of our director and officer stock ownership guidelines.

ANTI-HEDGING AND ANTI-PLEDGING POLICIES

We maintain an insider trading policy which expressly prohibits buying Quantum securities on margin or using or pledging owned shares as collateral for loans, in addition to engaging in transactions in publicly traded options, puts and calls, and other derivatives of the Company’s stock. The prohibition extends to any hedging or similar transaction designed to decrease the risks associated with holding Company securities.

Our insider trading policy also prohibits buying or selling Quantum securities, including offers to buy or sell, during any closed trading window. The window begins with the date that an insider possesses material inside information and ends at the beginning of the second full trading day following public disclosure of the information. All employees and directors are subject to our insider trading policy.

NO SINGLE-TRIGGER CHANGE OF CONTROL

Our change of control policy maintains that a double-trigger event must occur before an executive is entitled to specified compensation and benefits.

ANNUAL RISK ASSESSMENT

We conduct an annual risk assessment of our compensation program and believe our Fiscal 2022 compensation programs were appropriate and discouraged excessive risk taking.

44

44

PAY MIX

Retaining our executive officers remains a primary focus as internal and external factors impact our business. For Fiscal 2022, our pay mix was equally balanced between performance-based awards to align our executives with Company performance goals and time-based awards to address potential retention concerns.

PERQUISITES

We grant only limited perquisites to our officers.

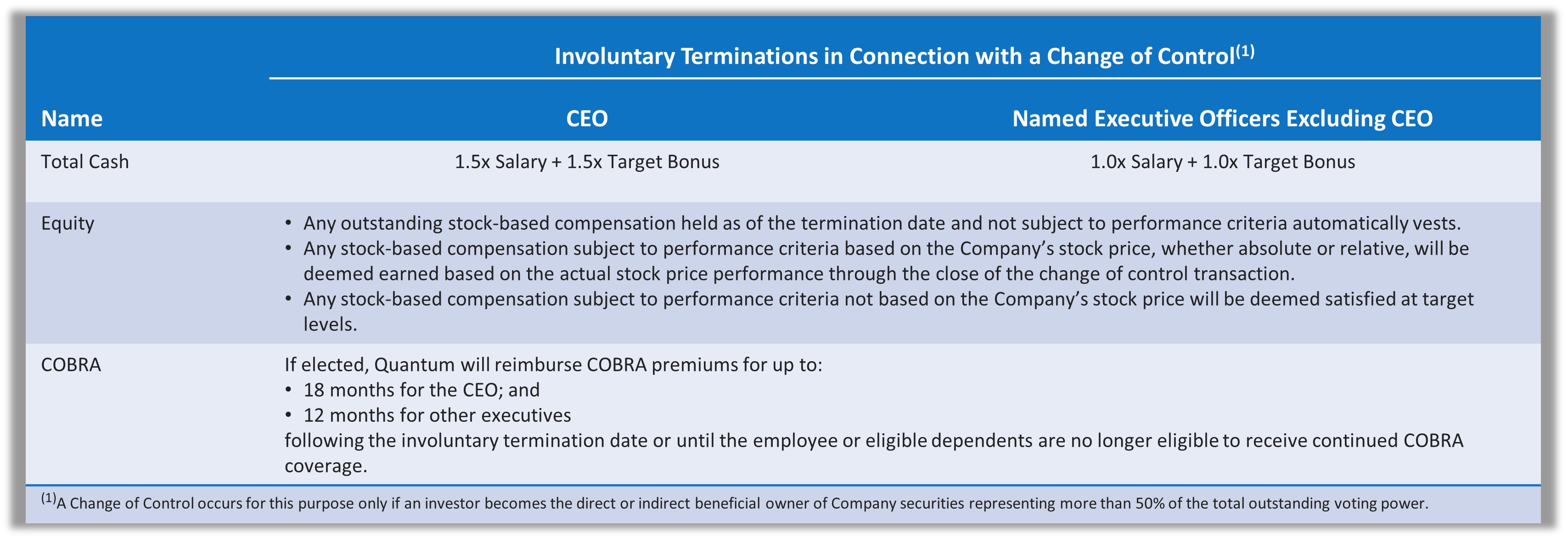

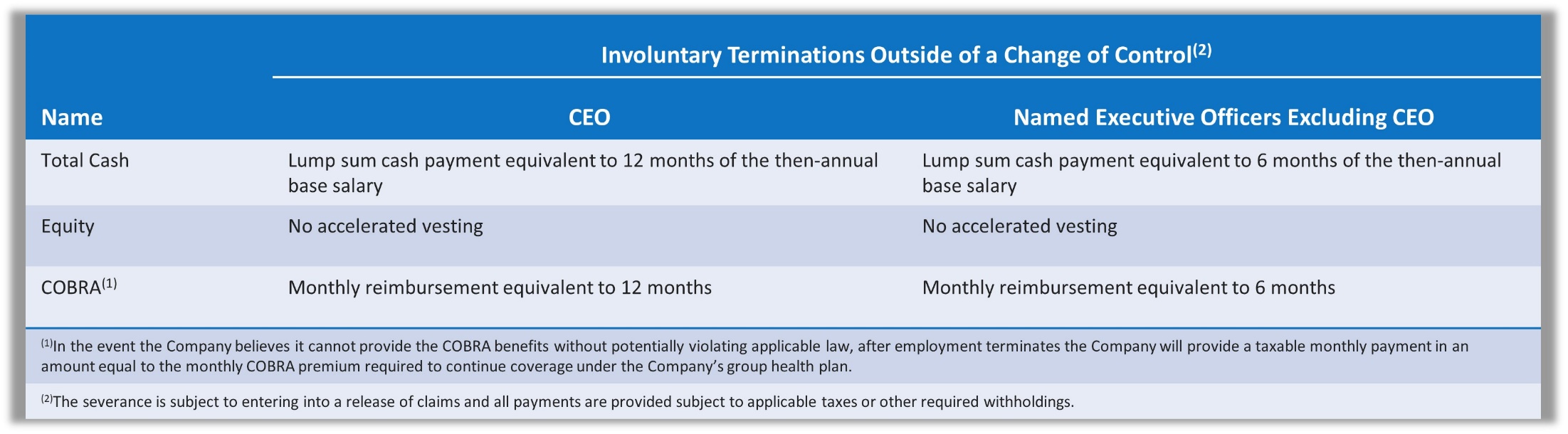

CHANGE OF CONTROL SEVERANCE POLICY, EMPLOYMENT AGREEMENTS, AND SEVERANCE AGREEMENTS

Details regarding our current change of control and employment agreements are described further in Potential Payments Upon Termination or Change of Control.

CHANGE OF CONTROL AGREEMENTS

Our change of control agreements are designed to promote the best interests of the Company and our shareholders by maintaining the continued dedication and objectivity of key employees during a possible or actual change of control. The agreement provides eligible employees with compensation and stock benefits upon an involuntary termination as defined in the agreement, providing financial security and encouraging them to remain with the Company during times of uncertainty.

EMPLOYMENT AGREEMENTS

We have employment agreements with all of our named executive officers. These agreements provide for certain severance benefits in the event of a qualifying termination of employment not associated with a change of control. Each named executive officer is employed at will and may be terminated at any time and for any reason, with or without notice.

TAX AND ACCOUNTING CONSIDERATIONS

The Committee considers, among other factors, the possible tax and accounting consequences applicable to Quantum or its executives when making decisions regarding our executive compensation programs. In particular, section 162(m) of the Internal Revenue Code limits our ability to deduct remuneration paid to our executives exceeding $1 million. While the Committee considers these factors, including the impact of section 162(m), it maintains maximum flexibility in designing compensation programs and does not limit compensation to those types that are intended to be deductible.

RISKS RELATED TO COMPENSATION POLICIES AND PRACTICES

Our Board and Committee conduct a risk assessment of our employee compensation policies and practices, including those relating to our executive compensation program. We also evaluate our pay-for-performance programs to determine whether they create unnecessary risk to the Company.

45

45

Our programs contain various mitigation features to ensure our employees, including our executive officers, are not encouraged to take excessive or unnecessary risks in managing Quantum’s business. These features include:

46

46

Fiscal 2022 Compensation Tables

FISCAL 2022 SUMMARY COMPENSATION TABLE

The following table displays our named executive officer compensation as of the end of Fiscal 2022 for fiscal years 2022, 2021, and 2020.

47

47

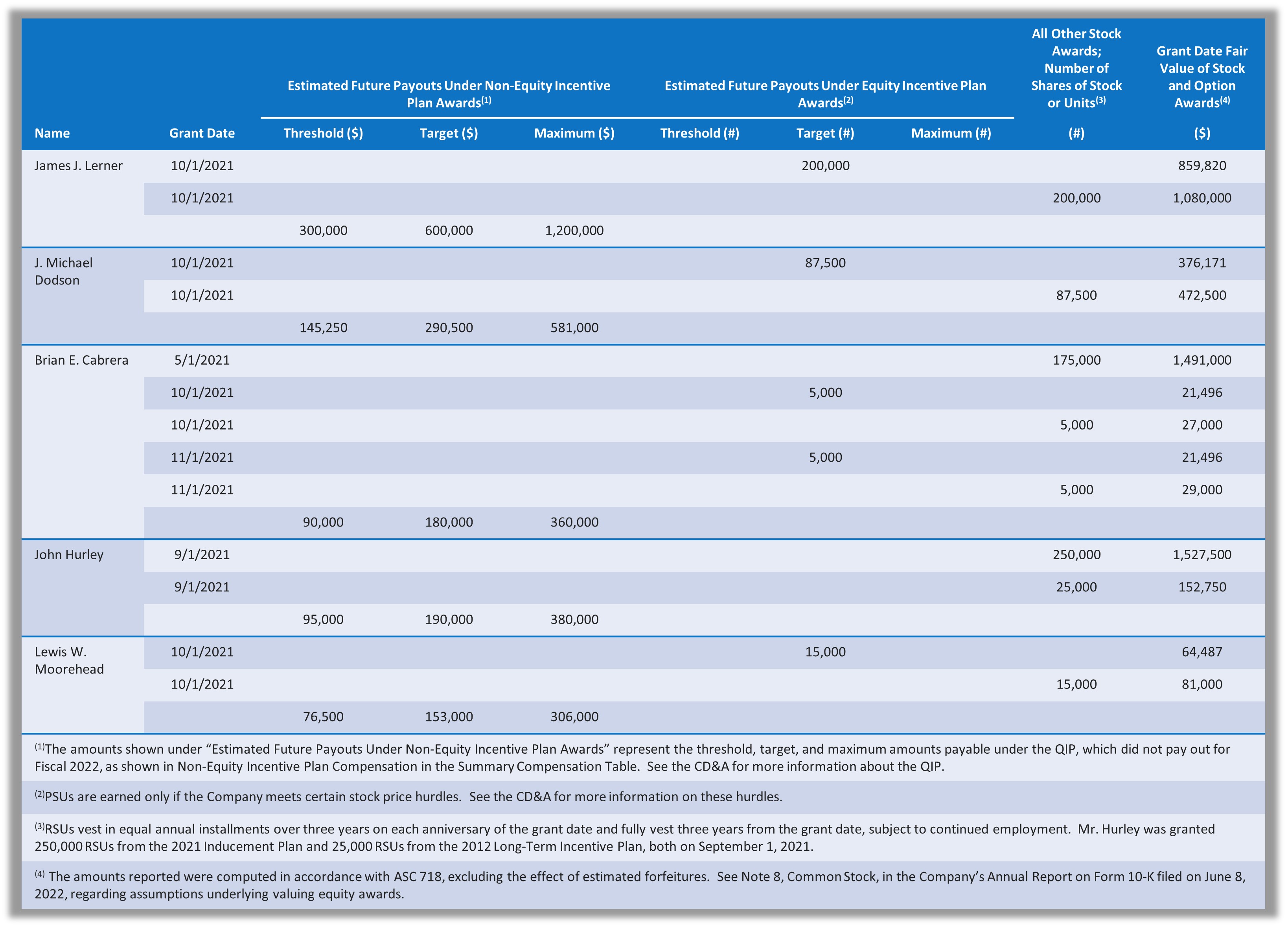

FISCAL 2022 GRANTS OF PLAN-BASED AWARDS

The table below presents information on incentive plan-based awards granted to our named executive officers.

48

48

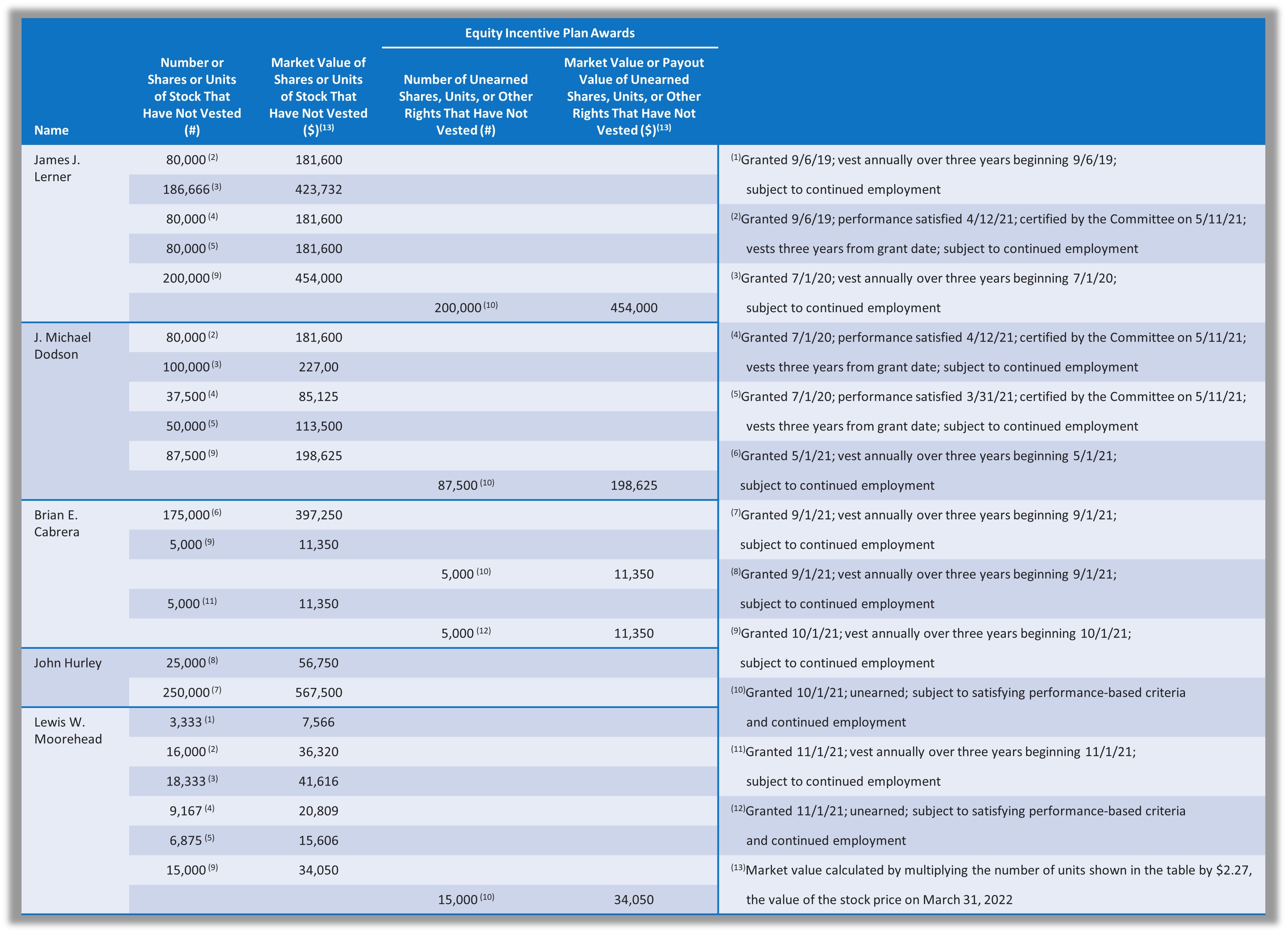

OUTSTANDING EQUITY AWARDS AT FISCAL 2022 YEAR END

The following table provides information regarding outstanding restricted stock unit awards held by our named executive officers as of March 31, 2022. There were no outstanding stock options held by our named executive officers at that time.

49

49

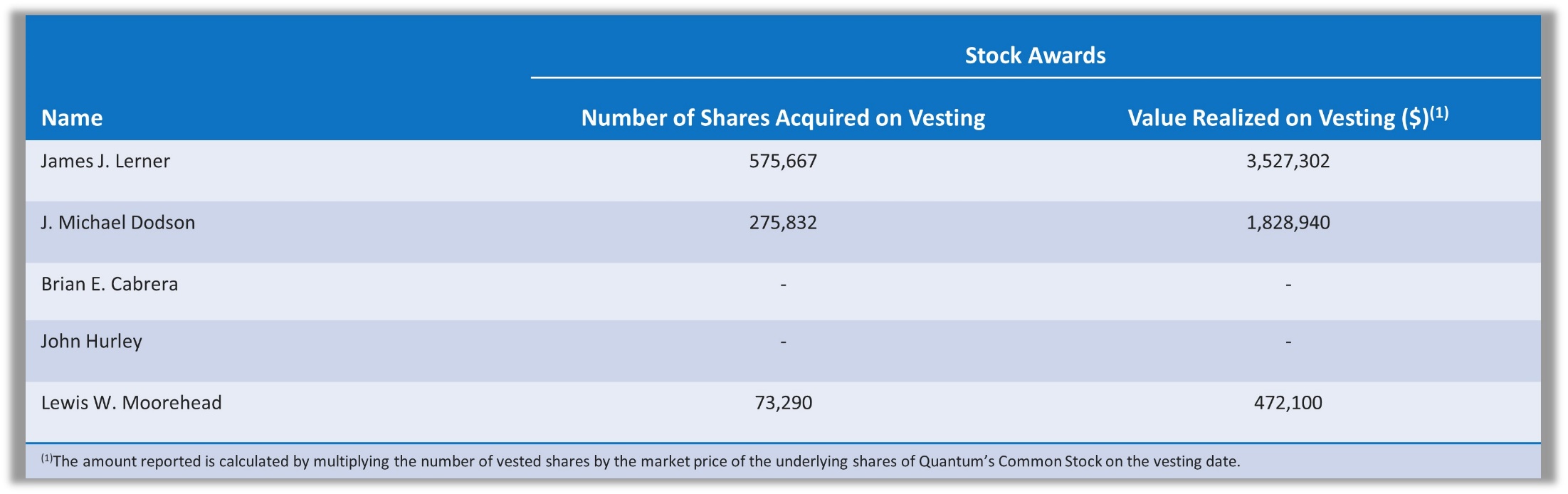

FISCAL 2022 OPTIONS EXERCISED AND STOCK VESTED

The table below provides information on Fiscal 2022 restricted stock and RSU vesting for our named executive officers. Our executive officers did not exercise option awards in Fiscal 2022.

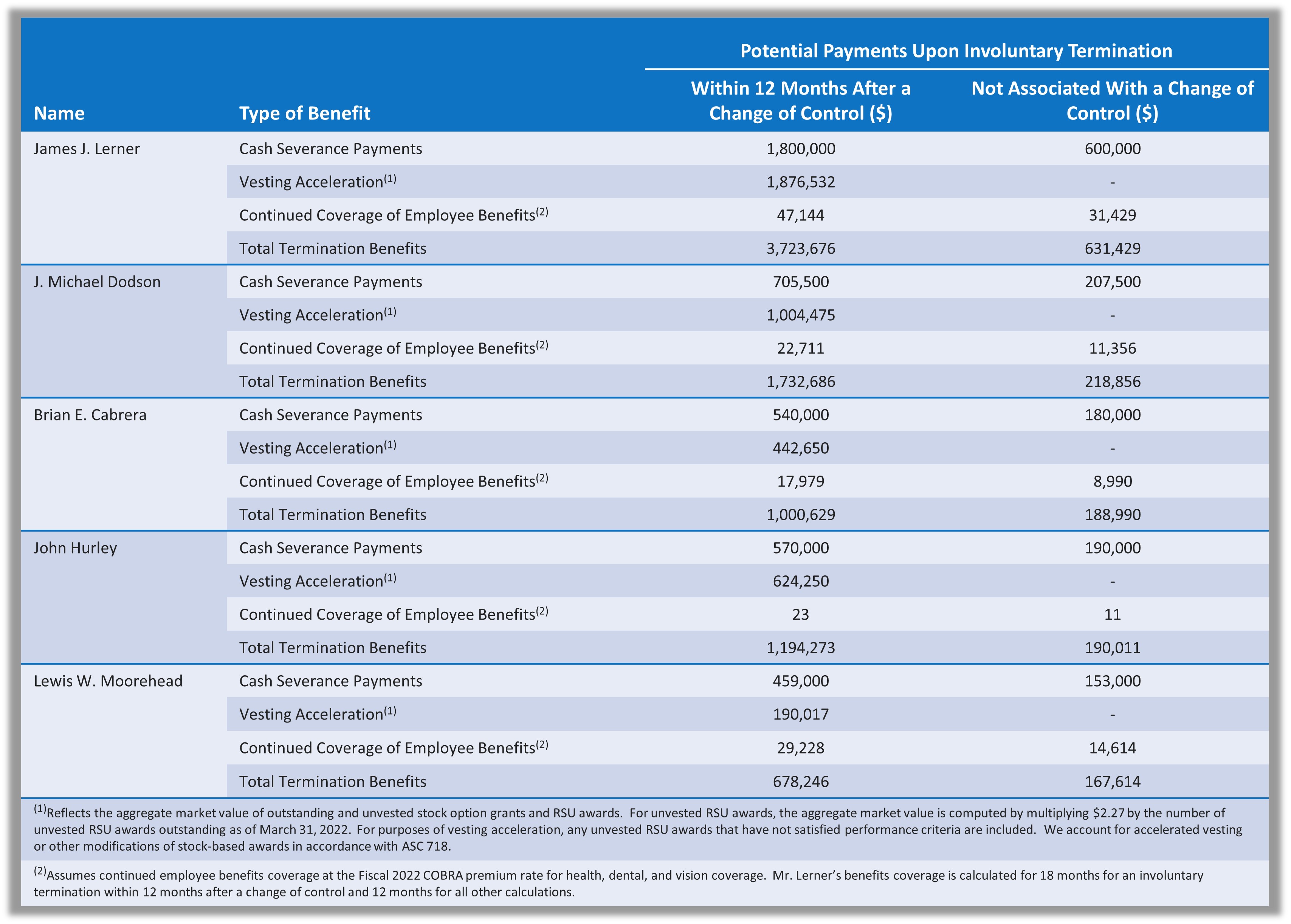

POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE OF CONTROL FOR FISCAL 2022

We maintain change of control agreements with all of our named executive officers, and their employment agreements provide for certain severance benefits in the event of a qualifying employment termination not associated with a change of control. These terms have remained unchanged since fiscal year 2019, and are explained in the tables on the following pages.

50

50

51

51

FISCAL 2022 POTENTIAL SEVERANCE BENEFITS

52

52

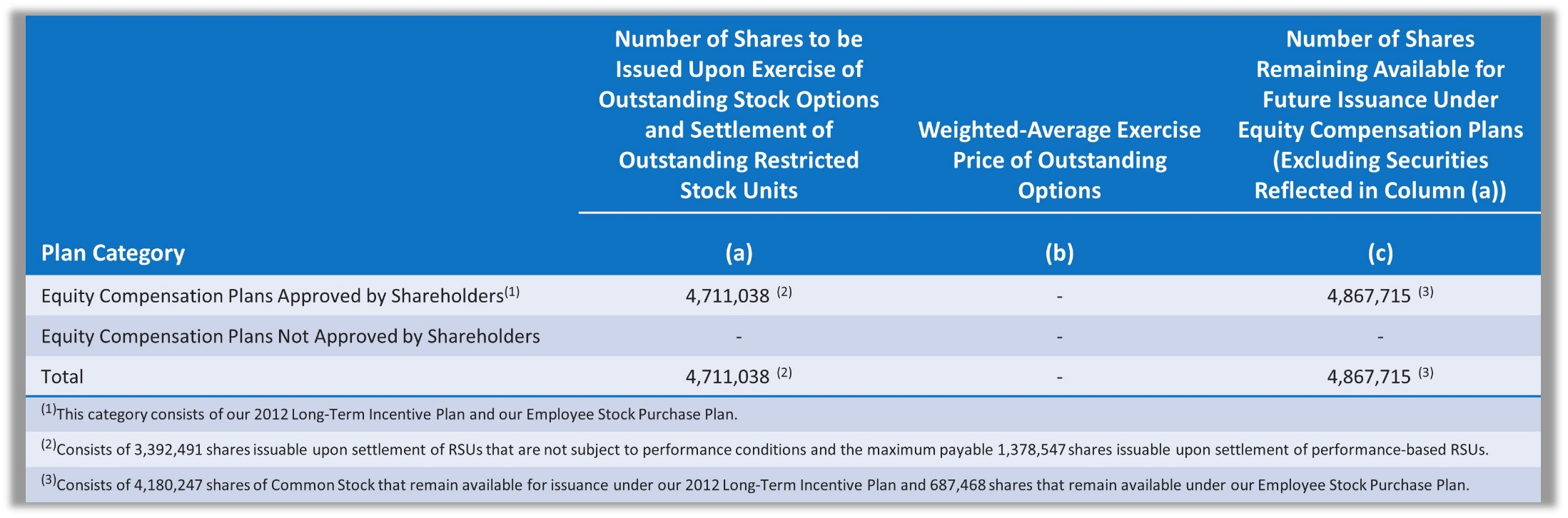

EQUITY COMPENSATION PLAN INFORMATION

The table below presents information relating to compensation plans under which we may issue shares of our Common Stock, as of March 31, 2022.

CEO PAY RATIO

To calculate our Fiscal 2022 CEO pay ratio, we identified our median employee in fiscal 2021 by:

•Using wages and compensation reported in Box 1 of the 2020 Form W-2, as reported to the Internal Revenue Service, for U.S.-based employees and equivalent earnings similarly reported locally for non-U.S. employees.

•Computing annualized target cash compensation from our human capital management system for the 52 new hires who started between January 1 and March 31, 2021 and did not have a 2020 Form W-2.

•Selecting the median employee amount from our entire active employee population, including full-time, part-time, and temporary employees but excluding our CEO, as of March 31, 2021.

•Comparing that data to the total compensation of Mr. Lerner as of March 31, 2022.

As of that date, we employed 826 people globally, with 62.2% based in the U.S. or Canada, 23.9% in Europe, the Middle East and Africa, and 13.9% in Asia Pacific.

Mr. Lerner’s Fiscal 2022 total compensation was $2,526,902, as reported in the Summary Compensation Table, while the Fiscal 2022 total compensation for our median employee was $125,182. The ratio of these amounts is 20.2 to 1, which represents Quantum’s Fiscal 2022 ratio of annual CEO total compensation to the annual median employee total compensation. This ratio is a reasonable estimate calculated in a manner consistent with the U.S. Securities Exchange Act of 1934, Regulation S-K, Item 402(u). SEC rules for identifying the median employee allow companies to apply various methodologies and assumptions, and, as a result, the pay ratio we report may not be comparable to those reported by other companies.

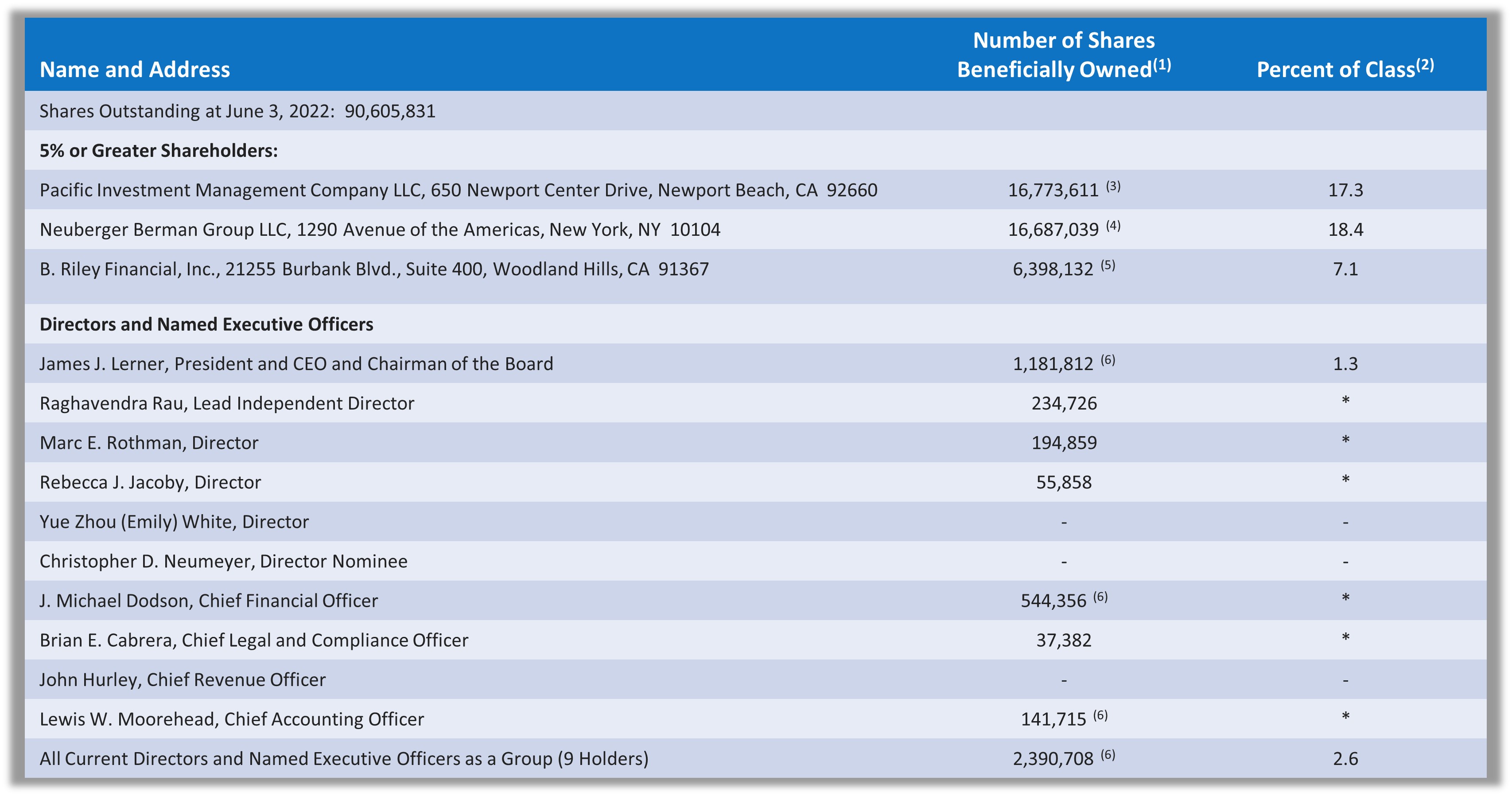

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The tables below set forth as of June 3, 2022, certain information regarding the beneficial ownership of the Company’s Common Stock by:

•Each person the Company knows to beneficially own more than five percent of the outstanding shares of Common Stock;

•Each of the Company’s current directors and director nominees;

•Each of the Fiscal 2022 named executive officers; and

•All current directors and officers as a group.

53

53

Unless otherwise indicated, the business address for the beneficial owners listed below is 224 Airport Parkway, Suite 550, San Jose, California, 95110.

54

54

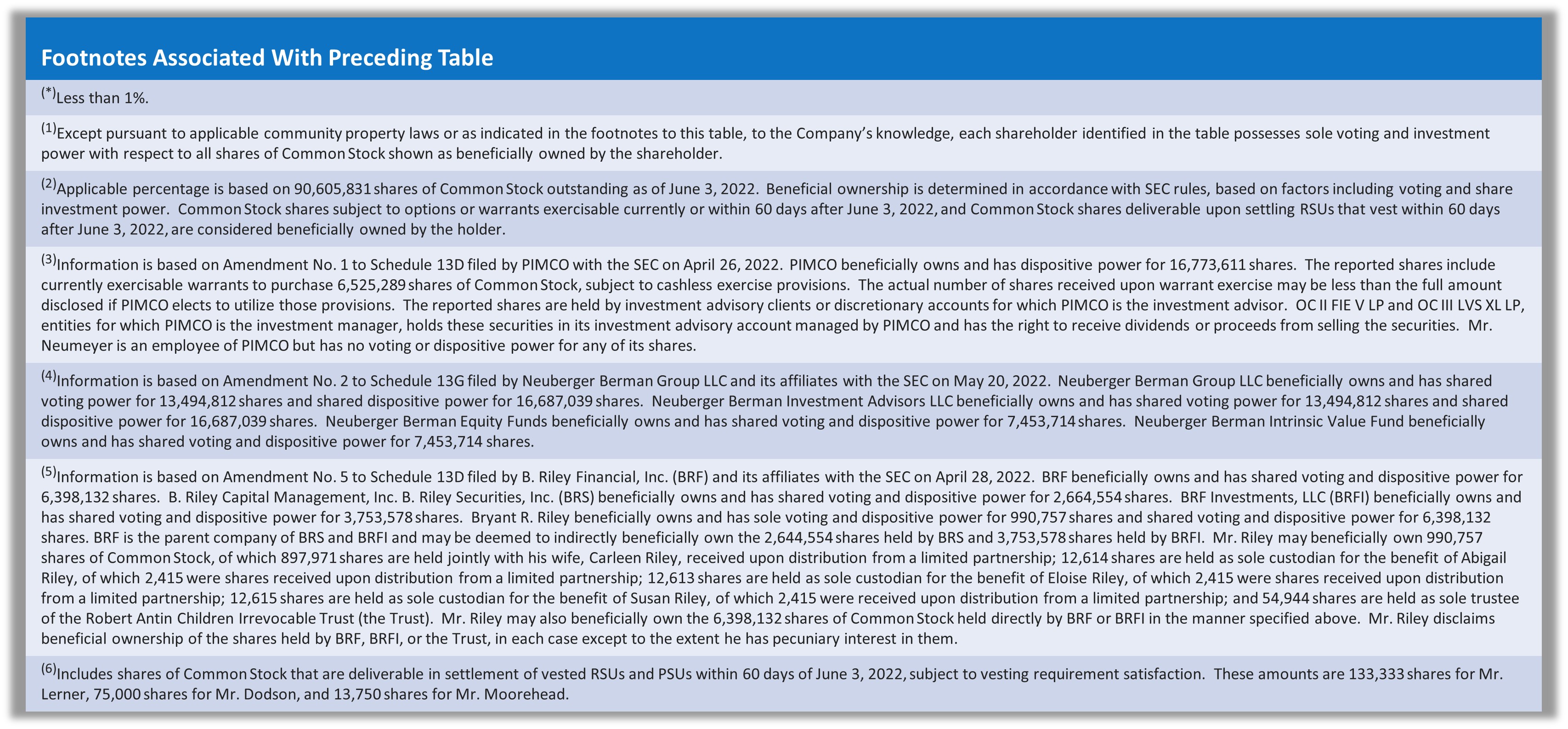

The following footnotes apply to the table immediately above:

55

55

Board Committee Reports and Related Information

REPORT OF THE LEADERSHIP AND COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS(1)

We, the Leadership and Compensation Committee of the Board, have reviewed and discussed the Compensation Discussion and Analysis within this proxy statement with Quantum’s management team. Based on such review and discussion, we have recommended to the Board that the CD&A be included as part of this proxy statement.

Submitted by the Leadership and Compensation Committee of the Board of Directors:

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS(1)

The Audit Committee of the Board of Directors oversees Quantum’s financial reporting process and internal control structure on behalf of the Board. Management is responsible for preparing and presenting the financial statements and ensuring their integrity and the effectiveness of the Company’s internal control over financial reporting. The Audit Committee reviewed and discussed Quantum's Fiscal 2022 audited financial statements with management. Quantum’s independent auditors are responsible for expressing an opinion regarding whether Quantum’s consolidated financial statements conform with generally accepted accounting principles and the effectiveness of the Company’s control over financial reporting.

The Audit Committee determined that it fulfilled its charter responsibilities during Fiscal 2022. Management represented to the Audit Committee that Quantum’s Fiscal 2022 consolidated financial statements were prepared in accordance with generally accepted accounting principles and the Audit Committee has reviewed and discussed them with the Company’s independent registered public accounting firm (the Firm). This review included discussing with management the:

•Quality and acceptability of Quantum’s accounting principles;

•Reasonableness of significant estimates and judgments; and

•Clarity of disclosure.

The Audit Committee reviewed with the Firm those matters required to be discussed by Public Company Accounting Oversight Board (PCAOB) Auditing Standard No. 1301, Communications with Audit Committees, and the SEC. The Firm provided the Audit Committee with the written disclosures and letter from auditors mandated by applicable PCAOB requirements, including the:

•Independent accountant’s communications with the Audit Committee concerning independence; and

•Firm’s own independence.

In reliance on these reviews and discussions and the report of the Firm, the Audit Committee has recommended to the Board, and the Board has approved, filing with the SEC the audited consolidated financial statements in Quantum’s Annual Report on Form 10-K for the year ended March 31, 2022.

_____________

(1)This report shall not be deemed soliciting material or filed with the SEC, nor incorporated by reference in any filing of the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, both as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

56

56

Submitted by the Audit Committee of the Board of Directors:

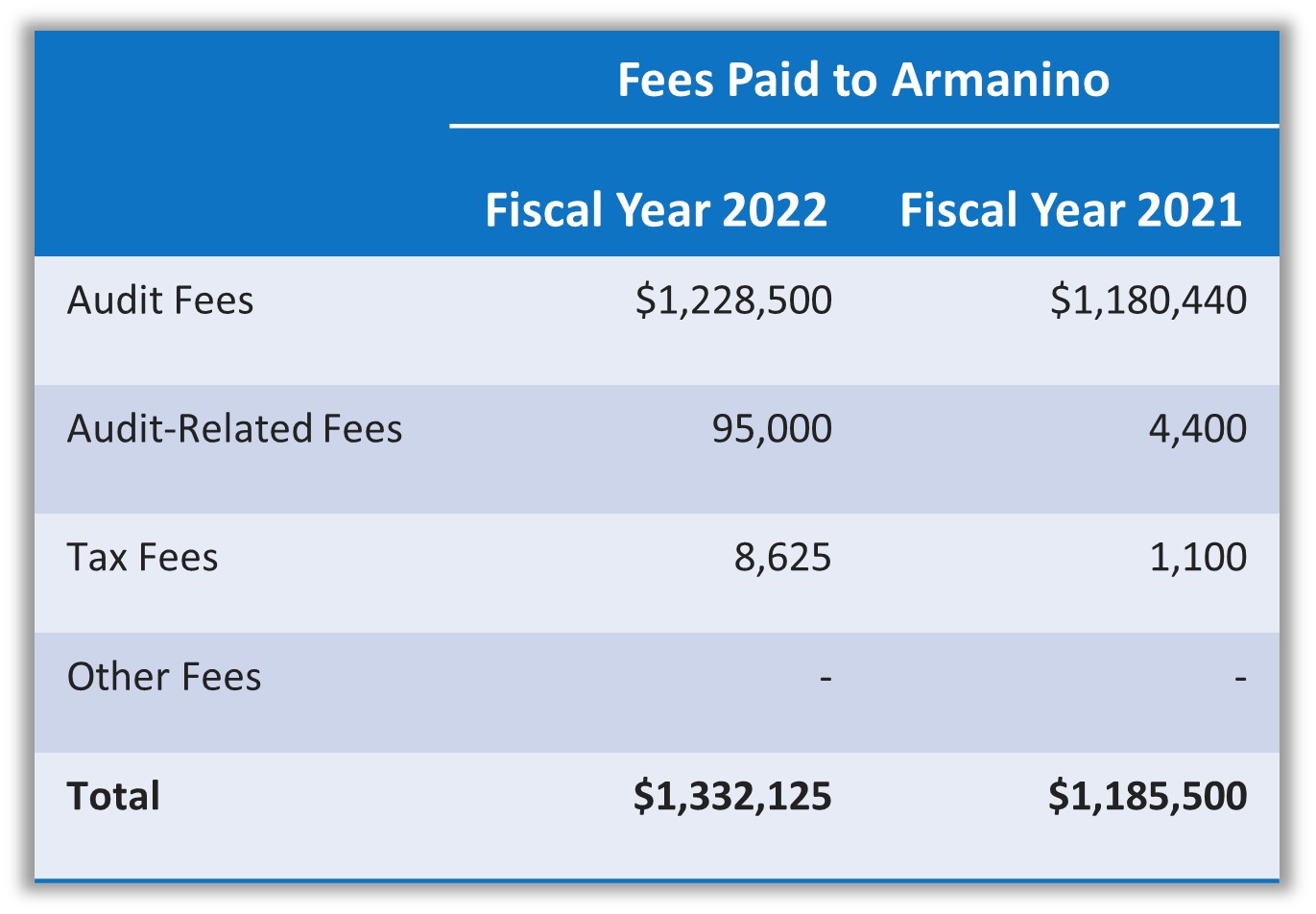

AUDIT AND AUDIT-RELATED FEES

FEES PAID TO INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM AND PRIOR INDEPENDENT REGISTERED PUBLIC ACCOUNT FIRM

The table below details the fees billed by Armanino LLP for Fiscal 2022 and fiscal year 2021, including out of pocket expenses.

Audit Fees

Armanino audit fees include the aggregate fees incurred for auditing Quantum’s annual consolidated financial statements and reviewing the quarterly consolidated financial statements included in Quantum’s Quarterly Reports on Form 10-Q.

Audit-Related Fees

Audit-related fees include the aggregate fees incurred for Armanino's work related to our Fiscal 2022 S-3 and S-8 filings, as well as the rights offering.

Tax Fees

Tax fees paid to Armanino relate to tax consulting services.

57

57

PREAPPROVAL POLICIES AND PROCEDURES

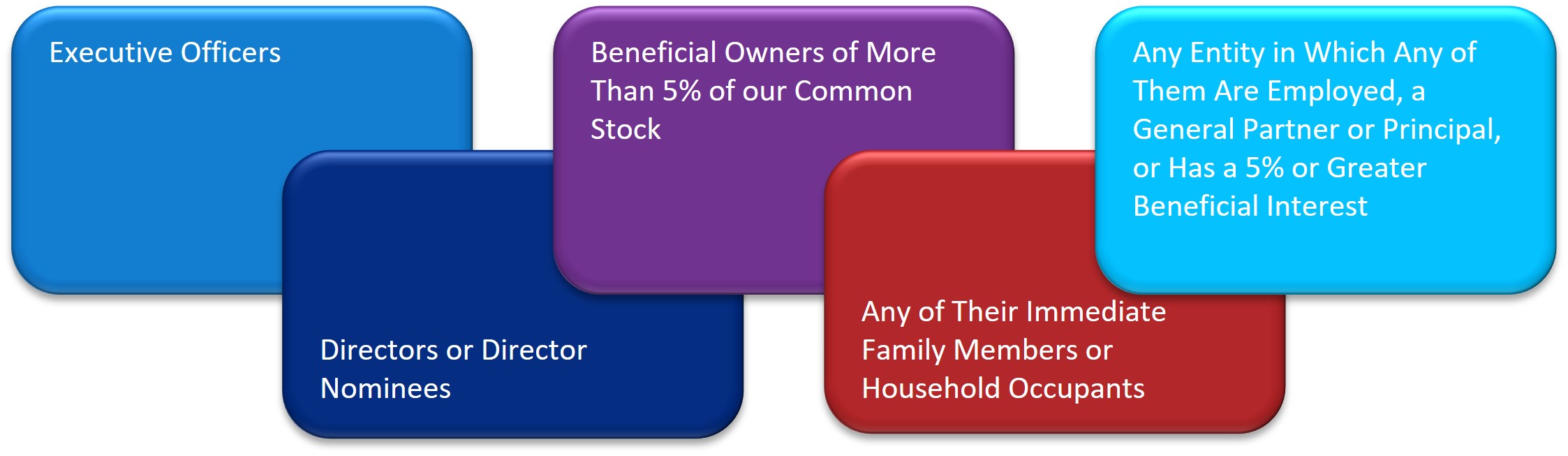

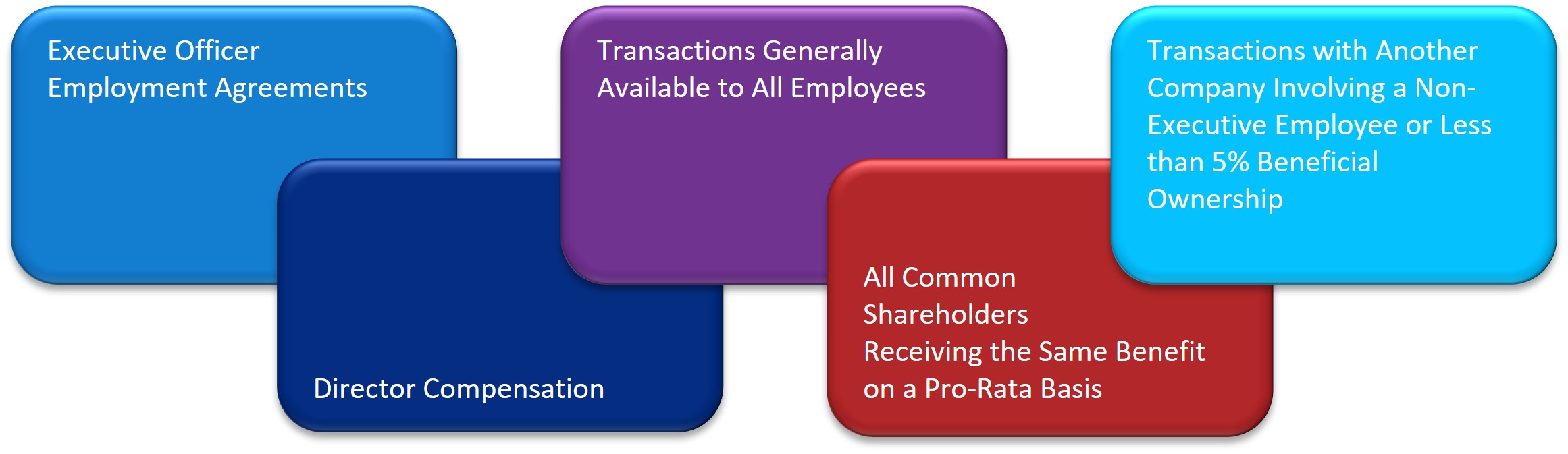

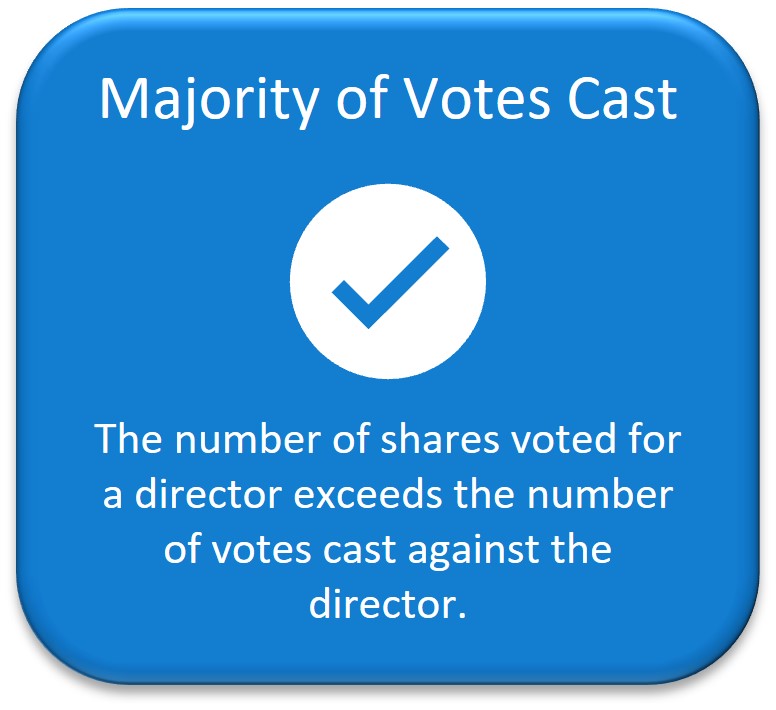

The Audit Committee annually preapproves, on a general approval schedule, appropriate audit, audit-related, and tax services the Firm may perform for Quantum, in accordance with its policy and applicable legal requirements. The Audit Committee preapproved all Fiscal 2022 services to avoid potential conflicts of interest that could arise if the Company received specified non-audit services from the Firm. The Audit Committee reviews and makes changes to the services listed on the general approval schedule annually and as otherwise necessary from time to time.